Week 47 Update: When in doubt – Get Small

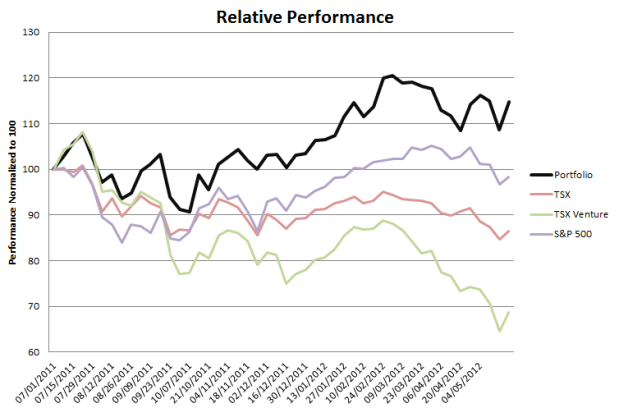

Portfolio Performance

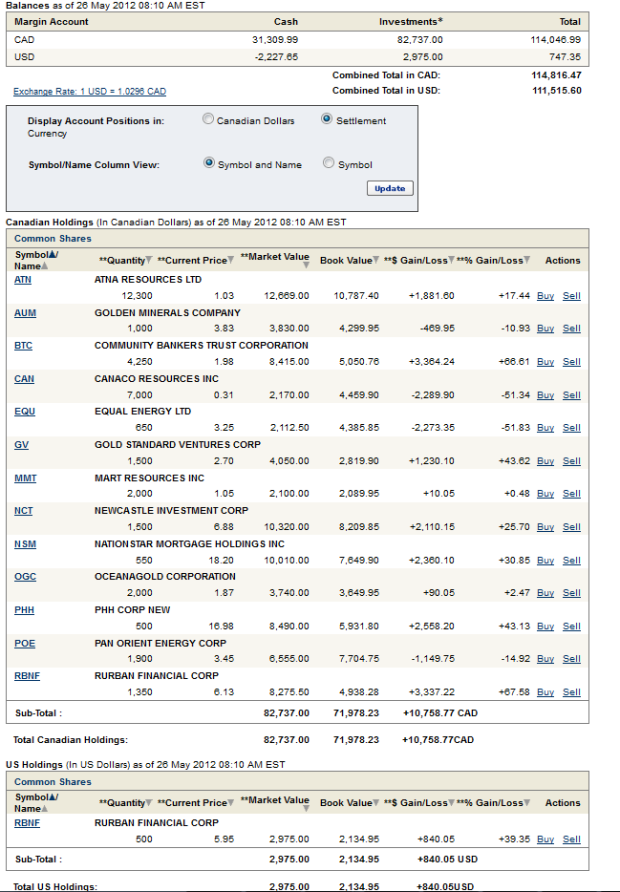

Portfolio Composition

For the last two weeks of moves, click here.

Letting Go…

The occupation of investing is really one of evaluating risk. If you run a large institutional fund or a hedge fund or some other large sum of money, you perform this evaluation on a formal basis, giving its conclusions a formal sounding name like risk adjusted return or something of the like. If you are an individual investor your process is much more informal, your conclusions are often not written down (though a blog helps in this respect), but nevertheless you are continually going through the same basic process of evaluating the potential risk against its potential return.

I try to eliminate risk through exhaustive research of the companies I invest in. That elimination process involves getting up at five in the morning on weekends and spending hours readings through 10-Q reports and MD&A’s. It involves staying up late on week nights listening to conference calls and reading industry publications. All this effort is done in the attempt to understand what makes each particular business tick, and to understand if the fundamentals of that business are improving in such a way that value is about to be realized.

I find this to be time well spent. On the one hand I enjoy the investigative process. On the other, it is profitable. I am often able to narrow my focus to sectors that should experience positive fundamentals, and then to further narrow my focus to companies within those sectors that have competent management teams and solid assets that can deliver on a consistent basis. Whether the sector is mining or mortgages, paper or potash, banking or bitumen, it makes little difference to me. Given the time I can understand the business and develop a thesis to invest or not, and more often than not I am right.

In the 1990s and in the early part of this decade that was all you needed to do to consistently beat the market. You could do the work, pick good companies, understand the industry trends and wait for it to play out. It was a simple time.

Nowadays however, following that recipe in a vaccuum can you leave you without a leg to stand. The market today is analogous to playing a hand of cards where within the deck lies a single trump card that if played automatically will lose the hand for you. You can manage the cards you are dealt the best you can, do your darnest to evaluate the probabilities and make the best risk adjusted decision, but if that trump card is played you will lose it all.

That trump card was the US banking system in 2008 and it is the European sovereign system now. In either case the details differ, but the trump-like nature is essentially the same. The risk is systemic, the probability of that risk occuring is unknown, the outcomes of that risk impossible to quantify. Whenever you play a hand in the market these days you put yourself in danger of the consequences that the risk happens to be realized while your money is still on the table.

Because this is a risk that is so difficult, perhaps impossible, to understand, there is no way to hedge against it. I have yet to hear anyone, expert or otherwise, offer up a coherent and definitive conclusion on what to expect if Greece exists the Euro. Do markets open down 10% and continue to fall? Is it a non-event and an opportunity to buy? Is Greece this years Bear Stearns, to be followed by a few months of a false reprieve before the big one hits, perhaps it being Spain that takes on the role of Lehman this time around.

There was an excellent conference call held by Donald Coxe this week. During the call Coxe laid out the situation in Europe as well as anyone has. It appears to be coming to a head. More and more what we are seeing is that people, organizations and banks are making adjustments on the assumption that the Eurozone will not hold. Banks in the Eurozone are frantically trying to tie their loans to countries that may be forced to leave by getting financing from within those countries rather than abroad. Assuming there is an exit, the potential for a true global financial crisis is great if it is not an orderly one. Along with that would very likely come a global recession.

While it is not clear whether Greece will leave this week, next week or next month, it has become more clear that they will indeed leave eventually.

What is unclear is how such an event will ripple through the system. To provide a few examples, consider the following:

- Right now the Eurozone countries run deficits with one another. Primarily Germany runs massive surpluses against southern periphery deficits. These imbalances are currently tallied in something called the TARGET2 mechanism. Target2 is essentially a way of transferring funds to countries (like Greece and Spain) that are running current account deficits so that those countries don’t run out of money. As long as all the countries are in the Eurozone these liabilities are just a paper trail between the individual Euro nation central banks and the ECB. However if a country with a large Target2 liability leaves the Eurozone, suddenly that liability needs to be paid back (the ultimate owner of the liability is the ECB). But will it be paid back? If it isn’t the ECB will take a big hit to its capital, potentially one that is big enough to cause the Central Bank to run out of capital completely. What happens when a Central Bank runs out of capital? I don’t think anyone really knows. Without a doubt it will be damning to confidence at the least.

- What exactly is going to happen to Greece (or a little later, to Spain) if they leave the Euro and stop receiving funding from the rest of the Eurozone? The reason Greece is able to make basic payments such as salaries, pensions, drug and medical benefits, is because of the inflow of money from outside the country. If that inflow stops, what happens to the country? Does it devolve from borderline chaos to complete chaos? You have to wonder.

- There are pension funds and insurance companies and other large entities that perform basic public services that likely have large balances of periphery debt. I was listening to the Goldman Sachs Insurance conference before bed last night. William Berkley, who is the CEO of the William Berkley Corporation, gave a fascinating talk about the industry. Most interesting perhaps is that Berkley believes that the biggest source of upside in the insurance industry over the next 24 months is likely to come from the failure of one or more of the large insurance giants in Europe. He gave it a 50/50 chance of happening. The reason he expects it to happen is because he is fairly certain that these companies are holding the bag on a large amount of peripheral sovereign and corporate debt. If this doesn’t scare you, it should. While 2008 began with the crisis of Lehman, it was amplified and extended by the crisis of the insurer AIG. Had AIG not been dealt with, that crisis could have been far worse.

- What will bond holders of Spanish, Portugese, and Irish debt do in response? You always have to remember that, as Donald Coxe has described, the situation is existential. What that means is that the perception of weakness is weakness, and it will breed weakness. Will a Greek exit destroy the perception of Spain to such a degree that it becomes inevitable they will leave to? Do Spanish bond rates skyrocket in response?

Look, I am not an expert on the Eurozone or the consequences of a break-up. I’m just throwing out these ideas to highlight the complexity of situation and to illustrate how it is basically impossible for any of us to make a legitimate assessment of it. What it means to our investments is anybody’s guess.

Lighten Up

All I think I can do in a situation like this is to get smaller. Take on less risk, don’t take too many chances, wait for it to play out one way or another before wading in too far. Remember that even after Lehman went bankrupt, it took a few days for the market to recognize the consequences that were about to be felt. I don’t think this was because the market was ignoring those consequences so much as that no one really knew what they were until they started to happen. Same considerations this time around. It could be Y2K all over again. It could be Lehman all over again. We will just have to wait and see.

As an individual investor you are at many disadvantages. You don’t have access to the research, you don’t have access to the capital, you don’t have the range of strategic alternatives (hedging, taxes, etc) that a larger investor would be privy too. But the one advantage that you have as an individual investor is your ability to act quickly and to the extreme. A mutual fund, pension fund or hedge fund would have a lot of difficulty going to all cash, both from a logistical and a performance perspective. As an individual you answer to no one but yourself. You generally can cash out with little to no movement of the underlying stock price. If things get hairy, you have a legitimate choice as to whether or not to wait it out until they aren’t anymore.

Such is even more the case for my particular circumstance. The reality of chasing above market returns is that I am constantly venturing into areas that are volatile. Such is the case with gold stocks, oil stocks, even to an extent with the mortgage servicing stocks and smaller banks. These companies trade up and down to a greater extent than the market. Whether the fundamentals dictate it or not they will move down hard if the general market moves down. There is no amount of analysis that I can do to mitigate or prevent this. I can only accept this consequence as the likely reality, and plan accordingly.

I completely sold out of Gramercy Capital, Bank of Commerce Holdings, and Shore Bancshares in the last two weeks. I lightened up on the rest of my holdings by 10-20%. I ended this week with a little less than 30% cash. I plan to raise that cash level to 50% in the next week or two.

I would have an even higher cash level already, except that I have also entered into two short term positions as well. OceanaGold and Mart Resources. My thesis for OceanaGold is that the situation for the gold stocks appears to be turning. There have been a number of days where the stocks have outperformed the bullion, and there was even one day were gold was down substantially while many of the large cap mining stocks were up. This appears to me to be the start of something. OceanaGold remains one of the cheapest gold producers out there. It is by no means the most efficient producer, and thus it has also been beaten down substantially during this bear market in gold shares. I bought some shares at $1.80 simply on the notion that if this is a turn in gold stocks, OceanaGold should see some outsized gains as it recovers the ground it lost. If gold weakens further or if the gold stocks resume their downward trend, I will bail quickly.

Mart Resources is purely an event driven purchase. I own Mart in another broker managed account already and so I follow the story closely, but have never owned it in the account I track here so I don’t talk about it much. The company has two news events that I suspect are going to occur shortly. The first is the potential for an announcement of a dividend. I believe that such an announcement could result in a significant pop in the stock, as it gives credibility to what is otherwise looked on warily as a Nigerian story. The second is a pipeline deal with Shell, which would allow Mart to increase their production, perhaps substantially, and allow the brokerages that follow the story to up their targets based on larger 2013 volumes. Again, I am looking for an event to occur in somewhat short order, but I am not holding this stock for the long run. If the events in Greece take a turn for the worse, I plan to cut and run.

I come back to the quote I gave last week from Peter Bernstein. I think this is something worth repeating at a time like this:

The trick is not to be the hottest stock-picker, the winning forecaster, or the developer of the neatest model; such victories are transient. The trick is to survive.

We live in impossible to understand times. You have to accept your own limits of knowledge and simply walk away from the table. Will I miss opportunities by having such a high level of cash? Quite possibly. But you can’t chase shadows. You have be a prudent manager of risk.