PHH and one way to bet on a turn in the US economy

PHH is one of those stories where the more I look at it, the more it makes sense to me, and the more it makes sense to me, the bigger the position I am willing to take.

I love to add to a rising stock. I think its truly the best way to make money. You buy a start position, the stock begins to move up, you add to that position, it moves up again, you add again. The market is telling you that you are right and so you listen to the market, and to use a phrase of Dennis Gartman’s “do more of what is working”.

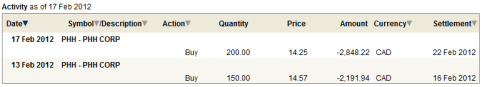

In the last week I basically doubled my position in PHH:

I wrote my basic thesis on PHH 3 weeks ago. I love that the company is involved in mortgage origination and servicing. I think that mortgage servicing rights represent one of the best investments you can own right now (I’ll put out a post a little later where I’ll discuss the upside of the mortgage servicing business along with another new investment I just made; in Newcastle Investment). I also love that the company trades at about half of tangible book and at around 4x a core earnings number that truly does represent the core earnings metric that should be used to evaluate the company.

What I had kind of ignored up until this this week was the company’s Fleet business. It seemed like it was making money, it wasn’t really a core part of my reason for owning the company, so I just disregarded it as something that wouldn’t necessarily hurt the investment thesis but was not really something I wanted to focus on.

What is Fleet Management?

The best definition I could find as to what the business of fleet management is all about came from wikipedia:

Fleet management is the management of a company’s vehicle fleet. Fleet management includes commercial motor vehicles such as cars, vans and trucks. Fleet (vehicle) management can include a range of functions, such as vehicle financing, vehicle maintenance, vehicle telematics (tracking and diagnostics), driver management, speed management, fuel management and health and safety management. Fleet Management is a function which allows companies which rely on transportation in their business to remove or minimize the risks associated with vehicle investment, improving efficiency, productivity and reducing their overall transportation and staff costs, providing 100% compliance with government legislation (duty of care) and many more. These functions can be dealt with by either an in-house fleet-management department or an outsourced fleet-management provider.

So what’s so great about that?

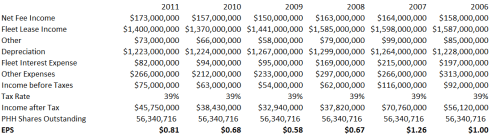

This week I ran a quick set of earnings numbers on the PHH Fleet business:

If you average earnings over the last 6 years you get average earnings of $0.83 per share of PHH.

Think about that for a second. Here you have a business that has shown the ability to earn money consistently, even through what was probably the worst recession of our generation. What would you value such a business at? 10x earnings? 12x earnings? 15x earnings?

If you start running the numbers at those kind of multiples on the average and peak earnings numbers, you realize pretty quickly that the Fleet business could be worth something pretty close to the current stock price. Or in other words, when you are buying PHH you are buying the mortgage business for very little.

Moreover, as one would expect, the fleet management business is going to improve along with the economy. As per last year’s 10-K:

The fleet management industry continues to be impacted by the relative strength of the U.S. economy. As the U.S. economy improves, we expect to see continued improvement in the industry. We believe that improvement in the economic conditions will be reflected in continued growth in our service unit counts.

If I am right about my previous speculation that the US economy is improving, the Fleet business could turn out to be a cash generating machine for PHH.

One last point. When you see the value that appears to be unrealized in Fleet you have to wonder whether there could be a spin-off of Fleet from the rest of the company at some point. There was a question on the Q4 conference call that alluded to this possibility. Management did not deny it, saying only that it wasn`t an appropriate topic for a public forum. Meanwhile, what better way for a cash strapped company to raise cash then to spinoff a somewhat unrelated business that isn’t being realized at fair value anyways. For those of you not familiar with spin-offs I would recommend Joel Greenblatts excellent and terribly titled book, How to be a “Stock Market Genius”. While there is no guarantee that a spinoff of Fleet will occur, the cards are all aligned.