Week 258: In Search of the Next Big Thing

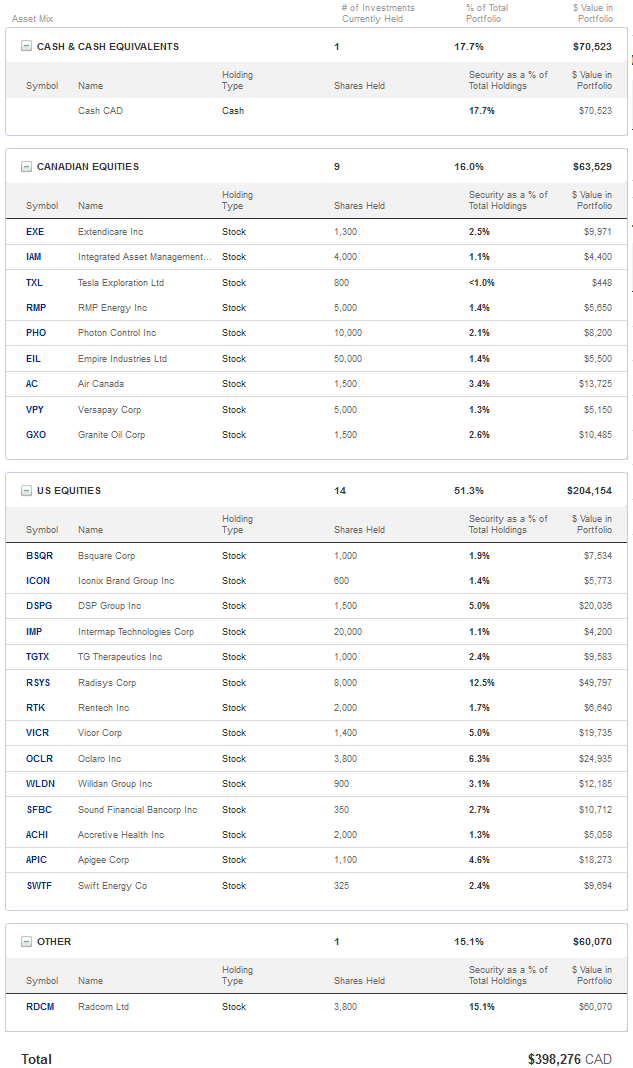

Portfolio Performance

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

I’m wrapping up the fifth year of the blog and portfolio I track here. Unfortunately it was my worst year since inception. With about a week to go I’ve eked out a miserly 3% gain.

In my last few posts I touched on what I think I’ve been doing wrong. My observation is that I am spending too much time looking for value and not enough time looking for growth and finding major trends underway.

To put that in context, let’s look back at the last number of years for a minute.

I did well in 2009 and 2010 as I bought stocks that benefited from the infrastructure build-out in China, in particular a number commodity producers, mostly copper/nickel (FNX, Hudbay, Quadra) and met coal (Western Canadian Coal and Grande Cache Coal).

In 2011 I extended that thesis into pulp stocks, with wins from Mercer International and Tembec. In 2011 I also made a few bets on gold stocks that paid off.

In 2012 I stuck with gold and began to see opportunities in small community banks that were recovering but where the market had yet to acknowledge this. I also saw a slowly recovering housing market, and made successful bets on mortgage servicing stocks like Nationstar, which was a recent IPO, originators like Impac Mortgage, and hated mortgage insurers like MGIC and Radian.

In 2013 I continued the theme of a recovering housing market, with my mortgage insurer bets continuing to pay off, added more underappreciated community banks, and bet on a number of oil and gas opportunities that were taking advantage of the new fracking revolution. I also correctly discerned that the market would take a more favorable attitude to debt, and so I made some of my biggest gains with stocks with debt, particularly YRC Worldwide, which rose from $6 to $36.

In 2014 my biggest gains were thanks to the ethanol stocks, in particular to Pacific Ethanol, which rose from $4 to $24. I also did quite well playing the cyclical turn in airline stocks, particularly Air Canada and Aercap.

And how about 2015? What led to my less than remarkable results?

For one I think that I spent too much time following tanker stocks. While these stocks were cheap, they couldn’t and can’t shake their cyclical stigma. Looking at the ships being delivered later this year and into 2017, maybe that is for good reason.

I focused too much on companies that were only marginally undervalued or where there was no real catalyst at hand to improve valuation. In particular, I wasted far too much time on REITs, both simple single asset REITs like Independence Realty and Sotherly Hotels, and more complicated multi-asset REITs like Ellington Financial, Northstar Realty and even New Residential. I remember Brent Barber commenting to me at one point to be careful with REITs in the environment we were entering into, and I should have heeded that call.

I also spent too much time trying to justify the airlines. As a whole the group is captive to their own history of pitiful returns. One day multiple expansion may come, but holding too many of these stocks in anticipation of that day is not a good use of capital.

And finally, and more generally, I didn’t have a big theme or trend that worked for me. There was no China infrastructure, pulp stocks, mortgage servicing, community bank or ethanol idea that I could ride.

For the upcoming portfolio year (beginning July 1st) I am going to focus on finding trends and growth. The one I have latched onto so far is the move of telecom service providers to software defined networks and network function virtualization, and more generally, the continued move by businesses to locate resources to the cloud.

So far I have made the bet with Radcom, Radisys Vicor, Oclaro and Apigee. Each of these is bearing or at least starting to bear fruit. Unfortunately I also came extremely close to taking a position in Gigamon, a company I really like, but instead waited for it to slips into the mid $20’s. It never did and now its $37+.

While I made a couple of endeavors into bio-tech stocks last year and for the most part got taken to the cleaners on those, I’m not giving up on this sector yet. I have been prepared to lose a few dollars under the agency of education and I am slowing learning more. I have a few more words about TG Therapeutics below.

Overall I really like the stocks that I own right now. While the risk of what I own remains high as always, I also haven’t felt like I have had so many potential multi-baggers in some time.

I’ve been talking about some of the above mentioned names in the past few posts. Below I am going to highlight a few others: a new position in RMG Networks, a position revisited in TG Therapeutics and some more information about Radisys. Lastly I’ll review Intermap, which is more of a crap-shoot than the other names I own, but if the cards align it most certainly is a multibagger.

As for stocks I haven’t talked about in a while but will have to review in a later post, Swift Energy is treading water in the grey market and the warrants I received post bankruptcy don’t even trade, but I remain optimistic that when the stock gets to a big board it will go significantly higher. While I remain wary of the Iconix debt load a few astute moves by management and the stock will trade at a more reasonable free cash flow level. And Accretive Health, a very small position that trades on the pink sheets, is struggling through its transition but will soon begin to on-board patients via its long term agreement to manage services for Ascension, the largest non-profit health system in the United States.

It was a tough year but I feel good about the future. Hopefully its a year that I have learned a little from, and that will set me up for a better one to come.

RMG Networks

RMG Networks provides what is called “digital signage” solutions. They provide the hardware, content, content management system, and maintenance of the product. The easiest way to understand “digital signage” is to see a couple of examples:

This is a small company with 37 million shares outstanding and about a $37 million market capitalization at the current share price. Yet even though the company is tiny, they do business with 70% of the Fortune 500 companies.

This is a small company with 37 million shares outstanding and about a $37 million market capitalization at the current share price. Yet even though the company is tiny, they do business with 70% of the Fortune 500 companies.

I came across the idea from a hedge fund letter I read by Dane Capital. At first I wasn’t very excited about the idea; it seemed like a turnaround story with a struggling business, something I have been trying to stay away from. It was really this quote from Robert Michelson, CEO, that led me to persist in my investigation:

I joined the company and was incentivized by two things. One, was on the company’s position in a really interesting growth industry, and two, my ability to make a lot of money and not salary bonus, but through equity. And you know, for me — I guess everyone wants to make a lot of money but I want to be able to make millions and millions of dollars. And you know I certainly go back and do the math and say, “you know, to get where I want to get to and it’s not just me — obviously, I’m doing this for the stockholders — this company needs to be significantly larger.” And I didn’t come to a company that was grow at like you 5% or 10% per year. You know, if you take a look at public companies, they get higher multiples when their growth is 20% plus.

The other thing that made it interesting to me is its size. I already mentioned that RMG Networks has a miniscule market capitalization. The company generated about $40 million of revenue in the trailing twelve months. That means that relatively small amounts of new business are going to have an out sized impact on growth. I will outline the growth strategy below.

The turnaround story at RMG began in 2014 when Michelson was brought in. He proceeded to cut what was a fledgling international expansion, reduce the sales staff and bring back R&D spending to a more sustainable level. We’re just on the cusp of seeing the fruits of that turnaround.

While the graphic I posted above shows five distinct end verticals the company has only made significant penetration into the contact center market.

This, in part, is where the opportunity lies. Michelson is trying to address new markets. His focus is the supply chain vertical and internal communications.

RMG’s supply chain solution provides real time data to distribution centers and warehouses. Think about big screens in warehouses providing information about shipments, and performance metrics of teams. The company currently sees a $10 million pipeline and has been seeing progress with leads with 40 prospects. In the last few months they moved ahead with pilot programs with five of those leads. RMG is targeting $5 billion companies with 80+ distribution centers and they expect to generate $1 million of revenue from each pilot if closed.

As for internal communications, RMG has a solution that delivers the existing content and management system but directly to employee desktop computers, mobile devices or to small screens around the office.

Internal communications is a $2 billion market. The company has had advanced discussions with large customers to roll out their solution across their enterprise.

Maintenance revenue has been a headwind over the past two years, falling from over $4 million per quarter in 2014 to $3.4 million in the last quarter, but should stabilize going forward. There have been two factors reducing maintenance revenue. First has been the election to end-of-life older equipment that has componentry no longer supported by manufacturers. Second, the new products being introduced can have a list price 40-50% less than their predecessors that were purchased 8 years ago and because the company charges maintenance as a percentage of sales, this has led to a reduction in maintenance revenue. Both factors should begin to abate going forward.

Since Michelson started with the company a focus on sales productivity has led to an improvement in lead generation and new pilots. Sales productivity was up 50% year over year in the first quarter as measured by sales orders per sales representative. Michelson describes management as having “a relentless pursuit on costs” which is validated by the decline in general and administrative costs from the $5 million level in early 2014 when Michelsen took over to around the $3 million level and a decline in overall operating costs from $11 million per quarter to $5.6 million per quarter.

With the focus on the new verticals and improve productivity of the sale force new opportunities in pipeline are up over 40%. And here is where we start to see an inkling that the strategic shift is bearing fruit. In the sales pipeline, Michelsen said that the number of deals $100,000 or greater has increased by 50% in the last year while the number of $1 million deals have tripled.

My hope is that these early signs of sales improvements lead to an uptick in revenues in short order.

The stock is reasonably priced given the potential upside and it will only take a few good sized contracts to move the needle substantially. I can see this one becoming a bigger position over time if they continue to execute along the current path.

Wading Cautiously back into a Biotech – TG Therapeutics

Here are a couple of thoughts on Biotechs that have begun to crystallize for me. I just finished reading a book called “Cracking the Code” and have started reading another called “The Billion Dollar Molecule”. Please let me know if you have any recommendations for other good books or articles to help me with the sector.

While I am still a newbie in the bio-tech world, I am starting to understand a few things about the business. I would distill the most important of my thoughts into the following three points:

- Approval/non-approval of any drug and the subsequent market for it is under SIGNIFICANT room for interpretation. Apart from a few obvious blockbusters that get snapped up by the large pharmas well in advance, there is a lot of uncertainty about what will work and what won’t and if it does work what kind of sales it will generate

- There is a big difference between the value of a company in Phase II or II trial that will eventually have to ramp up its own sales and marketing of the drug versus what that drug would be worth rolled into a larger entity that already has the salesforce, marketing engine and infrastructure in place.

- Biotechs in Phase 1-3 are event driven, open to interpretation, and their share price is as dependent on the capital markets as it is on the state of their particular research. In this respect they have a lot of similarities to gold exploration companies.

With those points said, and being fully aware of what remains to be limited knowledge in this sector, as I wrote about last month I did purchase, or re-purchase, a biotech position this month. I have been buying shares in TG Therapeutics.

The story at TG Therapeutics is the same one I wrote about a few months ago. But that thesis has moved forward in some ways.

TG Therapeutics has two drugs that are in late stage trials for B-cell cancers. The first, TG-1101, is what is called a CD20 monoclonal antibody. To dissect what that means, an antibody is a protein designed to attack a pathogen, monoclonal means it is an antibody that latches on to one particular cell type, and in the case of TG-1101, the cell that is latched onto is a B cell, the latching achieved by way of a protein called CD20, which is expressed on the surface of B-cells. Once TG-1101 grabs onto the CD20 receptor it works eventually to destroy the cell.

The second drug that is in the pipeline is called TG1202, which is a PI3K-delta inhibitor. An inhibitor blocks a particular pathway (a pathway is a series of action by which a cell changes or creates something), in this case the pathway is called the 3-kinase pathway. The 3-kinase pathway is one of the most activated pathways in human cancers. So the theory is that if it can be blocked, cancer development will be stunted.

TG-1101 is in Phase 3 trial in combination with an already approved drug called Ibrutinib, which goes by the trade name Imbruvica, and is owned by Abbvie. Ibrutinib inhibits another receptor on the B-cell called Bruton’s tyrosine kinase. Abbvie bought Imbruvica for $21 billion in 2014. Ibruvica has been approved and has shown strong sales; it generated $1.3 billion in sales in 2015 and estimates are that sales could peak at as much as $12 billion. TG-1101 is expected to improve both the efficacy and safety profile of Ibrutinib when used in combination and so far the results are bearing that out.

A second Phase 3 trial has TG-1101 and TGR-1202 working together. TGR-1202 is also in a stand-alone trial. In the stand-alone trial efficacy rates of TGR-1202 are tracking at slightly better than Ibrutinib monotherapy. In combination, efficacy is even better.

One of the concerns that I believe has hit the stock is because of results that have recently been released for two other PI3Kdelta drugs in development. Duvelisib (owned by Infinity Pharmaceuticals) and Zydelig (owned by Gilead), have run into issues with efficacy. The market could be looking at this that the read through to TGTX drug is that it is a PI3K inhibitor so in same class as these drugs and so maybe concerns spill over

Everything I have read suggests that Duvelisib and Zydelig had very similar structures whereas TGR-1202 does not. More importantly, so far TGR-1202 is showing a good toxicity profile (meaning manageable side effects). So I think we could see the current read through go in opposite direction as the data is digested.

This Barrons article quotes Wedbush as saying that the Zydelig problems have a negative read through for Duvelisib:

Zydelig safety issues raise red flags for duvelisib program. Given their structural similarities and similar mechanism of action, we believe the new Zydelig-related safety concerns provide a negative read-through for Infinity Pharmaceuticals’ ( INFI ) duvelisib program. Zydelig and duvelisib are both inhibitors of PI3K, a family of enzymes that regulate a variety of cell signaling processes, with Zydelig inhibiting just the delta isoform while duvelisib inhibits both the delta and gamma isoforms. A comparison across clinical studies suggests that duvelisib has a poorer safety profile compared to idelalisib, which we attribute to the potentially immune-weakening effect of PI3K-gamma inhibition.

Zydelig, before the recent issues, was approved and brought in $130 million in sales last year. I saw estimates that Zydelig could reach peak sales of $1.2 billion by 2020. If TGR-1202 can continue to show a better safety profile, presumably it should be able to take

The differentiation of TGR-1202 the other PI3Kdelta drugs was addressed by TG Therapeutics in a recent press release:

The integrated analysis, which includes 165 patients treated with TGR-1202 alone or in combination with TG-1101, demonstrates that the toxicities observed with other PI3K delta inhibitors such as liver toxicity, colitis, pneumonitis and infection are rare with TGR-1202 with discontinuations due to TGR-1202 related AEs occurring in less than 8% of patients. We see this as particularly compelling given the recent setbacks for idelalisib with the closure of a series of randomized studies due to safety concerns. The data presented today provides strong evidence to support the hypothesis that the adverse events seen with idelalisib are not necessarily a class effect.”

TG Therapeutics has about 55 million shares outstanding. At the current price the market capitalization is about $380 million. They have $85 million of cash on the balance sheet which should be good for a couple years of cash burn.

Success in the TG-1101 trial will give them a complimentary drug to the widely used Ibrutinib that can be prescribed alongside it. Success in the combination trial will give the company a “platform” of two drugs from which others can be layered in order to attack the cancer from multiple angles and deliver the knock-out punch. There are a couple of drugs addressing other mechanisms of attack of B-cells in earlier stages in the pipeline. And there are investigations ongoing into whether TG-1101 can be used in the treatment of Multiple Sclerosis.

Radisys – Comments on the B Riley Conference

For some reason I get a lot of emails about Radcom and absolutely none about Radisys. I don’t know why? I would be hard pressed to call Radcom the better investment of the two. Maybe there is more upside to Radcom, particularly if they can evolve their product into something that could be used in a larger market (ie. Data center or security) but in terms of product and sales performance, not to mention stock performance, Radisys is the clear winner so far.

Radisys presented a very bullish call at the B Riley conference. It isn’t coincidence that the stock moved up from $4.20 to $5 in the subsequent days.

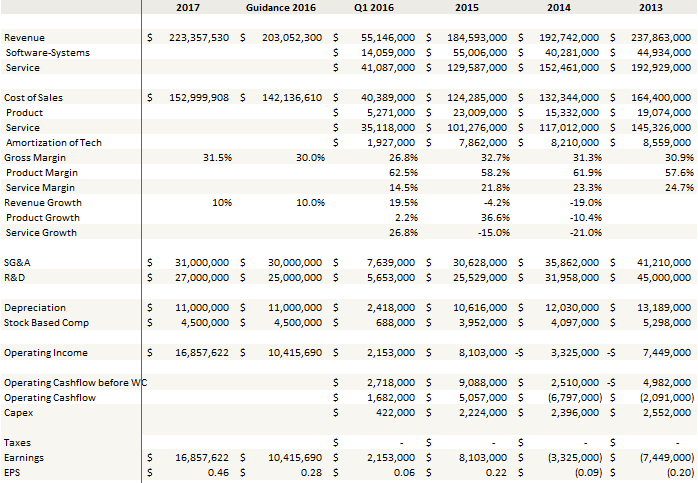

To recap the story, Radisys is growing off of three products. FlowEngine, MediaEngine and DCEngine.

FlowEngine is a software defined network (SDN) friendly load balancer; basically a packet forwarding box. It already has a Tier 1 customer (Verizon) that uses it to triage packets in their network. FlowEngine had no revenues in 2014, had $5 million in 2015 and is expected to double revenue in 2016.

At the B Riley conference Radisys CEO Brian Bronson said it’s a $100 million business in the long term. Towards the end of the Q&A Bronson pointed out a specific deal in India where they were competing against incumbent equipment manufacturers that were delivering similar functionality in a more traditional appliance for $750,000, while FlowEngine could provide the same for $250,000.

MediaEngine manages and manipulates media, is used in the conference space (I believe Mitel is a customer) as well as in VoLTE and transcoding. It’s the biggest revenue driver of the software and systems segment, had about $50 million in revenue last year, and while further growth is expected, it will not be the driver of growth going forward.

DCEngine is a rack solution for telecom datacenters. As they upgrade service providers are migrating equipment to a data center environment, replacing the central office that they operate in today. The DCEngine rack is half as expensive as the competition. Bronson outlined that their advantage with DCEngine is that they are not the incumbent equipment provider, which stands to lose revenue and margins by replacing their fully populated custom solution with a rack populated with 3rd party equipment.

Because most of the rack is populated by third-party equipment, DCEngine is a low margin business, pulling in 15-20% gross margins though it does deliver 10% operating income. More importantly it will begin to pull through FlowEngine sales beginning in the second half of this year, as there will be as many as two FlowEngine appliances installed per rack, depending on the application. Bronson suggested that at some point it could pull through MediaEngine sales as well but that is the first I have heard of that so I don’t know what sort of volumes we are talking here. Finally, selling the rack makes Radisys the natural player for profesional services (ie. installation, integration and maintenance) which on a gross margin basis are only about 20-30% but most of that drops to bottom line.

I gave my model for Radisys in the last update. What I have learned in the last month only strengthens my belief that I am likely going to be conservative on my revenue growth forecast.

Intermap Gambling

I had a friend go to the Intermap AGM, and some questions he subsequently asked about the company got me to review my research on the name.

I’ll review the details again but first the conclusion. Same as what I concluded originally, this is a coin flip with a large potential upside if things pan out, and an absolute zero if they don’t. I still feel the odds are favorable given the reward but only for a small “option” position type that I have reconciled to losing in its entirety.

Let’s review. The story is that of an Spatial Data Integration contract, or SDI. An SDI encompasses data acquisition, which in Intermap’s case entails crisscrossing a jet over the country collecting IFSAR data, and data integration, which includes bringing the mapping data into Intermap’s Orion platform, integrating it with existing data (both geospatial, think LIDAR, and other layer information that can be tied to a GIS location), and building queries to automate searches and perform analytics on the data.

The SDI that Intermap has won is with the Congo. Intermap is not dealing directly with the Congo. They are dealing with a prime contractor, of which the rumor is a company called AirMap. The purpose of a prime contractor is to provide the local contact and regional expertise, and to arrange project financing.

The project financing is what everyone is holding their breath on. You do project financing on a big contract like this SDI to help address the mismatch between project costs and funding timeline by the government. It basically is put in place to insure that Intermap gets paid on time and has the cash flow to keep executing on the deal.

The project financing was supposed to be completed within 90 days of some date in February. This would have put the deadline at the end of June at the latest. On the first quarter conference call management implied that there could be an extension, but that the expectation was, by way of the prime contractor, that the financing would close by the end of the quarter. Management said that financing discussions had moved away from financial details and were now focused on operational details, which presumably is to say things are progressing.

Intermap has 120 million shares fully diluted, so about a $20 million market capitalization. They have $21 million of debt, mostly payable to a company called Vertex One. The relationship with Vertex One is another wrinkle. Here is Vertex One’s position in Intemap:

- They owned 19.8mm shares in June 2015 (from here) and have subsequently reduced by 4.1mm (from this Sedar Filing)

- 7 million warrants at 7.5c (from Gomes and from Vertex One filing)

- They have a 17.5% overriding royalty on revenue

- Hold $21 million of debt as already mentioned

The question is, given the distributed position, what is in Vertex One’s best interests? I remain of the position that as long as the SDI is in play, Vertex One interests are best held by keeping their hand. The equity upside is at least $1, the royalty will skim off the top, and they will collect on the debt through cash flow repayments.

But if the SDI is lost the relationship with Vertex likely means game over for Intermap in their current form. Interest payments will overwhelm cash flow generated from data sales and InsitePro.

Its worth noting that InsitePro is a product sold to the insurance industry to help them identify insurance risks such as flood plains. While InsitePro is an interesting little product, and management has noted that the addressable market is upwards of $500 million with a similar competitor product from CoreLogic currently running at $50 million annual sales, the company is really all in on the SDI and it is the success or failure of it that will determine Intermap’s fate.

So Intermap is a binary bet worth holding a small slice of if you don’t mind taking a significant risk. I’m ok with it, I still think it makes more sense at this point that the deal closes then doesn’t. But I won’t be shocked if I am wrong.

Extendicare’s Slide

In retrospect Extendicare was probably fully valued when it crossed above $9 into that $9.50 range. But I like the long-term trends in the business which always makes me reluctant to sell a stock like this. With the stock back down to below the $8 level it looks like I am in for another cycle. While I didn’t add any in the tracking portfolio, I did add to the stock in my RRSP.

I can’t be sure what has precipitated the sell off. It could be that the activist is reducing or exiting. The first quarter results were a little light, they are struggling with the Home Health business that they are integrating and margins are coming up a bit short.

I believe they are correct to expand into the home health space. Government is going to try to keep people in their homes as long as possible because its cheaper. While the publicly funded side of the business is always going to be constrained by funding, it does give the company a base from which to build a private business, which they are starting to do.

I think of my wife’s parents, who take care of her mom’s parent in their home in Ontario. They get a nurse every day for an hour that is publicly funded but even with that help its becoming too much. One option is to start paying a nurse to stay longer, or come a second time later in the day, out of pocket. Its those kind of needs that Extendicare can serve.

What I learned about listening to Oil Bears

Its pretty interesting to look back at what has been said about the oil market on twitter over the past 6 months. From January to March there was a decidedly negative bent on oil market tweets. Many of these tweets were made by users with a large follower base, which presumed a degree of authority to their comments. I actually made a list of these tweets at the time, because I really wondered whether the market was as dramatically out of balance as was being suggested.

I’m not going to call out names, but it just reiterates that twitter has to be taken with a grain of salt.

I mostly sold out of my position in Clayton Williams Energy and Surge Energy. I hold a few shares in one account but am out of these stocks in the practice portfolio. I’ve replaced the position with another name that feels a bit safer with oil at these levels, an old favorite of mine called RMP Energy. I continue to hold Granite Oil.

What I sold

I sold out of Health Insurance Innovations after the announcement of the proposed ruling by the Health and Human Services department to limit short term medical plans to three months and not allow renewals. This is their whole business model, and if it goes I don’t know what happens to the company. I also noticed that I have been seeing complaints about the company’s call centers aggressive sales tactics pop up, which is worrisome.

I also sold out of Oban Mining, which has been another gold stock winner for me, more than doubling since the beginning of the year. I just don’t want to overstay my welcome here.

Also note that I did take a position in BSquare, which I will write up in the next post.

Portfolio Composition

Click here for the last four weeks of trades.