Week 270: Change is in the air?

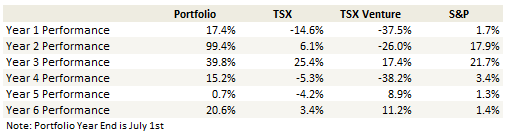

Portfolio Performance

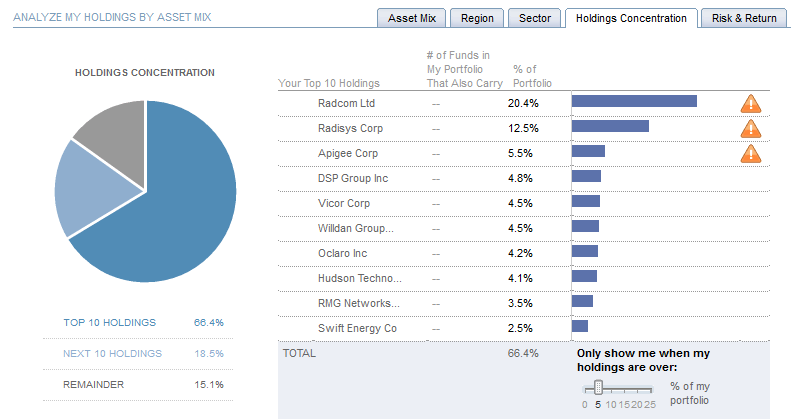

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

The second quarter results are finished and as I look back on August I can’t help wondering if something has changed.

Since February the market has done well but for the first time in over a year I have done better. I had a miserable first month of the year but after deciding things had gone too far in early February, its really turned around.

For better or worse Im stepping back in here with a number of buys. This has been going on for ~30 sessions now. Thinking exhaustion is near

— LSigurd (@LSigurd) February 8, 2016

Here is the performance of my more significant individual non-oil related positions since that day.

August was a particularly good month. I was up over 10%. I’ve had a number of big movers over the past few months.

But its more than performance that makes me think that something has changed.

The way that the small and micro-cap stocks I own have been acting has been different than the past year and a half. For reference, in August of last year I pondered whether you could have a bear market that was never actually defined as a bear market. At the time I wrote:

When I raise the question of whether we are in a bear market, its simply because even though the US averages hover a couple of percent below recent highs, the movement of individual stocks seems to more closely resemble what I remember from the early stages of 2008 and the summer of 2011.

Through most of 2015 and into the first couple of month of 2016 the movements of small company stocks just didn’t feel right. Every move up was pressured. Every move down was too easy. This of course climaxed with the selling stampede of January and February of this year.

But I have noticed a change in temperament in the subsequent months, and this seemed particularly evident through the second quarter earnings season. I still had misses. BSquare had miserable results. CUI Global was lackluster. Both stocks fell. But even then, the moves down didn’t have quite the same conviction as similar such moves in the past year.

Its hard for me to put my finger on exactly what it was that was different, so maybe this is all just sophistry, but it was almost like these stocks were going down grudgingly, because they had to, not because they wanted to.

Even Friday, which was a brutal day for the indexes, didn’t seem as bad as all that through the lens of my positions. Radcom ended up. Radisys spent most of the day green before giving up the ghost in the last 30 minutes. A number of other positions started the day poorly but didn’t really follow through, almost to be saying yeah, we have to be down because the averages are down but there is no reason to panic. A couple of the oil stocks I’ve recently added (more on that below), fell at the open only to grind their way back up.

To be sure, part of my perception may be that I’ve picked up my game and picked better stocks. It took me a while to figure out what my theme was for 2016 but once I settled on growth stories it has served me well. This replaced sectors like tankers and airlines and REITs where I tried to find gain in 2015 and for the most part failed at it.

So maybe that’s the source of the change. I’m staying away from value, looking for growth, and that’s what is working.

I’m wary that we have had a big move up, that each of the prior moves up over the last couple years has been followed by a precipitous fall, and that the election in the United States isn’t really setting itself up to be market friendly.

Nevertheless I can’t lose the thought that while we never had an official bear market we did have an extremely ugly period for small and micro-cap stocks and maybe that bear market capitulated in the first couple of months of the year and we are on to something new. Its worth keeping an eye on.

Oil and my oil stocks

Inline with my tweets over the last few weeks I have been increasing my oil exposure. I added a number of names and been adding to a couple of others. Here are the tweets. I’ll talk about each of these below.

Took positions in $GST and $JONE today, partly b/c natgas looking better but mostly b/c I think attention for STACK continues to grow

— LSigurd (@LSigurd) August 27, 2016

Tried to buy some $ZAR.TO this morning, got a little but its run away, its interesting after sale of SASK assets if it falls back

— LSigurd (@LSigurd) August 15, 2016

I also took a position in Journey Energy (JOY) late this week but I’m not going to write about that one in this update.

Nevertheless they are all small bets. Other than Granite Oil, which is about a 3.5% position for me, my oil bets are in the 1% range.

I don’t have a crystal ball on oil. I am sympathetic that the builds we have seen (up until this week’s rather massive 14mmbbl draw) are due to the drainage of floating storage. I’m hopeful that once this runs its course we could see some surprising draws in the shoulder season (this thesis has been expressed by a number of investors on InvestorVillage, not the least being Robry825, who describes his position here and here). I’m also cognizant that oil wells do decline and that we simply aren’t drilling like we were a few years ago. Still, as I’ve said on many occasions before, I play the trend till it ends but when it ends I really don’t know.

Its also worth noting that while the US election could turn out to be a gong-show for stocks in general, it sets up as having very little downside and a fair bit of upside for the Canadian oil stocks. Either Clinton wins and its status quo, which has been already heavily discounted in the disappointment of investors with Canadian oil stocks, or Trump wins and well, regardless of what chaos that entails, he did say he will approve Keystone, which would be a big tailwind for energy producers, particularly given the boondoggle that’s taking place with Energy East.

Nevertheless I don’t like not being in oil. Part of this is simply hedging. I am a Canadian investor who primarily invests in US stocks. Therefore I am naturally short oil via the Canadian dollar. If oil prices go up, so with the Canadian dollar and I will lose. Owning some oil stocks helps to balance that out. If I can hit the odd rocket ship like Clayton Williams or Resolute Energy have been recently, then all the better (note that while I have talked about Clayton Williams in prior posts I haven’t mentioned Resolute because I got the idea from a subscription service run by Keith Schaeffer. He’s had a few winners for me since I took a subscription and would recommend it).

Empire Industries – China Theme Park Deal

On September 1st Empire Industries announced a “strategic cooperation agreement” with a Chinese company called Altair to build out a new space theme park in the Zhejiang province of China. The announcement coincided with Justin Trudeau’s visit to China and apparently he was on hand at the signing.

The stock shot up on the announcement and to be honest I got a little too caught up in the hype and added to my position at 45 cents. While I think those shares will ultimately deliver a positive return, there were some details left out of the news release that warrant caution.

In particular, this article from Business Vancouver fills in some of the details.

On the positive side, Empire will be delivering 6 attractions to the park for a price of $150 million. This is significant dollar amount that will more than double the backlog.

Also, Empire will have an option to take a 20% stake in the amusement park. Guy Nelson, president of Dynamic Attractions, the amusement park ride manufacturing subsidiary to which the work is directed, said they would likely exercise this option. Given that the park has a price tag of $600 million, a 20% stake is a big investment for a company the size of Empire. It would also makes you wonder about how Empire is going to get paid, as it seems a little too coincidental that their ownership opportunity is about the same dollar value as the cost of the attractions they are to deliver.

The other consideration that contributed to the stock pulling back from its highs was that construction of the park depends on getting the land. Currently the land belongs to the Chinese government and the agreement that Altair struck was as the reserve bidder, meaning that they get the land if no one else places a bid.

I’m not selling any of the shares I own. If the deal goes through it should still be a significant positive for the company. But I should have been more wary of any Chinese dealings and I will wait for more news before acting further.

Granite Oil – Enercom

Granite presented again at the Enercom conference in September. They gave a presentation that an engineer would love and an investor would shrug at. I don’t believe I heard the acronyms ROR or EBITDAX or even NAV a single time.

Last month I wrote that I had reduced my position in Granite. After further consideration, a little more research and a more optimistic attitude towards the oil price, I decided to add back what I had sold. The stock had also sold off into the low $6’s which has been good support in the past.

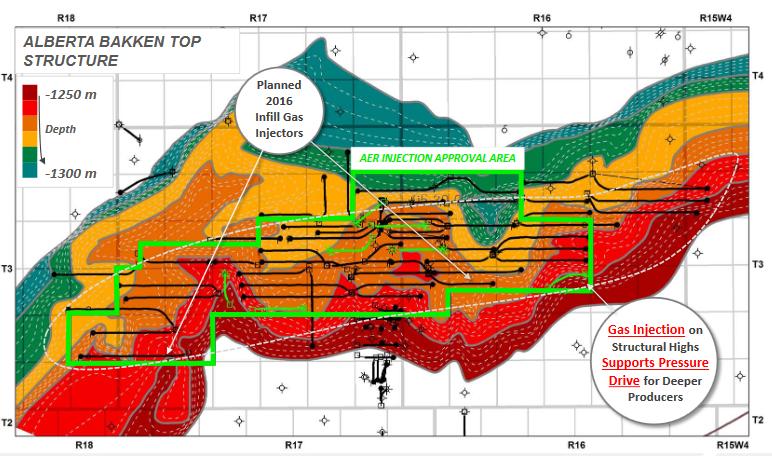

During the first six months of the year Granite focused on infrastructure. They drilled one well in the first quarter and three more wells in the second quarter. They converted a number of older wells into injection wells and added compression to facilitate the gas injection process (as I’ve written before their primary and only asset, Ferguson, is a large oil field where they are implementing an early enhanced oil recovery (EOR) strategy via gas injection.

In the second quarter the company achieved 100% voidage replacement in the heart of the Ferguson field. The reservoir is now pressurized back to its original pressure. Granite can move ahead with development drilling and expect the pressure support to limit well declines.

In the second half of the year the company expects to drill 5 wells. On September 6th they announced results from the first of these wells. Over a 96 hour test the well flowed at an average 815 boepd and ended the test at 995 boepd. The company well costs are $1.2 million, down from $1.9 million in the first quarter of the year.

One number Granite did mention at Enercom was that the total contingent original oil in place (OOIP) at Ferguson is 457 million barrels. This is actually from a fairly old estimate by Sproule in 2012.

I contacted the company to clarify how much of their land package the estimate accounted for. Their response was that the estimate encompassed an area a little larger than the current EOR approved area. The EOR approved area is about 23 sections, shown below:

The entire land package held by Granite is over 550 sections. This includes two other discovery wells to the south west:

Its an extremely large package for a little company with a $200 million market capitalization and very little debt. The wells aren’t as exciting as Permian wells, but they also come in at about 1/8th the cost. The company doesn’t get much respect, but I hope that changes if they show some growth in the second half, which is possible as they finish out their drill program and see the full effect of the EOR.

Its an extremely large package for a little company with a $200 million market capitalization and very little debt. The wells aren’t as exciting as Permian wells, but they also come in at about 1/8th the cost. The company doesn’t get much respect, but I hope that changes if they show some growth in the second half, which is possible as they finish out their drill program and see the full effect of the EOR.

There were a SeekingAlpha article written about Granite here.

Update/Summary of Accretive Health

I’ve owned a small position in Accretive Health since late last year. And I owned the stock once before that, in 2014. Yet I’ve never actually written about it.

Part of the reason I have stayed quiet on the position is because it has, until recently, been very small. But I’ve also kept quiet because the thesis is hard to get behind. This is the definition of a flyer.

Accretive Health has a few problems:

- They have been investigated for abusive billing practices. There is a VIC article written around the time these issues arose that explains the claims in some detail here

- The abusive billing practices were followed up by an SEC investigation into revenue recognition. The result of the investigation was that the company did not release its financial statements for the period of 2012-2014 until just last year. This article is a decent source for that episode.

- The conclusion of the SEC investigation led to a restatement of GAAP results and the subsequent GAAP accounting practices that were enforced make their financial statements pretty much useless. Accretive can’t book revenue from a client until either the end of the contract term or when the agreement is terminated. This means they go long periods with very little revenue and if they lose a client (generally a bad thing) they can show a big profit.

- Much of their business is dependent on Ascension Health. Ascension is a large non-profit hospital operator. They are also a large owner in Accretive. They have shown their willingness to exploit their leverage as they did when they tried to take Accretive over with a a low-ball offer in mid-2015

Sounds exciting doesn’t it? Nevertheless the potential upside holds my interest. Here’s some details about how Accretives business works.

Accretive provides revenue cycle management for hospitals. This means that they help streamline front- and back-office operations, including patient registration, insurance verification, coding compliance and collections.

Hospitals operate on extremely tight margins. I have gathered margins can be as low as 1-2% if they are profitable at all. Accretive’s model is to insert experts into the hospital, integrate their software into the hospital software, and work together with hospital employees to reduce costs, more effectively bill patients (for example finding insurance options, correctly classifying patient visits, etc), and improve revenue collection.

The contract with the hospital is performance based. Accretive receives a percentage of the savings that they are able to achieve for the hospital, compared against a pre-contract run rate. They also receive incentive fees that are based off of additional revenue the hospital generates due to their improved collection and billing processes.

This business model means that Accretive doesn’t get anything until later in the contract, after they have implemented their solutions, made changes to the processes, and the hospital has begun to reap the results.

It’s also a tricky business model for revenue recognition; billings are in part based on costs not yet invoiced by the customer and that have to be estimated, and the agreements typically include clawbacks if cost reductions aren’t maintained. The consequence is that GAAP accounting insists that very little revenue be booked until the end of the contract.

Now lets talk about Ascension Health. Ascension is Accretive’s biggest customer. Accretive was actually born out of Ascension in 2004. In 2015 Ascension accounted for 59% of gross cash generated (Gross cash generated is effectively the company’s internal metric of revenue equivalence it uses to get around GAAP accounting. I’m just going to refer to it as revenue from this point forward. Likewise, I am going to refer to their net cash generated as EBITDA, which is basically what it is).

The relationship with Ascension is not always friendly. Just around the time when the black cloud of lawsuits and SEC investigations was beginning to lift Ascension dropped a bomb on Accretive, writing a letter where they discussed taking the company private for about 50% of what was then the market capitalization (around $2.50 per share). In a not so veiled threat Ascension said that if the takeover didn’t proceed they didn’t plan to enter into a new master services agreement with Accretive once the existing one expired in mid-2017.

In December of last year Accretive came to an agreement with Ascension whereby Ascension would drop the takeover offer, not walk away from their relationship, and enter into a new long term agreement for services.

The agreement is for 10 years. Right now Accretive is responsible for about $6.5 billion of Ascensions net patient revenue. The new agreement will add another $8 billion of net patient revenue from new Ascension hospitals and affiliates.

As part of the agreement Ascension gets an even larger piece of Accretive. Accretive issued them $200 million of preferred stock paying 8% and convertible into shares at $2.50 (so 80 million shares). Ascension also received 10 year warrants for 60 million shares at a price of $3.50.

Accretive has about 107 million shares outstanding not including any of the above conversion. The market capitalization is about $200 million, cash is about $200 million and apart from the preferred there is no debt.

To put the size of the deal with Ascension in perspective, Accretive has provided guidance of $200-$220 million of revenue in 2016. This would be “pre-Ascension new deal” revenue. On the fourth quarter call management said that for every $1 billion of net patient revenue they on-board, they expect $40 million of revenue (they reiterated this statement on the second quarter call).

So basically Accretive stands to more than double revenue at the end of the on-boarding, which is expected to take 3 years (including this year). The new business from Ascension will initially be at similar margins to the existing business, and those margins will improve as time passes and Accretive’s own systems and processes are implemented.

The tumult of investigations and Ascension related distractions has caused Accretive to lose some other business over the past year. Ironically, the company had a blow-out first quarter on a GAAP basis, generating $167 million in net income. But that’s because of customer attrition, which allowed them to recognize deferred revenue that had been accumulating for those customers. The last thing you want to see with Accretive is strong GAAP results. Hospital count dropped from 77 in the first quarter to 72 in the second quarter.

Nevertheless, the amount of new business coming from Ascension is substantial. Accretive said that they expected EBITDA margins on the combined business showed be in the mid to high teens. At $400 million to $500 million of revenue Accretive stands to generate significant cash for a company with a $200 million enterprise value.

Still, there is enough uncertainty to warrant only a small position. Will Accretive be able to turn around the business outside of Ascension, keep existing customers and win new customers? Or have the last 4 years been too much. And what is the state of the company itself? Presumably after all the lawsuits, restatements, executive shuffles and unrest morale must be low so will they be able to execute? Finally, the new agreement with Ascension is a departure from the legacy model; Ascension employees will be joining Accretive and Accretive will be taking over most aspects of the revenue cycle, as opposed to just advising and consulting. Will this new model work and will it ultimately be as profitable as management predicts?

Lots of questions. Nevertheless, if the questions are answered positively the upside is going to be significant. While I did add to my position recently, I will keep it relatively small (its a little over 1%) until some of the answers become more clear.

Radcom Moves

Radcom has had no significant news since my last update. Yet we still only have a single NFV deal.

I’m not too worried about how this plays out in the long term. What I am bracing myself for is the scenario where Radcom presents third quarter results, gives a positive qualitative update on the pipeline but no quantitative progress.

Radcom has a $220 million market capitalization and a $170 million enterprise value. It trades at 5.7x EV/sales. I figure this means they need to grow revenues at 30-40% next year to justify that multiple. That means another AT&T sized contract.

The market is going to want to see that happening by the third quarter report. If it doesn’t the stock is likely going to sell back down to a multiple that reflects more skepticism. Unfortunately these carriers aren’t known for their fast movements. What’s another 3 months for a CSP looking to overhaul their network?

If such a sell-off occurs, it may be a great buying opportunity, but I’m not thrilled with the idea of getting from here to there. Nevertheless the opportunity with Radcom seems to still outweigh this risk. I sold a couple shares at $19 but less than 5% of my position. So I’m just bracing myself for a potential pullback if carriers live up to their name.

New Position: CUI Global

I bought CUI Global because it has a new and better technology (for measuring gas composition) than the current standard, and they can sell that technology into a large addressable market (gas transmission companies and chemical plants). But so far its been a struggle to gain a foothold into old-school industries that are not used to change and that are currently dealing with a protracted downturn.

Given this trajectory, it’s most likely that even if the story works out it will A. be delayed longer than anyone would have expected and B. have a number of false-starts and hiccups before finally showing consistent growth.

CUI Global operates two segments, Electronics and Natural Gas Integration. The electronics business has been treading water and while it may have some medium term potential its not really the focus of my purchase. There is a good discussion of the electronics division in the Q&A of the last quarter conference call. For this write-up I am going to focus on Natural Gas Integration.

The natural gas integration segment sells a product for sampling and analyzing gas composition that is quicker and graceful than the existing technology. Called the GasPT system, it consists of a probe and analyzer, both of which are unique in design and operation:

The GasPT system is faster and cheaper than existing solutions. These legacy techniques have been around for 60 years. Their process works like this: gas is pulled out of the pipeline using a high pressure probe, transported to a gas conditioning unit which lowers the pressure to sea level, and transported through the low pressure pipeline to a gas chromatogram located in a shed where it takes 20 min to analyze the gas and report to operator the chemical content, from which energy content is inferred.

The GasPT system is faster and cheaper than existing solutions. These legacy techniques have been around for 60 years. Their process works like this: gas is pulled out of the pipeline using a high pressure probe, transported to a gas conditioning unit which lowers the pressure to sea level, and transported through the low pressure pipeline to a gas chromatogram located in a shed where it takes 20 min to analyze the gas and report to operator the chemical content, from which energy content is inferred.

Installation of the incumbent technology costs a quarter of a million dollars, is a 6 week job, requires that a kiosk is built on site, that concrete, pipe, is laid and the carrier gas has to be replaced monthly.

In comparison, the GasPT system resides right on the pipeline, measures gas directly via the Orbital probe, there is no ancillary gas required, the cost of installation is $55,000 and it takes 90 minutes to install. There is no operating overhead and the gas is analyzed in seconds.

Management has said on numerous occasions that during the bid process for the recently won Snam Rete business (more on that in a minute), they went up against Emerson, ABB and Elster and the head to head competition demonstrated that there is no comparable technology on the market. They have also said that they are at least a couple years ahead of the competition in terms of development.

The company sells the GasPT system into two verticals:

- Natural Gas Transmission Operators

- Process Control for compressors and turbines.

The transmission operators they are trying to sell into are large national pipeline companies that aren’t easily receptive to change. It took some time but early this year they began to make some inroads. The company inked a contract with Snam Rete, an Italian gas transmission company, in February 2016.

The initial purchase order was for 400 units. CUI Global has been delivering units at a rate of 50 per month. The total volumes of the contract is for 3,300 units with the opportunity for that to expand to 7,000 units. They expect that next year volumes will ramp to 100 per month.

The thesis here is that

- The Snam Rete will ramp to 100 units next year and that will be enough volume to move the natural gas integration segment to profitability

- The Snam Rete contract will open the door to other national transmission operators.

CUI Global is engaged with transmission companies in France, Spain and Germany. Listening to management I get the impression that they are furthest along in France, where in the second quarter they announced a distribution agreement with Autochim for sales of GasPT units in France and Africa. They also talked on the second quarter call about their recent engagement with Transcanada Pipelines.

Worth noting is that Snam Rete is a low pressure pipeline delivery company, which is unusual. Almost all gas transmission at a large scale is done at high pressure. Because of the unique nature of their operations, Snam Rete did not have to purchase the whole solution from CUI Global, they took the analyzer but not the probe. The other potential customers will be taking the full GasPT solution.

They are also gaining traction in its second market vertical, gas processing facilities. On the last couple of calls they have talked about a contract with an ethylene plant operator in Texas. In the first quarter they said:

Recently Orbital NA announced its receipt of a purchase order from a large scale ethylene plant operator in South Texas to design, build and deliver nine patented, ultra fast and accurate in depth, VE sample probes and sample systems and another purchase order for an additional six VE sample probes. That order totaling almost 1.8 million is a trial project which may result in a similar deployment of our technology across 54 other facilities operated by the same customer worldwide.

In the second quarter they qualified the potential of this operator as being a $100 million opportunity if they can expand the order to all the plants run by this operator.

Extending their reach into North America a bit further, a couple of weeks ago they signed a licensing agreement with Daily Thermetrics for the sale of the VE Technology, which is the probe portion of the GasPT unit.

I’m not sure what to make of management. They tell a good story. I came across the idea from a conference they participated in (the rebroadcast has expired but I can provide it if you email me). What they described was compelling. But going back through their old calls and financials, the execution hasn’t been great, though this may also be more of a function of the businesses they are trying to tap into.

CUI Global has a market capitalization of $110 million and cash and debt come close to cancelling one another out on the balance sheet. When I model their business, it looks like they need to double the sales of the energy segment to get meaningful profitability for the company.

That may be a tall order. But the contracts in the pipeline are big numbers. The energy segment is operating at a run rate of $7.5 million per quarter. The contract with Snam Rete for the 3,300 units was for $60 million Euro. Presumably contracts with other transmission providers would be similar. Likewise, the potential of this single ethylene plant operator is $100 million.

So the total addressable market (TAM) appears to be significant. The company addresses its TAM on slide 11 of this recent presentation.

The question, which remains valid, is whether they can really gain traction and become the go-to solution. The thing is, its binary. Either they get more contracts or they don’t. I don’t think you can sit on the sidelines and wait and see how it plays out. Because the next contract, if it happens, will likely be the big move when it happens, and the stock will gap before you can react.

New Position: Jones Energy

I took a position in Jones Energy because of their recent acquisition of STACK/SCOOP acreage. Jones has long had a large acreage position in Oklahoma, but their target has been northwest and southeast of the STACK/SCOOP prospect, where they have targeted the Cleveland formation. The new acreage should give better returns and more prolific well results.

The story you want to see play out is one where attention grows for the STACK/SCOOP and the play becomes recognized for its multi-zone potential that is close to, if not on par, with the Permian. That should push up the price per acre and make the acquisition look even more attractive (it already looks like a good deal to me compared to other recent transactions. Meanwhile an upcoming drill program should give some prolific IP30 results that will add excitement to the story.

At the moment the STACK/SCOOP does not have quite as good of returns as the Permian but they aren’t far off. Demonstrating the viability of the play even at these prices, Newfield points out (in their June presentation) that rig count is rising at a similar rate as the Permian:

There are a number of large operators in the STACK. Devon has the biggest position, and Marathon, Cimerex and Newfield are also players. Newfield was the first mover in the play. Gastar (who I will talk about shortly) provides a good map of where the operators are.

Continental is a player in both the STACK and the SCOOP. They have acreage that is in the northwest for STACK (Blaine, Dewey and Custer county) and in Grady county for SCOOP.

Jones acreage (see the map below) is in the southern part of Canadian county, so around the Chaparral acreage, and south of that into Grady county. The northern border of Grady is roughly where the STACK ends and the SCOOP begins. The STACK and SCOOP regions are considered distinct because the geology changes, as the Meramec formation dips down and is replaced by the upper and lower Sycamore.

Jones bought their acreage at $7,600/acre which is on the low side of other transactions I’ve seen. Marathon bought 61,000 acres at $11,800/acre (here they define their position). Newfield bought 42,000 acres from Chesapeake at $10,000/acre. Back in December Devon bought acreage at $17,000/acre. Continental recently sold SCOOP acreage that is in south Grady and further SW into Garvin county for about $9,000/acre adjusted for production. I don’t see too much evidence that Jones bought an inferior acreage position, other than that the STACK acreage is further to the southwest than the core STACK region at the intersection of Blaine/Kingfisher/Canadian.

As I said, STACK results look comparable but slightly less prolific than Permian. Most of the results are drilling into the Meramec formation, some drilling into Woodford. Well costs seem to be in the range of $4.5 million to $6.5 million for a 10,000ft lateral, which is a big range but I think that is because of changes in depth across the play. Continental is an outlier, they operate much further west than the rest of the operators and their wells cost $9-$10 million. The IP30 for the wells are around 1,500 boepd, with some wells delivering as high as 2,000 boepd. Continental has seen its more expensive wells hitting 3,000 boepd. EUR per well is around 1 MMboe with again Continental being much higher at 1.7 MMboe. All operators report ROR that is consistently in the range of 70-80% at $50 oil.

The northern part of Jones acreage is prospective for the Meramec but transitions to the Sycamore as you go south (so where the STACK becomes SCOOP). Though there isn’t a lot of information I’ve found on the Sycamore, what I have gathered appears to validate that well performance is similar to the Meramec. Jones provides a few well results from Marathon and a company called Citizen Energy (who unfortunately is private and so there is no information on their website) in the map I showed above.

A second prospect in the STACK/SCOOP is the Woodford shale. Their are a few Newfield well results in the Woodford referred to in the Jones map. Continental seems have cracked the Woodford code recently. Continental talks about how they are seeing a 40% increase in EUR on offset wells from recent wells where they have tweaked the completion techniques for $400K incremental cost.

This is pretty interesting, especially because Jones acreage looks like it is in same area as Continental. Below outlines where Continental has been drilling:

While the STACK/SCOOP lags the Permian in performance, the perception I get from listening to comments from Marathon, Cimerex and Newfield is that the area is earlier in the learning cycle, and we should expect further improvements (like we may have just seen with Continental in their Woodford SCOOP wells).

While the STACK/SCOOP lags the Permian in performance, the perception I get from listening to comments from Marathon, Cimerex and Newfield is that the area is earlier in the learning cycle, and we should expect further improvements (like we may have just seen with Continental in their Woodford SCOOP wells).

Cimerex in particular has acreage both in the Permian and in the STACK and they are allocating significant capital to both plays. The gave a good presentation at Enercom, where they talk about both the Permian and the STACK/SCOOP making it easy to draw some comparisons.

Jones also has legacy acreage that is not too far away from the STACK/SCOOP. They have 100s or maybe 1,000s of wells in this area targeting the Cleveland formation. In total they have 180,000 acres in Ellis, Roger Mills and Beckham county in OK and in Lipscomb, Ochil tree and Hemphill county in Texas. This acreage is to the northwest of the STACK but its not that far northwest. Much like the STACK/SCOOP, the acreage has multizone potential. Jones has identified a number of potential zones in addition to the Cleveland. There is the Marmaton and Tonaka for example. Neither has been tested much. This article does a good job of delineating each of the STACK, SCOOP and the Cleveland/Tonkawa.

With respect to the multizone potential of the STACK/SCOOP and their legacy Cleveland land I thought the following comment was interesting from their second quarter call:

John Aschenbeck Got it, very helpful. One more if I could sneak it in on the Osage [ph], I’ve had a few operators say that Meramec EURs could potentially be possibly on the Osage as well leading you to believe Meramec-like returns in the Osage as well. Have any thoughts on that?

Jonny Jones We’ve got a 21-zone stack in the western Anadarko basin, of which these are just a couple of zones. We’ve been believers for a long, long time that there’s many pays out here, some of which are the ones you just mentioned, that really have not been exploited with modern technology. We have a lot of them in our section. People are just now starting to parse all the different trenches of the Mississippi and then that’s all they are. But there is a lot of other things out here besides those zones that are attractive. I think you’re going to see that come to fruition over the next six to nine months as folks actually start trying these different zones. The stack, the scoop, all these different zones right now are not one zone. There’s multiple pays here.

New Position: Gastar Exploration

Gastar is the other Oklahoma operator that I have taken a small position in. By any traditional metric Gastar is a disaster. They have about $575 million of debt versus a $125 million market capitalization. Absent their hedges they aren’t generating enough cash flow to cover their interest payments.

But they own a lot of acreage (84,000 acres) right around the heart of the STACK:

The big question is whether the land in Kingfisher, which is a bit north of where Marathon, Newfield, Devon et al are drilling, is as prospective as the land further south? I’m not sure, though from a number of presentations I’ve seen delineating the extents of the STACK it is clear the play extends well into Garfield county, so Gastar’s acreage is far from the edge of the formation.

While Gastar fails miserably on traditional valuation techniques, the stock looks pretty attractive if you apply acreage valuations that are comparable to recent land sales prices in the area. By my calculation the current share price is reflecting about $6,000/acre for the STACK position and $4,000/acre for WEHLU (the WEHLU is on the eastern edge of the STACK and I don’t have as much information on how prospective it is but Gastar has been drilling decent Hunton wells there for a number of years). The NAV is very levered to appreciation of this acreage. At $8,000/acre for the STACK acres the NAV rises to $2.22. If you use $11,000/acre the NAV is over $4/share.

I don’t know if Gastar gets revalued up to reflect the going rate of a STACK acre or whether the company sinks into bankruptcy. I know they are going to do some drilling to prove out some of their STACK acreage and those results will be the key. I also know from what happened to Resolute that when a company goes from reflecting bankruptcy to being valued based on current acreage prices the move can be pretty amazing.

New Position: Zargon Exploration

Unlike the first two positions oil and gas positions, Zargon isn’t a play on the STACK/SCOOP. The company’s operations are primarily in Alberta with a small amount of production in North Dakota that is likely to be sold in the near future.

Up until July Zargon had too much debt and there was some thought that the company would eventually become a victim of bankruptcy. At the end of the second quarter the company had $122 million of net debt to go against second quarter funds flow of $3.5 million.

But on July 22nd Zargon announced the sale of is southeastern Sasksatchewan assets for net proceeds of $87.5 million. The transaction significantly reduces debt and makes it much more likely that the company will make it through to the other side of this oil price downturn.

With the use of proceeds put towards the debt, the company’s net debt position is expected to be around $35 million. I was buying the stock a bit lower than it is now, but even at 90 cents the market capitalization is only $27 million, meaning that the enterprise as a whole is going for $62 million.

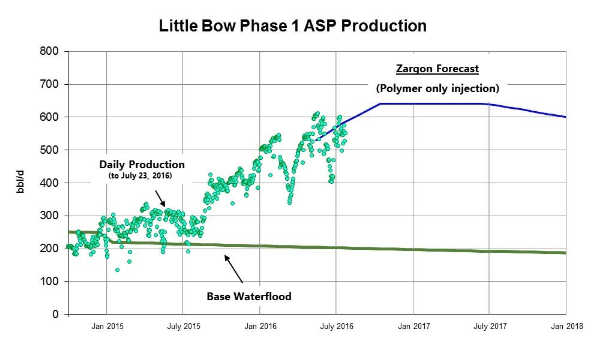

This doesn’t seem like a bad price to me considering what you get. After the asset sale Zargon is left with about 2,800 boepd of production, 79% of which is liquids. The production breaks down to 400 boepd from North Dakota, 2,000 boepd from various Alberta land packages, and 530 boepd from their Little Bow Alkali-Surfactant-Ploymer flood project.

All of these properties are low decline. Little Bow production should actually increase through the end of the quarter before stabilizing at over 600 boepd. This number could go higher if oil prices recover as the company has suspended alkali and surfactant injection because of the economics of the project at current oil prices.

The other properties are very low decline, 14% according to the September presentation.

The properties as a whole have a proved PV10 of $108 million and and a proved plus probable PV10 of $176 million. The enterprise value trades at a discount to the proved value of the reserves. This is at forecasted prices though, and that forecast is assuming a slow oil price recovery through to 2030.

I think the current price is probably reflecting about $45 oil. What I like about the stock, and why I took a position, is that at $55 oil the stock is probably a double at least. Its probably not a great long-term hold, as I don’t see anything in particular about the properties that excites me, but as a vehicle for playing a price recovery in oil I think its worth a position.

One Last New Position: Limbach Holdings

I took a position in Limbach Holdings after one of the funds I follow, Dane Capital, took a position. Dane Capital is the same fund that I got the idea for RMG Networks from. They have written up Limbach in two pieces on SeekingAlpha (here) and I’m not going to add more on the name right now because they describe the thesis quite well.

Portfolio Composition

Click here for the last four weeks of trades.

Below you will see that I’ve gone back to my old format for portfolio composition. Those of you who have followed the blog for a while will know my love/hate relationship with RBC Practice Portfolios. I used to be able to use the portfolio holdings page provided by RBC, but then they introduced a bug which basically screwed up the gain/loss on a position if you partially sold out or added to an existing position. So I started tracking my portfolio via spreadsheet as well as with the RBC portfolio. This is time consuming so when RBC introduced a new portfolio summary that wasn’t great but at least wasn’t totally out to lunch, I began to report it and have used it for the past few updates. Well this week I realized that this summary has a bug as well, so I am back to reporting via spreadsheet. I also took the time to add a function to my code that colors the gain and loss columns in green or red.