The US Economy: Is the data bad?

I put a lot of emphasis on the Weekly Leading Index published by the Economic Cycle Research Institute. The index is a leading indicator of US economic growth. The index and its smoothed annualized growth rate have both turned up recently.

Presumably this suggests an improving economy. Yet the ECRI has been sticking to a prediction that the US economy is going to fall back into a recession.

Why?

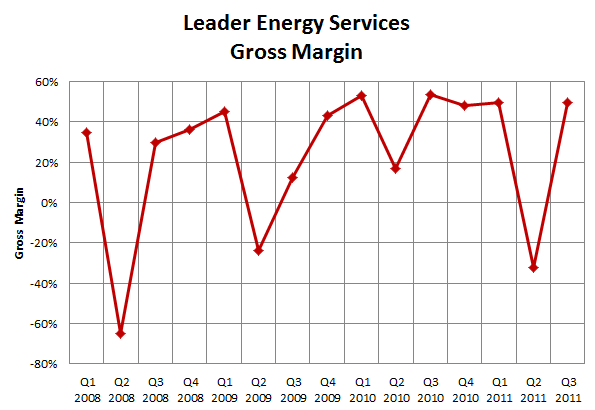

I was reading through the ECRI’s publically available articles trying to find out why when I ran into this article. It describes a problem that has developed with the seasonal adjustment algorithms. It seems that the economic collapse that followed Lehman Brothers in 2008-2009 has led to a skew in the adjustment that is being made. Many of the seasonal adjustment algorithms are interpreting the downturn that occurred in Q4 2008 – Q1 2009 as a seasonal event that should be adjusted for.

Most data, both public and private, are seasonally adjusted. But the nature of the Great Recession seems to have had an unexpected impact on the statistical seasonal adjustment algorithms that are hard-wired to detect when the seasonal patterns evolve and change over the years. This is normally a good thing, but when the economy fell off a cliff in Q4/2008 and Q1/2009, it was partly interpreted by these procedures as a lasting change in seasonal patterns. So, according to these programs, data from Q4 and Q1 would be expected thereafter to be relatively weak, and therefore automatically adjusted upwards. Our due diligence on this subject indicates a widespread problem, resulting in many recent economic headlines being skewed to the upside.

The article was written in mid-March but as recent as last week the ECRI remained behind its conclusions and their conviction that the pick-up in growth is illusory. This SeekingAlpha article quoted Lakshman Achuthan (who is the chief economist and spokesman for the ECRI) recentlyas saying that year over year (yoy) growth, which would not be distorted by the 2008-2009 numbers, is not improving.

Please note that PCI growth yoy is still -2.2% and even q-o-q is -4.9%… With yoy growth in all the coincident indicators (GDP, industrial production, personal income and sales) all staying in cyclical downturns, and yoy payroll job growth, which had been the only holdout, now rolling over — as we had predicted a few weeks ago — it’s pretty clear that for now U.S. economic growth is worsening, not improving.

The rub is that the data we have been looking at from January through March may be overly optimistic. It is being overly adjusted to the high side. Now that we are into April, that is about to end.

The data isn’t great

Indeed we are seeing something like that in the recent numbers. The monthly jobs report was a big disappointment. The jobless claims number that came out last week spiked to 380,000.

Home sales, which to me would be the true sign of a pick-up in the economy, remain depressed.

Add to this the fact that gasoline prices are about the only thing that have recovered to pre-recession highs.

What does it mean?

The situation feels to me like another false start. To use the phrase coined by John Maudlin, we are in for more muddling through. Low growth rates, low interest rates; maybe the ECRI will prove to be right and we will dip into another recession.

As for my portfolio, I am of the mind that I am mostly in stocks that should perform well in this environment.

Given the bleak outlook, gold and gold stocks should do well. Of course gold stocks have done anything but well lately. I have to remind myself of the volatility of these stocks, how they can bounce up and down like a yo-yo and turn on a dime. I think that as it becomes more clear that the skies remain grey and the horizon dark, the gold stocks should recover. I am certain that the reason we have not seen a breakdown in the price of gold itself is because there is smart money out there that sees the same picture I am drawing.

The mortgage servicers, Newcastle, Nationstar, and PHH, should hold their own in this environment. Servicing revenues are not dependent on an uptick in home sales to the same extent as other housing related businesses. Interest rates remain at such low levels that these companies continue to accumulate incredible assets (in the form of new servicing rights) that will outperform in years to come.

The regional banks are a bit of a tougher choice. However when I look at many of the regionals, they remain below their price level before the European shock in the summer. The US economy may not be getting that much better, but it is slowly healing, and to see these stocks at lower levels is, in my opinion, a disconnect.