How I know this is a bubble

Last night our family was about to sit down to dinner and just as we did I was struck by fear.

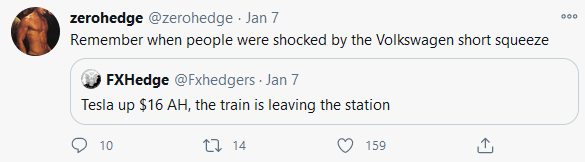

An hour before I had read this zerohedge tweet about Tesla:

After I read the tweet I looked at the after hours price of Tesla. It was up about 2%. After being up about 8% during regular trading hours.

I began to panic. Complete, pure, irrational panic.

Here’s the thing. I was short Tesla.

I’m not a TSLAQ guy. I think I shorted it briefly once in the past. But I had put on a short at the beginning of the week.

This was not a large position. It would not even qualify as a small position. It added up to 0.27% of my portfolio. And that’s after losing on it for 3 straight days.

Yet before I sat down for dinner last night, I was panicked enough about this tiny, little Tesla short that I had to run and close it out in after hours before I could sit down to eat.

Its not just Tesla.

I have had hedges on in my portfolio, in one form or another, since about 2016. During that time I’ve never really worried about them. If the market goes up, then my stocks go up. The hedges go down but that is part of the deal.

But right now, I have become actively worried about my hedges. So much so that before the market closed Thursday I went through all my inverse index positions and calculated how much my portfolio would lose from them if the market was up 2%, 3% or 4% on Friday. And then I adjusted their size to make sure each was at a level I could live with.

This is not normal.

It is not normal for me to be so uncertain. It is not normal for me to be thinking that the market could be up multiple-percent for no particular reason.

To be so unsure of what the market might do that a 0.3% short in Tesla feels dangerous? That it makes me start calculating the damage if this is the next Volkswagen and the stock flies up 2x, 4x or 10x in a few hours on some bizarre index inclusion short squeeze (which I have to say doesn’t really make any sense to me, not that such reason mattered at the time).

And this isn’t some fear bred from a string of bad trades. I know that fear. I’ve been wrong about a bunch, I’ve had bad luck streaks, and I know the feeling when you get to a point where you don’t trust your own judgement.

That isn’t what this is.

I’ve done quite well the last couple of months. Yet I can’t shake the feeling…

I have not been as skittish as I felt this week since… well I don’t know when.

I certainly have never felt this skittish at a time that my portfolio was going up.

I was not even this skittish in March. After all, that made some sense. This does not make sense. So anything seems possible.

It could be passive or options or $2,000 checks. Or some combination of all of the above. I look at Twitter and I see all these guys calling out their big returns on portfolios that look like they are all identical with the same SaaS and EV and momentum names (or they are just 100% Tesla or something crazy like that). And these guys don’t look like the guys that usually get rich on stocks.

Meanwhile many of the guys that I know from years on Twitter that are good at stocks are either silent or incredulous.

Apart from taking off my Tesla short (which I replaced with an even tinier option position where at least I know my downside if something bizarre happens), today I did the only thing I could do given my unease. I sold. Both longs, shorts and hedges. I am now very small.

That will mean I don’t fully participate in what could very well be the blow-off top. But I am just not comfortable with what is happening right now.

What the market is doing doesn’t make sense. I doesn’t feel right. So I had to get small enough that it doesn’t matter.