Falling Knives in the S&P

The S&P index is down about 6% and the Nasdaq about 8%. By these measures, thus far it has been a correction but not a steep one.

But it doesn’t feel like these moves in the indexes tell the whole story.

You get a bit better sense of how the market has been performing by seeing the larger swath of small-cap companies included in the Russell 2000 index, which is down 11% from its high in late July.

There are some individual situations that are much worse.

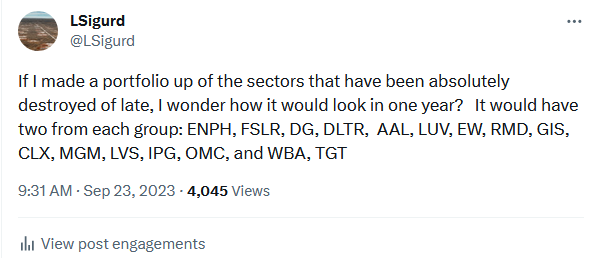

This weekend I went through the individual stock charts of all the S&P names looking at what has really been crushed. The knives that have fallen the most. On Twitter I made the following comment:

The funny thing about the above portfolio is how diversified it is. You have growth, defensives, cyclicals, healthcare. There is not a lot in common between the sectors that have performed the worst.

Maybe what is in common is who owns them? @CorneliaLake, a very smart guy who would have much more knowledge into this than I have, responded to my tweet with:

So maybe that explains it to some degree?

My history with catching a falling knife is good and bad. I’ve had some good luck with it recently – in December I bought a lot of SaaS stocks that were going down every day. Before that I bought Meta when it fell to the 80s and Amazon when it fell to the 90s.

Other the other hand, there have been plenty of cases where it hasn’t worked.

Here are some knives that have fallen a lot.

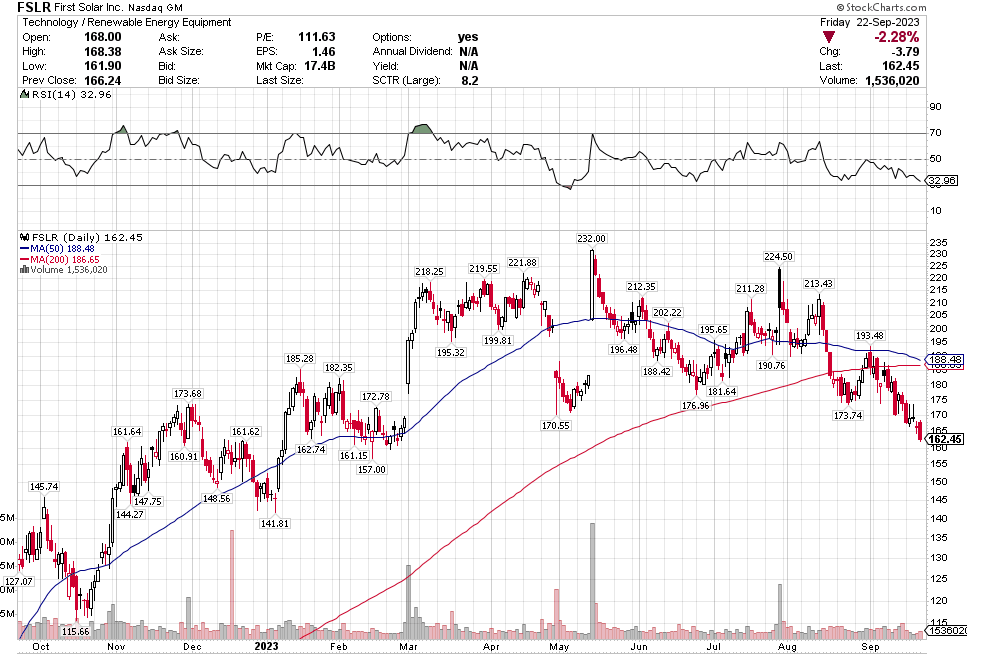

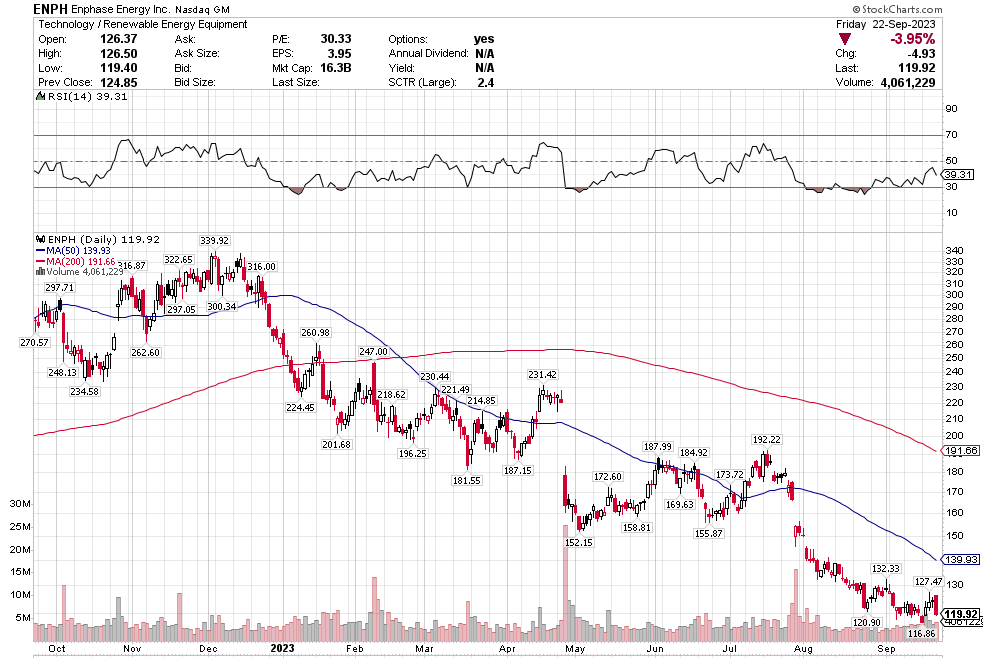

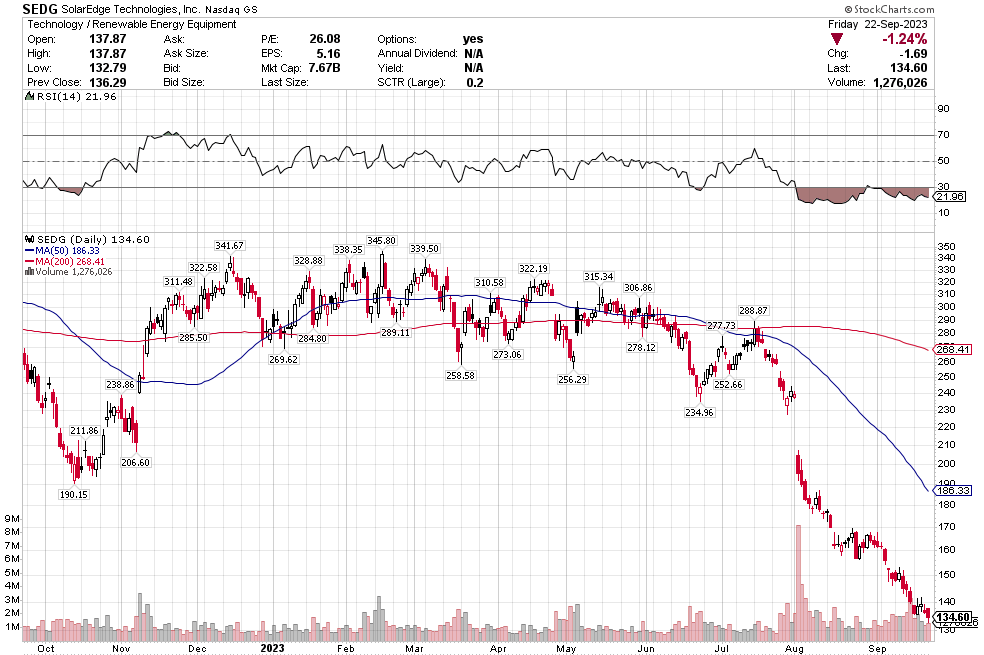

Solar

Some of these solar stocks have just gotten killed. I have read that the residential solar market in the US and Europe is slow and that because demand was so strong last year, the market over-ordered and that has caused an inventory glut. That is why Enphase and SolarEdge are down. Tesla is also making more of a push into solar, which adds another formidable competitor.

I’m less certain why First Solar is down, since they sell into the utility solar market and that has been okay from what I have read.

On the positive side, the longer-term demand picture for solar remains intact and underlying demand, especially in Europe, continues. Solar also benefits from higher energy prices, which are beginning to happen again.

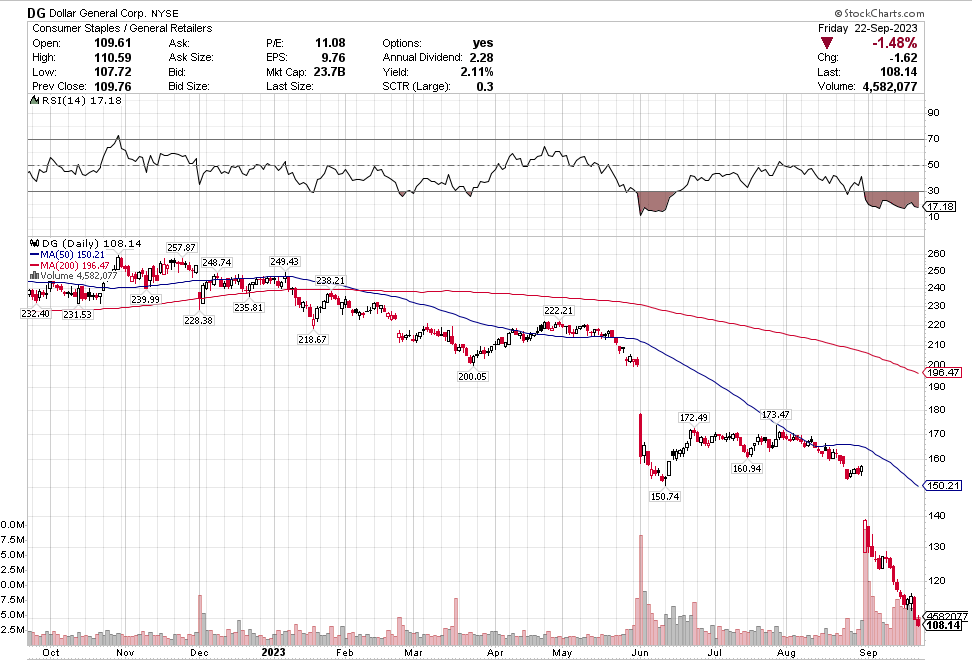

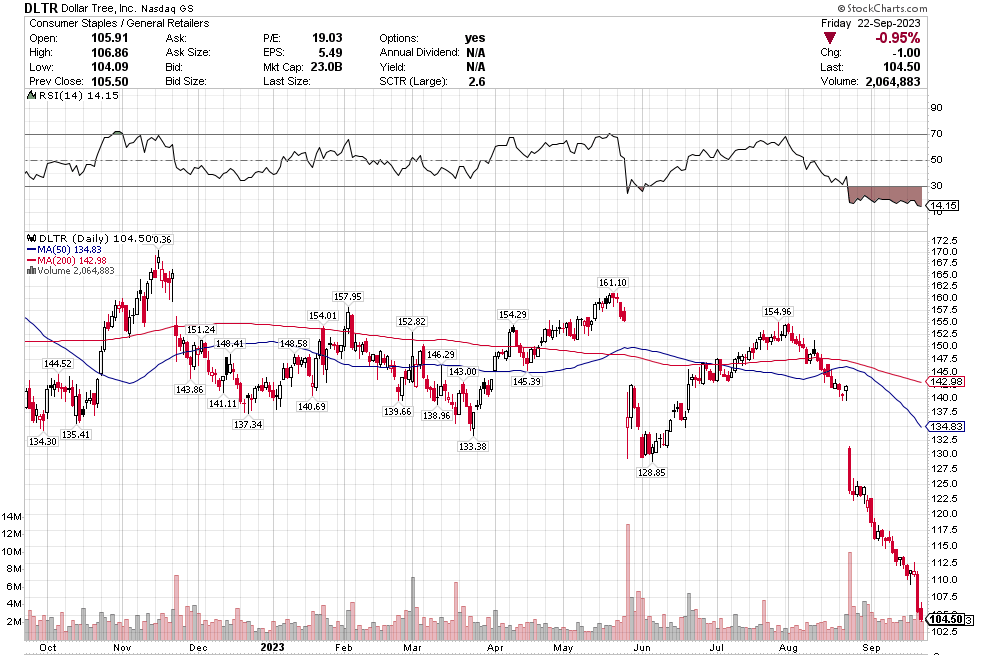

Dollar Stores

The dollar stores have been crushed. I have looked at Dollar Tree but not Dollar General. It appears that what started it all for Dollar Tree was when they raised revenue guidance for Q3 but did not raise earnings guidance. Of course that meant that margins were under pressure, which crushed the stock. I assume the same is true for Dollar General.

Today, these stocks are cheaper than they have been in at least 10 years. Dollar Tree buys back a lot of stock, they reduced their share count by almost 100mm shares (over 30%) the last 10 years. Dollar Tree has traded in a range of 1.1x EV/sales to 1.5x EV/sales over the last 10 years. Today its at under 0.8x. One odd thing about these dollar stores is that the Canadian comp, called Dollarama, is just off its 52 week highs!

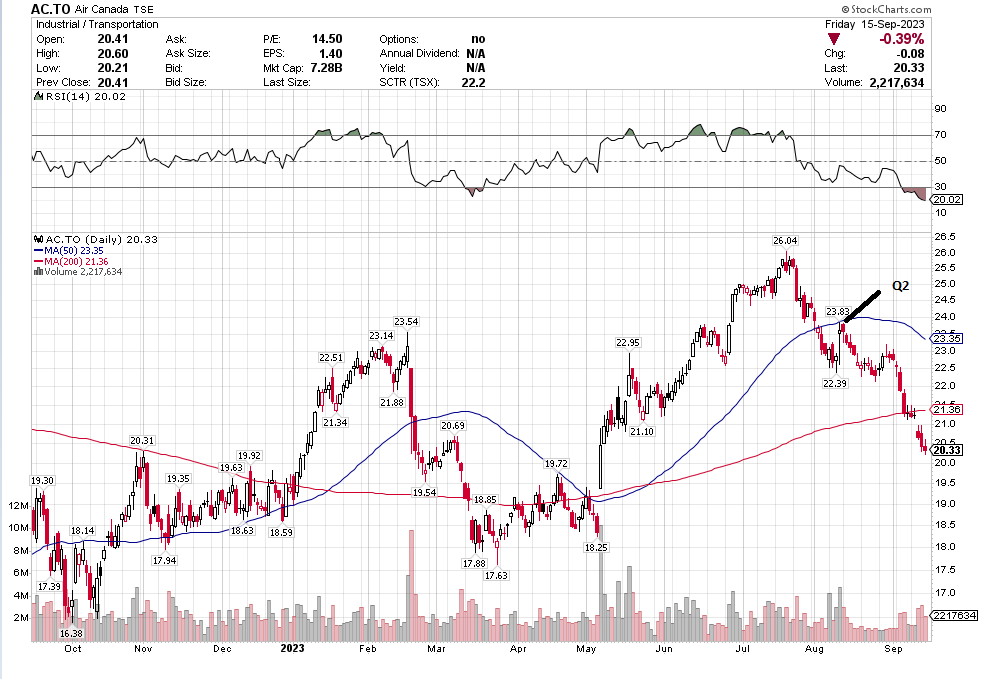

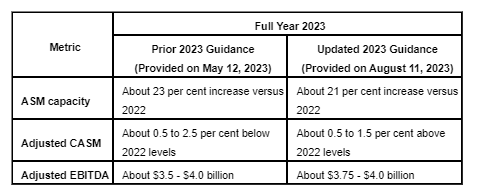

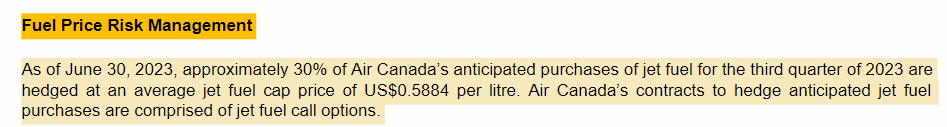

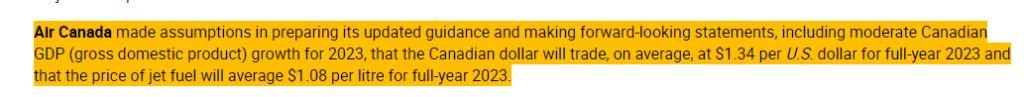

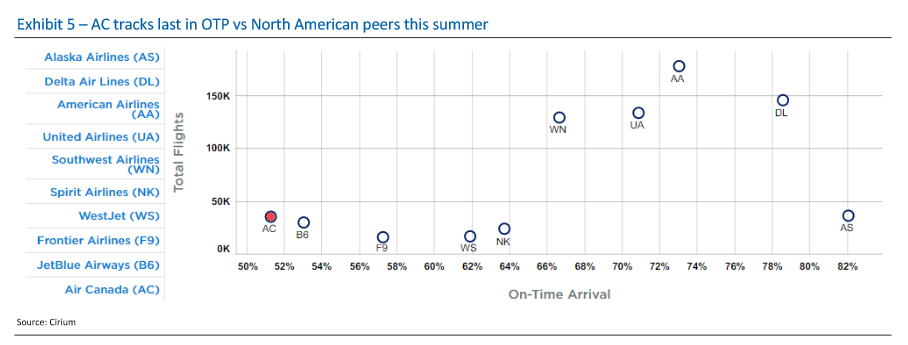

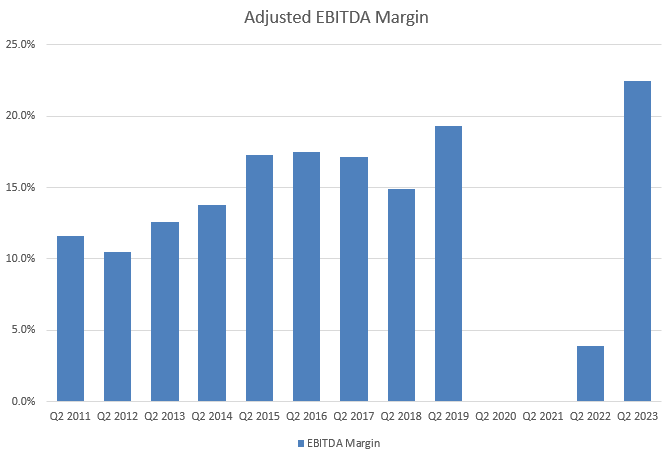

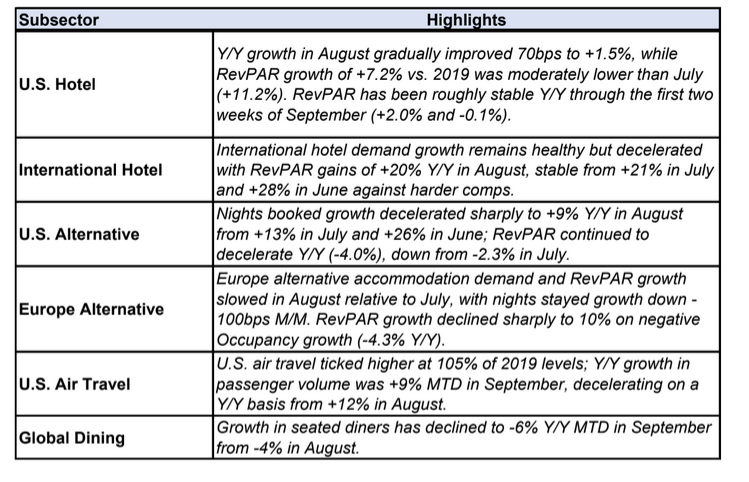

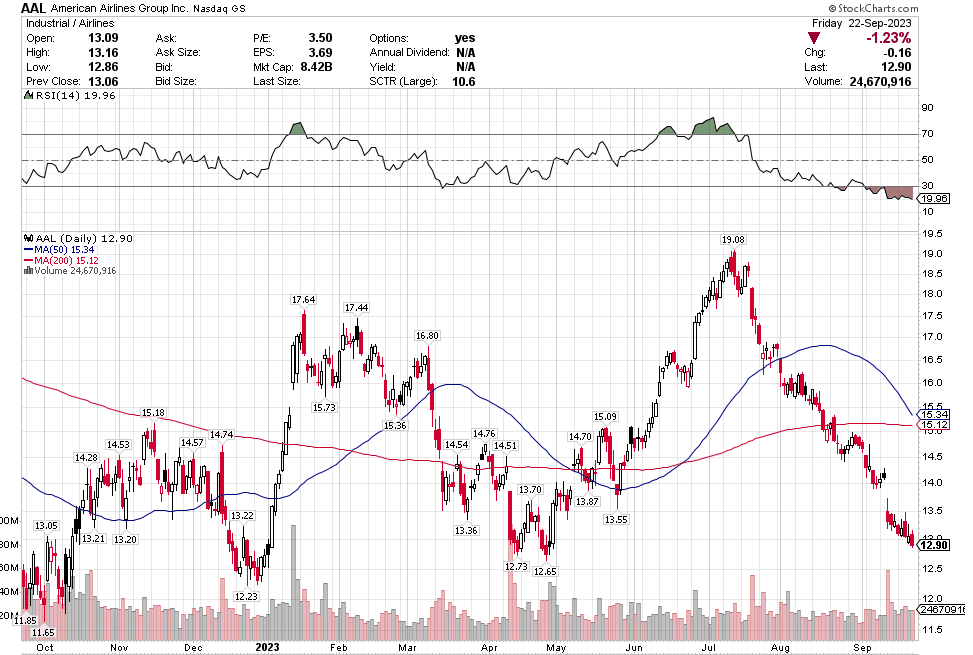

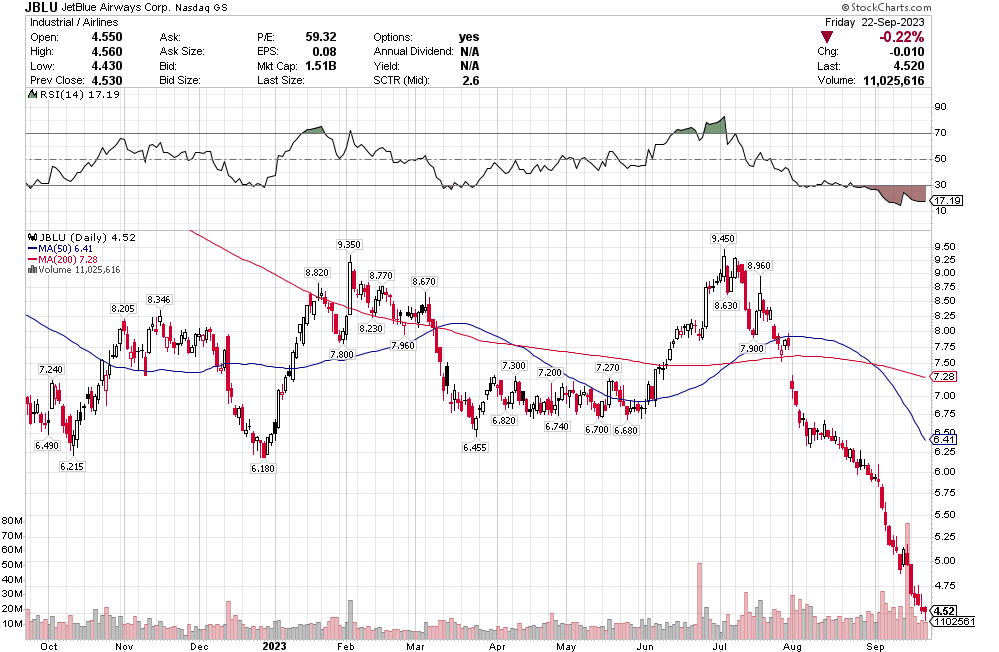

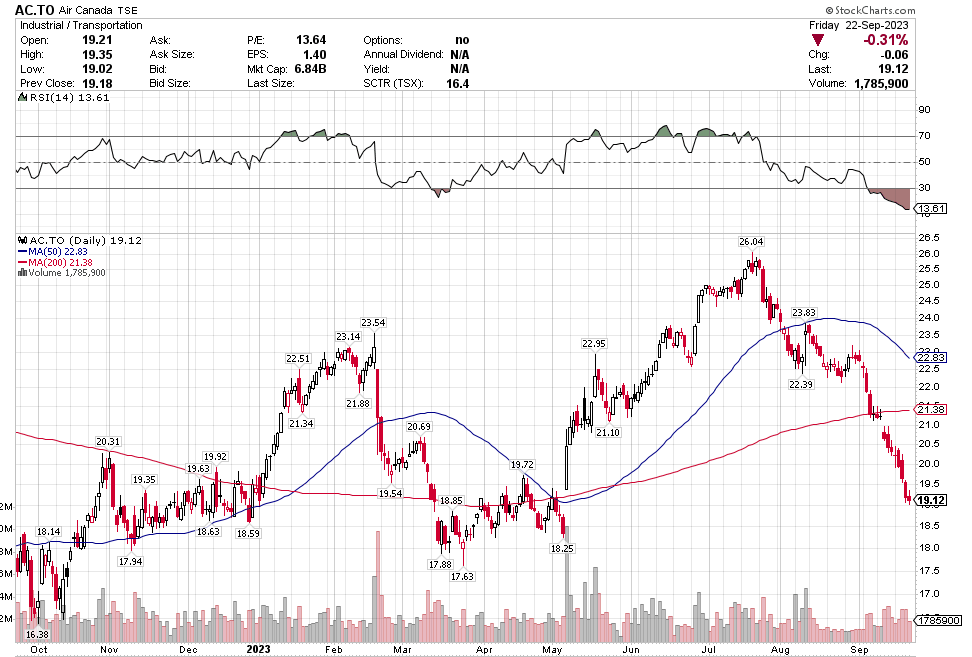

Airlines

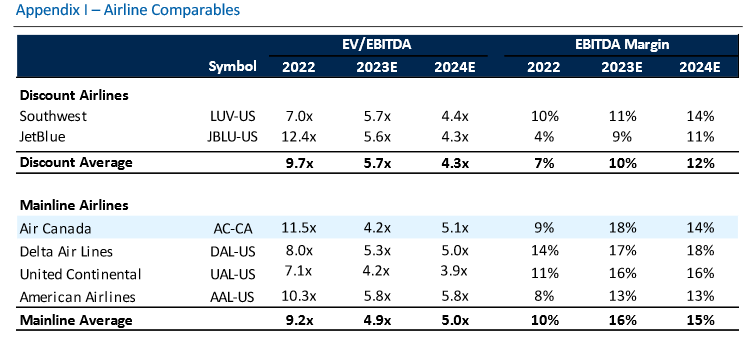

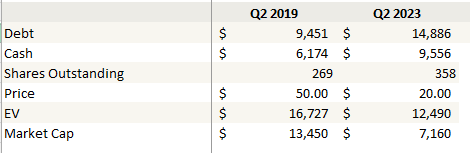

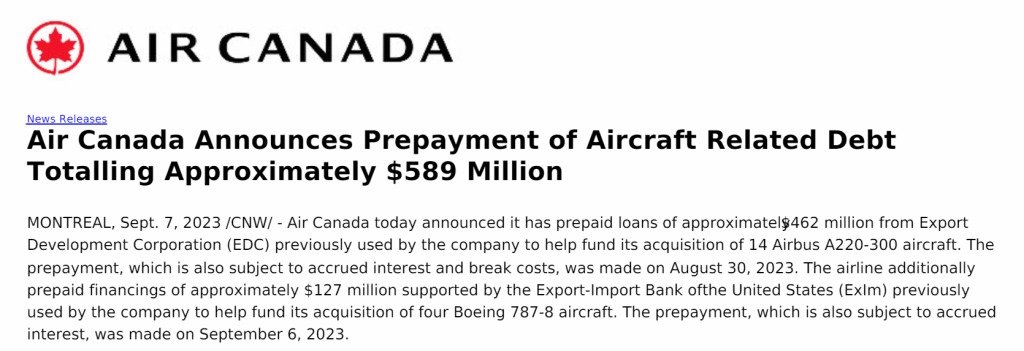

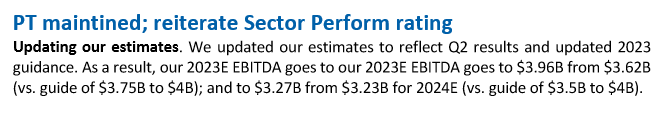

I already wrote about Air Canada last week. It has continued to go down. It is not the only one. The entire airline complex has been in free fall. Yet I read a piece from Wedbush this week that said air travel (and more generally travel) demand is slowing from the summer heights, but still holding up just fine.

The airline stocks are trading like a massive recession is upon us. Even stalled out oil prices hasn’t seemed to helped.

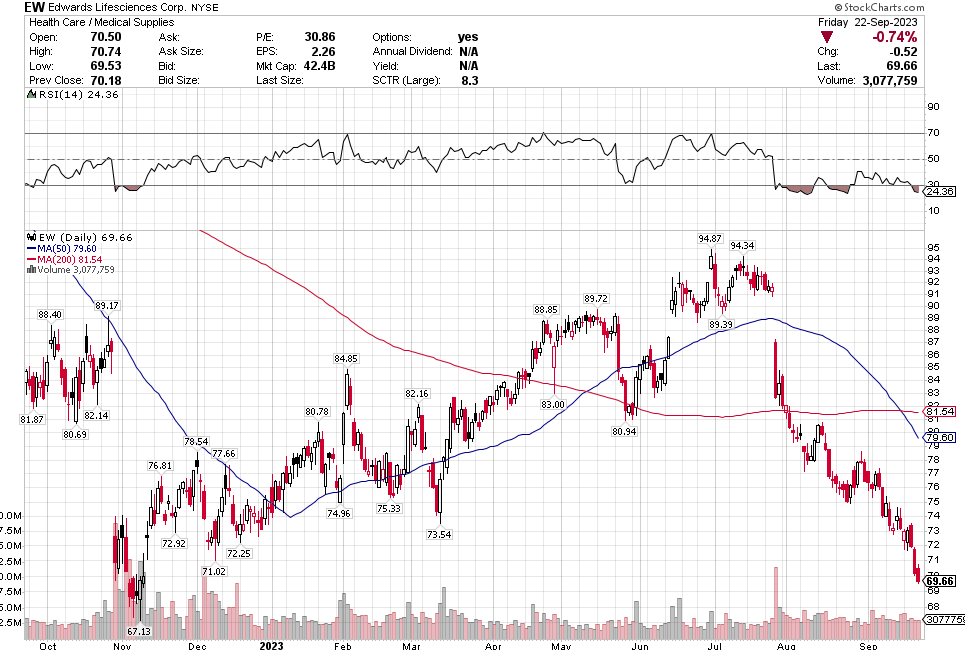

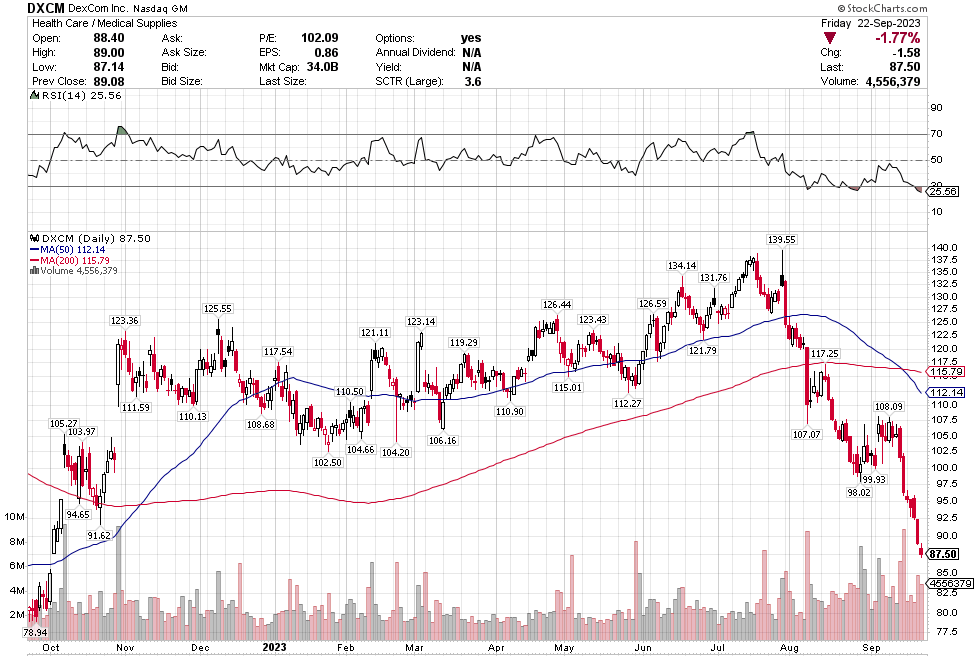

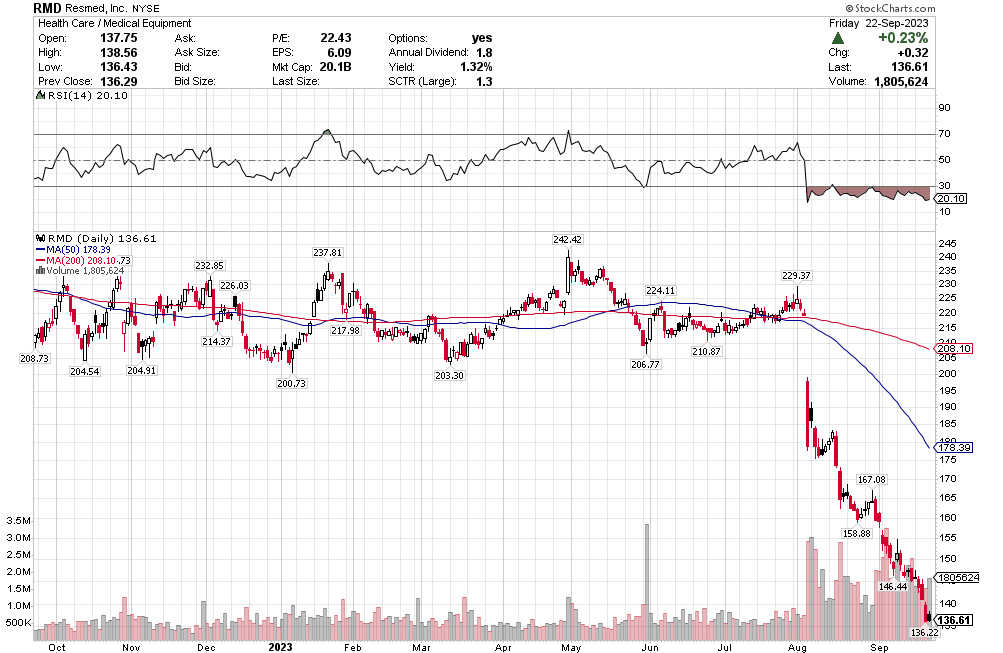

Medical Devices

One of the surprises when I went through the list of S&P companies was the number of medical device stocks that were just in free-fall. Edwards Life Sciences, Dexcom, Resmed and Teleflex are all disasters.

These companies are all growing the top line. They are profitable. Yet they are down near or even past their COVID lows.

It took me a while to figure it out. It all has to do with Ozempic and the weight loss drugs. Some of these are obvious – for example Dexcom is glucose monitoring for diabetes. Some are less obvious – for example it turns out Resmed makes money from sleep apnea therapy and sleep apnea is more prevalent in obese people. Who knew? Of all the names Teleflex looks most interesting because they are pretty cheap on earnings and I’m also not really sure how Teleflex is related to Ozempic, which makes me wonder if it is being caught in the downdraft.

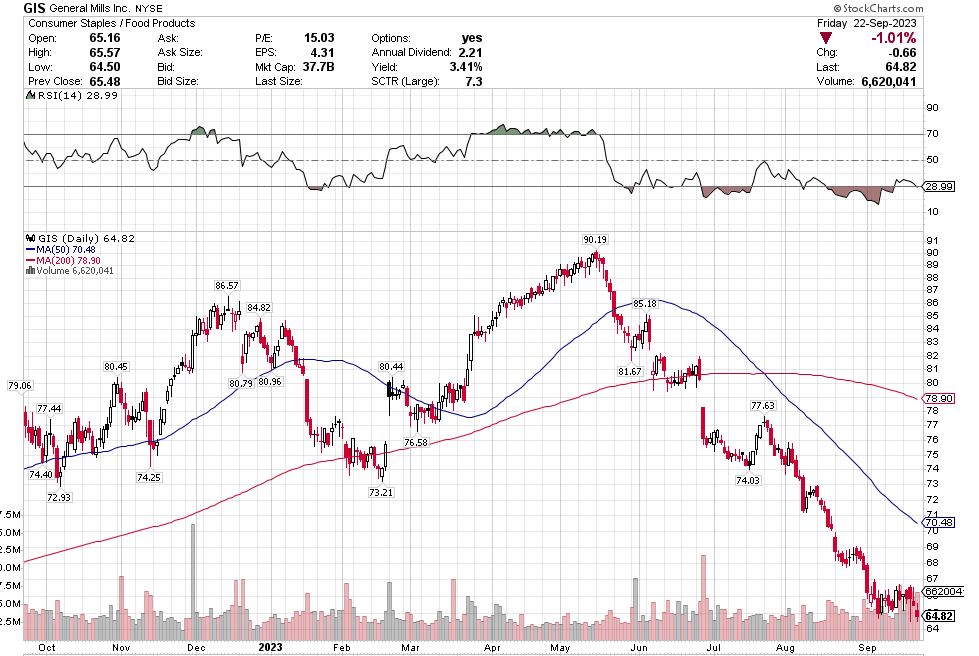

Staples

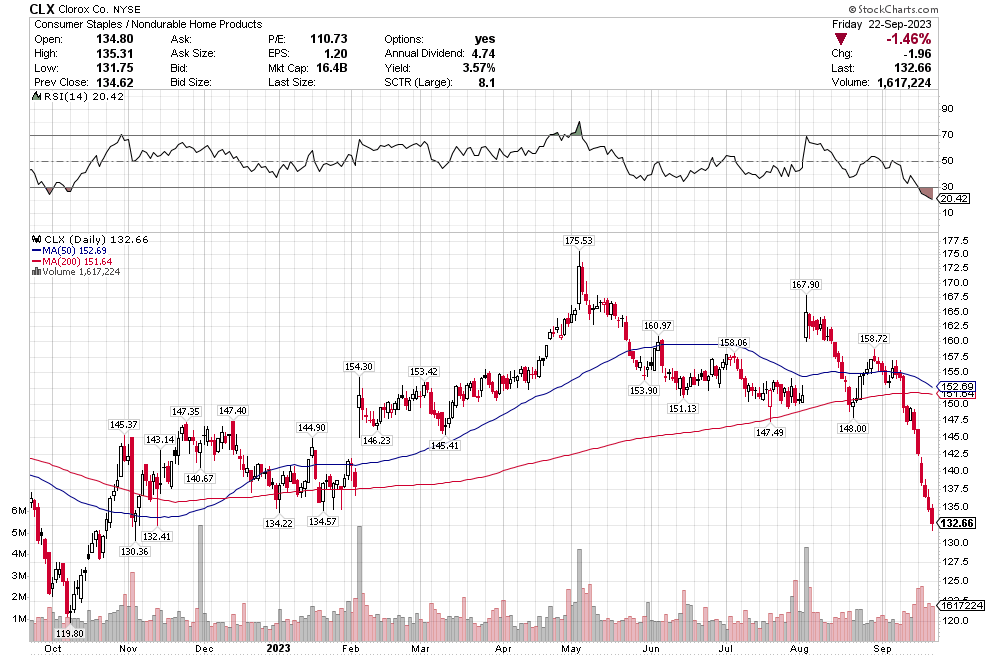

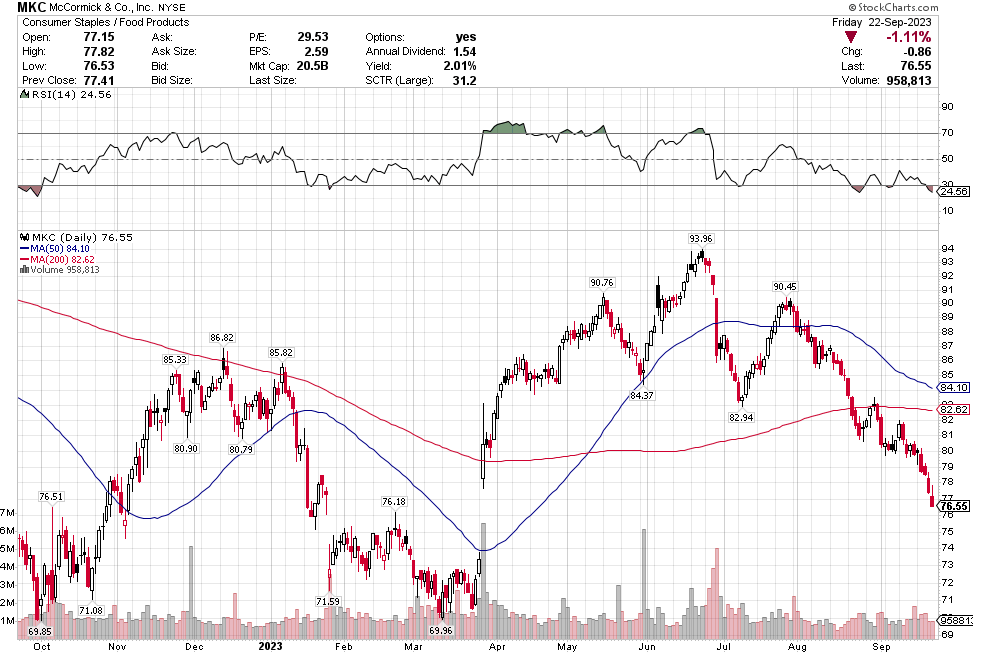

Some (but not all) staples, like General Mills, Clorox, Hershey, McCormick & Company and Kimberley Clark have been hit pretty hard. Some of this is again due to the weight loss drugs – like Hershey for example and probably General Mills.

Some of this is likely just because these companies are really expensive and with interest rates rising some of their multiples are coming down. These are names I have been paying attention to because I was actually right about a few of these – I was short both Kimberley Clark and Clorox.

I think General Mills is worth a closer look. I haven’t spent a ton of time on it yet but reading through their quarterly results, which they released just this week, and it seemed ok. They reiterated guidance, are going to grow 3-4%, grow earnings and FCF 4-6%. The stock trades at 14x PE with a 7.5% FCF yield which actually seems reasonable to me. It is a whole lot cheaper than some of the staples I was looking at last year, when they seemed to all trade at 30x earnings.

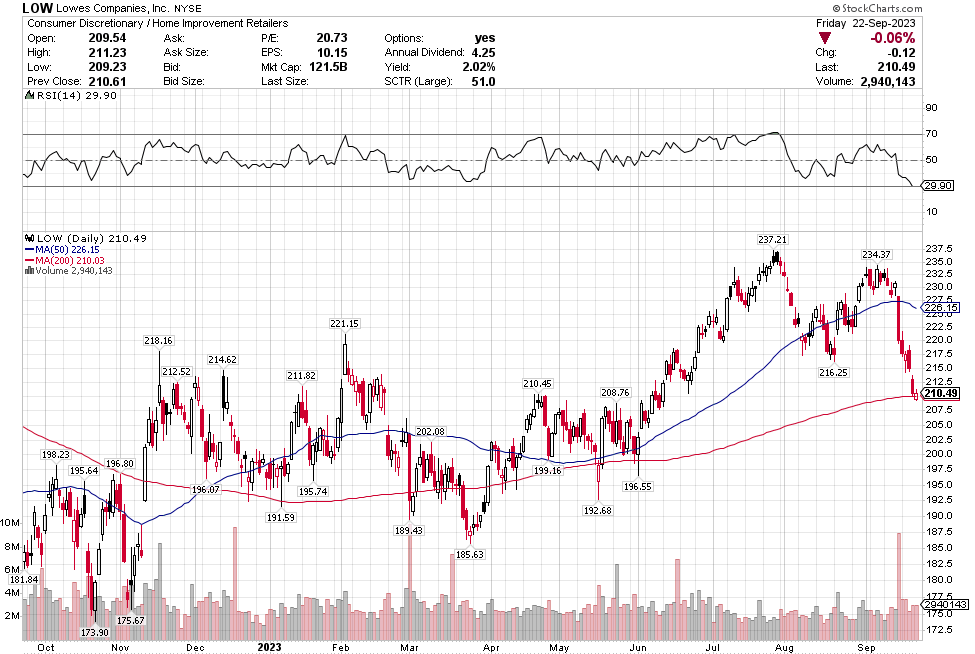

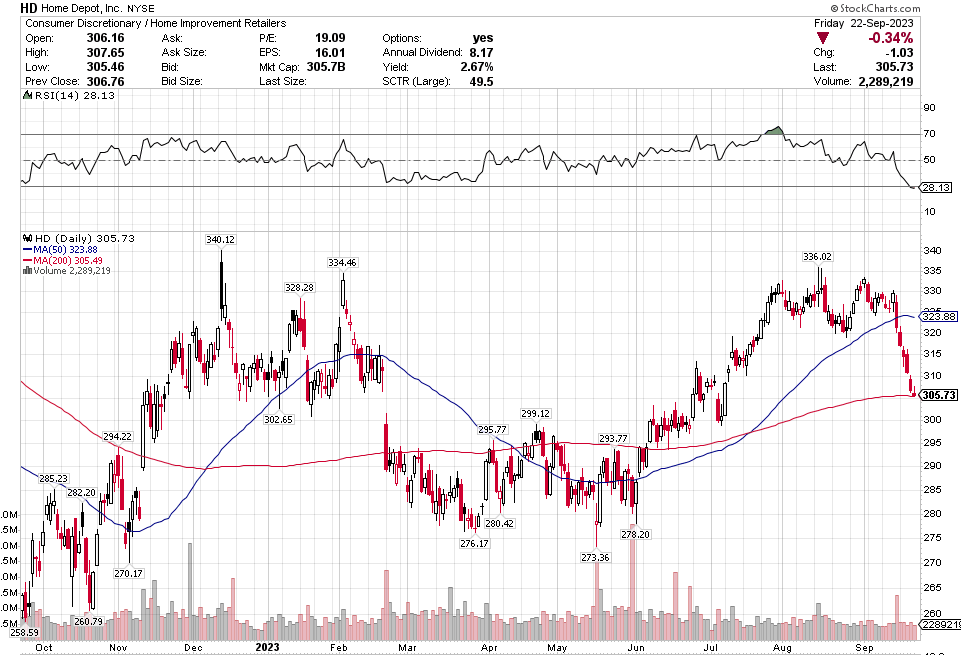

Hardware Stores

These are more recent victims. Lowes and Home Depot have done very poorly over the last couple weeks though both are still up on the year. It is probably too soon to be thinking about these stocks but at some point they would be interesting. It looks like HD trades at about 20x PE and LOW at 15x, so these are crazy cheap but not crazy expensive either.

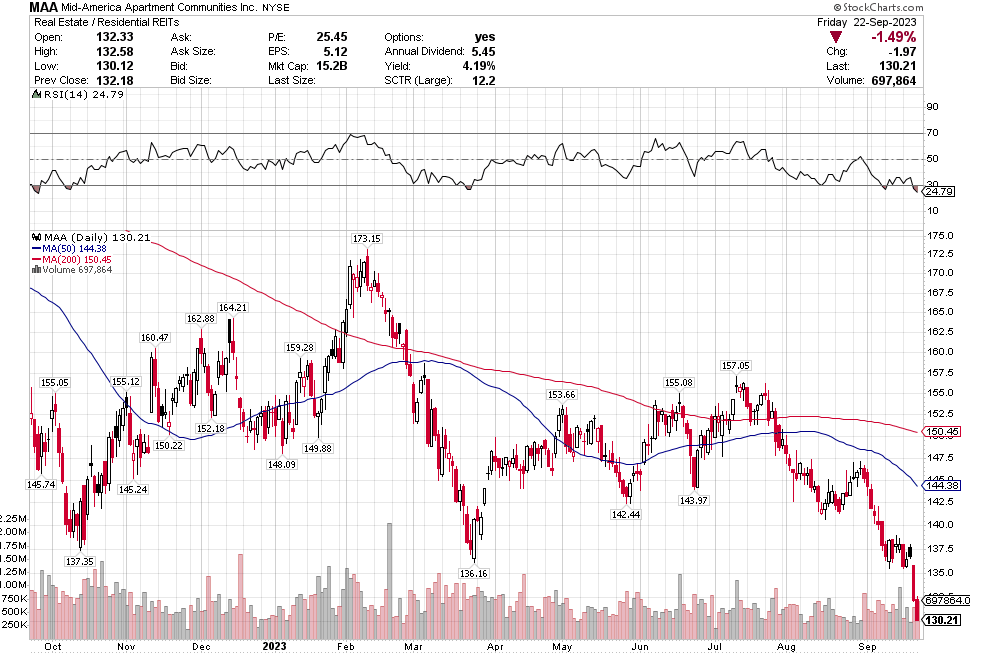

REITs

The REITs are pretty ugly looking in general, which I guess isn’t surprising with rates so high. Nevertheless, I am a little surprised that names on the apartment REIT side, like Mid-America Apartment Communities, is doing as badly as it is. Maybe I am biased from living in Canada where it seems like housing shortages are on the front page. This is another weird one where the Canada comp seems to be opposite. When I look at Boardwalk, an apartment rental company here in Canada, the chart is at its highs.

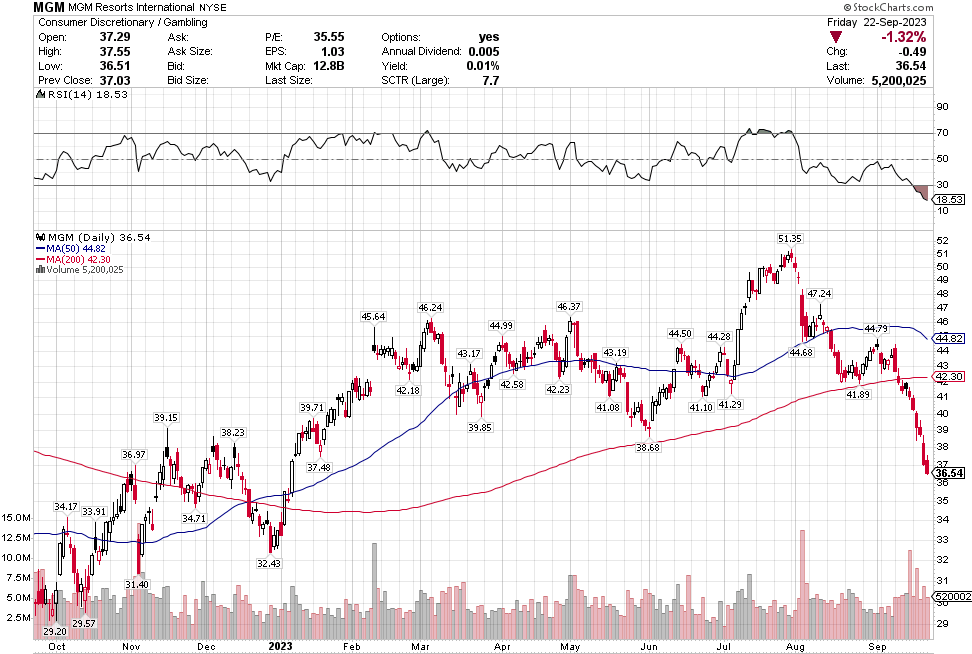

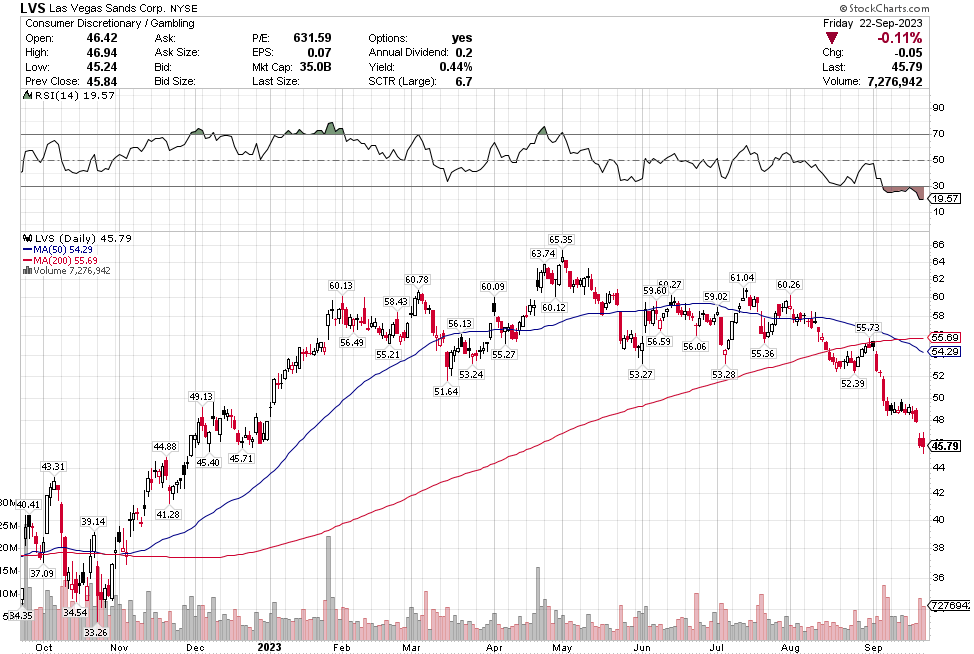

Casinos

Las Vegas Sands and MGM are in freefall right now.

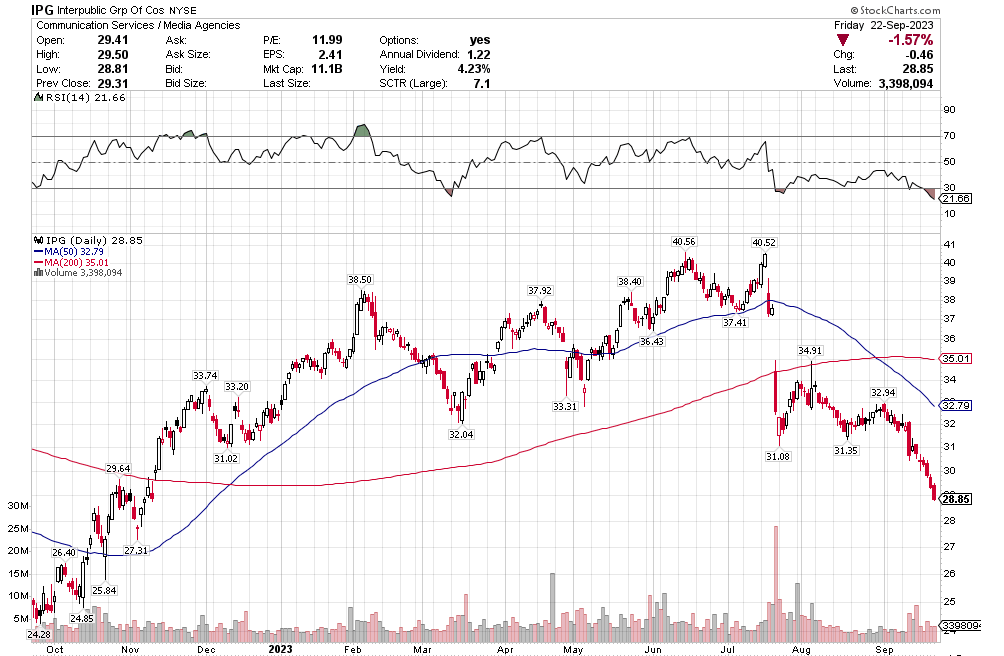

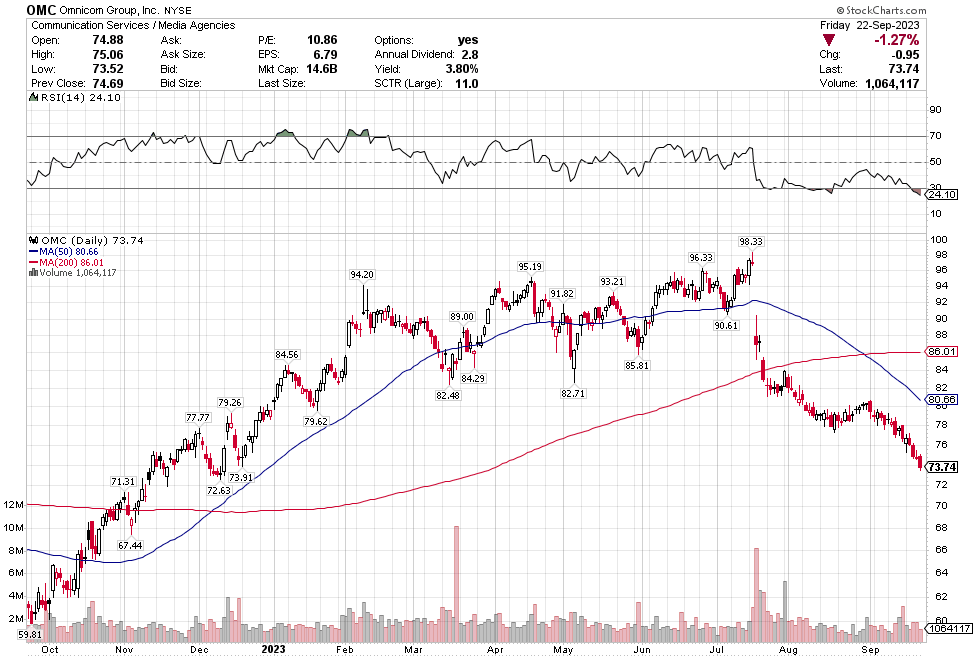

Advertising

I don’t know a lot about this sector but I plan to learn more. Interpublic Group and Omnicom both provide advertising and marketing services. Both of these companies are trading at 10% FCF yields and under 10x PE which makes them interesting.

Those are the sectors that I see performing the worst of late. Maybe most encouraging is that other than these sectors, most stocks in the S&P seem to be holding up okay. I did not see any wide spread collapses. Some of the charts look a little rough because of the sell-off Thursday but we’ll have to see if there is any more follow through.