Nimble Storage as a Bet on a Successful Pivot to All-Flash

I’ve been dragging my heels on a Nimble write-up. I knew I would have trouble with it. I have a thesis, but I’m not entirely convinced of it, and I don’t feel like I have a really firm grasp of the industry they operate in. So I’m not in a position to write anything very definitive.

What would accurately summarize my thoughts is to say that I think that Nimble may go a lot higher if things pan out. I think the downside is fairly low (maybe 20%) and the upside is high (maybe a double). And while I really don’t have a ton of conviction that events will transpire positively, the risk/reward makes it worthwhile to me.

Nimble sells flash memory. Flash memory has replaced hard disk drives (HDDs) as the preferred technology for persistent (meaning that the data persists when devices are powered down) storage. Flash has much faster read and write capabilities than HDD storage. Its primary disadvantage has always been cost, and that has narrowed as the technology has been refined.

Nimble has historically sold a version of flash memory called hybrid flash. Hybrid flash means they are not just selling flash, they are selling a combination of HDD storage and flash storage. For a number of years hybrid flash bridged the gap by providing some of the speed improvement of a flash array but without all the cost.

At the most basic level, hybrid storage works on the read side by keeping the most commonly accessed data in the flash and the less accessed data in the HDD. On the write side, the flash is used as a buffer that gives the appearance of speed as long as write loads are not too heavy.

This Youtube video, which is ostensibly about Nimble’s operating system, provides a good explanation of how hybrid flash works. It also explains some of the tweaks that Nimble’s hybrid flash incorporates to speed up performance even further. Nimble’s hybrid flash is considered top of the line.

Slowly, technology improvements and cost reductions have been made to flash arrays that have improved the cost/benefit equation enough to justify complete replacement of HDD storage in some of the heavy use applications (referred to as primary workloads). When a storage system uses nothing but flash memory it is called all-flash. The acronym AFA, which is the commonly used terminology in investment reports, stands for all-flash array.

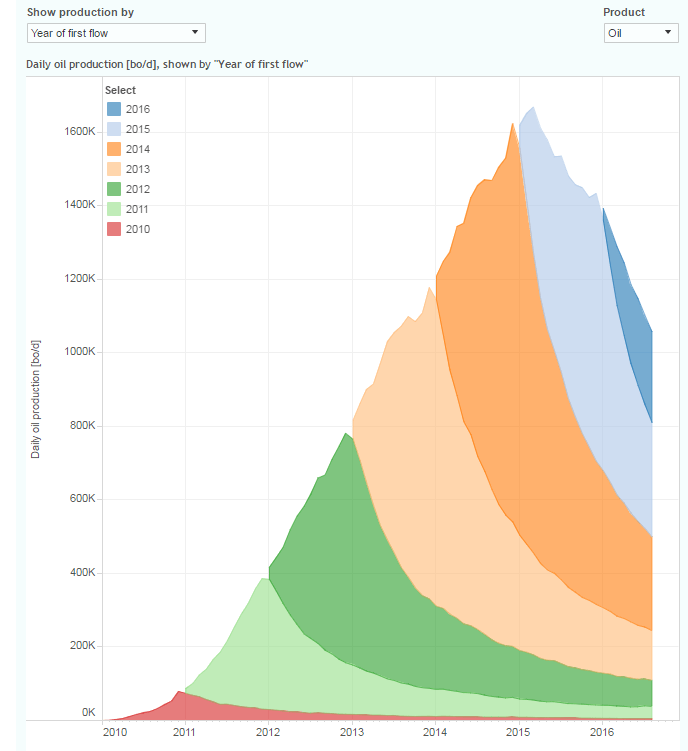

Adoption of AFA’s has happened much faster than had been originally predicted by analysts. Below is a slide from a Solidfire/Netapp presentation that was given at NetApp’s analyst day. The red line represents analysts average estimate of how quickly AFA storage would be adopted. The blue data points are the actual product adoption for NetApp.

BMO indicated in a research piece they did on Nimble (I can’t link to it but I can get it for anyone who sends me a note about it) that the AFA market grew at 88% in 2015 and was 11% of the flash market at year end. BMO expects compound growth of 22% from 2015-2020 at which point AFA will be 70% of the market.

There are only a few major players that provide All Flash arrays. The main one’s are Dell/EMC, Pure Storage, NetApp and HP, as well as a few private start-ups.

Nimble was late to the all-flash party. They have only had an offering since the second quarter of this year. The stock took a tumble in the third quarter of 2015 after investors realized that the growth trajectory of a hybrid flash business model was broken and that it would take time (and have risk) for Nimble to shift its resources to All-Flash.

Since that time Nimble stock has struggled as the company has repositioned itself as an all-flash player. There were poor results as they developed their all-flash offering, and growth from the new all-flash product hasn’t met expectations. There is also the turnover of a disgruntled shareholder base, which may be a bigger factor than any operating concern.

But the company is making progress. While the stock tanked after they released third quarter results, they did show growth. Revenue increased by 26% year over year. All-flash grew at about 30% quarter over quarter.

The negative perception around the results is in part because competitors have been growing as fast or faster off of a larger base. NetApp reported 185% year-over-year growth in the third quarter, while HP reported 100% year-over-year growth. Pure Storage, which reported results in December, showed 93% year-over-year growth.

The other part of the negativity is concern around when the current growth rate will lead to profitability. If you model out Nimble’s earnings assuming a continuation of 25%-ish growth, it’s 2018 before the company becomes profitable on an adjusted basis. It’s even longer if you factor in the very large stock compensation expense.

I bought Nimble because I think there is a reasonable chance that growth accelerates in the coming quarters. Nimble has a few things working in its favor. First, by all accounts their All-Flash product is as good or better than the competition. In fact I came across Nimble after hearing industry contacts raving about the new all-flash product.

Second, they have their legacy, complimentary, hybrid flash product that they can sell along with the all-flash. While high end workloads are moving to all-flash, secondary workloads are still better served by a cheaper hybrid storage. Nimble is a leader in hybrid and can offer both options. Other competitors, like Pure Storage, cannot.

Third, the company has a large existing customer base that they can tap. They had almost 9,500 existing customers at the end of the third quarter.

Fourth, Nimble is just starting to go after bigger accounts. In their third quarter release they said that “bookings from large enterprises (Global 5000) grew 53% and bookings from Cloud Service Providers grew 65%”. I suspect that some of the early disappointment in all-flash growth is attributable to the process of gaining traction in these larger accounts. If the company’s product is as good as it seems to be, this will correct itself over time.

At a $8 share price, Nimble has a market capitalization of $680 million and an enterprise value of $480 million. Given the growth rate of the overall business, I think this compares favorably to peers:

The idea here with Nimble is a bit reminiscent of Oclaro. When I looked at Oclaro in the spring the stock was trading at $4.50, it had kind of a crappy history, a depressed shareholder base, but was beginning to see some secular tailwinds at its back from the 100G ramp. It was well positioned with 100G products to take advantage of that tailwind. It appeared to have decent growth on the horizon, yet if you modeled out that growth based on analyst assumptions it still was a long ways from profitability.

Yet what happened with Oclaro is that growth took off. The stock doubled.

That is what could happen to Nimble. The product is there, the tailwind is there, certainly the crappy past and depressed shareholder base is there. There’s no guarantee it happens, maybe growth sags into the teens and profitability remains distant on the horizon. But if it does happen I think the stock does much the same thing Oclaro did. So it’s worth a position. And an add or two along the way as the thesis plays out.