Nuvectra: New position, didn’t even know it was a spin-off

I don’t go out of my way looking for spin-offs. I read Joel Greenblatt’s book You Can Be a Stock Market Genius years ago, I even did a take-off on the title a few years back, so I understand the value that can be there, but it has seemed like a saturated niche since value investing has gone mainstream.

Maybe the best way to find a spin-off is to unwittingly stumble upon one. That’s what happened to me with Nuvectra. I came up with the idea from a retweeted tweet by @ValuewithaCatalyst pointing to their large cash position and $0 enterprise value.

$NVTR – Not sure what it’s worth, but certainly more than cash… I really like the optionality here: https://t.co/s7IOIq39bw

— ValuewithaCatalyst (@ValuewaCatalyst) January 17, 2017

I looked into the company and found that Nuvectra is indeed trading at cash but that they also are burning through it. The company is in the early stages of a ramp of a new neuro-stimulation therapy, called the Algovita SCS system. They’ve hired a salesforce (headcount of 42 at the end of the third quarter and expected to reach 50 by year end) to begin marketing the product across the United States. They have kept up a decent sized R&D program (run rate of $3.5 million per quarter) and they are only just starting to generate revenues.

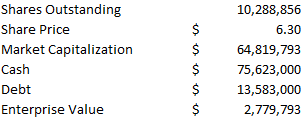

The consequence is they have a fairly significant cash drain of $5-$6 million per quarter. This plays against a market capitalization of around $60 million and an enterprise value that, up until Friday, was close to zero (I’m using the numbers based on my purchase price below because I started this post before the stock moved the last couple of days):

Their Algovita SCS system reduces back pain by stimulating the spinal column with small pulses of electricity. These pulses stimulate the nerves and override the pain sensation, replacing it with a tingling that eventually disappears entirely.

The system consists of a pulse generator, leads that are surgically inserted into the spinal column, and programmable GUI devices for the patient and physician.

There is a good video that describes the procedure in general here.

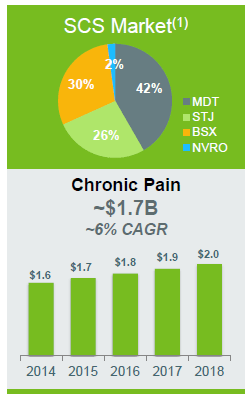

Algovita was approved in late 2015 and began to launch in the US in 2016. So its early in the ramp. Because Algovita is in the early stages, the market is not giving much credit to the product yet. There is also a lot of competition. The incumbent products are made by Boston Scientific, Medtronics and St. Jude, and a more recent newcomer is Nevro. From what I have read, Algovita’s feature set stacks up well against the incumbents but Nevro has a very good product that may or may not be superior to Algovita. Without question this is a very competitive landscape and that is at least partially responsible for the low enterprise value.

At this price, I think its worth seeing how the sales ramp plays out. The company said late last year at the Piper Jaffrey conference that within 12-24 months of the beginning of a sales ramp they expect a sales territories to generate $1-$1.5 million. This works out to 75 trials resulting in 50 permanent implants at $20,000-$25,000 a pop. Thus the expectation from the current hirings should be at least $50 million in annual revenue. The vast majority of their reps were hired in the third quarter and after, so we should start to see their benefit in the upcoming quarters.

The total addressable market (TAM) is fairly big, so reaching $50 million is only taking a sliver of market share away from their competitors (note that SCS stands for spinal cord stimulation):

Algovita revenue was $1.1 million in the third quarter. This was up from $569,000 in the second quarter. The third quarter was the first real quarter with any sales traction in the United States. The company is still mostly in the trial stage with its early adopters. At one of the conferences management said that trial revenues were only a fraction of permanent implants.

There are likely to be bumps in the road. In addition to the newly trained salesforce, Nuvectra is making slow progress to get insurers on-board and work through hospital approvals. The process entails agreements on doing business, payment terms, etc. It takes time. In smaller settings this happens in 1-3 months, while in larger regional systems it can take 3 months to a year.

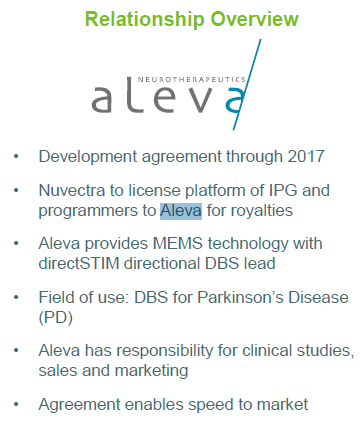

In addition to Algovita the company has a strategic development agreement with Aleva Therapeutics that allows Aleva to market Algovita for use in the direct brain stemp (DBS) market for the treatment of Parkinson’s disease.

DBS is $600 million market today, dominated by Medtronic, Boston Scientific also in market. Nuvectra will receive $6 million in aggregate payment, and recognized $1.1 million in the third quarter related to this. Once in production Nuvectra will receive a royalty, though I actually wasn’t able to find the details on the royalty payment yet.

Finally, Nuvectra has a “world class group of neuroscientists” that they refer to as Neuronexus (interesting website here). This group “creates probes and other neuro-technology for clinical applications and labs around the world.” The company expects sales from Neuronexus, would be around $5 million in 2016. I don’t get the sense that the business will be a huge revenue driver, but their research gives insights into the latest developments in neuro-stimulation.

So there is a lot of innovation, and hopefully some of that innovation translates into revenue growth. Its not a perfect investment case of course, none of my ideas are; there is a cash drain, there is plenty of competition, and there are insurance approval hurdles that could take months. I am prepared for a lumpy ride, and as usual I have kept my position small until I can see sales get more traction.

Nevertheless, if they prove that they can meet their goal of $1-$1.5 million in sales per territory in the next year or two, the stock should trade at a decent multiple to revenue, which is multiples of what its trading at now. And the cash drain will be no more.