Fourth Quarter Update: Ichor Holdings beats and beats

I have a lengthy update on Oclaro that I finished a couple of days ago and was planning to post this weekend but it will have to wait a few more days because I wanted to write a few short posts about what was a busy day on Friday. After going a few days without any significant earnings updates, I was blitzed on Thursday night with 3 sets of year end results: from Radisys, Ichor and Hortonworks.

Two of these companies, Ichor and Hortonworks, produced unquestionably solid reports. The third, Radisys, was considered a disappointment by analysts. Of the three names, I added to my position in one, and it wasn’t the one with positive results.

I’ll start with the beats in this post by talking about Ichor.

Ichor Holdings

I wrote up the reasons for taking a position in Ichor about a month ago.

This was the first quarter that Ichor reported as a public company. The report was very good, and the guidance for the first quarter was excellent, but all of this was expected. Ichor pre-announced both in early January.

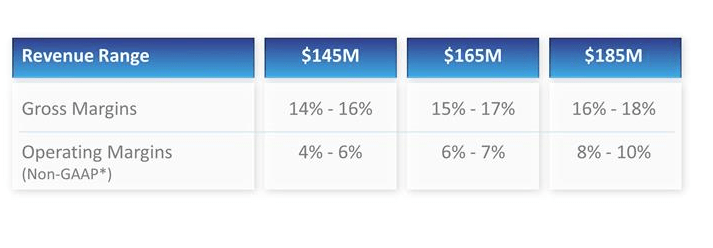

The most interesting new tidbit came from the conference call, where in response to a question asking ‘what if things get even better?’, management described their recent capacity additions. They said that they had recently added or were adding enough capacity to support $200 million of quarterly revenue. This is quite a large number. Consider that with the “big beat” in the fourth quarter the company had $131 million of revenue, and that they are guiding to $150 million in the first quarter. Only a year ago Ichor was generating a little over $60 million a quarter.

As strong as business has been, this has to be considered an indication that management sees it getting even stronger.

Given the growth (over 104% year over year and 24% sequentially in the fourth quarter), the concern of many, myself included , is that at some point this turns. These capacity adds, which presumably are being done now because of some visibility of what is to come, allay those concerns in the near term.

The company supplies its gas and liquid delivery systems to two major customers, Lam Research and Applied Materials. These two customers make up 90% of its revenue. Both of these companies have projected a slower second half. But even that level, which was described as a 55/45 H1/H2 breakdown on the call, is significantly higher revenue than Ichor was generating a year ago.

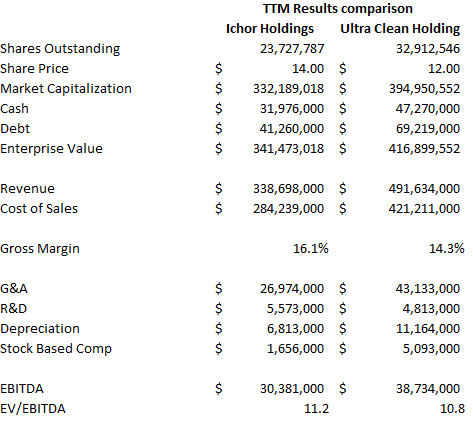

The company trades at a reasonable multiple considering the growth that is occurring. If you annualized the fourth quarter results, the stock price is at 7x EBITDA. The multiple shrinks to even less than that as revenue ramps higher in the first quarter.

Yet I struggled to add to my position on Friday even as the response to the report was somewhat muted. I worry about being blindsided when the turn comes, as I feel like I have very little insight into the catalysts that will precipitate it.

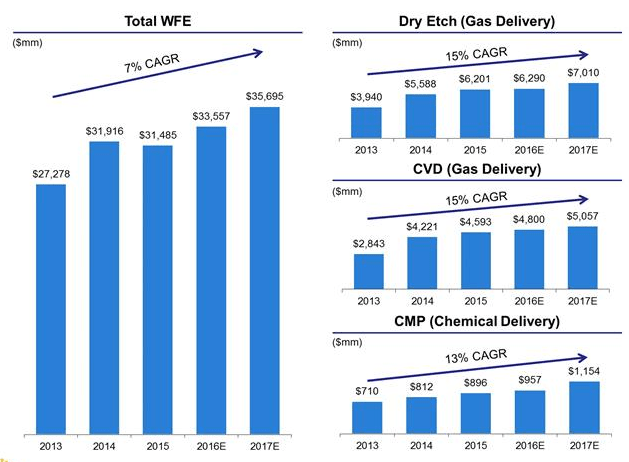

It could happen in second quarter or in two years, I just don’t know. The company suggests it may be more prolonged than many expect, as the drivers, which are 3-D NAND and multi-layer designs, are becoming ever more prevalent, and in the gas delivery business they have room to take market share from smaller competitors. They are putting their money on that by investing in more capacity today. But I wonder if Ichor is so far down the food chain that when the inflection comes they will be one of the last to know.

Thus I suspect that Ichor is destined to remain a 3-4% position for me, which I hope through appreciation eventually becomes a 5-6% position, but which I find unlikely I will be inclined to accumulate further and make it a portfolio changing score.