Make that 10 of the last 2 (3?) Crises

COVID is such a pain in the butt for investing. It is always something. This new variant, Omicron, is confusing to say the least.

I saw a tweet last week mocking all the faux-virology experts that have again come out of the woodwork on news of a new variant. I responded that after two years of COVID we actually are all virology experts.

While that is not true of course, it is true is that I know more about virology then I ever wanted to.

I wrote a post last weekend talking about how confused I was about Omicron but I ran out of time and didn’t finish it. The week went by. Now, a week later, I’m a little less confused (but still pretty confused), and a little more worried.

What makes Omicron so tough is that whatever does happen, it is going to happen fast. We don’t have months to figure this one out. If something bad is going to happen (or not) it is going to happen in the next six weeks.

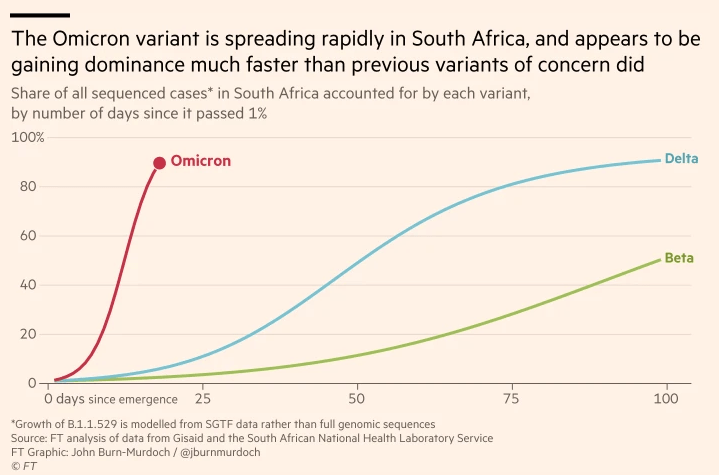

That is because the one thing we know is that Omicron is far more transmissible than any other strain.

In fact, it looks to be insanely transmissible. Puts Delta to shame. Transmissible to the point that you might get it standing in line at the supermarket behind someone.

I’ve seen numbers from a party of 150 people in Oslo. First reports were that 17 came down with the virus. Then I saw 50. This morning I saw 100. 100!!!!

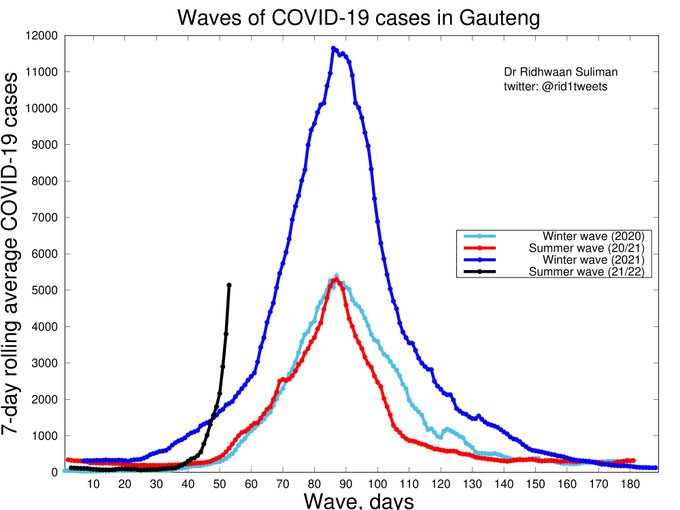

Other worrisome is the data from South Africa. There is a tonne of data that has come out but this chart from FT kind of sums it up:

Or if you just want to look at cases.

This thing is in a whole other world.

We are also getting more data on immunity. This paper was published in medRxiv just today. It suggests that there is almost no immunity from previous COVID infections. In fact, in South Africa previous infection seemed to make it more likely you’d get Omicron.

No, we don’t have vaccine efficacy info. But this sort of data does not bode well for vaccines.

Putting that all together and I feel pretty confident that this thing is going to run through the population fast.

The only thing we don’t know at all is the thing that is the most important. Whether the symptoms are going to be mild, severe or somewhere in between.

This one is a bit weird. The anecdotes in news stories and on Twitter are almost all in the pro-mild camp.

There are anecdotes about the guy in Minnesota or the couple in Colorado or whatever, and how they got it and its mild. How no one is hospitalized so far. And the South African doctor that is all over every stream saying that the cases in South Africa are mild.

And then there is stuff like this.

He’s right – it would be wildly bullish if no one dies! Especially if no one goes to hospital.

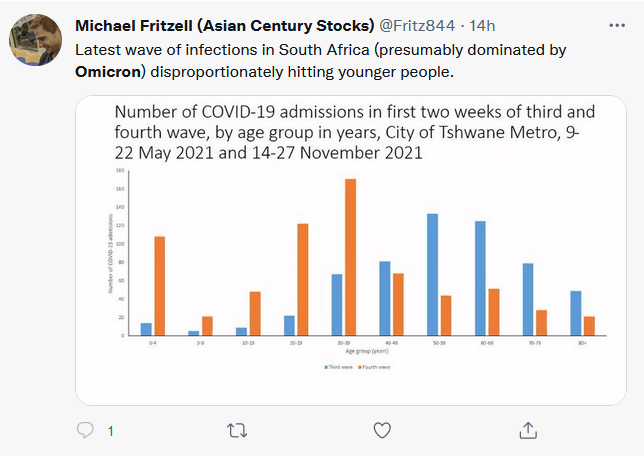

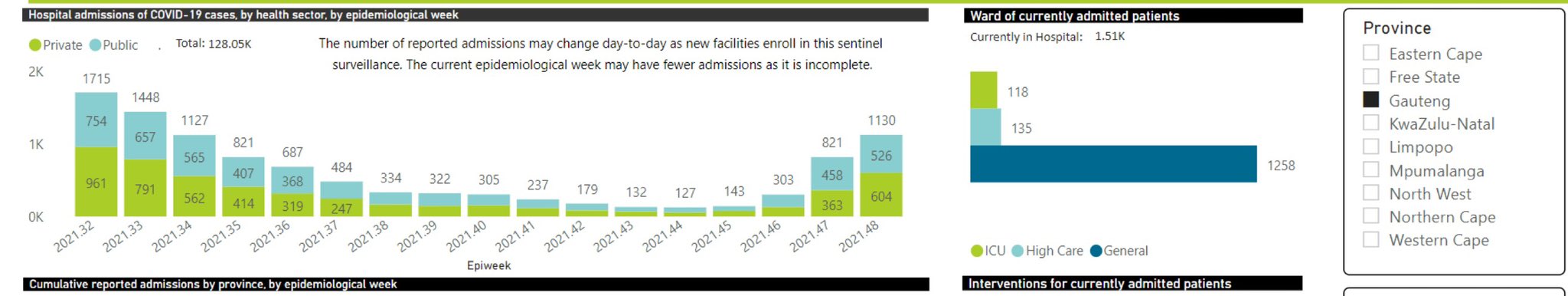

Yet the data from South Africa does not look very mild. Hospitalizations are rising quickly.

I have seen other data on South Africa, that I cannot republish, that suggest Omicron is at least similar to Delta in terms of virulence.

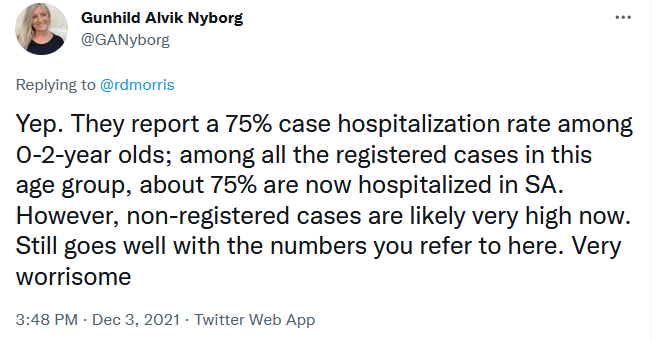

And this is just bad:

So I just don’t know. It is not at all clear. Yet the stock market is still within a two-day rally of all-time highs. And quite honestly, I don’t think the correction we’ve had has much to do with Omicron.

I said on Twitter the other day that I was going to sit this out. That is what I’m doing.

This is just my opinion but I believe that one of the most underappreciated attributes of stocks is the ability to sell them. If you own a business, you gotta ride it out. If you own real estate, you gotta ride it out. But if iou own stocks, just click a button and you can wash your hands of them.

Diamond hands are anchors. You can always buy a stock back later. For the odd, illiquid stock that you can’t sell, you can short something else to hedge.

Now I don’t think the market has concluded what I am concluding. When the market is going down, its being led down by SaaS and software. If this was the market waking up to a worrisome mutation, it would not be led down by SaaS. SaaS should probably, much to my chagrin, go up.

So it is a strange time – the market is going down, which I kinda get, but not for the reasons I think it should.

The crazy thing is, finally, FINALLY, after so much tumult and false starts (and yes, many a loss), my SaaS shorts worked. Wouldn’t you know it. We finally get the big one. Collapsing SaaS stocks from towering multiples. 5-10% down moves a day. Utter carnage.

But instead of enjoying it, I’m stuck wondering if I should cover because if Omicron takes center stage, SaaS could go right back up.

Its poetic in a twisted way.

On Friday I did start to cover a few SaaS names. And I even went long Zoom, which has been decimated and if I am right about Omicron I would have to think it bounces. I went long LivePerson, which again may get a Omicron bounce and is about the most oversold stock I have seen.

But these are just small longs. Otherwise I really cut back my longs a lot. This all started before Omicron, when a few weeks ago I threw up my hands and sold a bunch of stuff that wasn’t working. Sold oil. Sold gold. Sold commodities. This week, I kept selling.

I also added a few more shorts this week. A couple airlines. Honeywell. Dick’s Sporting Goods. Just some names that will balance out my remaining longs if the market continues to tumble.

I’m not trying to make money right now. Only not trying to lose it.

The only thing that sucks about this is it is year end and net, I’m taking in capital gains, so this next tax bill is going to be a doozy. But what can you do? I’ve played the game before where I’ve kept stocks until after year-end for tax purposes and all it does is make you frustrated about losing money on something you know you should have sold.

I only added one other new position, Biocept, which is going to get a short-term bump from testing if I’m right. Biocept is not a good company in many ways, but they do COVID testing and they have a new test and you know how the market can get about these sort of plays.

I also kept Eiger, which goes up and down like a yo-yo. Again, this TOGETHER COVID trial, if they show efficacy, could really move the stock. Of course if it doesn’t show efficacy I’m sure the stock is going straight to $4.

I also added a VIX position when I first heard about Omicron last week. VIX is a guaranteed money loser over the medium term, but if this thing is going to go south it will offset inevitable losses in my remaining longs. Again, trying to not lose money here. If I could easily go cash, I would just do that.

Lastly, let me be clear about where I am standing on this. I am not getting this defensive because I am convinced of the trajectory we are on. I’m just very unsure about the trajectory and the market is not pricing in that downside probability here.

I hope that I am being too cautious (again) and selling the 10th of the last 2 crises. I hope that symptoms turn out to be “mild” and this becomes the “natural vaccine”.

But…

One, I don’t see “mild” in much the data I’m looking at. And two, selling is easy.

There are 5,000 stocks out there. If you sell one another will come around when you are ready to buy. There is no reason to get attached. Being a hero in the stock market is generally a losing proposition.

Maybe this is a nothing-burger and I’m buying back in a few weeks. Because I do not want to go through the worst case scenario all over again.