Trying to understand Equal Energy’s position in the Mississippian Lime

I’ve spent a few hours this week trying to get a better idea of just how pervasive the Mississippian lime and chat formations are in Oklahoma, and to a lessor extent in Kansas. My investigation was precipitated by some comments by Equal at the Enercom conference a couple of weeks ago. I will talk more about those comments at the end of the post, but first I want to go through what I have learned about the Mississippian.

I found investigating the Mississippian to be a tough slog; the information is sparse, some of the companies are private, and most of the others are large multi-play companies like Chesapeake and Range, and so they don’t divulge the well by well granularity that I am looking for.

Nevertheless I think I’ve developed a decent picture of the extents of the play and the well results so far. What I will try to do below is step through the companies with acreage in the Mississippian and where that acreage lies, trying at the same time to put together a picture of the field and how prospective Equal’s land might be in relation to others.

I’ve limited this discussion to the economics of the Mississippian play. I looked at expanding to geology and how it might change across the extents but I just haven’t been able to find enough information to develop a coherent analysis. For now we will have to look at where the wells are being drilled and how successful are the results and draw conclusions from that.

Sandridge: King of the Mississippian

Any discussion about the Mississippian has to start with Sandridge. They are the largest land holder, the largest producer, and I’m pretty sure they were the first mover in terms of trying out the hz multifracs on the formation.

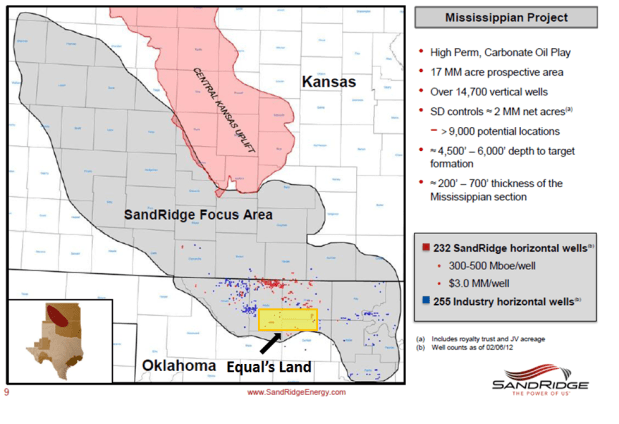

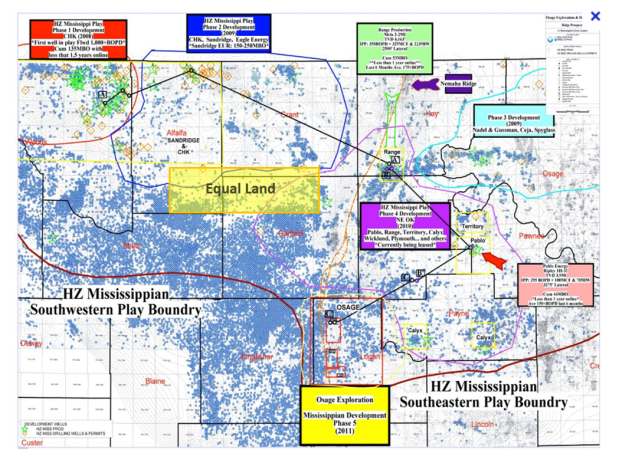

Sandridge provides a good map of where they have been drilling horizontal Mississippian wells so far. I have highlighted where Equal’s land sits in yellow.

You can see from the little red and blue dots that most of the activity in the Mississippian has been centered around Northern Oklahoma. Equal’s land is right on trend, if only slightly south.

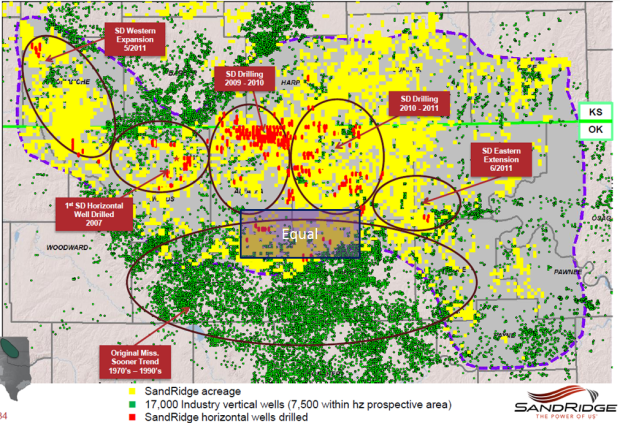

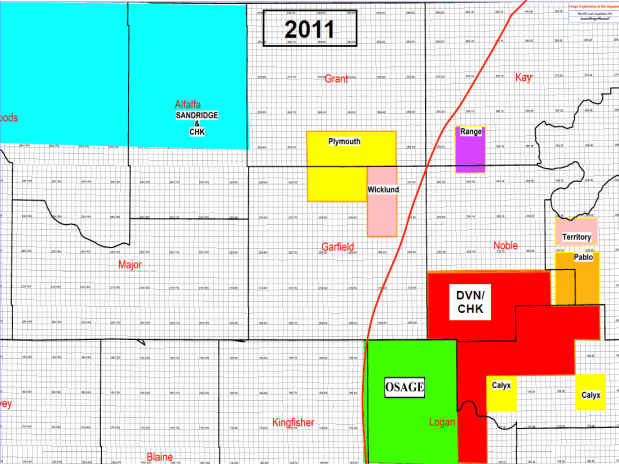

Sandridge (the red dots) has been drilling most of their wells to the north of Equal, but still in the same counties, Alfalfa and Grant. Sandridge provided a close-up of Grant, Alfalfa and Garfield counties in a later slide. Again I have tried to deliniate Equal’s land with respect to Sandridge. Based on the graph, and Equal’s own presentation that maps out their land holdings, it is clear that Sandridge surrounds Equal with their land package.

Valuing the Mississippian

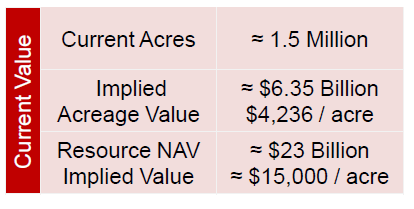

During the Investor/Analyst Day on February 27th, Sandridge stepped through the valuation of the Mississippian. Sandridge puts a value of $4,236 per acre on their Mississippian land.

The acreage value is implied from the joint ventures that Sandridge has completed with Repsol, Antinum, etc. The resource NAV is more subjective; it is an estimate of the eventual NAV of the land once it has been fully developed and is producing oil.

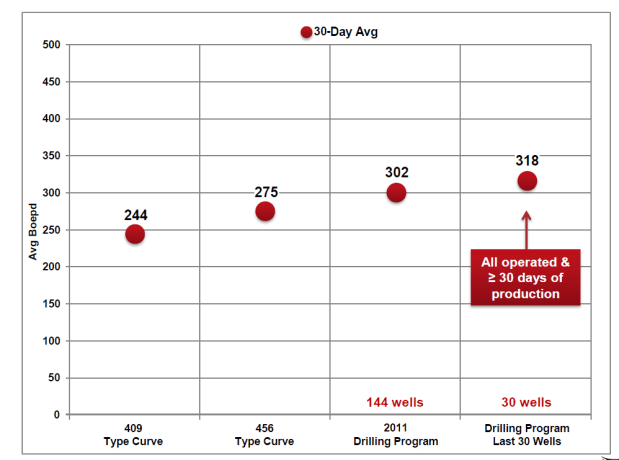

Sandridge has been showing improved success as they drill more wells. This is exactly what I would expect. It happened in the Bakken, it has happened in Equal’s own area in the Lochend, it has happened at Swan Hills with the Beaverhill Lake. As operators experiment and figure out what works and what doesn’t results improve. Below is an illustration of how the Sandridge 30 day average has improved over time, taken from their Credit Suisse presentation.

Sandridge put the following economics on the Mississippian in their Analyst Day Presentation.

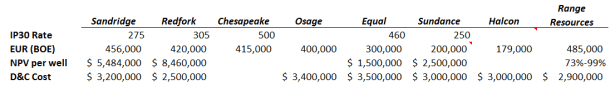

I thought it would be an interesting exercise to see how these economics compared to other players in the Mississippian. Below I have compiled a comparison of all the players with public data available regarding their Mississippian productivity estimates.

In the case of Range Resource, the company doesn’t provide a NPV estimate but did provide an ROI during one of their conference calls, so I have included that.

These estimates bring up the question of where some of these other companies are operating with respect to Equal. Osage Exploration has a decent map of the Oklahoma acreage that can help deliniate that. Its a bit cluttered but it helps to point out where some of the other companies have been drilling. Again the area where Equal Energy owns acreage is highlighted in yellow.

Range Resources and Nemaha Ridge

If you look at the upper right of the graph you will see a purple arrow labeled Nemaha Ridge that is pointing to a yellow line going north to south. Range Resources has built up a land position along this ridge, east of Equal’s land.

Range Resources had some interesting comments about the Mississippian on their Q3 and Q4 conference call (taken from SeekingAlpha). First, here is what Range says about their acreage around Nemaha Ridge:

We are on the ridge. So you have that whole area that’s been defined and there’s different mats out there. So there’s — you can go west of the ridge, on the ridge or east of the ridge. It’s interesting — and I saw somebody put a map out to just look at historical vertical wells out there. If you look at where the best historical, vertical oil wells are, that’s where range’s acreage is. Somebody asked me offline, why do your wells — it’s early on and granted, can we hold it up? And as we drill, we will continue to see those results, but why are your wells look so good for the — why you’re getting the 485,000 barrels for 2,000 foot lateral, while other people are drilling 4,000 foot laterals and their reserves are in the same range? And if you look at the historical vertical wells or where the best wells are, that’s where are our acreage is in and around. So it’s necessarily east of the ridge or west of the ridge. It can be on the ridge or there’s — just like in all of these plays, where your acreage is really matter.

Next, here is what Range said about recoveries along Nemaha Ridge:

Particularly if you look at the oil plays, specifically like the Mississippian, we put out recovery factors of 4% to 9% of the oil in place. Do I expect ultimately it’ll be that? No, I would say it probably will be higher.

They also had the following to say about EUR:

I think in any of these places it’s really important on where you are. There’s always a core area and non-core areas. There’s better areas and poor areas. I would say looking at the results of our Mississippian wells even though it’s early, there’s only 8 wells, but the average results of 485,000 barrels per well… [up on nemaha ridge] you have a chat component to your production… The chat — when you get off structure, you tend to lose chat or you don’t have nearly as much. The porosity in the chat is 30% to 40%. The porosity in the carbonate is 3% to 5%.

When asked by one of the analysts during the Q4 conference call about the variability of results being seen in some areas of the play, Range had this to say:

I think in any of these places it’s really important on where you are. There’s always a core area and non-core areas. There’s better areas and poor areas. I would say looking at the results of our Mississippian wells even though it’s early, there’s only 8 wells, but the average results of 485,000 barrels per well is really great. It’s outstanding. So I feel comfortable that we’re in a good position. And we think really what drives that is the fact that where our acreage is located.

Chesapeake: Alfalfa and Woods Counties

Chesapeake owns a large parcel of land in the Mississippian. The company is not as forthcoming as Sandridge and the smaller players about where the acreage is or what their results have been. I don’t think this has any nefarious intent; they are simply a big company involved in many plays and they don’t have the space in their presentations to deliniate each play in detail.

According to their comments on the Q4 conference call, most of their drilling has been centered around Alfalfa and Woods county, which would mean just to the west of Equal. This agrees with the Osage map above, which highlights an area in blue around Alfalfa county as being primarily CHK and SD.

Chesapeake has participated in about 70 wells in the Mississippian so far. Of interest, in their fourth quarter conference call the company said that the Mississippian would be seeing 22 rigs this year, second only to the Eagleford.

We do expect our operated rig count will stay relatively level for the year at an average of approximately 161 rigs for the year. This is including 33 rigs in the Eagle Ford Shale; 22 in the Miss Lime play; 20 in the Cleveland and Tonkawa plays; 14 in the Utica Shale play; 13 in the Granite Wash plays; and 10 in the Permian Basin.

Devon and Osage Exploration: To the southeast

Devon Energy (DVN) has 210,000 net acres of exposure to the Mississippian oil play in Oklahoma and Kansas. Devon bought land to the south east of where Equal owns land. Devon and Osage own land in very similar location.

Apparently, Devon Energy drilled twelve to fifteen vertical wells in the Mississippian oil play in 2011. Because they are a big company involved in multiple plays (much like Chesapeake) finding individual well data is difficult, even more difficult then Chesapeake. However the company did report during its Q4 conference call that it had drilled its first succesful horizontal well (again from SeekingAlpha):

We drilled our first vertical well in the second quarter of last year to gather data and have since drilled our first horizontal Mississippian producer, yielding very encouraging results. The Matthews 1H was brought online in the fourth quarter and achieved a 24-hour sustained IP rate of 960 barrels of oil equivalent per day, of which greater than 80% was oil. Through the first 30 days of production, the well averaged 590 barrels of oil equivalent a day.

Devon doesn’t describe where its land is. In one of the companies presentations they point to land holdings in SE Oklahoma but mainly with the intent on drilling gassy Woodford shale wells. There is no other mention by Devon of any Oklahoma acreage. Luckily, Osage Exploration again provides an excellent map of where both they and Devon have a significant land base.

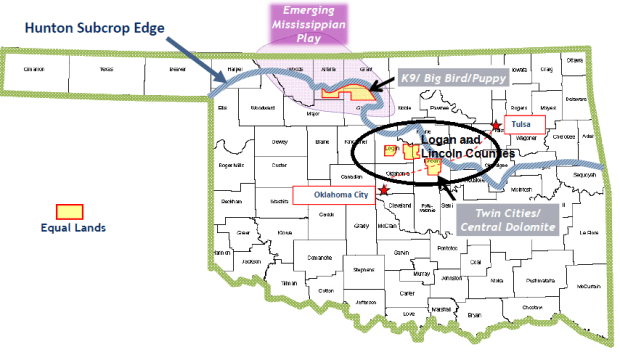

An extremely interesting point with respect to this map is that Equals Hunton lands are right in the middle of Logan and Lincoln counties, which are just to the south of the red and green blocks in the Osage map above.

Osage drilled one well at the end of December in Logan county and spudded another in mid-January. There are no results yet, which would normally be somewhat discouraging, except that the stock price of Osage has gone rather ballistic over the last two months (up from 45 cents to 70 cents). That and the the anecdotal Devon well leaves me wondering if Equal has more Mississippian acreage than they at first suspect?

Red Fork Energy: A Detailed Well Result

Red Fork energy is an Australian company that has been mentioned a number of times on the InvestorsHub Junior Energy Board. According to a recent news release, they control 60,000 acres centered around the Nemaha Ridge (Payne, Kay and Pawnee counties) but extending as far west as Grant and Noble counties. According to their presentation (which is from March 2011 btw) they expected to drill 11 wells in 2011. I think that number ended up being more like two. nevertheless, I stepped through the company news releases (here) to see how that drilling went. They provided a rather detailed account of the company’s first well, releasing updates on almost a two-three week basis.

The company’s first well, in Pawnee county, was estimated by Schlumberger to contain OOIP of 58.4mmbo per section. At a 5% recovery this would give 290,000bbl of oil per section, and presumably at 4 wells per section a little over 70,000bbl per well. The company said they expected 3-5 Mcf of associated gas per barrel so that would put an overall hydrocarbon EUR of around 500,000boe per section or 125,000boe per well assuming 4 wells per section. So pretty so-so numbers.

They fracked the well with 12 stages and provided information on the following 24 hour flow test:

The well produce 240 barrels of 28 degree API gravity oil, 240 Mcf of 1,300BTU gas, and 1,600 barrels of water by pumping via ESP and intermittant flow through the casing.

Don’t get too scared off by the water number. I have read numbers as high as 3,000bbl/d of water from some wells. It sounds like a lot, and is a lot, but it is being managed by Sandridge and others and isn’t indicative of any sort of watering out.

They follows that up with a news release on December 22nd and another on January 20th clarified that the well was producing at 300boe/d with about 80% of that being 38 degree API oil.

A second offsetting well (called Abunda 1-21H) is just finishing drilling in Pawnee. The company is also in the process of drilling two wells in Noble County (McMurtry 1-22H and Blair 1-24H).

Equal Downplays the Mississippian

If you take in all the information from above and try to sort out some conclusions from it, I think its reasonable to say that the Mississippian is slowly being derisked, and it looks like its a productive and economic play. Yet Equal seems to be really downplaying the potential. If you listen to the presentation that Don Klapko gave at the recent Enercom conference it really focused on the negatives, in particular the risk of a 50 boe/d duster.

The slide in question is slide 12 from the presentation:

The essence of the slide is that Equal has gone through all the public data and determined that the economics are just not up to par with the other plays the company has, at least when considered against the risks.

At the conference Don Klapko had the following to say about the Mississippian:

Our vision here is to liberate the value. What we’ve done is taken all the public available data and mashed it together. We are seeing is aout $3.5M capital expenditure, about 300,000 boe that kicks out at 25% rate of return… now I bet you guys are hearing a 75% rate of return on the mississippian play, well some wells will do that but you can also invest $3.5M and get a 50 boe/d well.

Now clearly part of the reason he is playing down the Mississippian is because of the need to justify the farmout. Why would you farm it out if it was the the highest ROR? So that makes sense. The point is that the EUR estimates from other company’s are quite different than what Equal is estimating.

So I don’t know what to say. I’m not sure where Equal’s public data is coming from and maybe they have access to more data than I have access to. I can only go by what I have access to and the fairly rigorous analysis of what I have available to me does not paint the picture of a marginal play. Its still early of course, but so far the results look pretty good, and appear to be improving as the engineers get a better handle on unlocking the play.

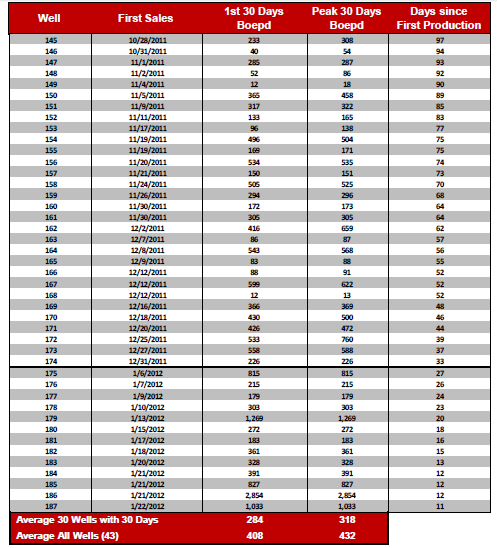

Below is a snapshot from another Sandridge presentation, providing estimates of 30 day production rates for the latest wells drilled in the Mississippian.

While there is indeed the odd 50 boe/d duster, there are far more 1,000boe/d + boomers. Particularly of late. 5 of the last 12 wells have seen 30 day IP’s of over 800 boe/d.

There are differences between regions, so that is a risk. Perhaps Equal knows, or suspects, that the land they own is lower quality. But at the conference Equal called the actitivy around their area a “hot-bed” which doesn’t sound like they are on any fringe. I can only speculate on the quality based on what is being drilled around them, and if you look at where Sandridge is drilling, it appears to be very near the heart of the play.

Nevertheless I do understand how quickly geology can change from section to section. Structures can end suddenly, or thin out quickly.

Either Sandridge, Chesapeake, and Range (as well as the juniors) are hugely overestimating the resource or Equal is hugely underestimating it. There’s no other way to take it. The 3 former companies have all publically stated EUR’s that are 30-40% higher than Equal’s estimate.

Anyways it’s all conjecture until these wells produce a little longer and we get to see the real declines. The bottomline, based on the information I have access to, is that the land itself should be worth at least $4,000 per acre. That is based on other transactions. The entire land base, 15,200 acres (I still can’t figure out if they lost the other 4,000 acres to lease expiration or what happened to it), should be worth $60M at this price. A 50/50 JV should bring $30M to the company.

Unfortunately I suspect they are getting less than that. At the Enercom conference Klapko said “this land tends to fetch huge dollars, up to $3,000 per acre”. So I suspect that Equal is getting closer to this number, which would put a 50/50 JV at $22.5M net to Equal.

I suspect that this might be the reason they talked down the Mississippian at the conference. Its too bad; I think they could do better.

A last word on Oklahoma Oil and Gas Information.

There is a wealth of information on oil and gas wells available at the website of the Oklahoma Corporation Commission. They have a GIS database of well information, including monthly production volumes, for wells in Oklahoma. Unfortunately finding existing Mississippian wells is nearly impossible. Even when I got to the North of Alfalfa county, where there should be lots of wells drilled by Sandridge, I can’t find any of them. If any one can point to me why this is (are these wells confidential or on some similar status?) or what I am doing wrong to not be able to see the wells, I would appreciate it.

Dude, you just have to learn how to use their Byzantine databases. I am a royalty owner of a producing well in Alfalfa County and depend on the OCC for verification and future research.

This play is highly irregular. Even the best producers have trouble working the numbers. But in some cases, wells produce like wild. Highly localized and therefore, highly dependent upon location and expertise.

Anton – where are you a royalty owner? Do you have any insights on Equals land? As I mentioned in the article based on the prices being tossed around I suspect it is not premium quality but I can only guess.

Thanks for the detailed blog.

I am invested in the play via Red Fork Energy. One thing I did note for correction is the recovery shown for Red Fork per section. Red Fork have had a section with 58 million barrells of oil PLUS 30-50 million barrels of oil equivalent (3-5mmscft per barrels) for 88-108 million barrells of oil in place. At 5% recovery thats 4.4-5.4 million boe per section. Red Fork have indirectly said to recover this high in place number may require more than 4 wells per section.

To the north of Red Fork on the Noble/Kay border Range Resources are using similar metrics of 12 wells per section (yes 12 wells per section, but not yet proven) to recover 4-9% of the oil in place. Interestingly Range Resources have also stated that would ultimately expect a higher recovery that 9%.