Talking about the losers: RUBI, NVTR and BVX

I have a lot of losers.

My investment methodology leads me to take small positions in stocks that I’m not entirely sold on. These are cases where I haven’t had the time to investigate all the details, or maybe I’ve looked at the company closely and while I see a big enough pay off to justify some risk, I’m still not sure about the odds.

Rather than stay away from these stocks, I take small positions and see how they play out. I don’t know why this works for me, but it does.

There are two potential consequences of this strategy.

- The stock goes up. I maybe am not completely sold on the story yet, but I tend to add anyways. With a bigger position I do more work, get some helpful hints from others, gain confidence in the story and have a winner

- The stock goes down. In this case having some skin in the game motivates me to look harder. When I do I generally either find something I really like and break my rule by adding to my position on the drop, or find something I don’t like, take the loss and move on.

I think the classic example of the second scenario playing out positively is my old position in MGIC in 2012. I bought the stock at maybe $2 or $2.50, at the time didn’t really understand the details of their mortgage insurance business (I would argue few did!), especially not how the capital requirements worked. I added a bit on the way down, but more importantly figured out how they allocated reserves and how the dynamics of their statutory balance sheet worked. Thus I knew exactly how important it was when management said on (I think) the second quarter 2012 conference call that they were getting calls from investors interested in raising capital (the company’s issue all along was liquidity), and I was adding stock while the call was still going on.

I never would have learned enough to pick up on this detail had I not already had a position in the stock.

So that is the positive side. The more common result of course is that I find something I don’t like and I sell. Take my lump (usually 10-20%) and move on to another idea. The important thing is to cut them quick if they aren’t panning out.

Somebody once messaged me (derogatorily I might add) that I should just throw darts. I like to think I’m a little more discerning then that, but I get the point. My reply is that this works for me and if you think you can beat the returns I seem to pull of for the time I have to put into the research (I work full time and have two kids), then more power to you.

Here are some thoughts on three losers I’ve had recently.

Rubicon Project

Why spend hours writing a free blog? Well one reason is because as you are writing something up it becomes quite clear if your idea is full of shit.

I started writing up Rubicon Project 2-3 weeks ago. I couldn’t finish it. I put it down, came back to it, did some more research. I just couldn’t figure out what the header bidding disruption meant to their business.

Management said it was manageable. That it would be a headwind to their desktop advertising but that they would get past it. But I read that header bidding was going to compress margins for everyone. That there was more disruption ahead with the adoption of server side heading bidding. It didn’t add up.

The fourth quarter results are out, and while the company actually performed admirably in the quarter, the first quarter guidance was just awful. They guided revenue in Q1 in the $40’s (millions) when analysts had expected it in the $60’s (which was still a notch down from the year before). Thankfully I kept my position small, and reduced a little ahead of earnings because I couldn’t make sense of it. I sold the rest in after hours.

Nuvectra

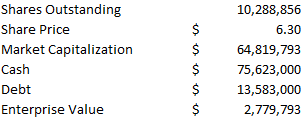

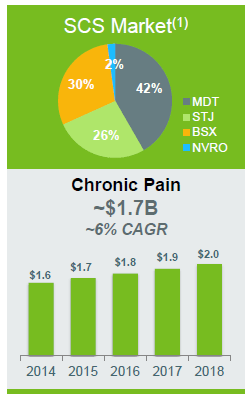

I have to give a hat tip to @Rubicon59 (no relation to Rubicon Project) for helping me suss this one out. I bought Nuvectra because I thought they had a very good technology (spinal cord stimulation with their Algovita system) and a fairly large total addressable market and so with the right sales push they could generate some impressive growth. They had a lot of cash, almost their entire market capitalization. And it was even a legitimate spin-off idea, even had an SA write-up on them.

They still might generate that growth. Probably will. But the cost side of the curve is just so out of whack, it’s hard to see how they do it before running out of cash. Particularly after announcing a fourth quarter, where G&A and R&D costs were (respectively) up from $8 million to $10 million and $3 million to $4 million sequentially.

Just to back of the napkin it, the company generated about $12 million of revenue in 2016. We can say that at least roughly, the Algovita system is going to give them 50% gross margins. R&D and G&A costs added up to $42 million. These costs increased as the year went on.

The company said at the Piper Jaffrey conference last November that they figured a good target for a sales region was $1-$1.5 million in 12-24 months. Right now they have about 50 sales regions. So you assume they hit the high end of that, they can generate $75 million of revenue, and at 50%, $38.5 million of gross margins. Problem is that’s still less than current expenses.

I realize they also generate some component sales, but even so the numbers don’t come close enough. and It seems like anything other than the steepest of ramps and they are going to be looking to raise capital in a couple of quarters. So I’m out.

Bovie Medical

I wrote about Bovie in my last portfolio update. I provided a pretty detailed explanation as to why I thought the concerns over Hologic were likely unfounded and therefore why I took advantage of the drop in the share price.

It was a well researched, well reasoned piece of tunnel vision.

I spent a bunch of time looking at Hologic and trying to confirm or discredit the idea that Hologic was a concern. What I didn’t spend any time is whether the third quarter numbers were goosed by Hologic even though they hadn’t actually sold any devices.

How is that possible? I provided most the information that you needed in my post when I said:

The average selling price (ASP) for a generator is much higher than a hand piece so Bovie generates a significant slice of their revenue from it. From the 2015 fourth quarter conference call :

I guess when you think about it, the generator ASP is north of $20,000, the hand piece ASP is $375

The other relevant piece of information comes from the third quarter call, where Bovie noted that their partners had been purchasing machines for their sales ramp.

So in the [revenue] number our demo product that we armed both Hologic and Arteriocyte sales forces with that is in the number

What never occurred to me (and what I am kicking myself over) was that obviously the third quarter J-Plasma sales were juiced by demo generators. Keep in mind J-Plasma revenue was a little over $1 million in the third quarter. It’s not a big number, it only takes a couple of extra generators to skew it significantly.

Unlike Rubicon and Nuvectra, I reduced my position a bit but did not exit it entirely. Bovie has a lot of positive catalysts on deck in 2017; two new iterations of J-Plasma that will be marketed in the second half, results from a clinical study using J-Plasma that should raise awareness among surgeons, a new partner to replace Hologic (it sounds like they have a number of interested candidates) and a sales ramp from their CONMED partnership for the PlazXact Ablator.

So there is enough reason to continue to hold the stock, especially down here below $3. But I sure wish I would have saw what was in front of my face a little bit sooner.