Week 262: Simplify

Portfolio Performance

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

I made a grand total of two transactions this month. I think that might be a record low for me.

The dearth of transactions is that it is not by design. It’s the result of a shift I made back in February when the market was crumbling. I decided I would get away from anything that looked like a swing trade.

In the past I’ve taken positions in stocks not because I see strong fundamentals or a particularly good event horizon or an industry development. Instead I’ll take it as a trade because the stock has sunk down to what looks like the lower level of a range and I think I can catch a bounce as it traces back.

Its a strategy that I think, overall, has been profitable. Over the years I’ve done it with success with companies like New Residential, Northstar Realty, Brookdale Senior, various oil stocks, and with the tanker stocks.

But its a strategy that expends a lot of brain power and it drains a lot of emotional capital without the opportunity for a big upside. It also tends to put me into positions that I don’t have a lot of conviction in, and when a market event like what happened in January and February occurs, I end up selling stock at the wrong time.

So I’m not doing it any more.

For example, even though the tankers have traded down to what is really very cheap levels, I’m not playing a bounce. I didn’t buy into any of the REITs that have recovered since earlier this year.

For what its worth, its probably saved a few grey hairs as I watch Teekay Tankers and DHT Holdings flounder with no appreciable momentum even as the market as a whole rises. While some REITs have done well, others continue to flounder at lower levels.

It makes for a more boring and arguably slightly less profitable portfolio, but also for one that is easier to stand by through the market gyrations. As Brexit hit and the market tanked for a couple days it didn’t even occur to me to sell any of my positions even as I lost a few percent. The stocks I own I do so because I like them and I want to see them through to the events that I believe will result in their upside.

Without many trades this month I will talk about a stock I bought the previous month but haven’t discussed yet (BSquare), one event worth mentioning (Empire Industries spin-off) my investigation into cybersecurity stocks, and an update on what has been happening in the world of NFV/SDN.

BSquare

I’ve owned Bsquare once before but under a different auspice. The first time around it was because of a good earnings report that made it look cheap. But I didn’t have a lot of conviction in the business so I sold it soon after for a small gain.

This time I’m buying BSquare for the potential that they may be on the cusp of some growth. This is another one of those stories like Radisys, like DSP Group, where you have a so-so legacy business and company that has traditionally floundered but there is a new product coming along that might be able to change that.

In BSquare’s case that product is DataV. DataV is a software application that collects device data, performs monitoring and analytics on the data, and applies rules for predicting future conditions and failures and automating corrective processes within the device.

The product is an example of an Internet of Things application, where a companies assets are connected to the network, information obtained from the asset is used to quickly identify problems, and solutions and operational changes are pushed back to the asset through automated routines.

DataV operates both on the asset and in the cloud at the data center level. The figure below illustrates the functionality at each. The green boxes represents a feature set provided by DataV. At the asset level monitoring and automation of simple rules are performed for time critical conditions. At the data center level further monitoring and more complicated and less time sensitive automation rules are performed, as more complicated analytics like predictive rules and optimization routines are performed.

Unlike some of the IoT solutions I researched, I feel like DataV is going down more of a solution specific path. Rather than providing a platform to be implemented across an company’s asset base like some of the bigger IoT names, DataV is being targeted to customers to deliver specific solutions where there is an existing issue that it can solve. It seems like the right strategy, especially since their target market for DataV is the smaller end of the Fortune 500, who are less likely to invest large amounts of capital up front for a platform solution.

BSquare announced their first DataV contract with a major industrial company back in June. The company described the use cases to be addressed as follows:

Predictive failure. The use of data analytics and real-time device information to accurately predict problems that could impair asset uptime, as well as prescribing remediation steps.

Data-driven diagnostics. Further use of data analytics and historical repair information in order to speed diagnostic and repair time, getting vital assets back in operation more quickly while reducing service and warranty costs.

I also found the following quote from the press release useful for understanding the product:

“This project is emblematic of what is truly possible with IoT: real-time data analytics applied to very large data sets in order to predict future conditions, prescribe corrective steps, and accelerate repair times. Collectively, these DataV capabilities can dramatically improve uptime while reducing cost. We look forward to a long-term relationship with this customer, working closely with them as they leverage IoT to achieve business objectives throughout their organization.

The contract is for $4 million over 3 years.

My hope here is that this is the first win of many. While the company has only one win, they did make the following comment in one of their job postings, which gives me some optimism that there will be further wins:

Bsquare is investing significantly in marketing demand generation tied to its industry leading DataV IoT platform. Market response has overwhelmed our current sales capacity, and we are looking for proven inside sales dynamos to join our team.

I would say my conviction that this works out is medium at this point, so like many of my positions I will start small and build as positive data develops. Given the size of BSquare, a $66 million maket capitalization with $27 million of cash on the balance sheet, there is plenty of room for upward appreciation if the product takes off.

I have also looked closely at the legacy business and while I don’t want to spend too much time on it here, I will say that it gives me pause. The company is almost wholly dependent on Microsoft as a reseller and the contract terms with Microsoft have recently tightened. It doesn’t feel like a very comfortable position to be in. Please contact me if you want more of my thoughts on the legacy business or if you have any insights into it yourself.

Empire Industries and their Hydrovac spin-off

In February Empire Industries announced that they were spinning off their Hydrovac business into a separate company. The transaction makes Empire more of a pure play on their amusement park ride business and creates a new hydrovac focused entity.

Both sides of the spin-out look pretty interesting.

Dynamic Attractions, which is the existing Empire business, is still very cheap, trading at around 3x EV/EBITDA with a market capitalization of about $25 million. There is a healthy backlog of $107 million though that is down from year end of $130 million.

There is some talk that the next step will be the divestiture of the steel fab business, which would be another step towards making Empire a pure media attraction product company. The company still has the telescope business and the 30m telescope contract, though recent setbacks make it unclear whether a new site will have to be found for the project before it can proceed.

Equally interesting is the hydrovac spin-off called Tornado. As part of the spin Empire partnered with a Chinese company, Excellence Raise Overseas Limited, who injected a little under $10 million into Tornado. $6.9 million of that is equity, $2.5 million is debt (it was supposed to be $7.5 million but the injection was done in USD and Reminbi and the Canadian dollar has gone up since the original agreement). The equity portion gives the Chinese firm 45.5% of the new hydrovac entity. If you do the math on that the Chinese entity paid about 25c per share. The stock is trading below 15 cents.

Tornado is going to use the cash to set up an operating subsidiary in China and offer Hydrovac services there. In Canada they just sell the trucks. The business in China will be more akin to Badger Daylighting; contracting out the usage of the trucks and personnel.

Here is what the Tornado management said about their new business endeavor in their first ever MD&A:

What I find interesting about Tornado is that at the current price the market capitalization is $9.5 million you are only paying a little more than what the Chinese partner invested in the company. Yet you are getting both the existing hydrovac manufacturing business in Canada, and the new Chinese expansion. While the truck manufacturing business has been poor of late, basically delivering flat EBITDA for the last year, before the collapse in oil prices this business generated $2.5-$3 million of EBITDA.

So there is plenty of upside from the existing business that is arguably not priced in. In addition you have a stake in what happens in the China segment, which is admittedly uncertain.

In addition to what I received with the spin-off, I bought a little bit of the stock because it seems cheap. I would like to buy more but its hard to get a real sense of how substantial the opportunity in China is.

I have no idea if this is a huge market that they will win big with, or whether this is going to be an uphill battle. It seems somewhat positive that the Chinese company wants to take a big slice, presumably they are doing so because they see the market opp, and the Empire management has been pretty astute, but who knows for sure.

So we’ll see. Management is making some interesting moves, they may have some more up their sleeve.

I’m not smart enough to invest in security companies

I spent quite a bit of time over the last month trying to familiarize myself with the cyber security universe. I went through transcripts, listened to conference calls, read presentations and 10-Ks. I looked at Palo Alto, FireEye, Proofpoint, Rapid7, MobileIron and Qualys in some detail and more briefly at Tanium, Imperva and Splunk. I come out of the whole thing still feeling like I only have a foggy understanding of the space.

Of all the firms I think I understand the biggest, Palo Alto and FireEye, the best. Palo Alto is a firewall company and FireEye is an intruder detection and mitigation company. I think on the most simplistic level, Palo Alto is trying to stop an intruder whereas FireEye is trying to detect and stop one once one gets in.

Both companies and for that matter most cyber security companies, provide an appliance (which is essentially a server blade that goes into the stack) supplemented by one or more subscriptions (along with maintenance and support which may or may not be bundled into the subscription price, depending on the company). The appliances sit on premise and perform the basic protection services. Some of the subscriptions are attached to the appliance, and some are not.

For example Palo Alto, to the best of my understanding, offers an appliance and 8 subscriptions. These are shown in the diagram below. The red boxes are subscriptions not attached to the appliance while the blue one’s are stand alone

Just to give some color on what these do, Wildfire updates the firewall appliance with new emerging threats, Aperture provides the ability to monitor SAAS applications, Traps, is installed at the endpoint that prevents untrusted apps from operating. GlobalProtect extends firewall capabilities to mobile and offsite devices, Autofocus allows you to access a database of threat tags that help you identify the source and nature of a threat you’ve discovered, and Threat Prevention and URL Filtering provide some of the basic data required for performing the firewall functions.

So that’s Palo Alto. If you go through the universe of companies you will find something similar in terms of an appliance with subscription services and/or stand-alone subscription services.

Where things begin to get fuzzy for me is once we get into the smaller players. So Proofpoint software is primarily geared towards email protection. Rapid7 and Qualys provide data hunting and analytics that try to aggregate and streamline the vast amount of data coming down to what is relevant. Mobileiron’s platform manages security for mobile devices. Imperva provides security to data centers and to a lessor degree to cloud applications and websites.

What I can’t figure out is how it all plays out between these niche companies and the larger one’s like Palo Alto and FireEye. Is there room in IT budgets for all of these products? Do the niche players get bought out by a consolidator? Or does revenue growth start to slow for some of them?

Another question that isn’t clear to me is how the move to the cloud impacts these businesses. Some of these companies still generate a significant amount of revenue by selling the appliances. As those appliances become virtualized and sales are software only, I wonder how margins and revenues will be affected?

In this regard, one of the most interesting things I listened to was this discussion at the Bank of America Global Technology Conference with former FireEye CEO, now Chairman David Dewalt. Dewalt makes a number of very strong comments; that security is going to move to the cloud, that this will be disruptive, that this will change the landscape of what products and services are required, and that it will move dollars from a product or appliance bucket to a subscription bucket.

The final piece is whether spending has been artificially heightened by a few outsized threats. There were some significant breaches in 2014 and even some of the company executives I listened to described the following period as being one where companies were throwing money at the problem without discretion. That appears to be changing now. We just saw Imperva issue pretty dismal guidance. Qualys recently characterized the environment as “much more rational” and that we were seeing more caution on the part of customers, that they were looking to consolidate vendors, etc.

Finally, I don’t really understand the growth expectations behind all the names I looked at. For example, the Stifel universe has 22 cybersecurity companies and the average revenue growth of those companies is 19% for 2016 and 2017. Yet the cybersecurity market as a whole is expected to grow at 6.9%. So who are all these low growth or market share losing companies?

It all sounds like one big bucket of uncertainty. Which is hard to stomach when you are paying the multiples you are for these companies. So the research has been interesting, but I’m not sure I will be adding any of these names soon.

Whats Happening in the NFV/SDN World

There are a whole lot of datapoints hitting the presses in the world of NFV/SDN. Here’s a brief run down of what I have come across.

In the last week AT&T announced that they will offer the code to their SDN platform into open source, that they will be introducing virtual security functions for their virtualized network, and that they will be launching network functions on demand starting with 4 virtualized functions. Of this news, the second may have relevance to Radcom, where there have been hints that their contract with AT&T could be expanded to some sort of security application. The third piece (more details here) refers to a 3rd party server vendor for the white box back end, which certainly could be something Radisys provides.

Along the lines of the third news item, Radisys and AT&T held a joint presentation demonstrating their Mobile-CORD initiative and how you can monetize SDN and NFV. Some more circumstantial evidence of the relationship developing between Radisys and AT&T.

This article (here) compares the move to NFV as being the equivalent to the datacenter move to cloud over past decade. The key difference is that enterprises moved apps like Oracle, Exchange and SAP, CSPs are moving network functions that deliver wireless and wireline calls, text messages, and streaming media, along with services such as VPNs and firewalls. This article specifically highlights service assurance as one of the two most important attributes of software defined infrastructure:

The second important characteristic of a software-defined infrastructure is service assurance. Customers expect seamless voice, video, and media quality and data protection. A truly carrier-grade infrastructure will deliver on these expectations by quickly analyzing the root causes of component failures, remediating those failures before they impact subscriber services, and ultimately, predicting and avoiding outages and performance issues before they occur. All of this can only be accomplished through automated software.

Another article I found interesting was this one, which exposes 10 myths about NFV. Two important points made are that encumbents will have to rebuild from the ground up to make their app virtualized:

The best way to build a carrier-grade virtual network function (VNF) is to take a ground-up approach, starting with a purposefully designed modular architecture that addresses performance, scalability and other important requirements, Luxoft recommends.

And that Verizon is looking to share risk with vendors, also move might be to subscription type of relationship with vendors:

Verizon, for example, proposes a new business model in which its vendors share the risk in the introduction of new services. If a service succeeds everyone will make money. If it fails everyone shares the risk…Furthermore, virtualization lends itself to usage billing models, not only for consumer services but for business to business services.

I also found this article that talks about the need for both SDN and NFV being brought on by the amount of data that will be travelling the network as the Internet of Things grows:

As the Internet of Things (IoT) becomes more of a reality, and as these companies look to deploy 5G and reap all its promised benefits, most realize that they need to revamp their networks in order to deliver value and to compete (with you-know-who). These trends will result in significantly more data of widely different types traveling across their networks, and to retain service agility on a more-or-less static infrastructure, these operators need NFV and SDN, along with “cloudification” and advances in distributed computing.

This article gives the rather impressive 116% CAGR for NFV and SDN from now until 2021:

Spend on NFV and SDN ramped up in 2015, with analyst firm TBR forecasting the market reach nearly $158 billion by 2021, representing a 116% CAGR.

And finally Mark Gomes gave some interesting scuttle about Radcom in a conversation with an industry contact that he posted over the weekend.

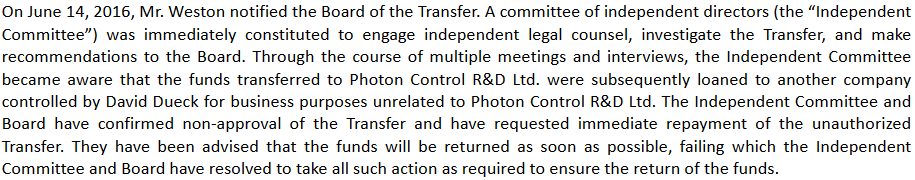

Reluctantly exiting Photon Control

There is nothing more fun than getting this kind of press release about one of your companies while being on vacation with limited internet access.

I have absolutely no insights into how this plays out. Maybe the loan gets repaid and the company puts itself up for sale at a premium. Maybe the company rights itself and gets on with the business of delivering sensors. No idea.

What I do know is that when I don’t know what is going to happen, I am more often than not better off selling first and asking questions later. So I sold my shares.

I note two things since that time. First, the shares have held up reasonably well, so there is clearly someone willing to buy into the panic. Second, there hasn’t been any news that the money has been paid back.

I continue to watch the story because the company valuation is compelling. The market capitalization is $73 million and the company holds $27 million in cash. After subtracting cash, the stock trades at only about 3x free cash flow.

This is too cheap if the business is viable and there isn’t any overhang from executive malfeasance.

The sensor business hasn’t grown like I had hoped, but that still may come and even in its current state it remains nicely profitable. I’d love to get back into the stock, but I need to remove the uncertainty before I do.

Portfolio Composition

Click here for the last four weeks of trades. Note that the two transaction labeled Adj are me manually readding the Empire Industries and Tornado shares. When Empire did the stock consolidation and spin-off my shares were lost in the practice account.

Also note that I bought RMG Networks stock, which I talked about already owning last month. This was another unfortunate example of me forgetting to take a position in the practice account, and as a result having to buy the stock later at a higher price. Oh well, if I am right about RMG Networks the upside will make 20 cents more I paid irrelevant.