Last week I decided that I would abandon all other research and devot my spare time to evaluating Canaco’s Mogambazi deposit. I have been thinking more about Canaco recently because the stock has fallen from such heights that even now, after the recent 50%+ move, the stock is less than a third of its highs.

I noted last week that Canaccord Capital has said that they expected the soon to be released NI 43-101 report to show 2.3 Moz at around 3 g/t.

I thought it would be an interesting project to come up with my own estimate. So that’s what I did. As you will read, I had some difficulties, was left with a big question mark, but learned a lot along the way that will help me evaluate Canaco and Magambazi going forward.

But first a bit about Canaco

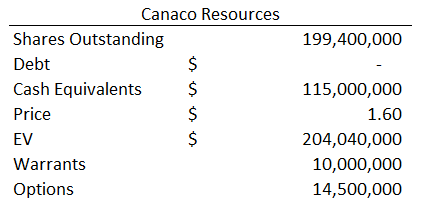

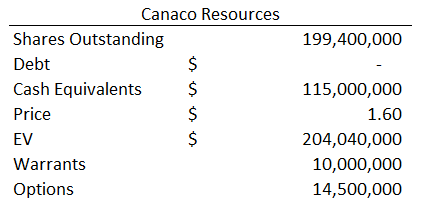

While Canaco has fallen rather dramatically over the last year, the still stock commands a rather large enterprise value for an company exploration company.

Even after subtracting the current cash on hand of $115M, the stock still sports a valuation of $200M. For $200M you need to be getting a lot of gold to make the upside worthwhile.

The gold is at Magambazi

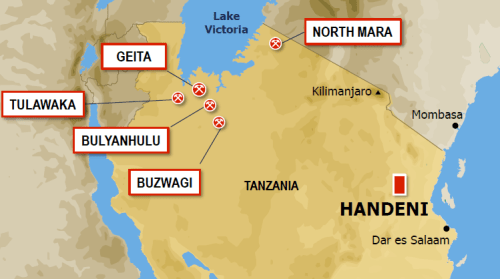

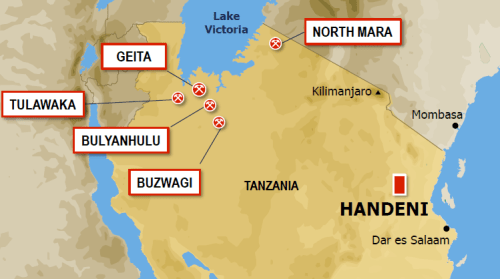

Canaco is a one trick pony and that one trick is Magambazi. Magambazi is in the eastern part of Tanzania.

There has been a lot of gold found in Tanzania but it is all in the northwest. There has been almost no historical exploration in the eastern part of Tanzania. That is because the geological intrepretation was that the Sukumaland Corridor, which is the belt that holds all of the gold on Tanzania, extended only to the western part of the country. In 2007 this changed, and academic research began to reinterpret the geology as extending much further to the east. It was around this time that Canaco stake claims around Handeni, and soon after that they returned their “discovery hole” at Magambazi of 53m of 4.32 g/t.

The deposit

The Magambazi deposit consists of a number of zones, or what the company calls lodes, that run any where from a few hundred metres to a kilometre along strike.

The most prominent of the lodes is the Main lode. The Main lode hosts the original discovery and also a number of other impressive intercepts with rather eye-popping numbers.

The most prominent of the lodes is the Main lode. The Main lode hosts the original discovery and also a number of other impressive intercepts with rather eye-popping numbers.

When you look at these drill intercepts your first reaction is that there must be a massive amount of gold here. Numbers like 48 metres of almost 15 g/t are extremely high numbers. The problem that I have found in the course of my evaluation, and perhaps this is why the stock has done so poorly over last year, is that the gold is erratic. More often than not, that long high grade intercept will be right next to a much shorter or much lower grade intercept, suggesting a quick pinch off, or even to a barren hole entirely, suggesting a fault line that ended the mineralization.

The numerous faults present in and around the deposit make any evaluation complicated. They create sudden start and stops to the mineralization that are difficult to pin-point exactly without dense drilling. I have to wonder how this will affect the Ni 43-101 that is going to come out in a few months? Will the evaluator be forced to make conservative assumptions with respect to where mineralization begins and ends?

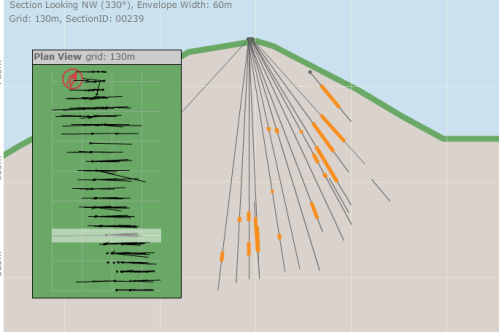

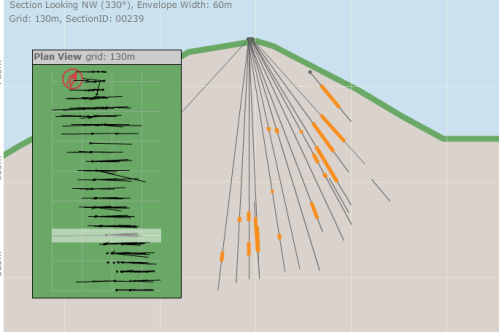

The deposit also has a number of very quickly narrowing finger like strands. These also make it difficult to evaluate without a lot of drill holes. Take for example the following section from the company’s presentation. In particular, focus on hole 265. Here is one of those fairly monster like holes, grading a little over 3 g/t over 56m. But notice hole 6, only a few meters away. The mineralization goes from robust to not even reported in the presentation very quickly.

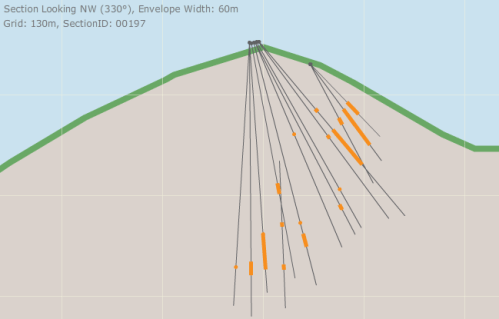

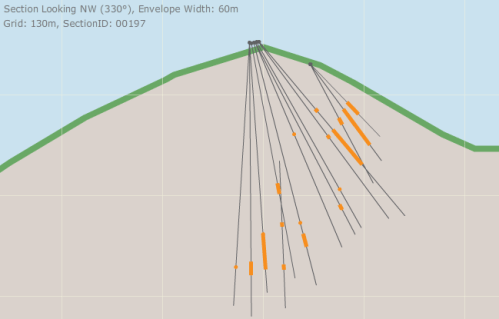

Another example of the same sort of quick pinch out can be seen from hole 134. Taken alone, at 34m of 2g/t, you would think that it has discovered another lode comparable to the main lode. But 225 quickly demonstrates that the lode pinches out quick to the east, and 220 shows that the lode ends abruptly due to a fault to the west. The overall ounces present in such a lode are not as impressive as the single intercept would suggest.

The point here is that you simply can’t take a bunch of drill intercepts and extrapolate the robustness of the deposit. You probably shouldn’t do that in general and you definitely can’t do that with Magambazi. You really have to look at it in detail and make out what the actual orientation is. So that is what I did.

The Power of Corebox

Corebox.net is a website that hosts a powerful and rather surprisingly free tool to help you evaluate mineral deposits. The tool holds a database of drill results for more than 100 different deposits. It displays those drill results in 3-d form, making it really quite simple to look at each cross section individually and evaluate continuity, overburden, etc.

The Magambazi project is on Corebox. This greatly simplified my work. Its a very empowering (dangerous?) tool because it lets you attempt evaluate a deposit to a degree that you would otherwise only be able to guess at. I have tried to do this sort of work before on other projects where I didn’t have Corebox. There isn’t a great way to graphically display the angles correctly, so in the past I ended up using a crude approach whereby I summed up lengths and multiplied by what the total width of the end holes were. This isn’t very accurate. Corebox eliminates the need for such simplifying assumptions. It also gives you the great advantage of being able to visualize where the deposit is with respect to topography.

My Process

Evaluating a deposit is time consuming, getting the information is a struggle, but overall it is not a complicated process. Basically I had to go through the following steps.

- Determine a volume of the deposit. You do this by simply figuring out the length x width x height of the ore bearing gold

- Use the volume to determine a mass of the deposit. Mass is simply volume multiplied by density (or specific gravity)

- Make an estimate of the average grade of the deposit and multiply that by the mass to determine the amount of gold in-situ

- Convert the grade from grams to ounces and you are done

Step 1: Determining the Volume

This is the step where corebox really helps out. Canaco has drilled the Magambazi deposit at 40m spacing. The birds-eye view of this drilling is shown below.

With corebox you can look at each of these cross sections and try to deliniate the deposit.

How did I do that?

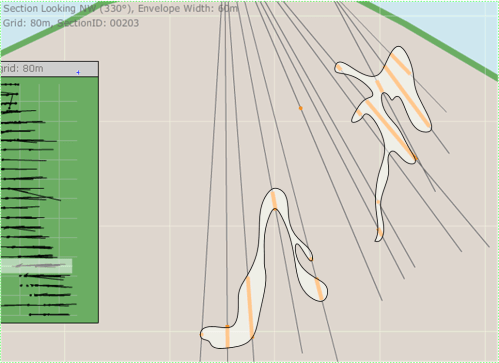

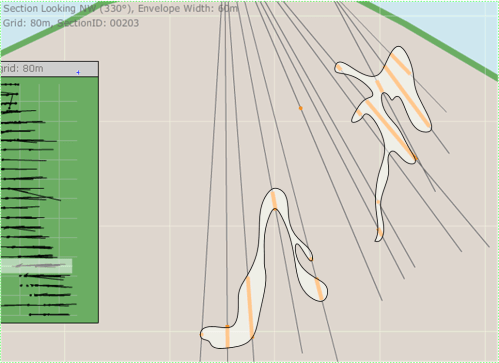

First I used the Microsoft program Snipit to snip the screen shot of the section. So I got something like this:

Next I had to find a program that would allow me to draw the deposit in free form around the drill holes but (and here is the tricky part) then tell me what the area of the resultant irregular polygon was. This proved to be difficult to find. The first program I used was a app on the web called SketchandCalc. It worked fine, you can import the image, you draw your shape and it calculates the area and as long as you have a reference block on your image of known area you can scale that block to determine the actual area of your shape. With a section like the above one, the reference block is the 130m x 130m grid block so you just sketch deposit, record the area and scale appropriately.

I probably would have stuck with SketchandCalc but I ran into some problems with my results not being quite what I expected (more on this later). This led me to question the validity of the area being calculated by the program. I went out searching for a second program to use as verificiation. As it is, it turned out to be rather fortuitous because one thing SketchandCalc doesn’t let you do is save the sketches so you have no record of your work. After much searching (there is truly a dearth of programs available on the web for calculating area) and many failed attempted to determine the area using Powerpoint (you can’t do it), I figured out that another Microsoft program, Visio, works extremely well for the task. By the way, it turned out that there was nothing wrong with the calculations by SketchandCalc, my Visio results matched up well to my original SketchandCalc work.

My Visio sections

Its really easy to draw and get the area of a section in Visio. You just have to do the following:

- Import the screen capture of the cross section into Visio

- Draw out the shape of the deposit to align with the intercepts

- Under the tools add-ons there is a Visio Extra that allows you to calculate the area and perimeter of an irregular polygon. Use this to get the area of the shape and of the reference block

What you end up with (for example with section 200 that I showed above) is something like this:

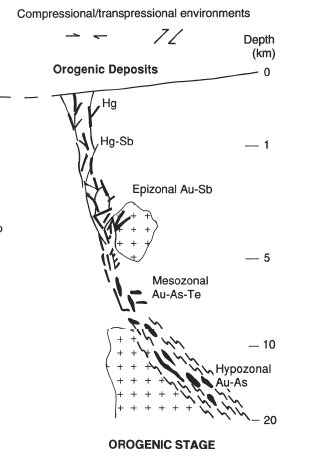

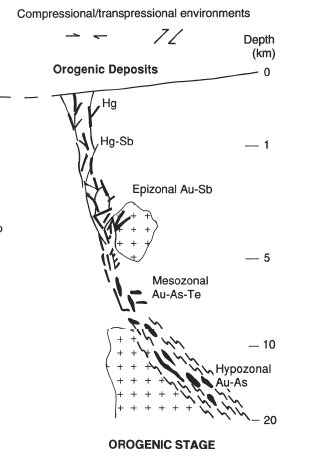

What a Orogenic deposit should look like

So clearly there is some interpretation going on here. And I am not a geologist so you do have to take my personal interpretation of the deposit with a grain of salt. With that said, before drawing out a bunch of squiggly envelopes I did do some research into the type of deposit at Magambazi to get a better idea of how one might expect the gold to be disseminated.

Of particular help was a fellow named D.I Groves. Groves is referenced numerous times in the 43-101 and I think it is fair to call him an expert on deposits of the Magambazi type. Magambazi is a Orogenic gold deposit. An orogenic gold deposit is a type of mesothermal deposit, which means a deposit that was created by the influx of water from deep in the earth’s crust that has been heated and risen through cracks and fissures, taking some gold along with it. Where this water find “traps”, meaning non-porous barriers that prevent it from rising further, it stops, and over time the water dissipates leaving behind the minerals it carries.

It used to be (and maybe still is in some circles) that all mesothermal deposits were called mesothermal deposits, but Groves wrote a few papers on the subject arguing that these deposits should be further categorized based on a bunch of technical geological attributes that aren’t really that important to what I am trying to accomplish. One such deposit type was named an Orogenic deposit, and the term must have stuck because in the NI 43-101 filed on Sedar by Canaco, the deposit is referred to as being of the orogenic variety.

Most importantly to what I am trying to accomplish is that Groves provided some descriptions and a few useful pictures about the specific nature of an orogenic deposit, how it evolves and thus how one might expect the gold to be deposited. One such picture is shown below.

What you would expect to see at Magambazi is a number of thick, organ like veins with small branches jutting up from the deeper sources. This is exactly what you get in Canaco’s own interpretation as illustrated in a couple of the cross-sections they make available in their February presentation. At Magambazi there is the added complexity of vertical faults along strike throughout the deposit, resulting in sudden terminations and offsetting of the mineralization.

For reference, the interpretation I used for these same two sections are below:

For reference, the interpretation I used for these same two sections are below:

With Section 280 (on the left in both pictures) you can see a few spots where corebox wasn’t perfect; where the complete drill result wasn’t shown in the cross section. I was careful about this, and whereever there was a discontinuity where it didn’t seem there should be one I checked the actual drill results against what corebox was showing to make sure corebox didn’t miss one of the shorter or lower grade intercepts (in a few cases it did).

With Section 280 (on the left in both pictures) you can see a few spots where corebox wasn’t perfect; where the complete drill result wasn’t shown in the cross section. I was careful about this, and whereever there was a discontinuity where it didn’t seem there should be one I checked the actual drill results against what corebox was showing to make sure corebox didn’t miss one of the shorter or lower grade intercepts (in a few cases it did).

Overall though it did a nice job.

There were 25 sections in the deposit spaced 40m apart. I basically spent my lunch hours last week drawing funny looking shapes in Visio (and/or SketchandCalc) for each one of these sections. I have a link to my visio sections here.

Because I am not trying to be excessively detailed, to compute a volume I made the simplifying assumption that each cross section was valid for a 20m strike in each direction, meaning that each cross section represented 40m of the deposit. Volume was therefore calculated by multiplying each cross section by 40m.

Organizing the intercepts and getting an average grade

The other tedious task was taking the long list of drill intercepts and determining which cross section each belonged to. Canaco provides a list of all the drill intercepts here. Basically I took the PDF file and turn it into an excel file (something that turned out to be more complicated then it should have been), and then went to each of thecross sections, found all the intercepts that lay within that cross section and grouped those intercepts together.

Now if I had been doing the analysis with the detail of an actual report I probably would have broken up each cross sectional volume up into smaller blocks, determine the average grade in each block and then determined that amount of gold in each block discretely. But that is too much work. Instead I made the simplifying assumption that the average grade in each cross section is constant throughout the section. I determined the average grade per section by summing up the length weighted grade of each intercept and then dividing by the total length.

I have a spreadsheet that I have tried to make available here with the data.

I calculated the overall average grade for the deposit as a whole as being 3.66 g/t.

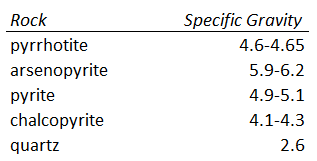

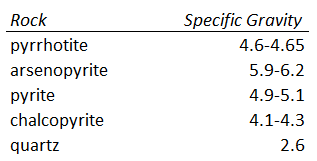

Figuring out the density

As it turns out, determining the density is was BY FAR the hardest part of the process.

The density that we are interested in is the density of the rock that immediately hosts the gold mineralization. The density is typically defined in terms of specific gravity, which is the ratio of the density of rock to the density of water. I have exhaustively researched what to use as thespecific gravity (also sometimes referred to as bulk density) and to be honest, I’m just not sure. This is a real sticking point and what it means is that I can’t report my results as a single estimate. Instead I’lll have to give a range of ounces depending on the specific gravity assumed and we’ll just have to see how it turns out when the actual resource comes out.

My initial assumption was that the density was simply the density of quartz, or maybe a little bit more. Quartz has a density of 2.6. According to the initial NI 43-101 put out by Canaco (Page 8):

In situ gold is spatially associated with quartz vein zones within silica and garnet altered amphibolite gneiss. Mineralization is commonly associated with arsenopyrite (possibly also loellingite), pyrrhotite and graphite. Visible gold is commonly present in drillcore.

And then later on, talking specifically about the Magambazi zone (Page 9):

Gold is spatially related to quartz veins within silica and garnet altered amphibolite.

So its quartz. Plug in 2.6 and its end of story right?

Wrong. Or at least I think so. The problem is that if I use 2.6 as my density I don’t get anywhere near as many ounces as I should. A specific gravity of 2.6 gives me a little over 1,000,000 oz of gold.

This is where the real work began. As I mentioned early, the first thing I thought was that there must be something wrong with my cross-sections. Enter visio and a rigorous re-evaluation of each intercept (sometimes 3 times!). Eventually I was satisfied that my original cross-sectional estimates were fine, and that this wasn’t the problem. Next I thought I might be using the wrong spacing. Was it 80m (my number was about 1/2 of what I would have expected). But no, its not, the spacing is 40m. I also checked all my units (intercepts are recorded in metric, gold is reported in grams per metric tonne, specific gravity is in tonnes/m3) so no that’s not it either.

The only parameter I am left with uncertainty about is the specific gravity.

My theory is that the gold is hosted in a quartz that has a lot of heavier pyrite (basically iron sulphide) in it. Maybe its even all pyrite. There is some evidence that leads me to this.

First of all from the NI 43-101:

Page 42: Mineralization is characterized as vein‐related structurally‐controlled orogenic gold associated with pyrrhotite, arsenopyrite, and locally graphite

Page 100: Mineralized zones at Magambazi and Magambazi North are distinctively mineralized with pyrrhotite and arsenopyrite, with graphite and chalcopyrite present locally. Additionally, graphite appears present in significant quantities related to major fault structures.

And second of all, from the original discovery press release:

The 293 metre drill hole (MGZD 001) has intersected a broad, intense alteration zone and sulphide mineralization (pyrrhotite, arsenopyrite, pyrite and chalcopyrite) with trace amounts of visible gold in eight separate metre intervals

Pyrrhotite, arsenopyrite and pyrite all have much higher specific gravities then quartz.

Therefore if the rock has a significant amount of pyrite in it, the specific gravity would be higher, which would help to raise the ounces to an amount more consistent with the Canaccord estimate. I scoured the net looking at the NI 43-101 of other projects that appeared to have the gold hosted in pyrite. Unfortunately I wasn’t able to find a single instance where the vein was not dominated by quartz and thus where the specific gravity was significantly higher than 2.6.

Finally I emailed the company and asked them if they would tell me what sort of specific gravity to expect. Unfortunately they wouldn’t give me a number but they did say:

We don’t have an exact number yet for the specific gravity of the rock but it’s hard silicified material, so likely a higher density than your average mineralized system.

Exactly how much higher remains an open question.

Summing up the resource

I’ve already mentioned the spreadsheet that I built to sum up the resource. Basically all I did was take the volume for each individual section and convert that volume into a mass using the specific gravity of the rock (in this case 3 scenarios with a range of specific gravity’s between 3 and 5). Once I had the mass, I multiplied that mass by average grade of gold in that section (as determined by by weighted averaging) and then converted that gold from grams to ounces.

What I ended up was the following:

All 3 of these estimates are lower than I would have expected. To be honest, I’m not sure what to make of that. I don’t know how much I trust my own work given the uncertainty with specific gravity and obviously the low-tech tools I am using. But before I draw any conclusions about the results, I want to talk for a second about some of the potential sources of error.

All 3 of these estimates are lower than I would have expected. To be honest, I’m not sure what to make of that. I don’t know how much I trust my own work given the uncertainty with specific gravity and obviously the low-tech tools I am using. But before I draw any conclusions about the results, I want to talk for a second about some of the potential sources of error.

Sources of error

Even my high specific gravity estimate is on the low side of the estimate provided by Canaccord (they estimated 2.2Moz). I suspect the actual specific gravity is closer to 4, which would mean that my estimate is really quite a bit on the low side. I am of the opinion that Canaccord probably knows more than I do, so I am pretty sure there is something being under-estimated by mine. With that in mind there are a few other potential sources of error in the calculationsthat could be responsible for the discrepancy.

First, as I mentioned already, there is a lot of interpretation involved here, and perhaps with Visio I was making the connections between drill holes too narrow or too short. I do admit that I was consciously erring on the side of conservativeness when I drew out each section, though I didn’t think that doing so would have such an effect. I played around with this a bit to see how sensitive the resource is to changing the cross sections. Its actually not that much, not unless you start getting really creative and adding mineralization where there clearly isn’t any. If you are just tweaking the known areas to make them a bit bigger, you might be able to add 200,000 oz but you would have trouble adding more. My conclusion is that this can’t be the only issue.

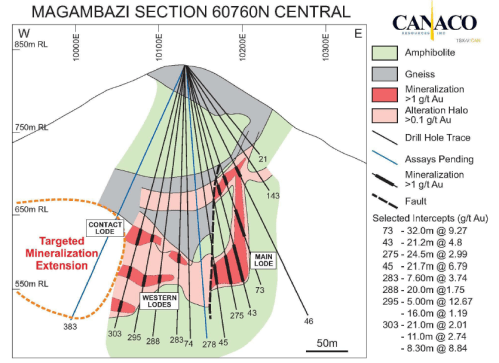

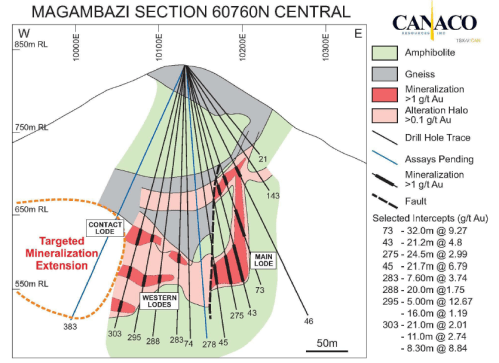

A second potential source of error is that the high grade intercepts are surrounded by a low grade halo of gold. Canaco didn’t report the low grade numbers in their press releases or in the 43-101 so its really difficult to get a handle on their significance. The 43-101 did have this to say about the low grade:

What is apparent from sectional review is that significant gold is present outside of acknowledged ‘main zones’ of mineralization, or key intercepts as documented, and the mineralization system is in areas, seemingly pervasive. While separate internal gold intercepts exist that would be considered high‐grade in terms of underground mining assessment, the overall type of mineralization can be difficult to quantify, and requires assessment as a potential pitable target.

If you look at the cross sections Canaco provides you get an idea of how significant the low grade is. The halo is the light red areas.

Based on what the 43-101 says, I think the halo likely has a grade of aroud 0.3g/t. Perhaps if you add this up over the entire strike of the deposit you might get another 500,000 oz, which would put you more inline with what Canaccord is estimating.

A third source of potential error is that corebox isn’t scaling correctly. I tried to verify this by taking a number of intercepts and measuring the depth of the intercept versus the length, and seeing whether the ratio was correct. In all the cases that I tested it matched up. But that does not preclude the possibility that some of the cross-sections I used to estimate area had error.

What other conclusions can you draw?

Aside from the resource number, I can draw some other qualitative conclusions about the Magambazi deposit.

1. This is not evenly disseminated gold.

The point here is that with an open pit project it is going to be difficult to maintain a consistent mill feed. The project dips from north to south, with the north being the closest to surface. Unfortunately the north has the lowest grades and the shortest intercepts. If you look at the deposit section by section, the northern most third of the deposit has on average 16,000 oz of gold per 40m width. This compares to 49,000 oz per 40m in the central part of the deposit and 70,000 oz per 40m in the southern part. Its not a uniform deposit and the deepest part of the deposit is the most economical.

2. The strip ratio is going to be pretty high

I didn’t calculate the strip ratio but it is clear from looking at the cross sections such as the one’s I have highlighted above that much of the gold is deep and vertically oriented, which is going to mean that you have to move a lot of waste to get to it. The ore at the northern end of the deposit is near the surface, but towards the central and especially southern portions that deposit deepens significantyl. To give just a couple of examples, taken from the company’s own cross sections:

You can see just how much waste lies above the gold.

You can see just how much waste lies above the gold.

3. The widths and grades of mineralization vary significantly

Perhaps one of the reasons that I struggled to match my estimate to Canaccord was because the mineralization changes so suddenly. While stepping through the deposit I found again and again the situation where a long, high grade intercept was offset by a shorter or much lower grade intercept. This has a consquence for the eventual mining operation of course but it also has a consequence for the upcoming Ni 43-101. There is certainly some wiggle room for the evaluators to mark up or down the resource depending on the interpretation they use. It’s not necessarily a good or bad so much as a risk.

What am I going to do?

At the end of the day I do this sort of analysis and it really comes down to a decision of whether I am still going to hold the stock or whether I am going to sell it. At the price level that Canaco is currently at I am inclined to hold. I would be reluctant to buy much more though.

As Steve T pointed out in one of his comments the other day, you really are holding a stock like Canaco for the potential that they can grow the deposit beyond its current size. At its current market capitalization I would say that the company is probably fairly valued for the resource it currently has, but there is certainly upside potential as the resource expands. Management gave a good presentation on the potential of the land package around Magambazi at the Denver gold conference this year. There are plenty other anomolies around Magambazi that are left to be explored, these anomalies are virtually untested historically, and because of the high levels of pyrite associated with the gold they are easy to detect through surveys. I wouldn’t be surprised to see more success from Canaco as they expand the envelope that they explore. So I will continue to hold my position on that speculation.

You could run the same sort of sensitivity with grade and you’d get about the same thing. Dilution and grade are really two sides of the same coin; the outcome of the two combined is the actual grade of the rock being mined and processed.

You could run the same sort of sensitivity with grade and you’d get about the same thing. Dilution and grade are really two sides of the same coin; the outcome of the two combined is the actual grade of the rock being mined and processed.