PHH, Newcastle Investments, and mortgage servicing rights

In my week 29 letter I began to talk the opportunity I was seeing in mortgage origination and servicing.

While an uptick in new home building may still be some time away, mortgage origination should benefit over the next year from the refinancing associated with HARP II and from less competition due to the exodus of originators from the ranks brought on by the dismal market conditions.

Mortgage servicing, meanwhile, has been hurt by falling interest rates (remember that as a servicer you get paid as long as the loan is being paid, so refinancing can hurt your business if you can’t reoriginate the refinancing), by uncertainty in the regulatory environment, and by the regulatory capital concerns of banks. But valuations on mortgage servicing rights are low and with loan quality standards currently high and with interest rates unlikely to go lower, new servicing rights should be a good investment.

I want to delve a little deeper into the mortgage servicing rights (MSR) part of the business this week.

What is a mortgage servicing right?

A mortgage servicing right is a somewhat complicated little piece of paper of conditions, responsibilities and payments. For the basic definition I will defer to investopedia:

An MSR is a contractual agreement where the right, or rights, to service an existing mortgage are sold by the original lender to another party who specializes in the various functions of servicing mortgages. Common rights included are the right to collect mortgage payments monthly, set aside taxes and insurance premiums in escrow, and forward interest and principle to the mortgage lender.

In return for these responsibilities, the servicer is entitled to a small piece of the recurring interest payments made by the borrower, usually around 25 basis points (0.25%).

A more investment oriented definition of an MSR comes from kamakuraco, who published an interesting paper on estimating the risk of an MSR, and who define the mortgage servicing right in the terms of a security:

One can approach the valuation of mortgage servicing rights as the valuation of a fixed income (broadly defined) security subject to default risk and prepayment risk.

There are two risks implicit to an MSR; either the mortgage is paid off, or the borrower defaults. In both cases the payments to the holder of the MSR are no more.

The collapse of the MSR

There was a great discussion two weeks ago on the Lykken on Lending mortgage banking podcast. Lykken had on Austin Tilghman and David Stephens, CEO & CFO respectfully, both with United Capital Markets. These fellows are industry experts in the mortgage servicing market. The discussion begins about a half hour into the podcast.

To take an aside for a second, I have to say that listening to the discussion brought about one of those exciting moments that make investing fun. I was biking home from work, had my ipod on listening to the broadcast. The roundtable discussion with the UCM execs came on and the second question, put forth by Alice Alvey, asked why are company’s beginning to retain their own servicing rights when traditionally most originators just sold those rights off for the cash up front? Austin Tilghman (I think. He didn’t identify himself) replied with the following:

Prior to the meltdown the price paid for an SRP [servicing release premium] was generally 5x or more of the [mortgage] service fee. That multiple dropped to 4x a few years ago and we are hearing that its dropped to 0x in some cases today.

Andy Schell, Lykken’s partner, then went on to say that he had recently done an analysis of SRP’s and MSR’s and, in his words, “I couldn’t believe the numbers are so low.” He reiterated that the SRP’s are in some cases approaching zero.

Wow.

When I hear that kind of disconnect I immediately think opportunity. And then I think how can I capitalize on that opportunity.

Defining SRP’s (there are too many acronyms in this industry)

But first of all, another definition. When a company originates a mortgage, along with that mortgage comes the right to service the mortgage. That’s the mortgage servicing right.

As an originator you have the option to keep the MSR on your book and service the mortgage through its life in return for the 25 basis point (or thereabouts) premium.

Alternatively you can capitalize the MSR up front by selling it. In return for selling the MSR you get cash. The cash you get is referred to as the servicing release premium (SRP).

The acronyms MSR and SRP get used all the time in discussions without definition so its good up front to understand what these two concepts are.

Why SRP’s have collapsed

As David Stephens alluded to above, the value of an SRP has collapsed of late. A few reasons why this is the case:

- There is concern about a regulatory change to make MSR’s a fee for service as opposed to a tacked on percentage of the loan interest (this is preventing new participants from getting into the market but it appears that it is not going to happen)

- There is a more nebulous concern about the regulatory environment in Washington in general and what the “unknown unknowns” of future legislation might be

- You only get the cash flow stream of an MSR over time whereas you get cash right now by selling the SRP and has of course been a liquidity problem in the industry since 2007

- Its a long term commitment to get into servicing. You can’t just jump in overnight without getting approvals as a servicer from the regulators and developing the infrastructure to do the servicing

- The market for buying and selling servicing is thin at the best of times and especially thin now (because of all the folks getting out of the business)

- And that is because… no bank wants to have anything to do with the mortgage industry

The opportunity

The basic investment premise here was well put on the broadcast by Joe Farr, who asked the following question:

With rates at 3.5% or 4% and quality never being better, why is it that that servicing values are close to zero in some cases?

To which Austin replied:

Its the aggregation of the aggregators. In 2007 an originator might have 20 take outs for the loan they produced. After the spectacular failures of 2008 and the combination of large companies into even larger ones there may have been 10 takeouts. Recently we’ve seen BoA and Citi getting out of the market and you can count on one hand the number of people that account for 50% of the market. And they have their own capacity limitations. It just gets tougher and tougher to find a takeout and then those that are left are becoming more selective about what they buy.

And there you have it. A simple supply and demand imbalance where demand for SRP’s has been decimated by the housing collapse have caused a disconnect in servicing valuations.

Who is going to benefit?

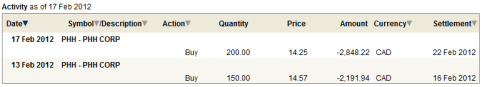

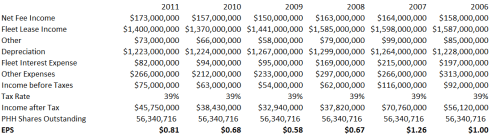

So I own a bunch of PHH now. They are big time servicer and the MSR’s on their books are valued at about 2.7x. Clearly from a book value perspective PHH has some upside to that servicing valuation if interest rates begin to rise and they can value that servicing at something closer to 5x. Servicing values have had to take major writedowns over the past 3 years as defaults have increased and more importantly, as interest rates have fallen, raising the possibility of refinancing. I found that really interesting table of the writedowns taken by some of the major banks over the past 3 years in the Kamakura report that I mentioned earlier:

That is nearly $30B in writedowns over the past 3 years for the 8 major banks. Wow.

Remember that the writedowns are being taken in part because the current MSRs are expected to refinance at a faster rate. PHH has, in the past, managed to retain most of their servicing rights that get refinanced by being the originator on those refinancings. So its perhaps a little misleading to value those servicing rights at 2.7x.

To get an idea of impact of a revaluation of those MSRs on teh PHH books to a 5x servicing fee multiple:

Ok, so that’s a pretty big impact on the accounting end.

As I already mentioned, PHH has proven that they can produce more MSR’s then they lose even during times where a large amount of the MSR’s are refinancing. The new MSR’s replacing the old MSR’s are of a much higher quality. By high quality I mean that these MSR’s are connected to mortgages that are being financed at extremely low rates (and therefore where the chance of early repayment is low) and within a market where credit quality is extremely restrictive (meaning the chance of default is low). This doesn’t seem to be reflected anywhere in the books.

So PHH has some upside as MSR come back into favor. That’s good. But there are two problems with using PHH as the vehicle to play the MSR disconnect:

- They don’t have the cash right now to take advantage of the disconnect in price and buy up MSR’s on the cheap. What I really need is a company with lots of cash and a savvy management team that recognizes that there is an opportunity in the market and you have to jump in.

- They are an originator, so when the MSR’s begin to recover their value its going to be on the heels of rising interest rates which will hurt the PHH refinancing business. In other words, PHH will never have all cylinders firing at once.

What I really need is a company with lots of cash and a savvy management team that recognizes that there is an opportunity in the market and you have to jump in.

Enter Newcastle Investment

I have owned Newcastle investment in the past. In fact, I owned them as recently as last summer, but I sold them in one of my “sell everything because who the hell knows what is happening in Europe” moments. At the time, I owned Newcastle because they, much like Gramercy Capital, had a large disconnect between the NAV of their managed CDO portfolio and the share price.

I’m not going to go through that CDO valuation right now because I want to talk about the MSR business that Newcastle is branching out into. I probably will in the next few weeks, just to get a better idea of the value proposition here. In the mean time the best places to find a comprehensive analysis of Newcastle’s CDO business are on the Gator Capital blog and the analysis by PlanMaestro on variantperceptions here and here.

The essence of these analyses is that if you add up the CDO business and cash at corporate, subtract out the preferred’s and other debts, you get a company with an NAV of about $5-$5.50 per share. So your net asset value is something pretty close to the current share price.

Here’s the crux then. Of that $5-$5.50 per share net asset value, about $205M (or a little less that $2 per share) was cash at the end of the third quarter. The potential upside exists if Newcastle can turn that cash into a cash producing asset that has a value greater than the face value for which it is purchased.

NCT gets into the MSR business

On its third quarter conference call Newcastle made the announcement of the change in direction. The company was getting into the mortgage servicing business. The company said it would be making major investments into MSR’s over the next few quarters (one of which they have already since announced). The reasons that they decided to make the switch in strategic direction was:

- They felt the MSR business offered the best risk adjusted returns out there

- The existing core business of CDO creation was basically dead

Interestingly, Derek Pilecki, who writes the Gator Capital blog, dumped NCT when the news was announced. While I am of the mind that getting into the servicing business right now is a savvy move, I recommend reading his final analysis of (and reasons for selling) Newcastle here for a contrary point of view.

Newcastle believes that there are significant returns that could be realized from MSR investments. From the SeekingAlpha Q3 conference call transcript:

We are still very optimistic that the returns on an unleveraged basis will be kind of mid-teens even mid-20, so very compelling in any environment but in particular with all the certainly in the world if we get something that is a big deal for us.

Newcastle went on to describe something that the fellows from UCM pointed out on the Lykken broadcast; how banks are basically dumping their servicing business on the cheap. Again from the transcript of the 3rd quarter conference call:

Banks in the U.S. are very focused on regulatory capital, on regulatory risk, on just the perception of headline risk, [and this has] made them more likely to be source [of MSR supply]

To get into the business Newcastle is partnering with an originator and servicer (Nationstar) and Nationstar will be performing the actual servicing. I think that Newcastle can be thought of as a silent partner that is putting up the cash. Again, the problem with MSR’s is that you have to have the cash to put up, and while most originators are running a tight cash flow, Newcastle has ample cash to take advantage of the investment.

Newcastle has also received approval from the IRS that MSR’s can receive the same favorable taxtreatment as other REIT assets.

That they had to clarify approval demonstrates the “first mover” status that Newcastle holds. Newcastle is early on in the game, being one of the first REIT’s to take advantage of this opportunity. As one of the analysts put it on the Q&A, Newcastle is “leading the way”.

What’s the upside?

The upside to Newcastle is a big increase in the free cash flow that the REIT can generate. Before getting into the MSR business, Newcastle was generating around $80M of free cash flow (FCF). At a 20% return on the $200M of unrestricted cash (using the assumption that the company puts all its free cash into the MSR business), you are looking at FCF of another $40M. Given the current market capitalization of $600M that puts NCT at a 5x free cash flow multiple. The company paid about a $60M common share dividend in the third quarter, so clearly another dividend hike would be likely.

The company announced their first MSR deal with Nationstar in a December 13th news release. In it the company reiterated the return metrics:

“I am very pleased to announce our first investment in Excess Mortgage Servicing Rights. This is a watershed investment for us in this sector. We expect this investment will generate approximately a 20% unleveraged return and total cash flows of over 2 times our investment. I am excited to be investing alongside Nationstar, a premier mortgage servicer and originator. Residential mortgage servicing is a large market and we currently see a strong pipeline of similar investments at very attractive returns.”

The deal was for $44M.

In my opinion, apart from the basic cash flow expected there is unrealized value in these MSR assets. For one, because Newcastle is partnering with an originator in Nationstar, there is a good chance that a decent percentage of the MSR’s that the company is investing in will be refinanced through Nationstar. Newcastle was quick to point out that refinanced mortgages remain in the portfolio and continue to cash flow to Newcastle. The refinanced value is not included in the value of the MSR. Newcastle estimated the following refinancing rate on the Q3 call (from the SeekingAlpha transcript again):

So our experience at Nationstar on our agency pools that we service which is a material amount of loans is that we’ve had recapture rates in the kind of low-to-mid 30% (inaudible) over the past six months, and that’s obviously significant, we think and we’re hopeful that with a little bit of focus, we could increase that to 40%, 50% at the extreme end of it, not that I’m predicting this, because it wouldn’t be prudent, but at the extreme end of it, you can capture a 100% of the loans that prepays, then you would have really the perpetual money machine right, as the IO would stick around, the extra service will stick around forever, but even at recapture rates at 20%, 30%, 40%, 50%. It has a terrific impact in terms of the volatility of the MSR and that’s (inaudible) investment profile looks like.

Second, as I already pointed out, recent and new MSR’s are being collected from mortgages that have been financed at historically low rates and in an era of extremely strict lending criteria. There is little chance that these mortgages are going to default and little chance that they will be refinanced any time soon. In other words these are high quality assets.

Its kind of a weird perfect storm here; you have a situation where the asset quality has never been better at a time when nobody wants the asset. While I suppose its not clear exactly what the quality of the MSR’s Newcastle is investing in are, if one presupposes a little faith in the management team (which has after all had the foresight to see an opportunity that many others have not yet seen), you might draw the conclusion that Newcastle is getting into high quality assets at a fraction of their underlying value.

Anyways if you add it all up I think NCT is on to something here. I bought a position in the stock and plan to add to incrementally as the stock moves up and my thesis is proven right.