Week 206: The Thin, Steep Line

Portfolio Performance

See the end of the post for the current make up of my portfolio and the last four weeks of trades

Monthly Review and Thoughts

I’ve been listening to interviews with traders. I found two interesting podcasts, one called Chat with Traders and another called 52 Traders. I go through an episode a day on my bike ride into work.

The interviews are generally at odds with my own investing style. These guys don’t pay attention to fundamentals and they are short-term in nature (mostly day trading). Nevertheless I have found the interviews insightful.

One concept that comes up a lot is “edge”. An edge is essentially the advantage that allows you to beat the market more than it beats you. For many of these traders understanding their edge; a system, a pattern, a money management technique; has been a major step toward consistent success.

So what’s my edge?

I have been pretty good about beating the market for the last 10 years. I don’t know if you can chalk it all up to luck. Though there is much I do wrong, there must be something I’m doing right.

I’m not going to dissect the details of what specifically I do “right”. I’ll leave that to a future post. I bet that if you read the last 3 years of writing you’d get a pretty good idea.

I want to talk more generally. I’m going to hypothesize about what I believe to be some general characteristics of my edge.

First, I doubt you could boil my edge down to a single thing. I think its more likely there are a number of small things I do right that together add up to decent out-performance.

If true, this means that I have to be careful about cutting corners. Not being sure exactly what aspect of my process leads to out-performance means that leaving out any one piece could be critical.

I also don’t think that these tiny edges act together linearly in an independent fashion. Let’s say I have 6 things that I do that contribute to the overall edge I have. I highly doubt that if I do 5 of these 6 I will get 83.3% of the returns. It will likely be significantly less. Maybe even I don’t outperform at all. The sum of my edge is greater than the parts.

Finally, I think that the slope of out-performance to edge is likely quite steep. In other words, if I am off my game, my performance deteriorates quickly.

As the chart below illustrates, the degradation of performance due to small changes in edge is closer to vertical than to horizontal. Think of the right side of the curve in the chart below as being the execution of maximum edge. In other words you are doing everything right. As you do more and more wrong; less due diligence, cutting corners on a spreadsheet, not following a stop rule, adding to a losing position, etc; you slide to the left of the curve and with your dwindling edge comes dwindling performance.

The point I am trying to illustrate is that small deviations from what make me successful will likely result in outsized drops in performance. If I don’t do everything right: do the mounds of research up front, follow my buying patterns, follow my stops, correctly discern when I should not listen to my stops, etc; I will see my edge decline and my out-performance will drop significantly when it does.

It’s a bit like I’m balanced above the ground on a pole, and the slightest wrong move, one way or the other, and I’ll fall off back down to earth. This is quite analogous to how each day on the market feels to me.

Continuing on with updates of some of the stocks I own

Hawaiian Holdings

Hawaiian got hammered along with the rest of the airline sector over the past couple of weeks. The hammering was precipitated by A. raised capacity guidance from Southwest Airlines, B. comments from the American Airlines CEO that they would defend their market share against competitors pushing forward with capacity increases and C. reduced passenger revenue (PRASM) guidance from Delta Airlines.

There is a good article on SeekingAlpha discussing the severity of these factors here.

What is frustrating about the above developments is that they should only be peripherally correlated to Hawaiian Holdings. Hawaiian runs 3 basic routes:

- Inter-Island

- Island-Mainland

- Island-Asia

None of these really have much to do with mainland capacity.

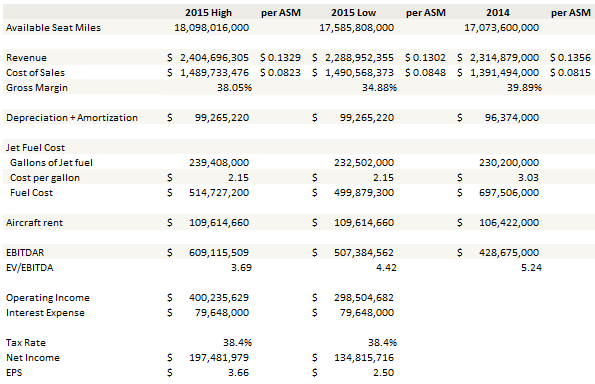

I think Hawaiian is cheap in the low $20’s. A move above $25 and I look to lighten up as I did earlier this month. Below is my 2015 earnings estimate based on the company’s high and low guidance. All of the inputs come directly from guidance with the exception of RASM, which I estimated as -2% year over year on the high side and -4% year over year on the low side.

When I look at analyst estimates they trend to the low end of guidance. The average analyst estimate (per Yahoo! Finance), is $2.79. The high estimate is $3.05. If the company hits the high end of their own guidance they are going to blow away these numbers.

I’m hoping that a combination of earnings beats and what has so far proved elusive multiple expansion for the airlines combine to send the stock price up closer to $30, which would be a nice gain from current levels.

DC Payments

I’ve spent a lot of time debating what to do with my position in DirectCash Payments. After a lot of thought but still without consensus (of my own mind), I added slightly to my position at $14.

The stock has dropped from about the $16 after reporting weaker results in the first quarter. The market is concerned about poorer revenue and gross margin decline.

I am somewhat sympathetic to the spirit of these concerns. DCI is in the ATM business. They buy an ATM, sign an agreement with the owner of a space to place that ATM into a space for a fixed period, and then depending on the agreement they either split the profits with the owner or lease the space for a fee. Clearly, this is not a growing sector. You would expect pressure on revenues and margins as society moves towards the use of less cash.

However I think the market is making a mistake to think that the first quarter results are evidence that this transition is accelerating. There were a lot of one-time items and events that impacted the first quarter. The company lost revenue from its CashStore ATMs, which has been going through bankruptcy proceedings. They lost 120 ATMs as Target exited Canada. In Australia, the recent implementation of cash-and-pay technology (something that has been in Canada for a while) led to steeper than usual declines (though not out of line with the declines experienced when the technology was introduced in Canada). Finally year over year comparisons were impacted by a one-time GST gain in 2014. On the expense side, they saw one-time accounting expenses due to the Australia acquisition as well as expenses related to the upgrade of the Australia fleet.

So I’m not convinced this is a secular decline story just yet. The second quarter is going to benefit from an additional 340 BMO ATM’s in Canada and 120 ATMs being installed at Morrisons in the UK. Some of the one-time expenses are going to roll off. Increased surcharges are being implemented in both Canada and Australia. And finally, beginning in the second half we will see some of the intangible amortization related to acquisitions begin to run off, which will result in a better income statement. So we’ll see.

New Positions

PDI Inc

I like to find companies with one of the following attributes:

- A market capitalization that is a fraction of their annual revenue

- A small but growing segment that is being obscured by a larger mature business

I really like it when a company has both of these attributes, which PDI Inc has.

PDI’s mature legacy business is a outsourcing sales force for the pharmaceutical industry. This is a 20% gross margins business that has seen some headwinds in the last year. These headwinds are responsible for the poor stock performance.

The growing business is molecular diagnostic tests. PDI entered molecular diagnostics via a couple of acquisitions, Redpath and some assets from Asuragen. They now offer diagnostic tests for malignancy of pancreatic cysts (PancraGen), and of thyroid nodules (ThyGenX and ThyraMir).

The molecular diagnostic test segment generated very little revenue in 2014. They have been ramping up the business through acquisitions since the summer of 2014. Below is a timeline, taken from the investor presentation, of their progress so far.

The company points to a recent report from Visiongain estimating that the molecular diagnostics market is around $6 billion and that it is growing at a 15% CAGR.

In the first quarter of 2015 revenue from molecular diagnostics was a little over $2 million. Guidance for the segment is $13-$14 million, which suggests that they think they can grow the segment by nearly 100%. Keep in mind that the company has a captive, experienced sales force at their disposal to help them reach that goal.

The company has significant net operating loss carryforwards of over $240 million so there will be no taxes paid for quite some time.

As part of the acquisition deals they also granted significant contingent considerations. In addition to two milestone payments of $5 million, they pay a net revenue royalty of of 6.5% on annual net sales above $12.0 million of PancraGen, 10% on net sales up to $30 million of PathFinderTG and 20% on net sales above $30 million of PathFinderTG.

While I like the direction and I like the leverage to gross margin improvement, I caution that even with growth from the molecular diagnostic segment profitability remains somewhat distant. If they meet their guidance for 2015 they will still have an operating loss for the year.

However the bet is that if they show some success the market will reward them for the potential of their acquisition strategy, rolling up new treatments and integrating them into their sales platform. Its not hard to see that strategy being worth significantly more than the current $25 million market capitalization.

Versapay

Versapay is another tiny market capitalization company ($29 million). They have a newly launched SAAS offering that could scale quire quickly.

In the past Versapay’s product offerings have revolved around point of sale solutions: point of sale terminals (basically the little hand helds that you use at every shop), payment gateways for online purchases, app’s for mobile payments, and virtual terminals.

Margins on the legacy business are north of 60% but it is not a high growth business; it grew at around 5% in 2014 and showed flat revenues in the first quarter of 2015. The business generated $2.1 million of EBITDA in 2014, so at the current market capitalization Versapay is probably slightly expensive if valued on this business alone.

Recently though Versapay expanded their offering to include a B2B e-commerce platform called ARC, or Accounts Receivable Cloud. ARC is aimed at small to medium sized business and provides an accounts receivable process for business to business transactions. Below is a slide from the company presentation that gives a high level overview of ARC’s functionality.

The company says existing offerings on the market either focus on accounts payable (so on the buyer), are geared towards large enterprises, or are accounts receivable applications for business to consumer transactions. ARC fills a niche that is largely unaddressed. The slide below depicts ARC’s target market:

The company says that its biggest competition are excel spreadsheets and inertia, for which, coming from a small business whose accounts receivable management consisted of a large excel spreadsheet with many tabs that had been maintained in the same way for years and emails sent out by salespeople with PDF invoices, I can sympathize with.

So I think there is a market here if Versapay can prove that their software is more efficient and can create more timely payments than the alternative.

What I really like about this idea is that if it does begin to take off the nature of the application could cause it to snowball quickly. When a supplier uses ARC for invoicing, all of their customers are introduced to the platform via their bill paying portal. If the portal is perceived as suitably impressive, these customers become natural targets for Versapay.

ARC also has synergies with Versapay’s existing point of sale solutions. Both can leverage the same payment backbone for processing transactions.

While the platform is in its infancy (basically at a pilot/early adopter level), the early results show what could be in store. As of the May conference call, Versapay had 16 suppliers signed up, 8 who are live, but already there are 14,800 buyers invited and 2,450 buyers who had signed up and registered. This was up by 1,000 buyers in past 20 days.

While the platform is in its infancy (basically at a pilot/early adopter level), the early results show what could be in store. As of the May conference call, Versapay had 16 suppliers signed up, 8 who are live, but already there are 14,800 buyers invited and 2,450 buyers who had signed up and registered. This was up by 1,000 buyers in past 20 days.

The numbers of the buyers who are somewhat incidentally being introduced to the system is impressive. It illustrates the need for quality before a full roll out. Just as it is extremely beneficial to Versapay if these buyers have a positive experience, it will be a disaster if they don’t.

So far the early response is positive. Two of the eight early adopters, Metroland and Teachers Life, went so far as to give positive testimonials at the Versapay investor day. Versapay also announced on their first quarter call that they had signed up a large commercial real estate firm subsequent to the quarter.

There is enough potential here for me to take a position. But I have to be careful. I’ve talked before about companies whose product is a bit of a black box, where I can’t really be sure whether its going to be a hit or miss and so I have to judge it based on the evidence but show humility if things go south. Radcom is a name I own that fits in this category. Radisys is another, as is Enernoc. The idea makes sense, the sector makes sense, but there is a bit of a leap as to whether the solution will be the best fit for the niche being marketed. I just can’t be sure.

I am being careful about position sizing and will be on the look out for any adverse developments, comments or even just poor price action that may imply things aren’t going rosily. This risk is justified by the reward; while the downside is that I get out at $1 after some poor results, the upside is likely multiples of the current price.

These are exactly the kind of bets I’m looking for, even if they all can’t pay off.

Transat AT

When I sold Transat AT at the beginning of the year it was always with the intention that I would get back in. As I wrote in the comment section of my February post (after it was pointed out to me that I had neglected to mention my sale):

I sold the stock because I think the weak CDN dollar is going to make Q1 and Q2 difficult. They also hedge fuel so in the very short term they are going to be hit by the dollar over the winter but not going to gain from fuel to the same extent yet. The winter routes also have a lot of added capacity from Air Canada and such so that is making it more competitive.

I still really like Transat though in the medium term. I think once we get Q1 released I will look to adding it back, because the summer is going to be stronger, they will begin to benefit from fuel more, and presumably the dollar will stabilize… I’m just stepping aside until the uncertainty has passed.

With the release of second quarter results last week the uncertainty has passed. And really, the results weren’t too bad. Because Transat runs a very seasonal business, it is useful to compare quarterly results from year to year. Below are second quarter results for Transat over the last 7 years.

The company guided that its summer quarters (Q3 and Q4) would be similar to 2014. That means that for the year they are going to have earnings that are pretty close to last year. Income adjusted for one time items and for changes in fair value of fuel hedges was $1.16 per share last year. The company has mounds of cash on the balance sheet and will also begin to benefit more from lower oil prices in the second half. I believe that things are setting up for another run at double digits here.

The company guided that its summer quarters (Q3 and Q4) would be similar to 2014. That means that for the year they are going to have earnings that are pretty close to last year. Income adjusted for one time items and for changes in fair value of fuel hedges was $1.16 per share last year. The company has mounds of cash on the balance sheet and will also begin to benefit more from lower oil prices in the second half. I believe that things are setting up for another run at double digits here.

Ship Finance

I added a position in Ship Finance after they announced an amended agreement with Frontline along with their first quarter results. The new agreement gives Frontline lower time charter rates ($20,000 for VLCC and $15,000 for Suezmax instead of $25,500 and $17,500 respectively) and higher management expenses (Ship Finance will pay $9,000 per day instead of the previous $6,500 per day) in return for a larger profit share (50% rather than 25%) and 55 million in Frontline stock.

I bought Ship Finance on the day of the deal because the stock wasn’t moving significantly (it was a little under $16) and I thought the deal was accretive by at least a couple of dollars. At the time I also bought July 17.50 options for 10c as I liked the short-term outlook.

Even though I don’t expect to hold Ship Finance for the long run, I did do a background check on the company before buying the stock. In addition to the Frontline charters, Ship Finance has 17 containership charters, 14 dry bulk charters, and 10 offshore unit charters (consisting of 2 jack-ups, 2 deep water vessels and 6 offshore supply vessels).

The supply/demand dynamic of these 3 other industries is not great but Ship Finance has very long term charters locked up in most cases. With the exception of 7 Handysize dry bulkers, everything is locked up until at least 2018 and most of the charters extend into the next decade. I don’t see anything particularly concerning about these other lines of business that would interfere with my thesis, which revolves around Frontline.

As I have been thinking more about the deal this weekend, I think I was wrong with my original conclusion that the deal was very one-sided for Ship Finance. Ship Finance is giving up a lot of guaranteed income for the speculative upside of much higher rates. I still think its a good deal for Ship Finance, but its also not a bad deal for Frontline. While I sold my Frontline position on Friday, I am very tempted to buy it back.

The dynamics of the new deal will lead to lower guaranteed cash payments for Ship Finance. They receive $5,500 less for the charter and pays $2,500 more to Frontline for operating the ships. This $8,000 is offset by the 25% increase in profit share and the 55 million shares they receive.

Under the old agreement at a low charter rate of $30,000 for VLCC’s Ship Finance would have gotten about $25,500 for the charter and paid back $6,500 of operating expense for Frontline management. They would have received 25% of the profit of $4,500 per day (I realize the profit calculation may be more complex than this but I’m ballparking here) that the ships made. So the total profit per ship per day would have been about $20,000.

Under the new agreement Ship Finance gets a charter rate of $20,000 per day, pays Frontline $9,000 in operating expense and Ship Finance receives 50% of the profit, which is now $10,000 per day. Total profit per ship is $16,000.

If you work through that math at higher rates, earnings accretion of the new deal doesn’t begin until somewhere around a $45,000 per day charter rate. Above that level every $10,000 per day increase in charter rates adds $0.16 per share to Ship Finance’s annualized earnings.

That means that at current VLCC rates in the mid-60’s, the accretion is around 30c. Pricing the deal at a 10x multiple would mean Ship Finance is worth about $3 more than it was before the deal. None of this includes potential upside from the 55 million Frontline shares they received.

Even though the deal isn’t quite as one-sided as I originally thought, I am inclined to hold onto my Ship Finance shares for another month or two and hopefully get $18+ for them. I came close to selling my shares at $17.50, which turned out to be unfortunate given the down draft in the stock over the last two days. Having sold my Frontline shares on Friday (something that I am looking at this weekend as a mistake) I’m inclined to hold onto my Ship Finance shares a little bit longer to see if they take part in a move up from Frontline that the chart is suggesting may occur and fully reflect the impact of the new agreement.

Closed Positions

Gold Stocks

I had a couple of gold stock positions (Timmins Gold, Argonaut Gold and Primero Gold) that just haven’t done well. The price of gold seems to be languishing below $1,200 and I’m not sure what the catalyst will be that will move it higher in the near term. Both Timmins and Argonaut hit my 20% stop loss and I couldn’t think of a good reason to hold onto either of them.

TC Transcontinental

Transcontinental is one of those stories that would fit into the bucket of “cheap stock with a little bit of earnings momentum so let’s see if something goes right here”. I buy these sorts of names all the time and sometimes they work out and sometimes they don’t. What I have learned is that if they don’t seem to be working out its best to dump them before they become “clearly not working out”.

Transcontinental is in a declining industry (printing flyers, packaging materials, newspapers, magazines and books) that will continue to produce a headwind that the stock will have to overcome. While I didn’t think the second quarter results were that bad, probably not justifying the 10+% drop in the stock the last couple of days, I also didn’t see a lot in them to give me confidence the price will bounce right back. So I sold.

I wrote about my purchase of Transcontinental TC here.

Fifth Street Asset Management

One strategy that I’ve employed in the past but gotten away from recently is the “sell now ask questions later” strategy. If a stock begins to sell off heavily I am better off getting out of it now and figuring out the right thing to do later rather than staying in it, dealing with the sell-off and taking a potentially larger loss in the future.

I think this is a common bias of investors. We believe that because we hold a stock we have to keep holding it until we are certain we should sell it. But this is false. There is nothing necessary about what we should do predicated on whether the stock is or isn’t already in our portfolio. If I do not hold a stock and news comes out that makes me uncertain about whether I would purchase that stock I certainly wouldn’t go out and purchase the stock. Why should that logic not work just because I already hold the stock?

So when Fifth Street came out with a crappy first quarter I sold it at the open. On my list of things to do is to revisit Fifth Street in more detail and look at whether my assumptions about assets under management growth outside of the BDC’s was unrealistic or just a little delayed. Until I have time to do that though, I would rather be out of the stock than in.

I wrote about my purchase of Fifth Street here.

Portfolio Clean-up

As I have discussed in the past, the portfolio I follow in this blog is based on a practice account that is available through one of the Canadian banks. While I do my best to track my actual portfolio transactions, from time to time I do forget to buy or sell positions to coincide them. Therefore I periodically have to clean-up the online portfolio to better reflect the actual securities I hold.

I haven’t done a clean-up in a while and so when I finally on Friday I noticed I was missing a number of positions that should be included. Thus I added Canacol Energy, Red Lion Hotels, Adcare Health Systems, Radisys, and Ardmore Shipping. Fortunately with the exception of Radisys and Red Lion none of the other positions had moved significantly from my actual purchase level. I bought Radisys at a little over $2 and Red Lion at around $6.25 so I did miss out on some gains there. But in the grand scheme of things the differences are minimal and now the tracking portfolio for this blog is much more closely aligned with my actual positions.

Portfolio Composition

Click here for the last five weeks of trades.