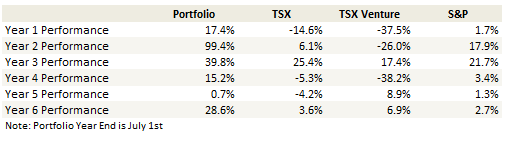

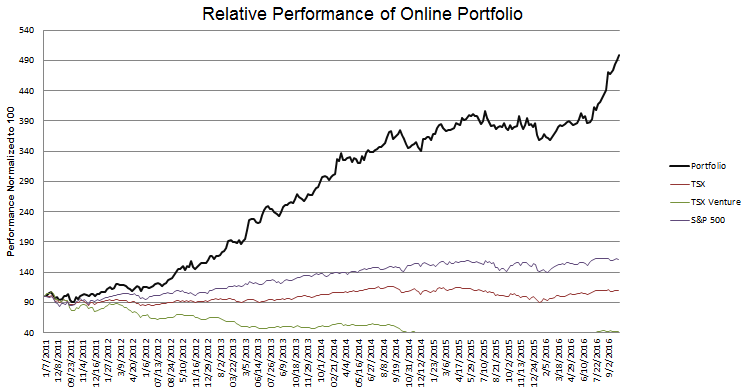

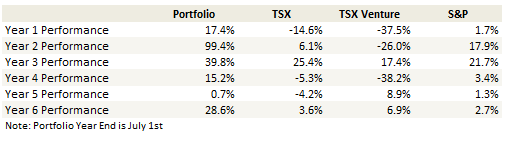

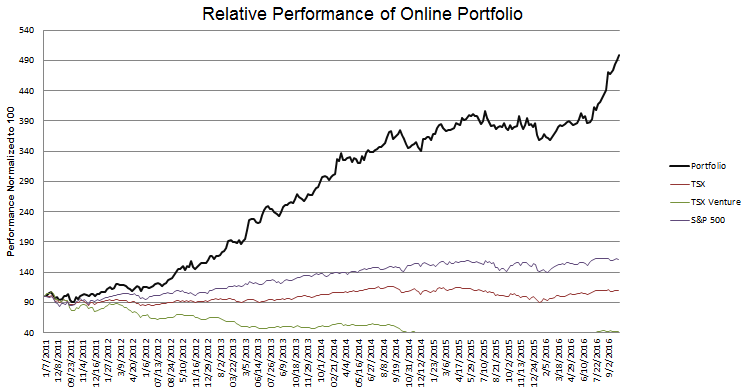

Portfolio Performance

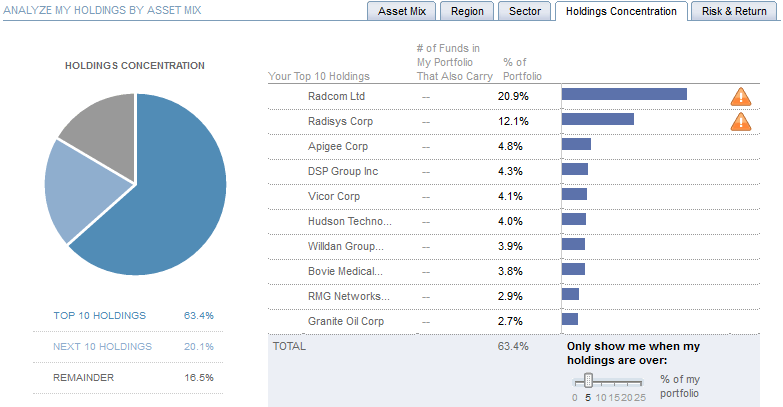

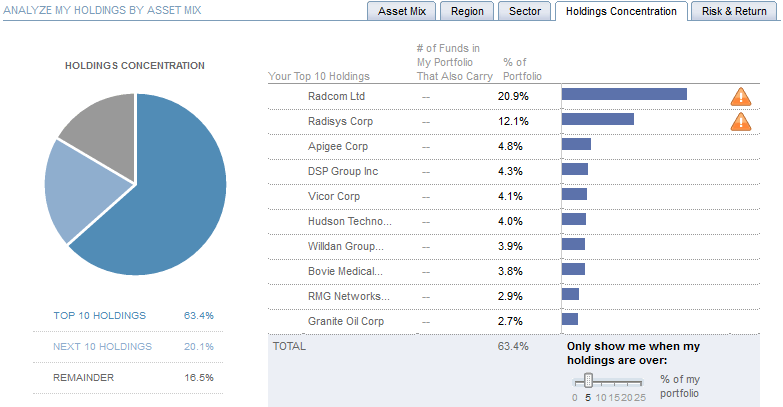

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

Since March I have been focused on finding companies with growing top line revenue. I have put less emphasis on EBITDA, earnings and cash flow. As long as the company is showing growth I’ve been taking a closer look.

This change in strategy has worked. The market has pushed up the price of stocks with growth prospects, while value stocks, at least the small and microcaps I follow, continue to lag.

But I wouldn’t reclassify myself as a growth or momentum investor just yet. Once it stops working, I’ll reevaluate, try to figure out what is working next. I try not to have any allegiance to any particular investing methodology. I’m just trying to figure out what is working and will take that approach whatever it is.

What remains constant is my process. Small positions. Add as they rise and announce positive developments. Reduce if they fall even if I don’t always understand the reasons.

When things are working at their best this process feels like a manufacturing conveyor of idea generation. I keep working hard, the ideas keep coming, when an idea doesn’t pan out I throw it away and move on to the next one.

This is the experience of the last few months. My portfolio gains have been anchored by my two large positions, Radcom and Radisys, but I have been churning out gains from the numerous small positions I have taken on. As is my method, I have been adding to these positions as they go up. When a position moves against me, I don’t add and will throw it out if it simply isn’t working.

Last month I wrote:

I have noticed a change in temperament in the subsequent months, and this seemed particularly evident through the second quarter earnings season. I still had misses. BSquare had miserable results. CUI Global was lackluster. Both stocks fell. But even then, the moves down didn’t have quite the same conviction as similar such moves in the past year.

Its hard for me to put my finger on exactly what it was that was different, so maybe this is all just sophistry, but it was almost like these stocks were going down grudgingly, because they had to, not because they wanted to.

It still feels this way, though I sense some early signs of headwinds. But the path of least resistance, at least for most of the stocks I own, seems to be up. I’ll continue to hold on until there is more evidence that the ride is about to end.

Apart from Radcom, the biotechs and the oils have been working particularly well. It seems like the biotech stocks have turned the corner. I took positions in a number of new biotech names: Aequus Pharmaceuticals and Novabay Pharmaceuticals, which I have written about below, as well as Supernus Pharmaceuticals, Verastem and Aeterna Zentaris, which I ran out of time to write about and are all pretty small starter positions anyways. You will note though that Supernus Pharmaceuticals is a derivative play of Aequus, as the rights of two of the drugs being marketed by Aequus in Canada are being licensed from Supernus, for whom they are growing significantly in the United States.

Oil Gains

I timed the oil stocks well. As I wrote about last month, I have positions in Jones Energy, Zargon Oil and Gas, Granite Oil, Journey Energy, Gastar Exploration, and Resolute Energy.

However, as I alluded to last month I haven’t had a ton of conviction in the price of oil over the last couple of months. I wrote:

I don’t have a crystal ball on oil. I am sympathetic that the builds we have seen (up until this week’s rather massive 14mmbbl draw) are due to the drainage of floating storage. I’m hopeful that once this runs its course we could see some surprising draws in the shoulder season (this thesis has been expressed by a number of investors on InvestorVillage, not the least being Robry825, who describes his position here and here). I’m also cognizant that oil wells do decline and that we simply aren’t drilling like we were a few years ago. Still, as I’ve said on many occasions before, I play the trend till it ends but when it ends I really don’t know.

Here is where it’s helpful to have knowledgeable folks to follow. I mentioned Robry and his extremely bullish outlook in my quote above. There is another poster on InvestorVillage named Sophocles. I’ve known and followed him for a long time. He isn’t always right, but he has an intuitive sense for a commodity bottom well before the data has changed or the experts are revising their forecasts upwards.

He has been steadfast in his opinion about the uptrend for oil prices over the last number of months.

Leaning on the calls of Robry, Sophocles and a few others has helped me hold my oil positions through what was a great deal of uncertainty in September. I doubt I would have do so otherwise. I would have been shaken out by the negative Goldman note, a couple of the precipitous two or three day drops, or after the price reacted negatively to what should have been extremely bullish storage numbers.

But here we are at $50 and one thing I have learned is to not second guess where you are going simply because the data hasn’t caught up with the price. In a real bull market price leads data, and you will never know the why until its too late.

With that said, I thought this IV post was a very good summary of the fundamental oil balance heading into next year.

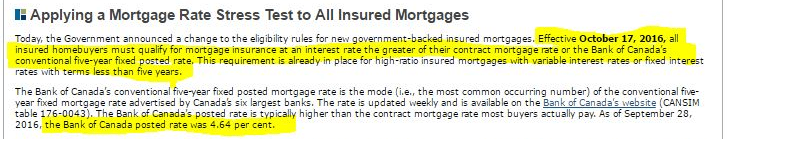

Shorts and Mortgages

The Canadian government laid out the ingredients for a pretty good shorting opportunity this week when they introduced new rules for insured mortgages. There is no question that these rules will have an impact on the housing market. There is a lot of uncertainty about the degree. I suspect it’s going to have a pretty big impact, especially if some of the comments below on declines in transaction volumes come to pass.

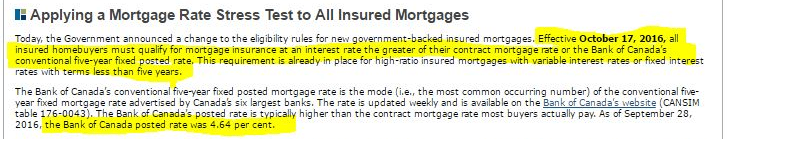

There are two major changes. First there has been a reduction in borrowing limits for anyone applying for an insured mortgage with a 5 year fixed rate. They will be subject to a much higher interest rate than before:

James Laird from Ratehub.ca calculated the following impact of the rule change on a typical borrower:

Rob Mclister (from the blog CanadianMortgageTrends.com) made a similar observation in this clip, saying that an individual with a $50,000 salary, 10% down, prior to the rule changes could take a $300,000 mortgage, now that has been reduced to $240,000.

Mclister went on to point out that about one third of buyers are first time buyers and at least one third of those would have trouble qualifying for a mortgage with the new rules.

The other change, which applies more specifically to the non-bank lenders, is that a number of mortgage products that were previously eligible for bulk insurance are no longer eligible. Mclister lists refinances, amortization over 25 years, rental properties, and mortgages over $1 million as being subject to the rule change.

Non-bank lenders don’t have a deposit base for funding. They therefore require securitization to fund new originations. In order to securitize the mortgages they need to be insured. So without insurance non-bank lenders basically have to stop originating these products.

Its not wonder that, as Sherry Cooper said on Thursday, “alternative lenders and mortgage brokers…have suspended activities” in some lines of business and that “the part of business that is no longer insurable can no longer be done by these lenders – they get their funds by insuring mortgages and securitizing – they can’t securitize if they can’t insure”.

Mclister said that “non-bank lenders are going to have heck of time trying to dispose of these mortgages, nonbank lenders are going to have to go to banks to buy mortgages, they are going to jack up financing costs unless regulators level the playing field

Dan Eisner, of True North mortgage, was quoted as saying “many of their funding sources have announced substantial changes or are telling them substantial changes are coming.”

Earlier in the week Eisner was on BNN where he made the rather chilling prediction that transactions would decline by 40-50% across the country.

The final clip I will point out is from the Moneytalks radio show this last Saturday (October 8th, 9am about 40 minutes in). The show has a weekly segment with a real estate expert named Ozzie Jurock. I have been listening to Jurock for a long time, years, and I have never heard him speak so negatively about the outlook for Canadian housing. He has typically been very upbeat and optimistic (which, incidentally, has been the correct position for the last number of years). Worth noting is that Jurock singled out the non-bank lenders as being particularly hard hit by these changes.

While the cause is different, there are two things at play here that are eerily reminiscent to the United States a decade ago. First, interest rates have, effectively, jumped suddenly for a number of borrowers (like the adjustable rate mortgages did in 2007). Second, a formerly reliable source of funds (securitization via portfolio insurance) is now no longer available to some lenders.

I’m not an expert on the companies in this area. I don’t know all the details of the loan books of Home Capital, Equitable Group or the insured portfolio of Genworth, to take a few names. But from the simple experience of the United States, I know that when transactions decline and funding sources dry up, house prices fall and the tide for the monolines and originators goes out. How far is the big question.

As I’ve said in the past, I don’t like to talk about my shorts. There are a few reasons for this. For one, I short to hedge and tend to have weaker theses around the individual names. For two, its too much of a negative activity. You run the risk of going offside companies, other investors, who wants the trouble.

But I took a few shorts in the mortgage space this week.

I still own this damn rental property. So I need a good hedge.

Radcom and Radisys

Lots of interesting puzzle pieces with both of these stocks.

There was an interesting announcement out of AT&T and AWS (Amazon Web Services) this week. The two companies agreed to forge “a tighter partnership to develop joint cloud, Internet of Things, and security solutions, targeting enterprises and combining AT&T’s network with the AWS cloud.

I think the big move that we saw in Radcom on Thursday is likely due to this announcement, and the potential implications that exist for Radcom.

There are a few puzzle pieces that revolve around this partnership and Radcom. They don’t all fit together yet, but they are beginning to.

A few of these pieces are centered around Gigamon. You might remember me lamenting about Gigamon in a past letter. It’s a stock I looked at in March, thought it was a great opportunity, but waited for a dip into the mid $20’s that never came.

Well Gigamon announced a few months ago that they would be offering the first visibility solution for AWS. This includes security inspection of traffic and monitoring of resource access and use.

Gigamon is also a supplier of AT&T. This was mentioned at the Gigamon analyst day but some more detail was given by kerryb in the comment section of this SeekingAlpha post:

I have an investment broker friend who introduced Radcom too contact Alex Henderson of Needham about Gigamon since the stock has done so well and asked the relationship with Radcom, Alex told him that Gigamon is not competition and that Gigamon and Radcom are currently working together for interoperability between their software. Gigamon does the monitoring of the data flows for mainly security and parses out the important information and sends the info to the Radcom MaveriQ software/tool which then takes the information and does the service assurance piece. Gigamon can reduce the processing of the Radcom and other tools by 65-75%.

Gigamon talked about how they were encroaching on the traditional probe vendors at their analyst day. I listened to that call a couple of months ago, and made note of what they said because it seemed important:

new battlefront in CSP arena is subscriber costs which is the cost to maintain, upsell, attract subs. To do that you have to understand sub experience. Gigamon has capabilities that can reduce this expense significantly, which is exactly why they are seeing traction in CSP arena. In their visibility platform they have ability to look at traffic across all interfaces 2G, 3G, 4G, Wifi, to be able to recognize subscribers intelligently, the devices that subscribers are coming from, the applications that subscribers are using, and to then take high value subscribers and pair them with the tools that are being used to manage subscriber experience. What this allows service providers to do is to match their tooling capacity to the high value subscriber and not waste the tooling capacity on subscribers who really are not subscribing to new services. So as an example in my family, our plan, the people who use it most are the kids, but the person who pays the bills is me, the CSP needs to be able to discern who the high value subscribers are, whether its my traffic or the kids, and then be able to come back and make sure I have a fantastic experience they can bill me correctly for the services I’m using but more importantly can upsell me on new services they want to introduce. They have to have that intelligence in the infrastructure and that is the solution Gigamon is providing. A lot of this functionality used to be part of the traditional probe of the tooling manufacturer but now is part of their visbility platform and is reducing the number of probes that CSPs that to deploy is shrinking or being eliminated because the subscriber visibility in their infrastructure.

The final puzzle piece is Radcom’s announcement on their second quarter call that they were developing a new product for AT&T. They said this product was “adjacent” to their service assurance implementation and “critical” to making the NFV implementation work.

The scuttle is that the new product provides a security function. On the second quarter call one of the analysts, George Marima, asked whether the product was the “threat intellect” product or something else and what the licensing model was. He was referring to AT&T’s announcement in July of “Threat Intellect”, which is a security offering to enterprises “helping to enable businesses to detect, analyze and address security threats faster and more efficiently than ever before.”

Radcom’s response was that it would follow a license model much like the rest of the MaveriQ suite. But described the model a couple of times to it being an “enterprise” license.

What I wonder is whether Radcom is referring to enterprise in the context of a single license to AT&T or whether this is an enterprise license to the customers of AT&T, specifically those using the threat intellect suite of security solutions that is now likely being integrated as security solution for AWS, see this article for more details on that. While there are still only a few puzzle pieces here, there is enough to speculate about it, and such a leap would be a huge win for a tiny player like Radcom.

On the Radisys front, in this joint paper (hat tip to kerryb again for digging this up) with Intel Radisys describes their DCEngine in some detail. On the last page are the following comment about the Verizon deployment of DCEngine this year:

“The success of the initial 20-rack deployment has led the tier 1 CommSP to continue to deploy DCEngine in multiple locations, with hundreds of petabytes of storage and more than 200 racks being installed by the end of 2016.”

On the first quarter conference call CEO Brian Bronson said the orders from Verizon were for “less than 100 racks”. This was said after the follow-on Verizon order had already been announced so presumably it includes most or all of the orders delivered in the first half of the year.

In the SeekingAlpha comments where this paper was linked to, Mike Arnold added the observation that the average selling price (ASP) of a DCEngine rack is $350,000. I haven’t been able to confirm that number. If it’s true, it suggests around 140 racks were sold to Verizon in the first half.

Either way the conclusion is that there has still been a lot of racks sold to Verizon in the second half. I hoping that this will help lead to an upside surprise when Radisys announces its third quarter results.

Hudson Technologies, R-22, and youtube

I spent one night this month watching youtube videos of air conditioner installers talking about regulatory requirements for refrigerant.

I turned to youtube because I was having a hard time finding information about R-22 conversions. Turns out that air conditioner techs don’t have time to pen a lot of articles. They do however like to talk about their trade on camera and take you through the installation process in detail.

Its interesting stuff. Most interesting is the perception. The reality is that in the US virgin R-22 is being phased out. But there is nothing preventing the use of reclaimed R-22.

However the perception for many of the techs I listened to is closer to “the government doesn’t want us using R-22 so we aren’t going to use it”.

It’s worthwhile to weigh these “boots on the ground” opinions before getting too rosy about just how high R-22 prices are going to go.

It’s also becoming clear that there are more legitimate R-22 alternatives than I originally thought. These are refrigerant blends made by Dupont, Honeywell, Chemours. This video does a good job of stepping through each of the blend alternatives.

Now again, the reality is that these blends tend to compare poorly to R-22. They have lower cooling capacity, require more power, and are more likely to damage equipment like compressors on the unit.

Nevertheless, you can drain your unit of R-22, replace a few valves, recharge the unit with the replacement refrigerant, and you are good to go. Add to that the previously noted perception that the government just doesn’t want you to use R-22, and you probably have more conversions, whether it’s the right thing to do or not.

There is also quite a bit of talk, both in the videos and on some message boards about the price of R-22 rising. The rising price is a further incentive to switch. It might not be the right decision, in terms of insuring the best performance and longest life for your unit, but I think its likely getting done more and more as R-22 prices go up.

This video provided some thoughtful insights about the pros and cons of alternatives.

This has made me a little more cautious about my outlook for Hudson Technologies. Not enough to sell just yet. I still don’t think the stock is pricing in the current $15 R-22 price and I also don’t think its reflecting the new contract with the department of defense. But the upside isn’t quite as high as I originally had anticipated.

New Position: Aequus Pharmaceuticals

This is a really tiny specialty pharma company based in Canada. Market capitalization is only about $15 million after a recent $2 million capital raise. The CEO participated in that raise to the tune of 800,000 shares.

The company is focusing on the marketing and sales of drugs in Canada. They also have a pipeline of early stage opportunities that revolve around taking existing drugs and repackaging them into a transdermal delivery mechanism.

The company has the Canadian marketing rights for 4 drugs, Tacrolimus XR has been marketed since December 2015, Vistitan has been marketed since May 2016, while Topiramate XR and Oxcarbazipne XR are still awaiting approval from the Canadian Health board.

Let’s start with Tacrolimus. The drug is used as an immunosuppressant in patients receiving organ transplants, most commonly kidneys. Aequus is selling the first generic form of the drug available in Canada. In other countries, generics make up a significant portion of the market. In the UK its 53% while in the US its 40%. Right now Tacrolimus account for $100 million of a total $240 million immunosuppressant market. The long-term goal here is for Aequus to take a market share that is inline with the US and UK.

Vistitan is a prostaglandin. Prostaglandins are created naturally within our body and promote or inhibit all kinds of different effects on bodily tissues. Vistitan contains bimatoprost, which is engineered to increase to fluid flow from the eye, which in turn reduces pressure in the eye. Therefore Vistitan is used in the treated of elevated interocular pressure, or high eye pressure. Its most commonly used in glaucoma. I haven’t been able to get the figure on the Canadian market in 2015, but in 2014 the market for IOP-lowering medication was $140mm and bimatoprost 0.01%, which is a lower dose form of Vistitan that was the only dosage available in Canada, accounted for $42 million of this.

While Topiramate XR and Oxcarbazipne XR are awaiting approval in Canada they have been approved in the United States since 2013 by Supernus. In the US sales of the two drugs are growing and the combined prescription growth was up 39% year over year in the second quarter while sales were up 47% to $50.3mm. Assuming similar results in Canada, it doesn’t seem unreasonable to me that sales could exceed $20 million annually.

Its pretty early to be estimating revenue from these products, but in a recent Midas Letter interview, CEO Doug Janzen said:

You have a $20 million business that expects to do $2 to $3 million in sales this year, closer to $15 next year, peaking that at $40 off of existing products

That estimate doesn’t seem unreasonable to me, and may even be low given the corresponding markets in the United States for each drug.

The final puzzle piece here is the pipeline, which consists of 3 drugs in development. Each of these drugs is already approved and well established. Aequus is developing a new transdermal delivery method for each. Transdermal means that the drug will be administered by path.

For the patch they have entered into a multi-product collaboration with a company called Corium International, which specializes in transdermal manufacturing. The two companies split the costs 50/50.

The three products are still in very early stages. One advantage though of the new drug application for a transdermal version versus an entirely new drug is that costs and time to deliver are significantly reduced, estimated to be $15 million and 4.5 years for a transdermal development versus $500 million and 10+ years for new drug.

It seems like a lot of irons in the fire, and a lot of potential, for a $15 million market capitalization. If the stock dips back below 30c I will probably finish off my position with another add.

New Position: NovaBay Pharmaceuticals

I came across Novabay while scouring through presentations and the Rodham and Renshaw conference. Most of the participants at the conference are early stage drug companies, but Novabay is an exception, having a product in production called Avenova.

Avenova is a really simple product. It consists of a compound called Hypochlorous acid in a saline solution. Hypoclorous acid is a natural compound that is given off by while blood cells to fight viruses. It’s a particularly potent substance and is used in fighting flesh eating disease (for which Novabay provides Avenova for free) and can kill the ebola virus.

A second advantage of Avenova is that it does not create resistance. Unlike antibiotics, Avenova can be prescribed without worries of creating anti-resistant strains of the virus that become harder to manage. This is particularly important in chronic applications like bleptharitis, which I’ll expand on in a minute.

Novabay reminds me a lot of Bovie Pharmaceuticals, which I bought and wrote about back in August. Both are tiny, have a single product driving growth (J-Plasma in Bovie’s case), are seeing really strong growth, and have plenty of room to run.

The two differences are A. Novabay is cheaper than Bovie and B. the potential market for Avenova is bigger than J-Plasma.

Fully diluted including warrants that are close to being in the money, Novabay has 12 million shares outstanding. That gives it a market capitalization of $43 million at $3.60. Bovie has a market capitalization of over $120 million. Novabay is operating at about $10 million of sales run rate. Bovie is at about $20 million, but keep in mind that only about 20% of this is revenue from J-Plasma, the growth engine here.

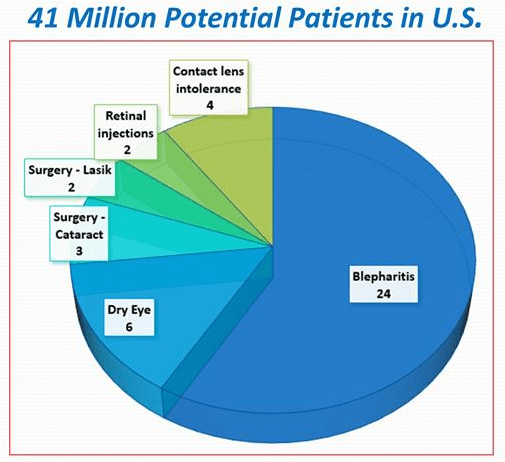

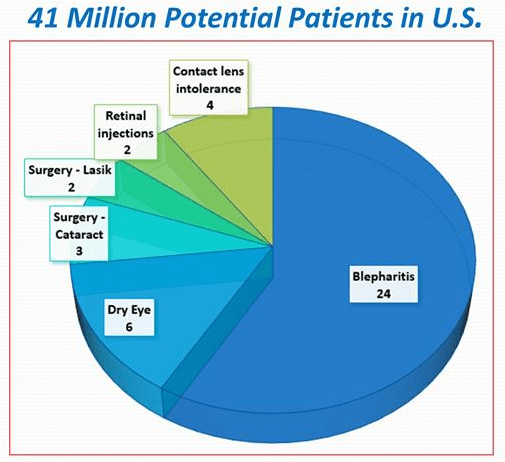

Meanwhile, the potential market for Avenova is really big. Here is a slide from the company’s presentation:

The biggest part of this market is Blepharitis, which is a chronic condition of eyelid inflammation. You can treat it with antibiotics but because it comes back opthamologists don’t like doing that unless it’s a severe case. This article describes the benefits of Avenova:

Blepharitis has become more difficult to manage because of the resistance bacteria build against traditional antibiotics used for this condition. Hypochlorous acid utilizes a different mechanism of kill from traditional antibiotics and may therefore be less likely to promote bacterial resistance.

I read through a number of forums, which while anecdotal, generally pointed to positive patient experiences. The most common complaint I heard was that Avenova is not covered by all insurers. This is simply a fact of the newness of the product.

There is competition. This article describes Blephadex and Ocusoft which are two of the primary competing products. Ocusoft published this report comparing their product with Avenova. I think many of their claims on price comparison have been mitigated by recent insurance approvals.

While there may be some headwinds with competition, its such a big market and the patient experiences appears to be varied enough to support a few different products. Moreover, the company is showing product and revenue growth. Given what remains a fairly low market capitalization, I’m inclined to think the upside justifies the risks.

Portfolio Composition

Click here for the last four weeks of trades.