Week 202: Better Late than Never

Portfolio Performance

See the end of the post for the current make up of my portfolio and the last five weeks of trades

Monthly Review and Thoughts

I am a week late getting this portfolio update out due to a really busy weekend that kept me from doing any writing. Fortunately very little is pressing. I only made a handful of portfolio changes and added two stocks, small positions at that.

Given the relative dearth of transactions, I thought this would be a good post to give an overall update on some of the stocks I own. I have stepped through my thoughts on a few positions, giving a brief summary of why I own them and what I expect going forward.

But before I do…

This week I picked up the book Reminscences of a Stock Operator. It is a book that, in addition to which this blog received its name, I read again and again, rarely from start to finish, usually just a chapter starting at whatever page I happen upon. It has is so much knowledge and so much of my own investment philosophy is tied to its precepts.

This week I opened the book to the chapter about Old Partridge, an fellow with a thick chest who carried a big line and had been around the block a few times. Its quite a well known chapter, mostly for two comments made by Partridge.

The first is perhaps the most famous. Being one of the senior members of the house, and given the propensity of speculators to look for an outside influence to sway their opinion, Partridge was often asked for his opinion on tips and whether they should be bought or sold. When asked such a question he would always respond with the same answer: “You know, its a bull market”.

The weight of this statement is the simple recognition that in a bull market the general trend of stocks is up and if you are confident of the general condition of the market, you can’t go too terribly wrong. The general trend will lift most boats. A precept to be taken seriously for sure.

The second well known passage occurs when Partridge is being presented with advice from a tipster who had given him an idea that had worked out well and was now suggesting that Partridge sell and wait for a correction. To this tipster Partridge replies that he cannot possibly take the man’s advice, for if he were to do so he might lose his position, and he could not bare to do that.

This is really a statement about our own fallibility and our own psychology. Regarding the former, if the correction does not materialize, then where are is poor Partridge now? Without a position and up against his own mind’s wrongness to get it back.

As for the latter, are we really so sure of our own emotions that we can stomach either A. buying back the stock at a lower price only to have it fall further or B. waiting too long for the bottom so as to miss it entirely and not being able to stomach a later purchase at a price more dear?

Anyone who has played with real money will know that the mind plays tricks in each of these circumstances.

So this is what is well-known and often quoted from the chapter. But I was struck by a less often, if ever, quoted passage that is, in my opinion, equally or more important. I will quote this exactly since it is less well known, with emphasis on one sentence in particular:

“In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks. Then [when the bear market comes] get out of all of your stocks; get out for keeps!“

Now step back and think about this for a moment. Livermore is not saying that one needs to be cautious in a bear market, or flee to safety stocks, or go net short.

He is saying sell it all.

How easy would it be to sell every position tomorrow if you had to? Forget about the logistics, think only of the psychological strain. Could you really let go of every stock you owned? Or are reasons already creeping into your mind about why this one or that one should be different, should be held onto, will persevere through the carnage.

I know those reasons are abound for me.

My point is this. This is not a precept to be taken lightly, and not one to be first dwelled upon at the time when action is required. To follow it requires training the mind to ruthlessly let go of all your former beliefs and go to 100% cash (or as close as is possible) when the time comes. This is something that requires practice, and something I am trying to ingrain in myself right now.

With that said, on to the stocks.

New Positions – Enernoc and others

I had a few new positions in the last month. I bought Enernoc (ENOC) I bought Chanticleer Holdings (HOTR) and I bought some gold stocks for another swing. I’m not going to talk about the gold stocks. I bought a few very small one’s on the recommendation of a friend that I agreed not to talk about on the blog and so I won’t. I bought a few larger one’s for the online portfolio that I have talked about before and really have nothing new to add other than that gold looked ready to break-out (it did) and so I thought the stocks would follow (they did).

The idea behind Chanticleer came from this SeekingAlpha article, which I found to be quite good. But to be honest I bought the stock as more of a short-term momentum play than a long-term hold. I have to spend more time on it to know whether it is anything more and if I do and decide favorably, I will write more about it later.

On the other hand I expect to hold Enernoc for at least the immediate term.

Enernoc operates two businesses, a legacy demand response power management business and an evolving energy intelligence software (EIS) business.

The demand response business is very lumpy, and that lumpiness leads to the kind of stock reaction that happened in February and again a few weeks ago. The company partners with enterprises to provide load reductions in times of high power demand. By pre-buying into generation capacity that is no longer required (and thus no longer needs to be delivered) they split the winnings from the savings derived thus profiting from the result. The difficulty is that the company’s profitability depends to a degree on the volatility of the power market, which is cyclical and hard to predict.

This year Enernoc is experiencing this negative cyclicality in Western Australia. In addition, a contract they have with PGM cannot have its revenue recognized until fiscal 2016. This combination led to revenue guidance in 2015 of about $100 million below 2014. The market didn’t like that.

It is the second business, an EIS software platform, that really has me interested. The EIS platform is sold to enterprises and utilities and allows for the centralized monitoring, analytics, reporting and most importantly management of energy to reduce consumption and manage supply. From what I can tell they have one of the leading solutions on the market. And I really like the market.

As a general rule I’m not much for technology story stocks but this makes sense to me. I believe that the electricity grid is in the early stages of a pretty profound transformation. Anyone can pull up a graph of solar costs and see that while we are not there yet, we are headed for a world where solar will be cheap enough to be competitive in say the next 5-10 years, if not sooner. As that time comes upon us the management of energy, both to and from the grid and at the level of each individual enterprise or consumer, is going to be much more important.

Meanwhile, the evolution of the industrial internet means a general trend toward the greater use of measurement and analytics in all areas of business. Energy consumption and distribution will be forefront of this shift.

Enernoc says that right now their primary competition to their EIS platform are spreadsheets and apathy. I believe both of these impediments will become less viable as the electricity grid evolves.

I would urge readers to give a listen to at least the first 45 minutes of the investor day presentation, available here. I thought they painted a compelling picture. Please tell me if you think I’m on crack.

Of course one look at the stock and the numbers and they are terrible. So terrible that I am not going to roll out any spreadsheets or models because they are just too ugly. I think 2015 guidance was for -$3 per share in earnings or something like that; I can’t even remember the exact number because it was so bad that it wasn’t even worth remembering. Cash flow isn’t quite so bad because much of the earnings hit is due to the revenue deferral. The company expects break-even cash flow in 2015.

The stock delivered crappy numbers in the first quarter and got smacked and it could easily deliver crappy numbers in the second quarter too.

Nevertheless I think at some point we see the EIS business overshadow the results. The key metric is annual recurring revenue (ARR), which the company reports for both utilities and enterprises. ARR growth will reflect annual subscriptions to the software.

In 2015 Enernoc is expecting 70% ARR growth for enterprises and 15-20% growth for utilities. If they hit or exceed those numbers I don’t think the stock will continue in the single digits.

This is the kind of story that could get a silly valuation if things turn out right. It is a somewhat un-quantifiably large opportunity that could be extrapolated to a big number if it starts to work. Its not working yet and that’s why the stock is in the $9’s. I think there is a reasonable chance that changes in the next 6-9 months.

Revisiting some existing positions

Air Canada

I made this my largest holding after first quarter earnings were announced. Air Canada continues to get very little respect from the investor community. With estimates that top $3 for the full year 2015, the stock trades at around 4x earnings.

Even after accounting for the relatively difficult business of air travel, and recognizing that free cash generation hampered in the near term by the build out of the fleet, I have trouble believing the stock isn’t worth more than this.

I was talking to a twitter acquaintance about Air Canada and WestJet. He was making the very valid argument that WestJet was an easier position for him to make larger because it was A. less leveraged and B. had lower cost.

The conversation made me revisit a comparison I made of the two airlines. One thing I looked at was analyst estimates for the two companies.

Air Canada trades at a discount to WestJet on both and EBITDAR and EPS basis, but the discount is far greater with regard to the latter because of the leverage that Air Canada employs. Air Canada has about $5.5 billion of net debt while Westjet debt is around $1.1 billion.

I believe that the discount Air Canada receives is due to historical biases that are beginning to close. There is evidence that Air Canada is taking market share from Westjet. Costs are coming down and CASM declines nearly every quarter.

The nature of their network is that it is always going to be higher cost, but what matters are margins and margins have been increasing. In the first quarter operating margins reached 6.3% and return on invested capital rose to above 15%. If they continue to roll out their plan, expand margins while increasing capacity, it will be harder and harder to justify a 3-4x earnings multiple on the stock.

Axia NetMedia

Axia is one of about five stocks that I rarely look at. I have no intention of selling my position. I have confidence in the long-term direction of management. And I think they provide an important service to rural residents and businesses (high speed internet access) that has, if I were to steal the term of a value-investor, a wide moat. I’ve also lived in Alberta all my life, grew up in one of the small towns that Axia provides service to and know the family of their CEO and Chief Executive Officer to be stand-up people.

The business is not without its faults: it requires large up-front capital expenditures to lay fiber to mostly out of the way places. In Alberta it is dependent on a somewhat complicated agreement between Bell (which owns the fibre backbone connecting the 27 largest communities), the Alberta government (which owns the backbone to the rest of the communities) and Axia (which operates the backbone owned by the Alberta government as well as owning branches to individual communities and businesses off of the backbone).

The stock has appreciated over the last couple of years but still trades reasonably at around 7x EBITDA. Once the build-out of fibre in France and Alberta is complete and capital expenditures trend into maintenance, the business should produce ample free cash.

Its a stock I hold without concern and add to on any of its infrequent dips.

DHT Holdings

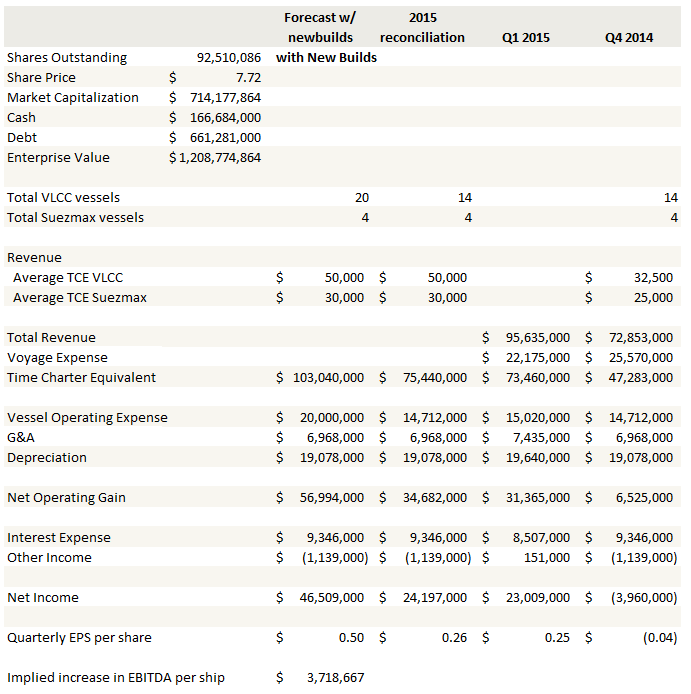

This is my biggest tanker holding. DHT owns a fleet of 14 VLCCs, 2 Suezmax and 2 Aframax vessels. They have another 6 VLCC vessels scheduled for delivery in 2015. I like that they have growth on the horizon and I do not feel like I am paying up for that growth.

In the first quarter DHT reported earnings of 25c. They booked VLCC rates of around $50,000 per day and Suezmax rates of about $30,000 per day (note that in the press release DHT referenced $60,000 per day for its VLCC’s but this referred to spot exposure only).

Along with the first quarter results the company gave guidance on new builds, saying on the conference call that “under a rate scenario, say, $50,000 per day, we estimate that each of these ships will add some $3.7 million of additional EBITDA per quarter.”

Take a look at my model below. Those 6 additional ships, delivering $3.7mm of EBITDA at $50,000 day rates, are going to double earnings to around 50 cents per share quarterly. This is comparable on a per share basis to Euronav, yet Euronav trades at $13.

Like the other tanker companies reporting earnings DHT had mostly positive things to say about the future. The company pointed to a 2 year plus wait to get VLCC delivered from Korean or Japanese yards. They also don’t think the strength in the tanker market has anything to do with contango – instead that it’s a function of higher demand, longer routes and limited order book bringing on little new supply.

Like the other tanker companies reporting earnings DHT had mostly positive things to say about the future. The company pointed to a 2 year plus wait to get VLCC delivered from Korean or Japanese yards. They also don’t think the strength in the tanker market has anything to do with contango – instead that it’s a function of higher demand, longer routes and limited order book bringing on little new supply.

Empire Industries

I was really happy when I found out that the Canadian government had decided to support the 30 meter telescope. As I’ve written in the past, Empire had significant contract work lined up for the telescope, but the work was contingent on financial support for the telescope from the government. The company expects the 30 meter telescope contract to add about $80 million to their backlog.

Even without the $80 million, Empire’s backlog has been increasing. Backlog at the end of the first quarter was $155 million versus $93 million at the end of the fourth quarter. The increase in backlog due to orders for the Media Attractions group, which continues to make inroads in Asia and the Middle East for its amusement park rides.

So with all this good news, why is the stock languishing? Oil. The Hydrovac truck business is getting squeezed on volumes and margins and the steel fabrication segment is weak:

So the problem with the stock is that some business are doing quite poorly. Even with positives from the telescope revenue things remain a bit up in the air because of these other lagging businesses.

So the problem with the stock is that some business are doing quite poorly. Even with positives from the telescope revenue things remain a bit up in the air because of these other lagging businesses.

Finally I have read on Stockhouse that there is the Chinese seller trying to get out of their position. I have no idea whether this is true, but it makes some sense particularly given the pressure on high volume that the stock experienced after earnings. Earnings day is often a good opportunity to liquidate in these low volume venture stocks.

Teekay Tankers

This was my third largest tanker position (behind DHT Holdings and EuroNAV), but after being downgraded by Deutsche Bank on concerns about supply in the second half of 2016, I hemmed and hawed, modeled what looked like it was going to be a very strong quarter and after a whole lot of consternation, I added to my position.

I actually got a copy of the Deutsche Bank report thanks to one of my very helpful twitter pals. It’s a reasonable report. Deutsche Bank expects higher supply growth in 2016 than they had previously estimated. This is because of a pull-in of 2017 new builds into the second half of 2016, and lower scrapping of ships.

I don’t totally agree with their numbers; in one case in particular they assume scrap of 0.5% for 2015 and 2016 while the actual year to date numbers for 2015,which have been extremely low, are 0.3% over the first four months. It seems a little to pessimistic. Nevertheless the themes are reasonable.

The question I wrestled with through the day on Tuesday was whether the tanker rally would end prematurely on the basis of an expected re-balancing of ship supply in year and a bit down the road. My conclusion was that it’s too far to see; too far to expect the market to discount.

What is the new equilibrium price of oil? What is the new demand level at that price? How many new-builds are going to get out on the ocean?

We are already seeing the EIA increase oil demand estimates and we know they are typically behind the curve. We are already seeing costs come down for oil services, suggesting a lower price of oil will deliver similar margins. Deutsche Bank assumed a 38% non-delivery of the order book. This is probably reasonable, but after listening to comments from Euronav and DHT about the composition of the order book its conceivable that the number could be higher.

I get the feeling that Deutsche Bank, and presumably many others, are basing their conclusions on the narrative that tankers are a fragmented industry that has never and will never get their shit together. The problem with this narrative is that its not really historically accurate.

Below is a chart from the Euronav roadshow giving historical VLCC rates, followed by one from Teekay Tankers investor day giving historical Suezmax and Aframax rates:

The VLCC, Suezmax and Aframax markets went through a 4 year period, from 2004-2008, where rates were extremely profitable. In fact they were higher than today. Yet the narrative is that at the first sign of positive earnings, tankers will flood the market and so the current cycle will be 12 months tops.

The VLCC, Suezmax and Aframax markets went through a 4 year period, from 2004-2008, where rates were extremely profitable. In fact they were higher than today. Yet the narrative is that at the first sign of positive earnings, tankers will flood the market and so the current cycle will be 12 months tops.

I’m not so sure.

I’m not suggesting that the questions and history paint a clear picture for tankers. I’m simply suggesting the picture is not convincingly dark. And the valuations, in particular Teekay, reflect a lot of darkness.

Rather than give you my model for Teekay, just take a look at the following slide of the company’s cash flow.

The company’s cash flow increases by 57 cents for every $5,000 increase in day rates. Its extraordinary leverage. Now albeit their definition of “free cash” is a little suspect – free cash for tankers is basically, “we’ve bought all our ships and don’t plan to buy any more”. But nevertheless a cash flow multiple of 3x, when that cash will go straight to the balance sheet in one form or another absent further ship purchases, seems inexpensive to me.

The company’s cash flow increases by 57 cents for every $5,000 increase in day rates. Its extraordinary leverage. Now albeit their definition of “free cash” is a little suspect – free cash for tankers is basically, “we’ve bought all our ships and don’t plan to buy any more”. But nevertheless a cash flow multiple of 3x, when that cash will go straight to the balance sheet in one form or another absent further ship purchases, seems inexpensive to me.

Extendicare

Sometimes you just have to wait out the speculators. When Extendicare announced the sale of its US assets in November, my first instinct was to sell my position. It was a poor deal, though maybe not as bad of a deal as the market reaction insinuated. I did a lot of work in the days after the deal, basically distilling what remained of the thesis into a simple observation: the current market price at the time (around $6.50) was essentially assuming that Extendicare did nothing right going forward: that they remain underleveraged and that they don’t put the cash from the deal to work in a accretive manner. When I thought about the chances of this happening, I saw it as a real possibility, but not a certainty. I also suspected that there were some very large shareholders who had been betting on a positive outcome to the US divestiture and they were now forced to sell shares of an illiquid stock with no momentum at the end of the year.

The picture was thus one of abnormal and perhaps unwarranted weakness. Thus I concluded that I would hold onto my shares and in fact added to them when the stock got as low as $6.20.

Since then we have had a recovery. Extendicare has proven that it can put the cash proceeds towards a positive end, having purchased Revera Home Health homecare business for $83 million. The acquisition is expected to add 10 cents to Extendicare’s AFFO. This has allayed concerns that the dividend may need to be cut to what is sustainable for the Canadian only operations. Also in the first quarter the company bought back 978,000 shares, or a little over 1% of shares outstanding.

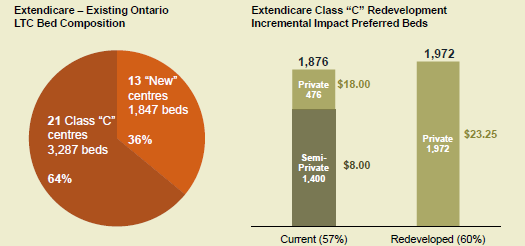

Perhaps most importantly, the Ontario government amended its subsidies for redevelopment at the of February. The base subsidy for large homes was increased to $162,000 per bed from $121,000 per bed over a 25 year life. Also the revised design standards no longer include LEEDs certification, which should bring down construction costs. Below is the outcome of Extendicare converting 1,876 of its Class “C” beds (the lowest type) into 1,972 Class A beds.

The amendment of subsidies is a big deal for Extendicare. The vast majority of their beds are in Ontario. When asked on the call whether the latest changes by the government would make it economically attractive to redevelop their Class-C beds, Extendicare responded that while there are still practical details to iron out, in theory the economics are there.

Given that Extendicare now has multiple options for its cash including further acquisitions in the homecare segment, redevelopment of existing Class C facilities, and new developments in the independent living/assisted living space, investors can begin to look forward at possibilities rather than backward at missed opportunities. I’m holding my shares.

Hammond Manufacturing

The stock has so far been a bit of a disappointment. They had a great quarter on the top line – revenue was up to $30.5mm from $24.5mm in 2014, which is inline with my thesis that they would be one of the manufacturers to benefit from the lower Canadian dollar. The revenue gain was partially due to foreign exchange gains and partly due to market share gains.

Income from operations was also up significantly:

The problem with the quarter, and what was unexpected for me, is that they had a really big foreign exchange loss of $623,000 versus $145,000 last year. $380,000 was due to a USD loan for their US subsidiary. This really depressed the bottom line.

Excluding the foreign exchange loss, Hammond actually didn’t have a bad quarter. The stock remains reasonable. Below are the trailing twelve months results for the company. The free cash generation (below computed before changes in working capital) is compelling and I see no reason for a return to parity for the Canadian dollar and thus no reason to think this level of cash generation can’t continue. I am considering adding to the position, even as I am down fairly significantly on it.

Euronav

Euronav had a very interesting conference call, which unfortunately has no transcript via Seeking Alpha, so it is difficult to quote. I’m paraphrasing. Euronav said they believed we are at the beginning of a multi-year run for the market. They see the catalysts for this run being:

- limited vessel supply

- increasing demand for oil

- rising tonne-miles as cargo moves over greater distances and ships reposition over greater distances

One of the most interesting points that Euronav made, and one that I had not heard before, is that there is a significant amount of vessel tonnage available for sale. They estimated that 10% of the tanker fleet is up for sale from private owners, distressed entities, and opportunistic speculators. Of that 10% a significant number of the vessels are in the 0-5 year range. The point here is that the quality of available fleet is not far off of new builds, and so if capital begins to come into the tanker market looking for a home, there are plenty of places for it to go without adding to supply via new build orders.

Another interesting comment that Euronav made was that you need 40 new build VLCCs per year to keep up with oil demand. Returning to the Deutsche Bank analysis I mentioned in my Teekay Tankers remarks, Deutsche Bank is estimating an increase in 30 VLCCs in 2016, followed by only 10 in 2017. Again, I’m not so sure that their analysis is as bearish as their price target changes suggest it is.

Euronav’s bottom line is the same one I have already stated for DHT Holdings and Teekay Tankers. Its too cheap if you think rates in the current range can sustain themselves. The company can generate earnings north of $2 per share at current rates (earnings were 55 cents in the first quarter). At $13, which is where I was buying it, it trades at 6x earnings. If that multiple goes to 8x you are looking at a 36% upside in the price.

Stocks I sold

I exited a number of positions in the last month. I sold out of Handy & Harman (HNH), Ellington Financial (EFC), Hooper Holmes (HH), Amdocs (DOX), Ardmore Shipping (ASC), Impac Mortgage (IMH) and Avid Technologies (AVID).

In the cases of Amdocs, Ardmore, Impac and Avid, I sold out because the stocks had risen to a level that I thought closely reflected a fair price. With Impac Mortgage in particular I caught the top with the on-line portfolio sales, but I regret to say that in my real dollars portfolio I only sold half at $27, and had to let go of the rest at $22. I may revisit Ardmore in the future if it dips but I just have so many shipping plays in my portfolio right now I thought it prudent to take profits on some of them.

Handy & Harman and Hooper Holmes both just weren’t working out, I was down about 20% and so I had to make a decision of what to do. I decided to cut the positions because I am simply less certain about their future direction than I am with other stocks in my portfolio.

I still own Ellington Financial in my other account where I hold mostly dividend payers. I just didn’t think holding a stock where the upside is mostly yield makes much sense in a portfolio that does not track dividends.

Portfolio Composition

Click here for the last five weeks of trades.