On Not Writing and Prothena Corp

It is getting harder to find companies that I want to talk about. As I wrote on the weekend, I am content with the positions I have, but being enthusiastic about new ones is tougher.

Even some of the new positions I might take, I don’t really want to elaborate on. I have four positions in my portfolio right now where I can definitively say that the only reason I own them is because I think they are going up more. All four are crappy companies. Of them all, I have very little good to say. But largely because they are in the right sector at the right time (Bitcoin, SaaS, and clean energy), they are all going up and are some of my best performers. One is (ridiculously) the best performer in my portfolio this year. And the company is a mess.

I’m not going to write about these names because what would I say? I am not going to say I am excited about their prospects because their prospects are largely smoke and mirrors. I am not going to say that I like the growth runway because I don’t. In one case, a SPAC (of course), the growth run way to 2025 revenue is so ridiculous that I can’t imagine that they will even come within even half of that number. But the stock goes up.

These facts would make it depressing to write about them. Depressing because right now doing research on stocks is only peripherally related to success. While the stocks you spend hours of research on, and find to be attractive, are likely doing well, there are other stocks, one’s where even a cursory overview would find them to be garbage, that are probably doing better. That is depressing.

The reality is, the market is taking the dumbest, silliest ideas and bidding them up to even sillier heights and nothing that you can reason will change that. So you might as well own a few on speculation even if the business makes zero sense in the long run. But don’t write about them, because it will be embarrassing to look back in a year and see that you even mentioned the names.

So instead of talking about these depressing messes of success, I want to point out a stock that I found that has found very little success so far this year (until of course today – I swear that I started writing this post I had no idea that the company would release news this morning. Total coincidence. The number of times I look at a stock on the weekend and it has news within days is uncanny). But it does look attractive to me.

Prothena

First, what is going on today. Prothena announced results of their Ph1 follow-up for the molecule PRX004, which is targeting Amyloidosis. The reason the stock is up is because, while the trial was primarily looking at whether the drug was tolerated by patients, it also gave us an indication of efficacy.

Prothena said that “PRX004 showed favorable results as demonstrated by slowing of neuropathy progression for all 7 evaluable patients at 9 months, including improvement in neuropathy in 3 of the 7 patients, and improved cardiac systolic function for all 7 patients.”

The targets here are amyloidosis patients. These are patients who have heart problems. Those heart problems are caused by little deposits of mutated tissue called amyloids that are on their heart and eventually constrict it. PRX004 is expected to stop amyloids from forming (they come from the liver) and also remove the amyloids that have already formed in the heart.

These results that patients are seeing improved cardiac function and improved neuropathy suggests that the drug is doing what it is expected to do.

So its a positive result. And the stock is up a little on that. But it is a Ph1, so it is a long way from knowing anything for sure with PRX004. I would not buy the stock on this news. It will be forgotten soon I think.

At any rate, PRX004 is not the main event. The main event is two-fold. It is a very early stage Alzheimers pipeline and a later stage molecule called prazinezumab. First, the latter.

Prazinezumab is targeting Parkinson’s. This would be a huge market if successful. No therapies to slow progression. 7-10mm patients.

Prazinezumab works like a lot of drugs, binding to the bad molecule or protein before it can bind to something else:

- Targets alpha-synuclein

- Alpha-synuclein accumulates in cells in Parkinsons

- Prasinezumab molecule binds to the extra-cellular (means the one’s just floating around) alpha-synuclein instead of letting the alpha-synuclein bind to new cells

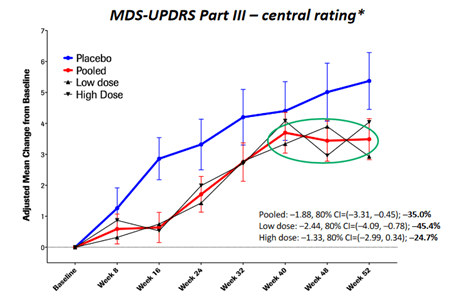

Prothena is collaborating with Roche here. It is a 30/70 split. They’ve done a Ph2a study and they showed some positive results though it did not meet the primary endpoint, which is what has held back the stock. However, the efficacy was there as they did meet secondary endpoints and, though I’m not an expert in this, it seems like the study was more geared toward compiling data on the secondary endpoints that were achieved, so they are now onto a Ph2b add on to that study.

The reason that they are doing a Ph2b instead of going to a Ph3 has to do with the symptom masking medications most Parkinson’s patients are on. In the Ph2a study, Prothena/Roche wanted to make sure they were comparing apples to placebos, so they limited enrollment to patients that were not taking any meds that would mask symptoms. Now that they have the data that shows that prazinezumab works versus a placebo, they are expanding enrollment to include this much larger (they said 4x the size) patient population.

So far the results look promising.

Prothena has interesting molecules targeting big markets and it has a lot of cash.

First is the cash on the balance sheet. The net cash position is $310 million right now. The market cap of the stock is $470 million.

Then there is a $60 million payment from Roche that will occur when the first patient is dosed with prazinezumab in the Ph2b. That is going to happen soon, so you can add that cash to the bank.

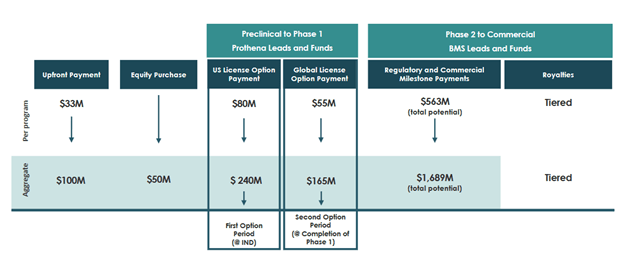

More cash could be coming in from their licensing agreement with Bristol-Myers-Squibb. For every new program that Prothena files an NDA for, BMS has the option to opt-in for $80 million.

Prothena is going to be filing an NDA in 2021 on a molecule called Tau that would qualify for this collaboration. Tau is targeting Alzheimers. We can’t say for sure whether BMS will opt in or not, but it is another potential event.

Also on the event front, there is a read-out from Biogen that is coming up on their Parkinson’s drug that could have an impact on the stock. Biogen is using a similar mechanism, targeting alpha-synuclein, but in a different way. Good results would probably boost PRTA, at least temporarily.

Biogen plays into this story in another way. Prothena has a couple of different Alzheimer candidates. The first is Tau, which I mentioned. The second is PRX012, which has similarities to another Biogen drug, aducanumab, which has had a roller-coaster ride. I’m not really sure if it is a good thing to have a molecule that investors relate to aducanumab, at least in the short run.

But Prothena was clear, even before the aducanumab/advisory committee findings (this is a very long story and just go google it if you want all the details), that their molecule was similar but different and that they expect different results. Here is how they put it in their 10-Q:

Prothena has developed anti-Aβ antibodies with greater potency that retain or improve on key attributes that are thought to underlie the observed efficacy of N-terminally directed therapeutics such as aducanumab, with the aim of offering similar or improved efficacy with sub-cutaneous dosing regimen. Prothena antibodies demonstrated a higher binding strength to amyloid than aducanumab; specifically, a 5- to 11-fold greater affinity/avidity for fibrillar Aβ than aducanumab while also neutralizing soluble, toxic (i.e., oligomeric) Aβ species. Prothena antibodies were also shown to recognize Aβ pathology to a greater extent than aducanumab, demonstrating more extensive plaque area binding at lower antibody concentrations, which are estimated to be clinically relevant exposures in the central nervous system following systemic dosing.

There is even a third, more secretive molecule targeting Alzheimer’s that is as of yet undisclosed.

With the Alzheimer angle, kind of like the Parkinson angle, this is more about just how small of a fish Prothena appears to be, even as it is playing in these very large oceans. I look at the company and the collaboration with Roche, the deal with BMS, the similar molecules to the one Biogen has and it makes me go hmmm.

Just think about it. Biogen stock moved a $100 when it looked like aducanumab might get approved. That is like $15 billion in market cap. On the other hand here we have Prothena, that has a similar molecule, that has another AD targeting molecule with an NDA that BMS may participate in, that has yet another molecule targeting AD that is still hush-hush, and the stock trades at barely $100 million net of cash. Then they also are going after Parkinsons, have just had some decent early results in amyloidosis, and have this early stage dev agreement with BMS that will pocket them $80 million every time BMS wants to participate.

All this for less than a $100 million? While my SPAC play with the stupid 2025 revenue number that has a zero (and I mean a Steve Eisman hand gesture with your thumb and index finger zero) probability of being hit, has an EV of $1 billion+ ? Like I said, hmmm.