Why I Own Jaguar Mining

I want to talk a bit about Jaguar Mining in this post. I own a lot of JAG (its my second largest position next to Arcan right now), I’m essentially flat on my investment, and the results for Q2, which will be coming out shortly, are going to dictate whether I continue to hold on to the stock or drop it.

I bought Jaguar because I think its a potential turnaround story. The current valuation allows for a lot of upside if the company can turn around their operations. The stock is hated or ignored by analysts that have been burnt on it over the last year. The stock is heavily shorted. The company has missed targets for over a year now.

Yet when I look at the problems that they have, I think that they are fixable. In fact, I think the company may be fixing them right now. If they are, then the stock should move up to reflect that.

In this post I am going to recap the issues that have led to the higher costs, and what Jaguar is doing about that.

The Operations

Jaguar has 3 mines. There is Turmalina, Paciencia, and Caete. Caete is a new mine, producing for 2 quarters now, while Turmalina and Paciencia have been producing much longer. Turmalina and Paciencia have historically, on average, produced about the same amount of gold.

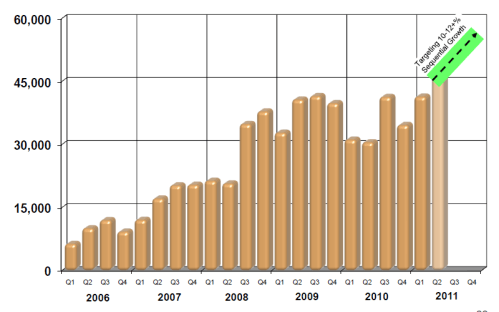

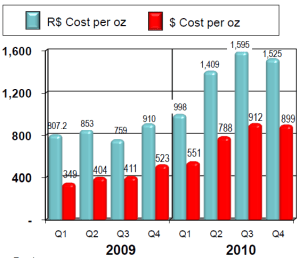

You can see the dip in production in 2010. This was not supposed to happen. It happened because of problems at Turmalina. Costs rose too high and grades fell. See the chart below and note the escalation in costs on a per ounce basis:

Problems at Turmalina

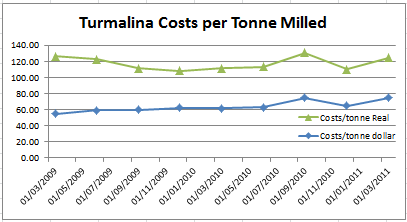

Why have costs risen so high? Its been a grade issue. Mining costs, on a costs per tonne milled basis, are fairly flat, particularly in Brazilian Real’s. Even in USD, mining costs have not risen substantially. If the company was producing the same grade they were in 2009, there would not be a problem at Turmalina.

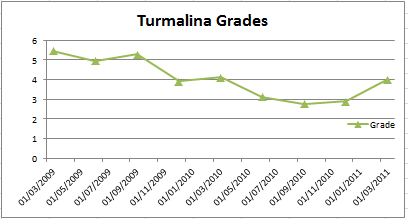

Unfortunately, they are not. Grades fell dramatically in the last 3-q’s of 2010:

So what is the cause of the grade problem? Grade problems can be one of two things. They are either problems with the resource model, or they are problems with the extraction techniques. A resource model issue is something like what Gammon Gold experienced. Its probably best to stay away from a problem with the resource model for the simple reason that if the resource model isn’t right, then who really knows how much gold is there and whether the company will be able to profitably extract it.

I don’t think that there is a resource issue with Turmalina. On the Q4 conference call management stated that they had reviewed the resource model with an independent advisor and are confident it is accurate. So the gold is there and in the expected places.

The problem at Turmalina have been extraction issues. The company has highlighted two problem, both related to one another; dilution and mine management. First, the mining method that they had been using had been taking too much waste rock along with the good ore. They were seeing 30-40% grade dilution due to the excess waste rock going through the mill. Second, the mine management was not developing a sufficient ore and readily available stope stockpile to smooth out natural grade variability in the mine. So when they hit upon an issue with the current mined area, there was no back up area to fall back upon.

What Jaguar is doing about the Problems at Turmalina

Jaguar has done 3 things to address these problems.

- Mining technique was switched from selective stoping to back and fill

- Mine Management was replaced

- An extensive development program was undertaken to make available more stopes and stockpile ore

Good Progress So Far

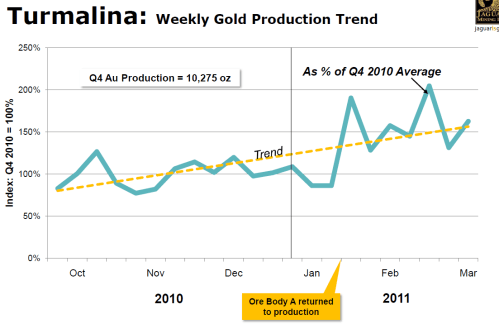

On the Q4 2010 conference call the company described the progress they had made. They have moved ahead. Dilution came down to 10-15%. The chart below illustrates the improving gold production at Turmalina through most of Q1. (Ore body A is the main high grade ore body where the problems have occured.)

On the Q1 2011 conference call the company confirmed that progress had continued. The level of dilution in Q1 was 12% and thus far in Q2 it had been steady at that level. They were on track for having 18 months worth of developed stopes in their inventory by year end. And grades, which had improved significantly from Q4 to Q1, were said to have continued to improve in Q2.

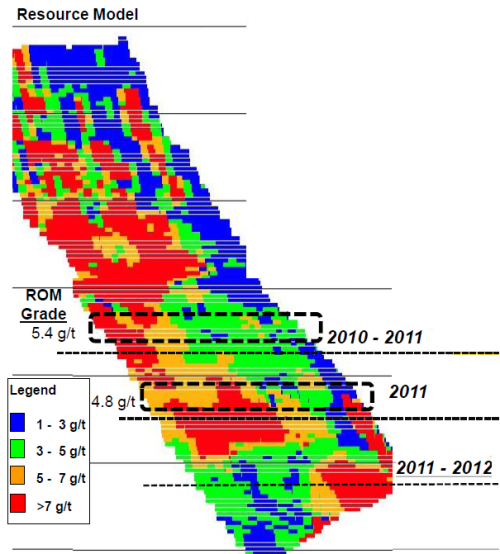

To elaborate a bit on the grades, I believe that the operations at Turmalina should be helped by the grades of the next levels being mined. Below is a cross section of Turmalina provided in the Q3 conference call material. You can see how the grades of the ore that will be mined through the latter part of the year should continue to improve.

As for the mining costs themselves, they have been rising somewhat, but primarily that is the effect of the rising Brazilian Real. Below is a chart of the mining costs per tonne in both USD and Real.

Gold in Process Effects…

The costs in Q1 were already showing improvement, but the improvement was somewhat obscured by the gold in process from the previous quarter. Turmalina costs for Q1 were $775/oz, an improvement over the $900/oz+ costs of the previous quarter but still very high. But excluding gold in process, and looking only at the gold that went through the mill from start to finish during the quarter, costs were a much more impressive $639/oz.

Turmalina Improvements Will Determine the Share Price Direction

I see Turmalina as the main driver of the share price in the short term. If all goes well, the Q2 results should show costs more in line with the ex-gold in process costs of Q1. Higher grades in Q2 may result in an upside surprise in gold produced. Management seemed very confident about the mines progress on the conference call. A turnaround at Turmalina gives Jaguar two solid mining operations with a third one ramping up.

So lets take a look at that other solid mining operation, and the problems with the one that is ramping up production.

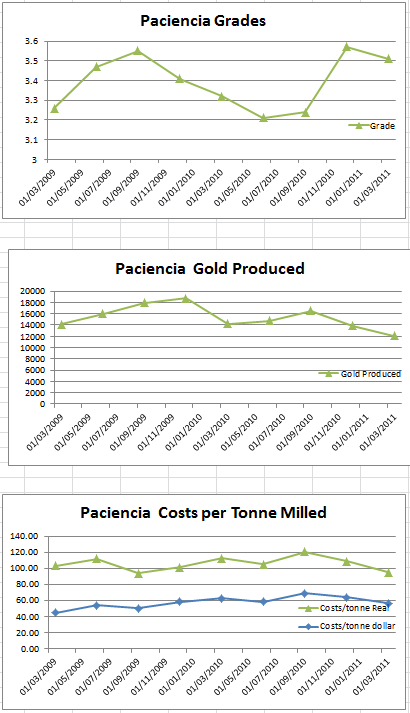

Paciencia: The one Model of Consistency

At Paciencia all indications are that the mine, which has been a consistent producer, should continue to be so going forward. Costs have been stable, production has been stable, grades have been relatively stable. The increases in costs at Paciencia have been exclusively because of the rising Brazilian Real, which is something that there is not much that can be done about. Perhaps most telling is that the company spent almost no time talking about Paciencia on their last conference call. There are no problems to discuss.

Still Expecting more Blah Results at Caete

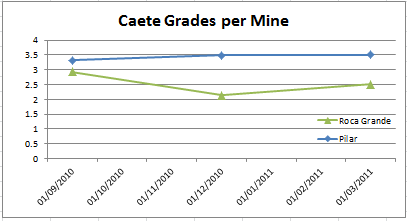

The Caete complex consists of two mines, the Roca Grande mine and the Pilar mine. Roca Grande is a new mine, while Pilar has been in production for a while, with the ore originally being shipped to Paciencia.

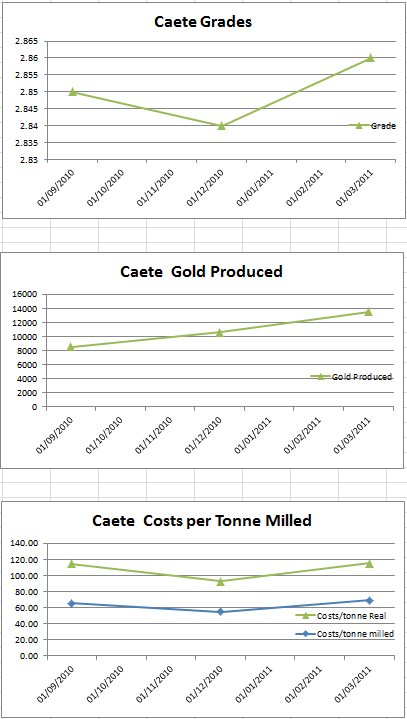

The Caete mill reached commercial production in Q3 and has struggled with the ramp up. You can see below that costs continue to be quite high, and they haven’t started to come down as of yet.

Their appears to be two main issues at Caete, both of which do not seem to have been resolved yet.

- Ore from the new Roca Grande mine is seeing highly variable grade and lower grade than expected

- The mill at Caete is running significantly below capacity

I would consider both of these issues “start-up” issues that should be resolved as the mine development progresses.

The grade of the Roca Grande ore has bounced around significantly over the first three quarters of operations. The overall Caete mill grade is obscured by Pilar. You can see how the Pilar ore over the past 3 quarters has been higher grade and more stable grade than Roca Grande. Jaguar is probably managing Pilar to make up for Roca Grande problems.

In addition, the capacity is not being fully utilized. In Q1 the Caete mill processed 166,000 tonnes of ore. The mill has a capacity of 2,200 t/d, so it could have processed 198,000 tonnes at full capacity.

On the Q1 conference call management said that increases in capacity will come in Q3 when the Archie-1 shoot of the Roca Grande mine begin to be extracted.

With more stable grades from Roca Grande and the higher tonnage produced, Caete cash costs are expected to come down to $650/oz by the end of the year. That would be great, but its important to realize that unlike Turmalina, where there is real evidence of progress, so far at Caete it is all just promises, along with the understanding that new mines have problems that generally get ironed out with time.

I think that Caete is unlikely to produce any upward surprise in the short term. We’ll probably see more of the same (ie. 12,000-13,000oz and $800/oz costs) in Q2. Based on the way management talked candidly about the progress at Turmalina, I would expect that they would have said so if there was anything positive to say about Caete. So there probably isn’t, yet.

Ideally in Q3 and Q4 improvements to the mine will result in a further upward revaluation of the stock, on top of what I hope to see from the Turmalina turnaround that should be evident in Q2.

How do you Value The Company?

There are two ways of looking at Jaguar’s current valuation:

- Jaguar is expensive if you extrapolate the trailing twelve month performance

- Jaguar is cheap is you look ahead at the potential if they turn around Turmalina and bring Caete up to expectations

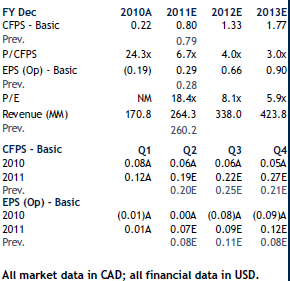

RBC has the following estimates for Jaguar over the next few years.

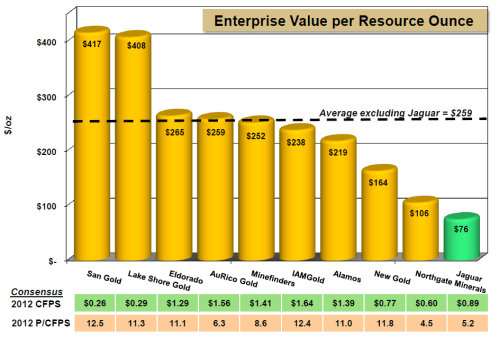

Jaguar itself presented the following peer comparison in their June 2011 analyst presentation.

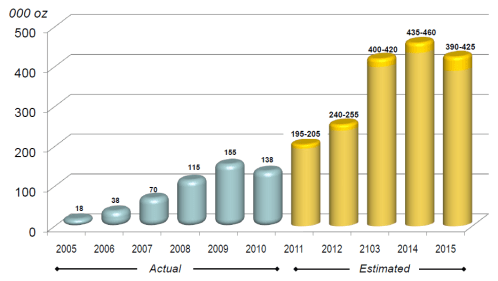

What I like about Jaguar, and what led me to invest more heavily in them as opposed to OceanaGold (which is a cheaper stock by far just based on current production), is that they have a great future growth profile. Now this growth has been continually pushed off into the future as the company has had to deal with the problems encountered with their current operations, but if those problems are settled, there is the potential to grow production substantially over the next few years.

Wall street loves growth. Its not a stretch for me to see this company go back to darling from dog as the street begins to look towards the future rather than focusing on the ugly present.

Anyways, we shall see. Q2 will go a long ways to telling whether this story is progressing or whether management will disappoint yet again (at which time I will jump out quickly).