In the last month I sold off most of my oil related positions. Reliable Energy was bought out. I sold Second Wave, sold Arcan Resources, and just this week sold Coastal Energy.

I haven’t sold Leader Energy Services. The reason is partially because the stock hasn’t budged since I bought it. With fourth quarter results coming out today, I am hoping for an uptick in the stock from strong earnings, but am worried about a disappointment.

The company closed a share offering at 70 cents. It was the share offering that precipitated me to get back into the stock.

Leader Energy Services Ltd. (“Leader” or the “Company”) is pleased to announce that it has completed its previously announced bought deal short form prospectus offering (the “Offering”) entered into with AltaCorp Capital Inc. (the “Underwriter”). Pursuant to the Offering, Leader issued an aggregate of 9,790,000 common shares of the Company (“Common Shares”) at an issue price of $0.70 per Common Share, including 1,218,000 Common Shares pursuant to the partial exercise of the over-allotment option by the Underwriter, for aggregate gross proceeds of $6,853,000.

The company then used $6.1M of the proceeds to pay down debt. In a subsequent press release the company said that after the pay down, the debt facility will be $8.9 million. The debt reduction will save Leader approximately $730,000 in cash interest per year.

I think the heavy debt load has been partially responsible for the cap on the share price. Getting the debt down to $8.9M makes that debt load more manageable. I would expect that they will bring down the debt even further as the year progresses.

The share offering increases the share count to 28,040,000 shares outstanding. That puts the current market capitalization at $19.6M and the current enterprise value at $28.5M.

The company generated $2.2M of earnings (11 cents per share) in Q3 off of $10M of revenue.

The company guided Q4 revenue at over $11M back at the beginning of January.

The company guided Q4 revenue at over $11M back at the beginning of January.

Leader Energy Services Ltd. (“Leader” or the “Company”) today announced that it expects revenue for the fourth quarter ending December 31, 2011 to exceed $11.0 million, an increase of approximately 25% over the comparable quarter last year and approximately 10% higher than the third quarter of 2011.

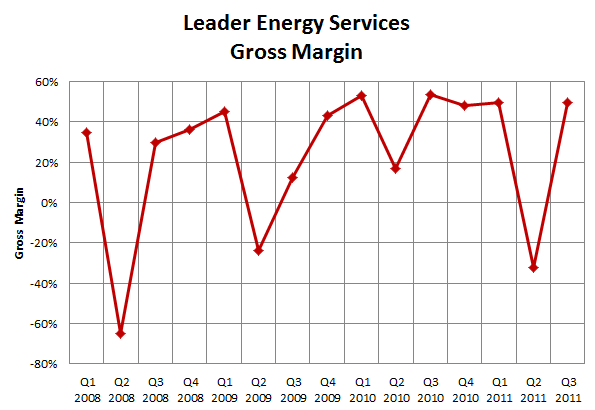

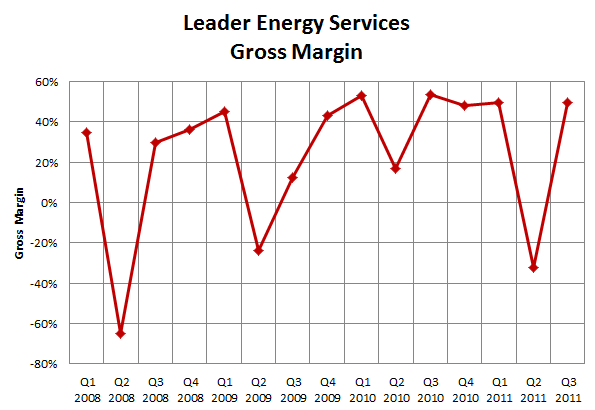

Leader has consistently shown that they can achieve gross margins of around 50% for the 3 quarters that aren’t spring break-up (in Q2 every year the ground gets very wet in Alberta and Saskatchewan and so oil and gas drilling activity comes to a halt. This causes Leader’s earnings to have a somewhat seasonal aspect to them, with a yearly dip in Q2).

From the company’s revenue guidance and the expectation of 50% gross margin it is easy to predict earnings of around $2.7M for the fourth quarter. Using the new fully diluted share number this is about 10 cents per share. This doesn’t include the 750K, or 2.5 cents per share, of savings the company will derive from reduced interest costs every year due to the debt pay down.

If I extrapolate earnings for a full year, the company has, on average, lost $2.6M during Q2 because of the spring break-up. If you assume $2.5M of earnings for the other 3 quarters and add back the $750K of interest savings you get full year earnings of around $5.65M or 20 cents a share.

The company said that they plan capital expenditures for the full year of $4.5M If I look at the cash flow that the company would generate, adding back amortization expense of $2.4M, the company should be able to generate about $8M in cash flow, or enough to pay down debt by another $3.5M.

So there you have it. That’s why I remain a holder of the shares of Leader Energy Services. It seems like the company is going in the right direction by paying down debt and at the current price I am getting the shares at the same price as the offering. If my expectation that the company can generate $8M of cash flow this year, then they have a debt to cash flow ratio of just a little over 1 and that will come down further as more cash is used to pay down more debt. Couple that with the fact that they are trading at under 4x what I expect them to earn for the year, and with no slowdown to oil drilling activity in sight, and I conclude that the stock looks cheap. Its an illiquid stock, so I don’t want to own too much of it, but the valuation makes it compelling to own a piece.