Is Bank7 a Compounder?

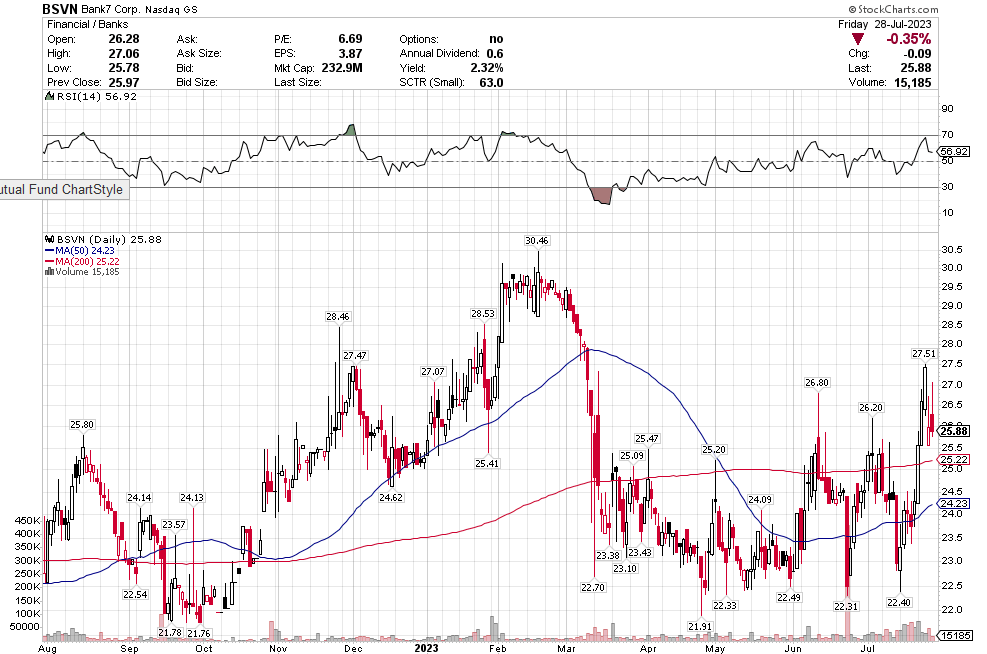

Bank7 got hit in March, along with the rest of the banking sector, but it never really traded down close to its 52-week lows. It corrected, but the move in the stock looked more like volatility than any real secular change.

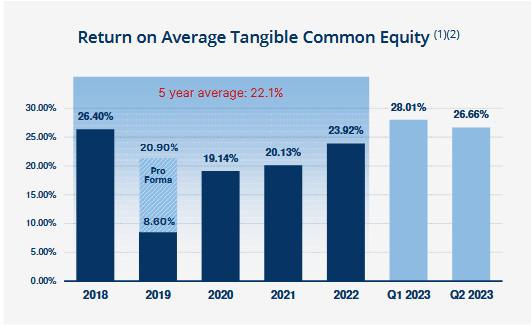

That is probably for good reason. Essentially it comes down to this. For the last 5 years Bank7 has been averaging 22.1% return on tangible common equity. Those returns even accelerated in Q1 and Q2 of this year.

Since 2014 Bank7 has grown assets at a 15.9% CAGR. Most of that organically, as this has only included a couple of acquisitions.

Bank7 managed through COVID and now through inflation and they just keep growing. That has left them with a nice problem, which they articulated on the last conference call:

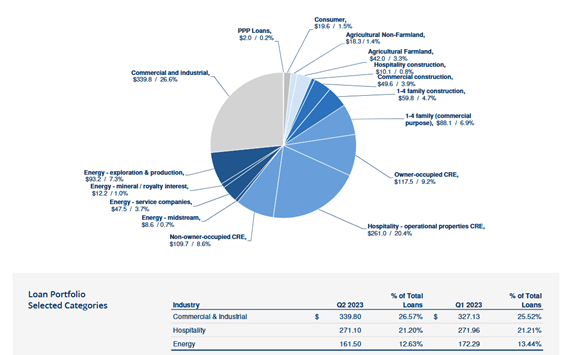

In the current moment of high interest rates and a (surprisingly) strong economy, Bank7 fits my criteria of a bank that should do well. They are heavily weighted to the loan side (as opposed to securities), to variable rate loans, to the type of loans that will hold up better in a good economy, and the loans they are making are at 8%+ rates.

Of course all this means the loans that Bank7 makes are riskier than most. There is quite a bit of energy and quite a bit of hospitality CRE in their portfolio. In a bad economic environment those could cause trouble.

But for now, apart from one outlying energy credit that is going through bankruptcy (and that BSVN expects to recover fully on) their loan book seems to be performing fine.

There’s one large credit, I think that’s out there in the public realm that we really can’t talk about because there’s ongoing litigation. Outside of that line of credit, the energy book is performing very well. I will say that the deal flow there has slowed quite a bit from the pace of last year, and we did contract about. It’s about $10 million during the quarter. I wouldn’t be surprised if there’s a little more contraction as the year goes on in that book, but overall, credit quality there is very strong with primarily companies we bank for a long time.

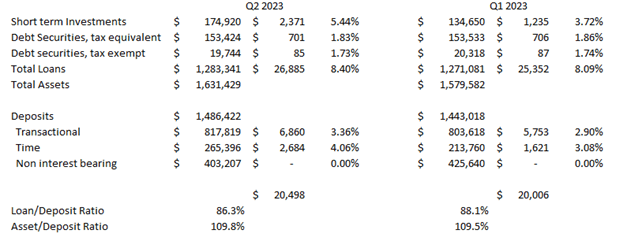

Bank7 Q2 earnings were one of the few bank earnings reports that showed minimal deterioration to the bottom line. Even though they did have a noticeable rise in deposit costs earnings were flat. Bank7 had $1.06 EPS in Q2, essentially the same as Q1. At this run-rate they are trading at 6x P/E.

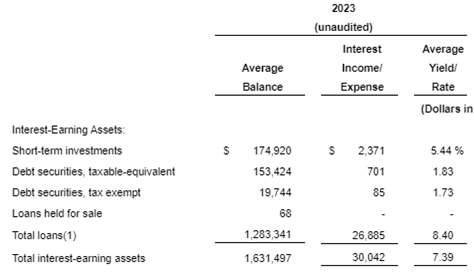

I found it interesting to walk through Bank7’s interest income numbers in Q2. It kind of highlights how a bank can avoid earnings compression even as its deposit costs rise.

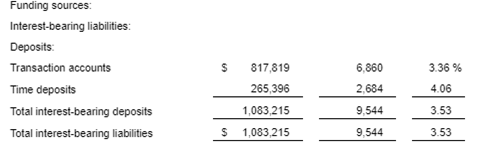

In Q2 Bank7’s deposit costs rose quite a bit. They were far from immune to the repricing of deposits. Their total cost of interest bearing deposits in Q2 was 3.53%. This was up from 2.94% in Q1.

Just purely on cost of deposits Bank7 lost nearly 60 bps of margin. On the surface that would seem a bit worrisome. It had to cut into the bottom line right?

Not so much.

This was, in part, because Bank7’s loans re-rated upwards as well. Their average yield on loans is now 8.4%. That was up from 8.09% in Q1, so up 31 bps.

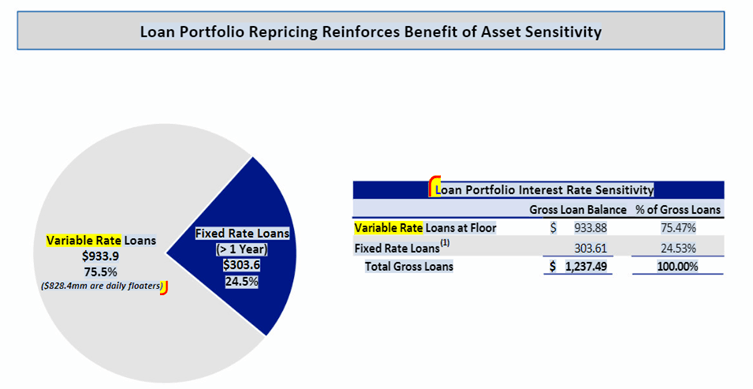

That loan book repricing is because of variable rate loans. A couple of quarters ago Bank7 put out a slide on their loan book. Three quarters of their loans were variable rate. Some of these loans are hitting a ceiling now though, so I think that going forward the variable-ness of their loan portfolio is less, closer to 50%. But up until now, Bank7 has seen their loan book reprice along with their deposits.

So the loan book re-rating up helps explain why earnings didn’t decline. But it doesn’t explain it entirely. Even with the re-rating of the loan book Bank7’s deposit costs rose a lot more then their loans. Subtracting the interest rate of what Bank7 paid for all its liabilities from the interest rate it got from its assets, you get a spread of 3.85%. This is down 25 bps from Q1 so better than the 60 bps they lost on deposit costs but still not insignificant.

But their actual net interest margin was down only 10 bps from Q1 to Q2. It was 5.04% in Q2 vs 5.14% in Q1. And their net interest income, the dollar amount of net interest they received, was actually up from the first quarter (which is what really matters for earnings).

What sort of black magic is this? How does Bank7 go from losing 25 bps on interest costs to only 10 bps on net interest margin to actually gaining on net interest income?

I talked in prior posts about how well-managed banks can manage their earnings and often they have more levers to pull than they are given credit for. With Bank7 it wasn’t so much lever pulling as them setting themselves up with assets and deposits that match in terms of their interest rate sensitivity, so that even when a portion of those liabilities (the interest bearing deposits) was rocketing higher their bottom line was insulated.

When you look at the interest income breakdown for Q1 and Q2, it really comes down to two things.

First, Bank7’s short-term investments, which is really just their own cash that is held at the Federal Reserve banks, yielded more. They also added to the cash pile by $40mm, which was offset by deposit adds of about the same. This had some impact on the net interest income number.

Second is the “magic” of non-interest bearing deposits. Yes, Bank7 saw the cost of their transactional and time deposit costs rise a lot. But their non-interest bearing deposits were (by definition) still non interest bearing. While some of those deposits shifted from non-interest bearing to interest bearing, they didn’t shift that much. As a result, the rise in the interest earned on their loans and their cash held at other banks more than offset the increase in deposit rates.

Their core NIM, so not including any impact from fees and such averaged 4.66% in Q2 2023. This was only down 5 bps from Q1 after excluding a one-time purchase accounting adjustment. On the call they gave some guidance of what to expect with core NIM.

I’m not sure we’ve ever dipped below about 4.25% or 4.3%. And so there’s nothing that we see today that would lead us to believe that we’re going to operate outside of those ranges. And I’m not saying that we’re going to go from 4.55% real time today to 4.30%, but if it happens, it happens.

Their worst case scenario NIM is a drop to 4.25%-4.3%. Their core NIM right now is 4.55% which means worst case it drops down somewhat but still pretty strong. Moreover, 4.55% is their “real time” number and the number they say to use going forward. Which suggests (and this is an important point) they have an expectation that we’re at the bottom.

But even with some continuing slippage in their margins, I don’t see much of an impact on earnings at all in Q3. I modeled out Q3 assuming their overall NIM drops from 5.10% to 4.9%. That assumes they see another, albeit smaller, drop in non-interest bearing deposits in Q3, that the re-rate on their loan book is less than Q2 and that their loan to deposit ratio stays flat. I get earnings of $1.02 EPS, which is a drop for Q2 but not much of one.

Bank7 could manage this to be even better. By simply adding a smidge of growth to their loan book – say 2% sequentially, something that would only move their loan to deposit ratio up from 84% at end of Q2 to 85% – they could offset that drop entirely. And given that their transactional and time deposit costs were already at 3.36% and 4.06% on average in Q2, there isn’t a lot of room for these to go much higher. In fact some of those time deposits might be looking favorable as the Fed has raised rates again and loans are probably in the mid-8s or higher right now.

Is Bank7 a compounder? It seems like I am likely to only really know this after the fact. As someone who is more of a generalist, who cannot know all the intricacies of the Oklahoma market or Bank7’s reputation there, I can only make an educated guess. Banking is a little trickier in this regard than other businesses. While it is relatively straightforward to evaluate a business’s product or service and its enduring value to customers, the value of a banks product, its loans, can only be known for certain in retrospect, after the loans are shown to be good and repaid. All I can say is so far, Bank7 has the earmarks. And they certainly think so: