Another Banking Story – Eastern Bankshares

As I have dug into the bank stocks over the last few months, one thing that has crystalized for me is the importance of flexibility.

Apart from a few banks that aren’t really all that reliant on deposits, usually because they have other ancillary businesses that drive their income or because their loans are high-risk and what they pay for deposits is not that important, pretty much all the others are in the same boat. Rising deposit costs and worries about commercial real estate dominate the risks.

What differs, sometimes significantly, is how much flexibility they have to deal with issues as they arise.

Eastern Bankshares is interesting for this reason. On the surface EBC has many undesirable characteristics. I can make a good case for why you would not want to buy this bank. Yet if you look a bit further, EBC has one big thing going for it – flexibility – and that makes it pretty interesting, and I think could allow it to outperform.

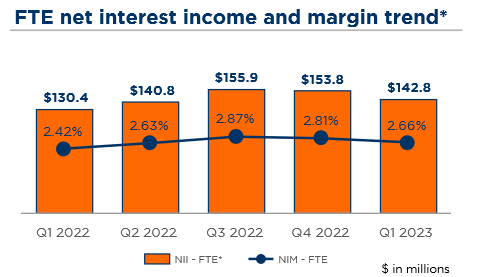

What might make you skittish about Eastern Bankshares? For one, EBC has a very narrow net interest margin.

Net interest margin is the difference between the yield on assets (loans and securities) and the cost of deposits. Narrow is bad, particularly today.

EBC’s net interest margin has been well below 3% each quarter for the last year. That is pretty low. I talked about this in my last post. I consider a NIM in the 3%s to be on the low-end of acceptable, and in the 2%’s I get nervous.

Having a tight NIM puts a bank in a tough position right now because they are more susceptible to rising deposit costs. It is ironic that, as long as the economy is strong, it is actually safer to be invested in more risky, and higher interest, assets.

For example, if you are a bank invested in nothing but credit card loans at 19%, does it really matter much if your deposit costs go from 2% to 3%? Nope. But if your loans are low-risk real estate in the 4% range, it matters a lot.

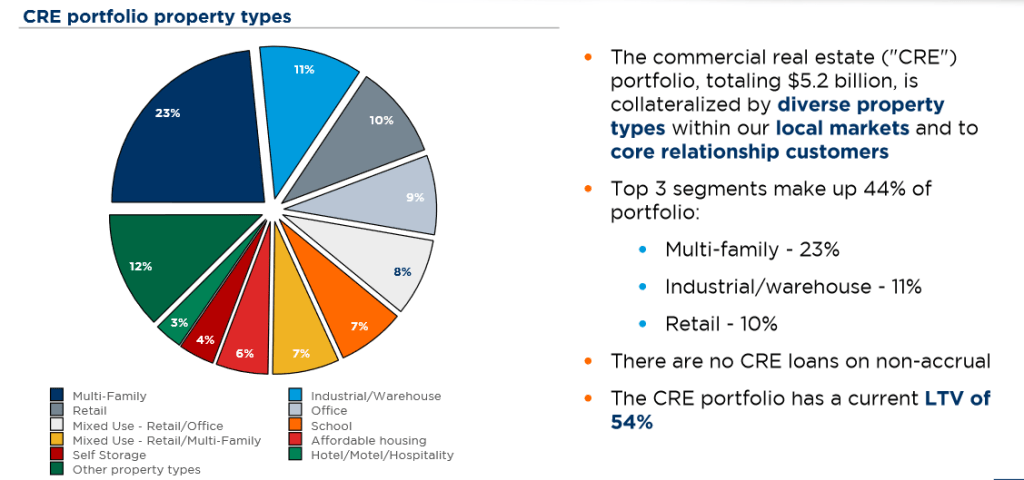

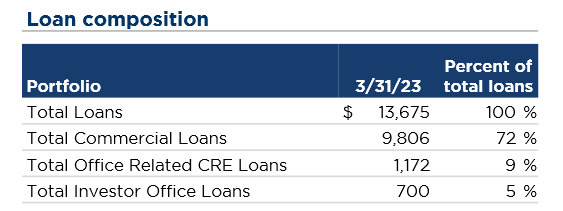

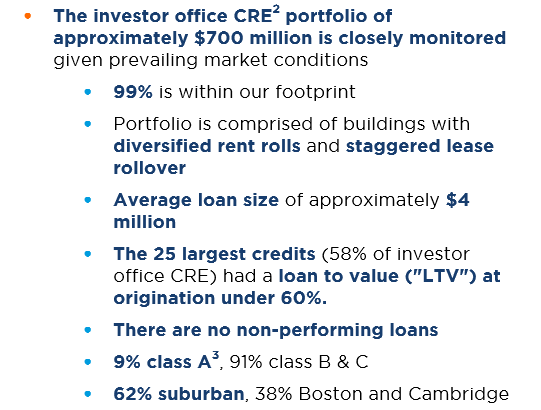

The next thing about EBC is that they have a relatively large commercial real estate portfolio.

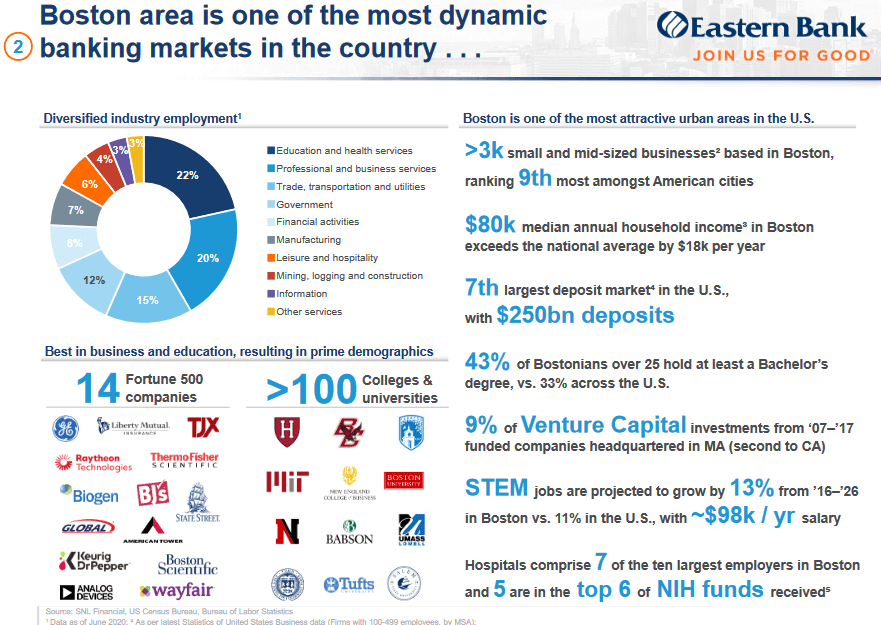

EBC operates in “the greater Boston area, specifically eastern and central Massachusetts, southern New Hampshire, including the seacoast region, and northern Rhode Island.” Much of their loan portfolio consists of commercial real estate in this area.

Of that CRE portfolio, office is a decent chunk. Their office loans make up 9%. Mixed use office + retail make up another 8%.

The composition of those office loans is average at best. It is 2/3 suburban (so not big towers) but there is very little in the way of Class A properties.

EBC did say on the Q1 call that they don’t consider any suburban office to be Class A so that makes the Class A/B,C breakdown look a little bit worse than it actually is. But still, if 9% of their office loans are Class A and 38% of office loans are non-suburban, you can do the math. They certainly have some exposure to downtown Class B and C properties, which is where most of the CRE stress is.

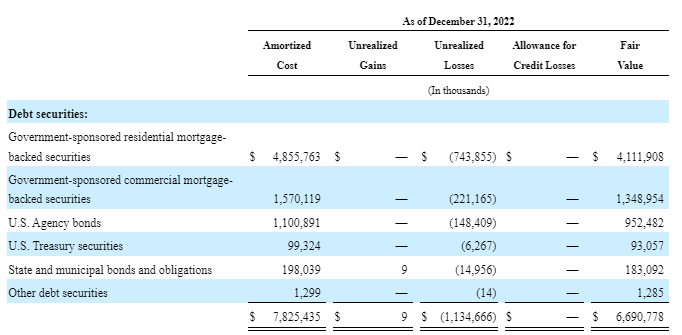

Finally, and this was the big worry going into 2023 – EBC had a big underwater securities portfolio. At the end of 2022 their available-for-sales securities portfolio was $6.7b and had a $1.1b unrealized loss on it.

The securities portfolio was 30% of assets, which is sizable. And compared to their $1.8b of tangible equity, the $1.1b unrealized loss was quite large (though because this is an AFS portfolio of securities, the loss has already been subtracted from tangible equity).

Ok, so those are the negatives. Why in the world would I find this bank interesting?

Flexibility!

It starts with what EBC did with their AFS securities portfolio. In March EBC sold a big chunk of it. They ripped the proverbial band-aid off.

EBC sold $1.9b of securities during Q1, taking a loss of $280mm after-tax in the process.

Here is where flexibility comes in. The reason EBC did this is because they could. I have already explained how EBC positioned themselves poorly by buying a whole bunch of low yielding securities. But they made up for this guffaw in another important way: by not levering up the bank risk and keeping around lots of excess capital.

EBC has more capital than most banks. The median KRE bank has core tier 1 equity ratio of 11.12%. EBC has a CET1 ratio of 15.8% and that is after the sale of 25% of their security book. EBC would stand 6th in the KRE in terms of CET1 ratio:

Second, EBC is not a very levered bank. They have a loan to deposit ratio of 72%. As I noted in my last post, a loan to deposit ratio in the low 70s is on the low-end of banks. It is also far below where EBC was before COVID. Their loan to deposit ratio was 93% at YE 2019.

Having more equity at a time like now gives a bank options (you could say optionality but I hate that word). Options like taking a loss on a security portfolio that is yielding only a bit over 1%.

And if you can do that, you get even more options. Because now you can replace that asset with something yielding much more. Or you can remove some of your highest-cost borrowing.

After the securities sale EBC had cash of $2.1b. This is about 10% of assets. It is way, way higher than it needs to be for a bank in normal times. On an exchange with an analyst on the Q1 call EBC said they can reduce their cash level substantially:

Historically EBC has operated with a couple hundred million of cash. Right now, the sweet spot probably needs to be higher than that historic number, but still nowhere near $2.1b.

At the very least, EBC can use some of their cash to pay off some of their high-cost funding. If you look at EBC’s balance sheet in Q1, they had $1.1b of FHLB advances and another $1.97b of CDs:

The FHLB advances have an interest rate of 4.6%. The CDs have an average interest rate of 3.7%.

It is fair to assume (because they said so themselves) that EBC will use most of the cash to wipe out all their FHLB advances and let some of CDs run-off through to the end of the year.

Eliminating the FHLB advances alone would have a big impact on earnings. In my model of Q2 earnings, I calculate that simply moving excess cash to get rid of the FHLB advances (for the whole quarter) would move earnings from 29c EPS to 38c EPS. Not bad.

CD run-off would help even more. Because EBC has a low loan to deposit ratio, they can afford to let deposits run off without doing anything on the asset side. The only thing is that I’m not sure whether a run-off of CDs will just be offsetting other deposit mix shifts from non-interest bearing to CDs, meaning cost wise its a wash.

EBC had planned to use the cash right away to pay off high cost funding but the banking panic delayed that. On the Q1 call EBC said that after the banking panic in March they had decided to keep the cash on their balance sheet until things settled down a bit. My best guess is that we will see the cash be put to better use in the second half of this year (but I’d be pleasantly surprised if it happened sometime in Q2).

Once they do, earnings will benefit.

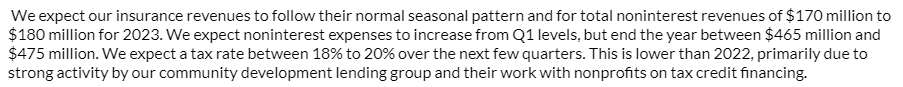

Which is why EBC was able to do something that few banks are doing right now. Raise guidance.

EBC said that they expected their net interest margin to increase through the rest of the year:

There aren’t too many banks that are seeing net interest margin going up. In fact, the late-quarter conference appearances of banks that I listened to had most of them making reductions to their Q2 NIM guidance.

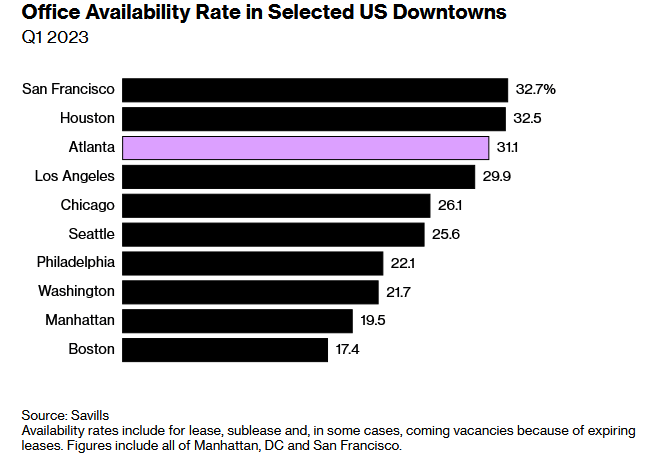

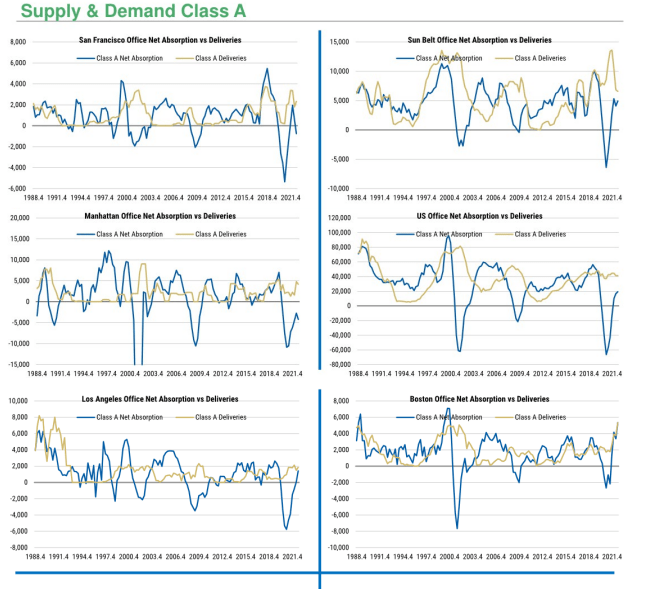

Now remember, EBC is no perfect bank stock. Their CRE and in particular office exposure could be a problem. But even that might not be as bad as it looks. This Bloomberg article pointed out that Boston is one of the better performing cities:

These charts from Morgan Stanley, albeit from earlier this year, also show Boston performing well compared to other major markets.

EBC is a lesson I think – of what flexibility can mean for a bank. It was a bank in a tough spot to start the year. But they had one trick up their sleeve: they began the year with the flexibility that comes from having low leverage and excess capital.

They used some of that capital to take a loss on extremely low yielding securities, which in turn gave them the flexibility that comes with cash. Now they seem likely to use that cash to de-lever even further, reducing their high-cost borrowings.

But again, they have flexibility. If the economy accelerates there is nothing to stop them from deploying that cash into loan growth, where they could likely get 7%+ on new originations, which would be even more accretive to EPS than paying down the FHLB. Remember that EBC has a loan to deposit ratio of 73% vs. 93% pre-COVID. There is plenty of room to grow their loan book if they believe the economy supports it.