Lydian International

Its honestly not my intention to write exclusively about gold stocks on this blog. But they do make up a significant fraction of my portfolio right now, and I think the gold stocks hold the most chance of significant upside in the short term. Yesterday is evidence to that. Gold stocks jumped to the upside. Now one never knows is such moves are breakouts or fakeouts, but we can only hope for the former.

As for Lydian International., its too bad I didn’t start my blog a few months ago. This post on Lydian would have been writing about the stock near its lows. Since then the stock has moved up 25%, including almost 10% yesterday alone. I still think its going to go much higher, but its always nice to catch the low end of the trading range before the breakout.

Recommended by Trusted Folks

At any rate, I’ve held Lydian International since late last year, when I was first introduced to the stock during a BNN interview with Rick Rule. Since that time it has been recommended here and here by Brent Cook, a geologist that writes a newsletter I used to subscribe to. I’ve gotten a lot of stock ideas by searching for and listening to interviews with Rick Rule and Brent Cook. That they both own Lydian is encouraging.

Looking at Lydian’s Deposit

As Rule describes in the interview, Lydian is a little gold company with a decent sized gold deposit called Amulsar, located in Armenia. The deposit is about 2.5Moz, its low grade, near surface, and will be surface mined using bulk tonnage techniques. The deposit that Lydian has have a number of things going for it:

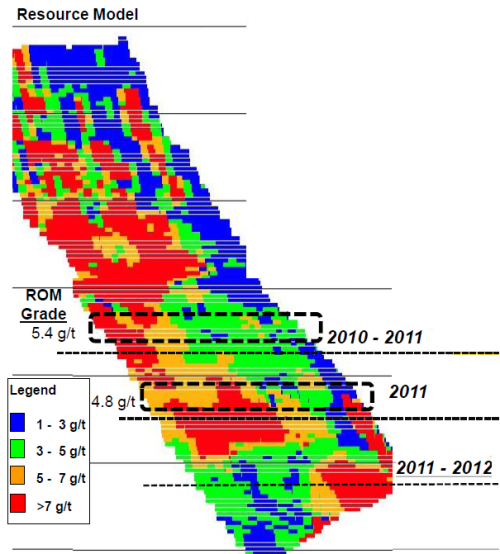

1. Its a oxide gold deposit – oxide gold can be extracted from the rock using a heap leach process that requires very little in the way of capital costs. You don’t need to build a complicated mill circuit. To put this in perspective, if the deposit was not oxide the CAPEX to build a mill would probably be around $300M to $400M. In the 2008 scoping study it was determined by Golder that Lydian would have to spend less than $30M CAPEX to bring on a large enough run of mill heap leach operation to process a 3Moz deposit (see figure below).

2. The strip ratio looks like it should be quite low. The deposit sits right on top of a hill (see cross sections below).

This will make it much easier to get at the ore without having to dig through a lot of overburden first. That means lower cash costs. Below are the operating costs assumed by Golder in the scoping study.

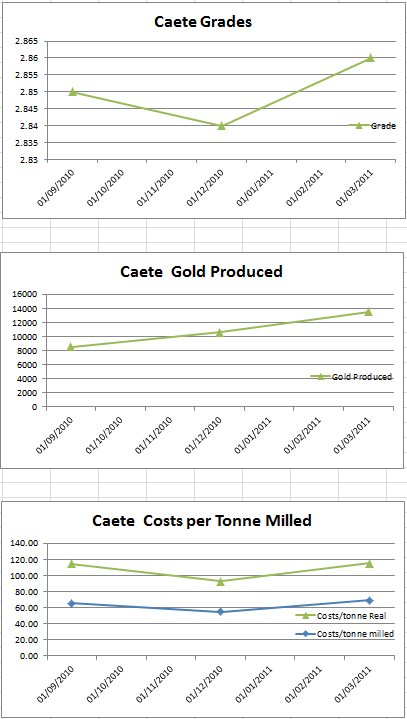

3. The metallurgy looks favorable. I already mentioned the oxide nature of the gold. That’s great. But sometimes its difficult to get a large percentage of the gold out. Take a look at Aura Minerals as a contrasting example. Aura has struggled on and off with recoveries with each of their deposits. Albeit part of those problems has been the mix of oxide and sulphide ore, but it just goes to show how metallurgical complexity can ruin an otherwise good deposit. Lydian shouldn’t have that problem.

4. Permitting should be in hand by the end of the year.

What’s Amulsar Worth?

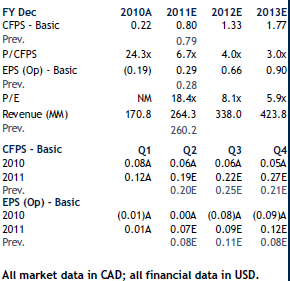

Using the numbers from the scoping study that the company performed, I worked out a spreadsheet of what the net present value of Amulsar is. Here is a list of the assumptions I used, followed by the results of the spreadsheet.

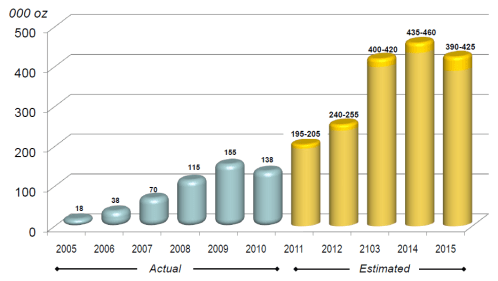

- Total production is expected be 135,000oz per year to occur over a 15 year period

- Strip ratio is 0.5 each year

- Recovery is 92% each year

- Mill grade is 0.9g/t each year

- Operating costs are $4/t mining and $2.5/t milling (I checked these against some other heap leach ops to make sure they were reasonable).

- The capex is $100M. This is conservative but it also includes $15M that they have to pay to Newmont and another $15M contingency I added on.

- Taxes of 20% base plus 12.5% excess profit are included.

I looked at two scenarios. One with gold at $1100/oz and the other with gold at $1300/oz (I’ve attached the original spreadsheet to the end of the post).

You can see that the upside to the stock, even at $1100/oz long term gold price, is still fairly substantial. Also note that cash costs should be less than $400/oz. This would put Amulsar on the map as a very low cost producing mine.

A lot of brokerages seem to be using NPV with a 7.5% discount these days. If you use that discount rate the NPV rises to $6.82.

An Eventual Takeover?

Honestly, I think what will happen with Lydian is that they will be taken on before they get the mine into production. I think this will occur at a substantially higher price than what its currently at (even after the run up yesterday).

One possible candidate for a takeover is Newmont. They own 9% of Lydian shares. There are probably also a number of mid-tier producers that would be happy to take on 150Koz per year production with cash costs of less than $400/oz.

The company should have an updated Preliminary Economic Assessment out any day now. It was scheduled for June but these things are inevitably late. The PEA will (hopefully) go a long ways to confirming some of the numbers I have put forth here.

Appendix

This is the original spreadsheet that I used to calculate the NPV. Also included is a low case sheet. This was done when the resource Lydian had was only 1.4Moz, so the low case incorporates that smaller resource. Now that more gold has been found, the low case is not realistic.