The Aptly Named Sound Financial

Over the last couple of weeks I have built a position in a recent mutual holding company conversion called Sound Financial. It took some time. The stock trades 10,000 shares on a good day, so you have to pick and be patient and don’t flood the bid.

Sound joins what is now a rather long list of mutual holding conversions I have owned over the past couple of years. It began with Oritani Financial, which I bought at a little less than $10 and sold out of (too soon) at $12. That has been followed by such names as Oneida Financial, Home Federal Bank of Louisiana, First Financial Northwest, Kaiser Federal Financial, and recently Atlantic Coast Financial. With he exception of Atlantic Coast, the rest have shown decent price appreciation and I probably should have held each longer than I did.

I first became interested in mutual holding companies after reading David Einhorn’s book Fooling Some of the People All of the Time, which is about the mostly unrelated topic of Allied Capital, a couple of years ago. In the first chapter, before getting into the gory details of Allied, Einhorn discusses his investment strategies, and makes the case for value in mutual holding company conversions.

What is a mutual holding company and why do they convert?

A mutual holding company (MHC) is a type of corporate structure whereby the company is partially “owned” by its customers. Now, I put the word “owned” in quotations because the ownership is not quite what you think it might be and I will explain that in more detail in a second.

The MHC structure is most commonly used by insurers and banks. In the case of a bank, which is what I am going to focus on here, the customers/owners are the depositors, and they usually have a majority stake that is held through the MHC. The rest of the bank is held by common stockholders

From time to time a mutual holding company will convert to a fully public stock holding company. This is usually done because there is a growth opportunity, a merger, or some sort of use of cash that makes it desirable to the company to raise capital. The conversion to a publicly held stock is called a second step (with the first step being the initial partial sale of the company).

Along with the second step comes opportunity for investors. The nature of it is such that in addition to the company raising capital to fund future growth, it is often done in such a way that it is not dilutive to equity, and sometimes actually results in a lower amount of shares outstanding.

If that sounds weird it’s because it is.

Here is how it works:

Before the conversion, the bank is jointly owned by shareholders and depositors (the depositors own their share through the mutual holding company). As part of the second step, the shares that were held by the mutual holding company are sold off to investors as common stock in a bank holding company that will take ownership of the bank.

This is why I put the term “owned” in quotes earlier when speaking of the customers ownership. Within the mutual holding structure, the depositors have certain rights (like electing directors) that are consistent with ownership, but when it comes to converting that ownership to shares, the depositors don’t get a free ride. They have a right to buy shares at the set price, but they have to pay up just like everyone else.

In addition to the new shares created, the existing shares outstanding are often restructured to a lower amount when they are converted to shares of the bank holding company. For example, you might find that every existing share is only worth 0.75 shares of the new holding company post conversion. This is done to preserve the percentage ownership post conversion. If, for example, before the conversion the mutual holding company held 60% of the bank and common shareholders held 40%, post-conversion the existing common shares outstanding and would be adjusted to insure that shareholders still held 40% of the company.

Why MHC’s make good investments

As Seth Klarman, an extremely successful fund manager and advocate of mutual holding conversions has described it, the result is that investors are “buying their own money and getting the preexisting capital in the thrift for free.”

Its typically a good deal if you can get into these stocks post conversion. What you end up with is a cashed up company, usually at a significant discount to book value. If the business is solid, you have an excellent opportunity for price appreciation.

And its the gift that keeps on giving. Even though the conversion process has been around for years, ever year a few more companies take the plunge and are inevitably mispriced at the get go. The reason this happens, I think, is simply the size of the prize. Most of these banks are tiny; they often have market capitalizations of less than $100 million and in some cases less than $50 million. They are also illiquid. The combination makes it difficult for them to be bought in size. But what is bad news for larger firms, is great news for us lone gunmen, because we can buy a few thousand shares and still have it make an impact in our portfolio when the stock goes up 40% or 50%.

And that’s what I’ve done with Sound.

The Sound Financial Second Step

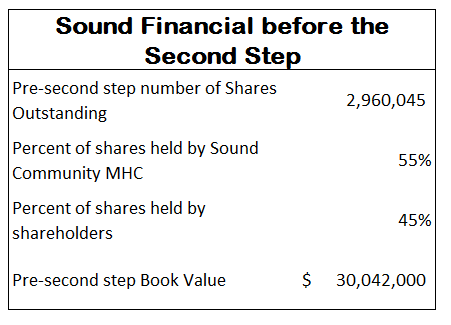

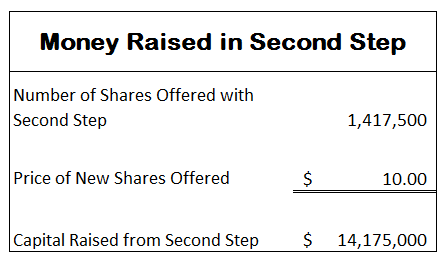

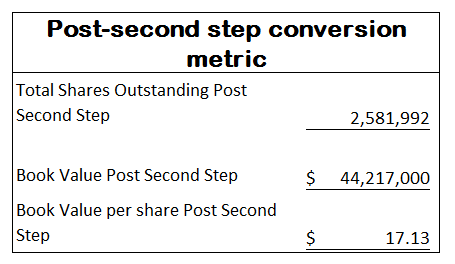

Let’s take a look at the conversion just completed by Sound. In Sound’s case, the mutual holding company, called Sound Community MHC, owned 55% of the shares outstanding before the conversion took place, with common shareholders owning the other 45%.

Here is what Sound looked like before the second step conversion.

The second step conversion took the 55% ownership of the mutual holding company and sold it to shareholders for $10.00 per share.

To keep the ownership percentage of existing shareholders at 45%, existing shares were converted at a rate of 1 existing share to 0.87423 new shares.

The result: there are less shares outstanding than initially were and the book value is much higher because of the additional cash.

Why buy Sound?

The value proposition with Sound is pretty straightforward. The book value after the second step conversion is $17.13 per share. You can pick up shares right now at around $10, which is a 70% discount to book.

But I don’t like going after a strict value play. You can sit around for years waiting for a scenario to develop that might allow that value to be realized. I want to be able to see the catalyst on the horizon.

With Sound, that catalyst is going to be earnings growth. I see a couple different ways Sound could increase earnings over the next few quarters.

- With the cash they’ve raised they are going to be able to take advantage of lending opportunities.

- The company’s existing book has been taking swrite-downs against earnings every quarter, and when those write-downs dry up we’re going to see a jump in net income.

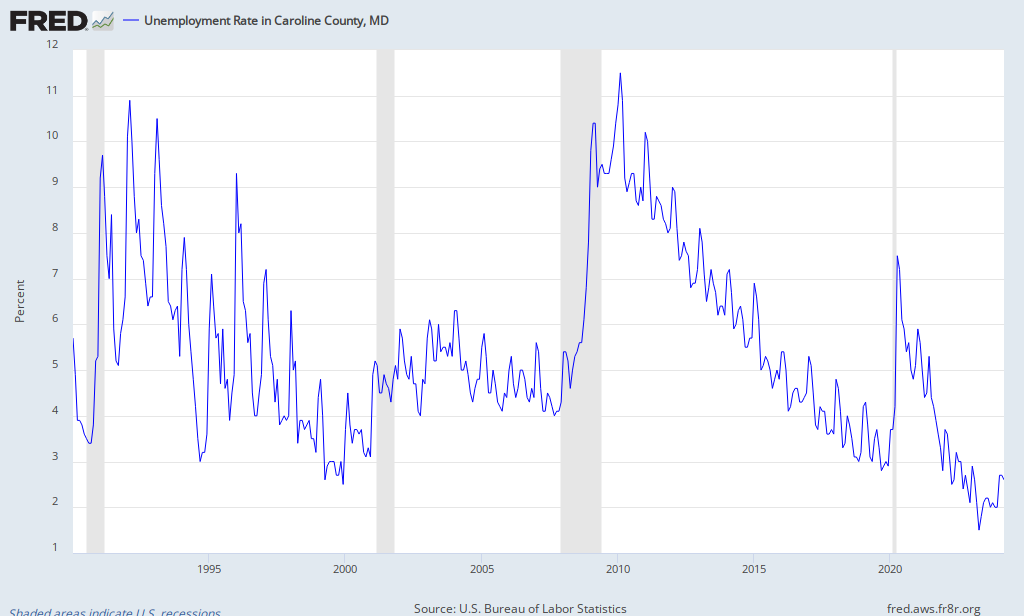

Of course both of these catalysts are contingent, or at least will be easier to achieve, if the Puget Sound area economy recovers. Let’s start by taking a look at that.

The Puget Sound Region

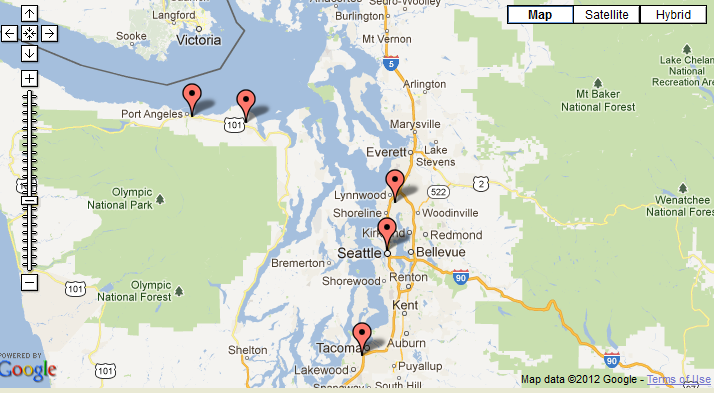

Sound Financial operates in the Puget Sound region. Puget Sound encompasses Seattle and Tacoma and consists of the Clallam, Jefferson, Kitsap, King, Pierce and Snohomish counties. The map below shows where those counties are:

Sound has three branches in the King-Pierce-Snohomish beltline; one in downtown Seattle, one in Tacoma, and one in Everett. They have another two branches in Clallam County; one in Port Angeles and another in Sequim. Locations are shown below.

The bank started with the 3 branches in the Seattle-Tacoma corridor. The expansion to Port Angeles was relatively recent, with the purchase of a branch from 1st Security Bank.

A large majority of Sounds loan book is related to the real estate market. They had $302 million in loans outstanding at the end of the second quarter. Of that amount, $98.6 million were 1-4 family homes, $38.6 million were home equity loans, and another $105 million were commercial real estate and multifamily homes.

Thus, as the Puget Sound real estate market goes, one might expect Sound to go.

The first thing I set out to do was find out how the housing market is doing in Seattle. What I found was that it was turning, and rather hard at that. I have taken the chart below, which shows August housing statistics, from the Seattle Bubble blog.

I was somewhat shocked by just how low single family home inventory is. Months of supply is down below 2? I’ve lived in a city with inventory below 2 before, and I have to say that in my experience it doesn’t portend to flat or gradual price increases. Below is an inventory chart (again via the Seattle Bubble blog) that shows the state of affairs even more vividly. Inventory is at the lowest point in the last 12 years! And by a significant margin.

Something has to give here. I think its going to be prices.

Its not as easy to get data on Port Angeles and Clallum County, which is a smaller and more remote center. From the data I have been able to gather, I don’t see the definitive bottom that I do in and around Seattle. But I also know that it is the major metropolitan areas that will turn first, followed by the periphery, so I wouldn’t rule it out.

Port Angeles, WA Inventory

See more Port Angeles, WA statistics and real estate market trends on Movoto.

Looking at the broader economy in Washington state, I think the generalization that could be made is that things are picking up. Economy.com has all Washington regions except for Spokane in “Recovery” mode according to their Regional Recession watch.

Also bullish was this presentation on the state of the Washington economy.

Also bullish was this presentation on the state of the Washington economy.

The speaker points out that the major employers in the Washington area are Microsoft, Boeing and Amazon, and that these companies are all doing well. I found it interesting that he described Boeing as undertaking “a huge hiring frenzy” to staff themselves for the 7 year backlog they currently have. The speaker also notes the unusually tight conditions in the Puget Sound area real estate market. If you look at some of the inventory charts he shows for the various counties, they reinforce just how tightly wound the housing market there has become.

How an improving economy is going to funnel down into earnings

Here is a back of the napkin estimate to provide an idea of what Sound might earn if they can put the capital they raised to good use.

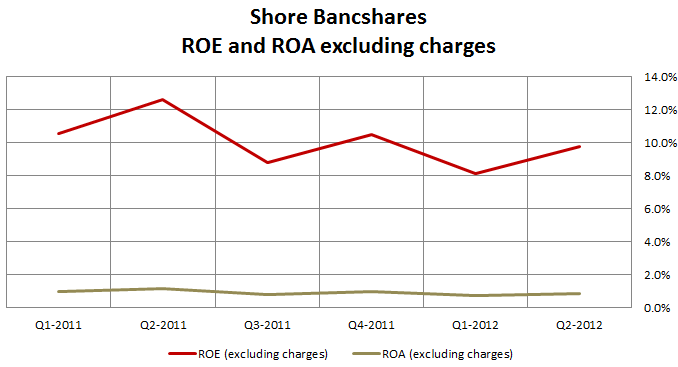

The company raised $14 million. Return on equity (ROE) has been around ~7.5% over the last year (it was 7.9% in the second quarter). So assuming the company can put that capital to work at approximately the current ROE, one might expect incremental earnings in the neighborhood of $1 million.

This is not an insignificant sum. Annualized earnings in the second quarter were a little less than $2.4 million. So the potential here is for 40% earnings growth just from the company putting to work the excess capital on its balance sheet.

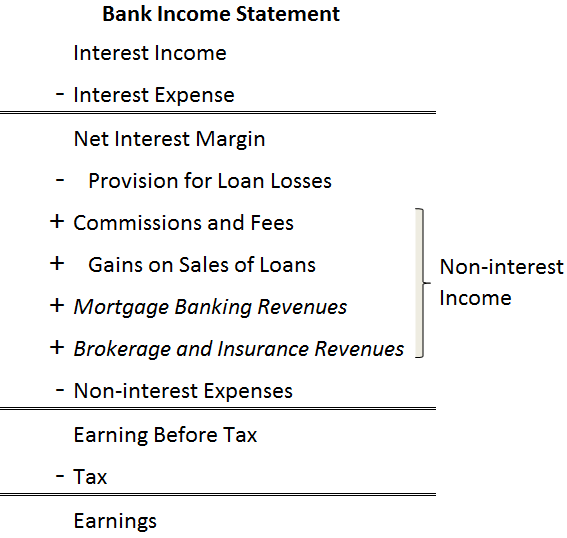

Provisions for loan losses and their impact on earnings

One of the reasons that Sound has a less than stellar 7.5% ROE is because the company has been taking losses on its legacy loan book.

The losses have been cutting into net income every quarter. But even so, Sound has had decent earnings over the past number of quarters. Earnings in Q2 were $0.20 per share, while earnings in the first half of this year were $0.39 per share. Judging the company on current earnings alone, the stock trades at 12.5x ttm.

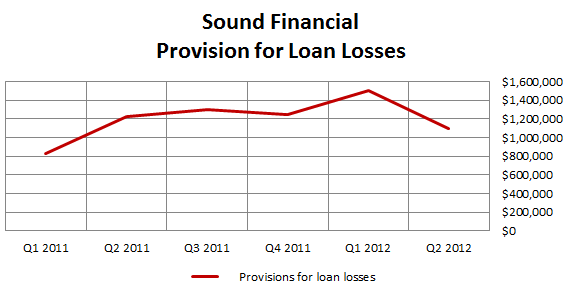

Nevertheless, earnings have been significantly reduced from what they could have been by the provisions that have been made to loan losses. Provisions for loan losses were $1.5 million in the second quarter and $2.6 million in the first half of the year. Provisions were more than double what earnings were. Going back a couple years, Sound has been consistently taking provisions in the range of $1 – $2 million per quarter.

This need to take provisions for loan losses will not continue indefinitely. First of all, the troubled loan book is centered on the residential real estate market, which is recovering.

Second, the company does not have a large delinquent loan book to begin with, so the back log is small.

As with incremental earnings, while the numbers involved in the provisions do not seem large, they are significant on a per share basis. $1 million of earnings lost to provisions is over 40 cents per share for the company. If and when those earnings come back onto the income statement, the company should be valued higher to reflect that.

Management

The one area where I still feel like I’m in the dark is with respect to management. Unfortunately this is the case with a lot of these tiny thrifts; there just isn’t a lot of information out there about the people involved. This isn’t like a mid or large cap where you can dig up articles or even books on the personalities at the helm of the company.

What I have found though has been reassuring. This link here gives a few good reviews from customers.

Another article I stumbled on reported that Joseph Stilwell purchased 153,000 shares of the company pre-conversion. He paid somewhat less than I am paying today (I calculated that taking into account the conversion his price was around $8.25). The article also implies that Stilwell was instrumental on getting the second step done.

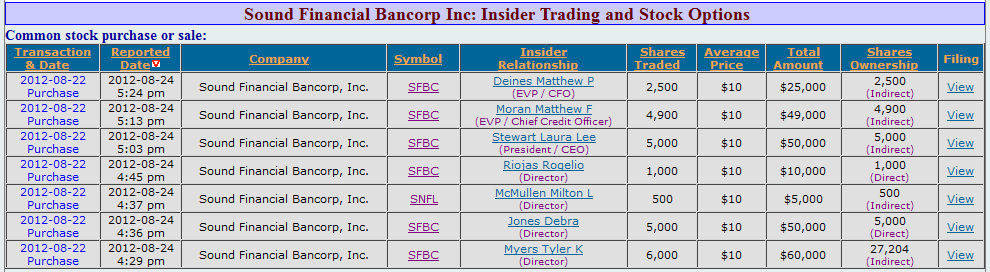

Finally, there was a significant amount of buying taken up by insiders from the second step. Over 200,000 shares were bought, including $50,000 worth from the CEO and Chief Credit Officer.

Summing it up

This isn’t like some of my holdings where the stock could be worth $30 or $3 next year depending on whether it plays out the way I think it will or not. At best Sound Financial gets to book value by this time next year. More likely, the stock trades up to $13 or $14 as loans get made and loan losses begin to taper off. Still, that would be a return of 30-40%, which is nothing to scoff at, and I won’t. I’ll just sit on my hands and watch to make sure it plays out that way.