Week 107: Back to Commodities

It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that – Warren Buffett

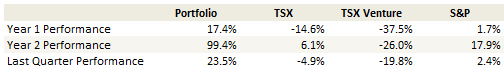

I’m adding a simple year by year and quarterly performance table to the start of every portfolio update. I’ve had the on-line portfolio going for over 2 years now, and I find that the chart is less informative the longer the time horizon gets. The quote, which I have mentioned before, is more of a goal than a statement. Buffett says it’s possible, let’s try to prove him right.

I’ve already written about most of the new stocks that I added in the last month (Ainsworth Lumber, Tronox, Novus Energy,smaller positions in Lightstream Resources and Penn West, and lastly Niko Resources. In this post I will focus on some of the stocks I sold (including most of my large position in YRC Worldwide), and add some thoughts on oil and Canadian oil juniors.

I’m getting this update out a day late so all of the numbers are are of Friday July 19th.

Portfolio Performance

Portfolio Composition

The last four weeks of trades are available here.

The last four weeks of trades are available here.