Things that worry me about the Mortgage Insurers

I have been devoting a lot of space to the mortgage insurers, and while the stocks make up a decent percentage of my portfolio, it would be impossible to justify the ink spilled if it were judged only in proportion to position size. But this is a new business for me to learn, and it is a complicated business with a lot of risk. Radian and MGIC appear to have a great deal of upside if everything goes right, and a similar amount of downside if everything goes wrong.

Well I did some thinking over the weekend and came up with a list of 5 things that worry me the most about these stocks. Below I have investigated each worry and became familiar (if not comfortable) with the reality of the risk.

1. Rescission and Denial activity assumptions may be off, particularly for Radian

Rescission and Denial activity is my biggest concern and so I am probably going to devote the most space to it.

Both Radian and MGIC are recording historically high levels of rescissions and denials. At the end of the second quarter Radian had $532 million of future expected rescissions and denials baked into their loss reserves, gross of $208 million reserved against the reinstatement of previously rescinded policies (called the IBNR reserve). MGIC had $700 million of booked reductions in losses due to rescissions and denials and $276 million of IBNR reserve.

This is significant in comparison to the capital of each company, which is roughly $1 billion for Radian and $1.5 billion for MGIC. If there were a significant revision to the assumptions involved, it could impact capital quite a bit.

For Radian, of particular concern is the growing number of denials. In the first quarter Radian had $177 million of denials where they held the first loss position (was likely to take a loss on the default) versus only $33.3 million of rescissions. Denials have become much more prevalent than rescissions, which is opposite of how things have been historically.

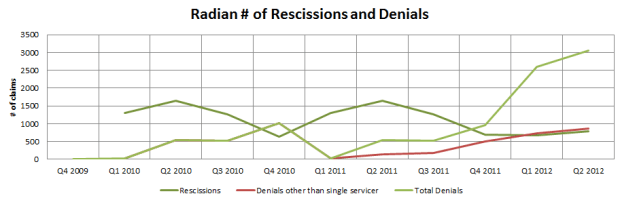

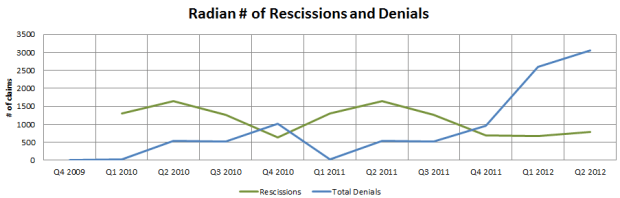

Below are denials and rescissions at Radian over the last 11 quarters.

What is worrisome about the increase in denials is that a denial is much more likely to come back as a resubmitted claim than a rescission is.

While denials and rescissions are often lumped together, they are quite different in definition. Whereas a rescission occurs when there is something wrong with the original documentation that voids the insurance, a denial occurs when a servicer hasn’t provided all the documentation. Problems with the documentation are difficult to fix, whereas an absence of documentation simply requires that the servicer dig it up and present it. When the servicer comes back to Radian with said documentation, Radian has to reinstate the claim.

Radian put it like this in their first quarter 10-Q:

Due to the period of time (generally up to 90 days) that we give the insured to rebut our decision to rescind coverage before we consider a policy to be rescinded and removed from our default inventory, we currently expect only a limited percentage of policies that were rescinded to ultimately be reinstated. We currently expect a greater percentage of claims that were denied to ultimately be resubmitted as a perfected claim and paid.

Radian assumes that 50% of denials will come back to the company in the form a resubmitted claim.

As we’ve previously disclosed, approximately 50% of the currently outstanding denials are expected to be reinstated mainly as a result of servicers ultimately finding and producing the documents necessary to perfect the claim within the time frame allowed under our master policy.

So Radian has partially accounted for the increase in denials the last couple of quarters by increasing their reserve for expected resubmissions (the IBNR reserve). The IBNR reserve increased from $170.6 million at year end to $249.5 million at the end of the second quarter. While the increase is significant, it’s still a long way from the $177 million of first loss denials that Radian had in the first quarter and the $174.6 million they had in the second quarter. It remains to be seen whether the company has to further add to their reserves to account for the number of denials that come back to the company in the form of a resubmitted claim.

Radian has tried to downplay the impact if they had to do such a reinstatement. The company said the following on the Q2 conference call:

While our experience [with denials] clearly supports this estimate, it is important to note that this assumption is not very material to our overall loss reserve estimate. For example, even if the reinstatement percentage shifted significantly to 75, the resulting addition to our total loss reserves will only be about $97 million.

I’m not so sanguine about the company taking a $100 million hit.

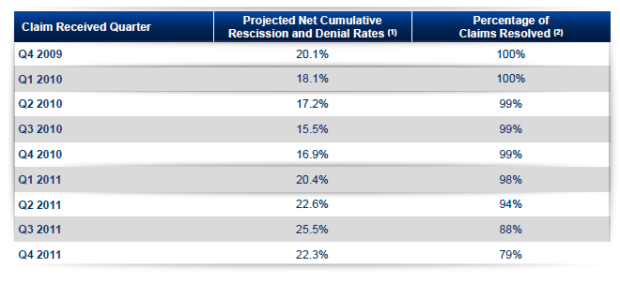

The mitigating factor is that Radian can back up their expectations of future reinstatements with historical data. Every quarter Radian provides a table of how many rescissions and denials have stuck (not come back as a resubmitted claim) as a percentage of paid claims. The data below, which they disclosed in their Q2 presentation, is for the past 9 quarters.

The second column shows rescissions and denials as a percentage of total claims for the period. The third column shows the percentage of claims that have been resolved from that quarters bucket.

The second column shows rescissions and denials as a percentage of total claims for the period. The third column shows the percentage of claims that have been resolved from that quarters bucket.

For example, if the number of claims resolved is 100%, as it is for Q4 2009 and Q1 2010, then the Projected Net Cumulative Rescission and Denial Rate has been determined completely from the actual finalized settlement of claims. To the extent that the percentage of claims resolved is less than 100%, the Projected Net Cumulative Rescission and Denial Rate may still change as the remaining claims are resolved.

With 80%+ of claims resolved, we can be confident that the final percentage of rescissions and denials is going to be pretty close to the percentage stated in column 2.

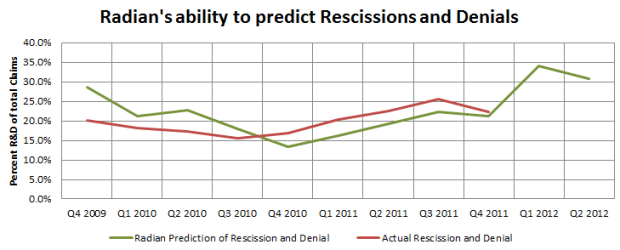

Well I wanted to see how well the actuals compared with the original estimates, so I took the above and compared it to the estimates of rescissions and denials that Radian had disclosed for each quarter. For each quarters estimate, I recorded rescissions at face value and cut the number of denials in half to reflect Radian’s estimate that 50% will return as a resubmitted claim.

If Radian was being too aggressive with denials and rescissions, it should show up as a discrepancy between the original estimate and the actual finalized claim settlement.

The conclusion (shown below) was that the eventual rescission and denial to claim ratio matches pretty closely to what the company would have estimated it to be.

Given the above, I don’t know if I really buy the argument that Radian has been more aggressive on its claim management practices than MGIC and that this is going to bite them in the ass at some point. Radian appears to have done a good job in estimating eventual rescission and denial levels.

There are a couple of other conclusions that are worth discussing.

1. Radian clearly has a higher rescission and denial rate than MGIC, especially of late.

Part of the reason for the drop off in rescissions from MGIC is that MGIC is in a dispute with Countrywide, who is rebutting the rescissions that have been putback on them, and they have chosen not to rescind any Countrywide loans until the dispute is resolved. Countrywide makes up about 20% of MGIC’s delinquent inventory. So that’s part of it.

Part of the reason for the drop off in rescissions from MGIC is that MGIC is in a dispute with Countrywide, who is rebutting the rescissions that have been putback on them, and they have chosen not to rescind any Countrywide loans until the dispute is resolved. Countrywide makes up about 20% of MGIC’s delinquent inventory. So that’s part of it.

Yet even if you make a liberal allowance for Countrywide loans, at the very most it would raise MGIC’s rescission rate (for example) Q3 2011 to ~13%. This is assuming all remaining unsettled claims belonged to Countrywide and were rescinded. It still wouldn’t put MGIC in Radian’s ballpark. Clearly Radian has something different going on than MGIC. I’m just not sure what it is. Perhaps Radian really is just better at evaluating claims?

2. Radian’s Single Servicer Denials

The above chart is similar to the one I showed earlier. It illustrates the number of rescissions and denials at Radian by quarter, but with the difference that now the denial activity has been broken out a bit further. Beginning with the Q2 2011 quarter, Radian further delineated its denials between those that have come from a single servicer, and those that have come from everyone else.

The above chart is similar to the one I showed earlier. It illustrates the number of rescissions and denials at Radian by quarter, but with the difference that now the denial activity has been broken out a bit further. Beginning with the Q2 2011 quarter, Radian further delineated its denials between those that have come from a single servicer, and those that have come from everyone else.

What you can see is that while rescission rates at Radian are falling, and while denial rates other than the singled out servicer are fairly stable, there has been a huge increase in denials from this one mystery servicer.

Of course, the obvious question is whether Radian’s assumption that only 50% of those denials are coming back into claim is valid given the high percentage of those denials from this one servicer.

I don’t know the answer to that, and we won’t get better visibility until the next quarter when Radian provides their actual rescission and denial to total claim rate percentage. Until that time, what we can say is that based on the data so far, it appears the assumption is on target. The one quarter we can look at is the Q4 2011 quarter, which was when the trend of higher single servicer denials really began to take off. And for that quarter, Radian looks to have predicted eventual rescission and denial rates fairly well. Go back to the chart labeled “Radian’s ability to Predict Rescissions and Denials” and note that for Q4 2011, actual rescission and denial rates have been slightly higher than predicted. And this is with 79% of total claims resolved, so its not a small sample size.

What to make of it all?

I understand the concern; the rescission and denial rates for Radian are high, both historically and versus their competitors. I have no answer as to why they are consistently higher than MGIC. But Iargue that Radian has been running at higher rates since Q1 2011, and with most of the claims from Q1 to Q4 2011 resolved, the evidence is clear that Radian was right on the mark, if not a bit conservative, in its assumptions. Whether this continues with the recent trend of increased denials is open for debate, but as I pointed out, the data we have so far (Q4) again points to the accuracy of Radians estimate.

2. There is an assumption that a large number of late stage delinquent loans will not result in a claim

This one is a concern for both Radian and MGIC. MGIC has already taken a fairly big hit in the second quarter because cure rates on their late stage delinquent loan bucket (ie. loans that have been delinquent for 12 months or more) were not running as high as they had originally expected. The company was cautious on the conference call when discussing whether this was a one time event or whether further revisions might be required in future quarters. They said they didn’t think so, but that they would just have to wait until the data came in.

I’ve talked about this issue in some depth in my post on Radian’s second quarter. While from what I can see MGIC does not provide claim rates broken down by bucket in their material, Radian does. As shown below, Radian assumes that only 47% of the existing delinquencies (net of rescissions and denials) that have been around for at least 12 months will result in a claim.

Intuitively, one would expect something pretty close to 100% of delinquencies that have been around at least 12 months to result in a claim. That it isn’t, is the concern.

The mitigating factor is that, as Radian pointed out in the following slide from its quarterly presentation, a large percentage of these 12+ month delinquencies have been around for 2+ years.

Of course that delinquencies are hanging around for years makes as little intuitive sense as does the idea that only 2/3 of them are going to result in a claim. Clearly something is going on with a large percentage of these loans, and perhaps whatever is going on is going to make them less likely to go to claim, but I have yet to hear a coherent explanation as to what it is that is going on. As a I wrote previously:

Clearly these loans are broken. I mean there is a servicer at the other end of these loans and that servicer has every interest to get that loan through to foreclosure as quick as possible. I find it hard to believe that there are servicers out there eating the costs on defaults for 2+ years before getting the loan foreclosed on.

Until we actually start seeing these loans clear out, this remains an uncertainty, and with so many loans delinquent and in this 12 month bucket, a little bit of error in the assumptions involved could lead to either a big gain or loss to the companies involved. Going back to Radian’s slide of Primary Loans in Default, the 12+ month bucket accounts for about $1 billion in loss reserves. If Radian is off on its eventual claim rate assumption, we are talking about a whoopsie in the hundreds of millions of dollars.

As I said, at least as far as I can tell MGIC doesn’t provide enough information to determine its late stage claim rate from their quarterly material, so you can’t draw the specific conclusions you can with Radian. But you can back out some information based on comparisons to Radian, what management has said on conference calls and from some of the data that they do provide.

First of all, MGIC said on the Q2 2012 conference call that the claim rate for new loans was assumed to be 25%. Presumably this is referring to 1-3 months delinquents, which would mean that their projection on this bucket is the same as Radian. Now lets compare loss reserves per default. Radian had reserves per default of $28,410 as of Q2 while MGIC had reserves per default of $25,547. The severity on claims paid, which is a basically the amount in $’s that the company has to pay to settle out a claim, has historically been similar for both companies if not a little higher for MGIC, so you can’t really argue that the reserve per default at MGIC should be lower based on severity. Putting it together, if the early stage bucket is the same, and if the severity per claim paid is the same, then the only reason the reserves per default could be lower at MGIC is because they are assuming a lower claim rate on its 3-11 month and 12+ month buckets.

In other words, all else being equal, MGIC may be more susceptible to future revisions of late stage delinquency cure rates than Radian. Moreover, the write down last quarter could be viewed as a catch-up of sorts. But take it all with a grain of salt, because the data is sparse and its difficult to be sure without knowing the intricacies of each insurers current books.

3. MGIC and the Freddie Mac issue

Freddie Mac and MGIC are in disagreement about policy coverage, with the crux of the disagreement being described well by this Reuters article:

The disagreement has been going on for some time, and centers on loss limits on policies that insure Freddie Mac, the No. 2 provider of U.S. mortgage money.

MGIC said in April that it believes the loss limit decreases as policies lapse, while Freddie asserts that the initial limit remains in place until the last of the policies expires.

If MGIC can settle their issues with Freddie Mac in a satisfactory manner the stock will be above $2 again. Simple as that.

The key word is satisfactory. $550 million, which is the amount in dispute between MGIC and Freddie, is a lot of money. Its perhaps not make or break it money for MGIC, which has around $1.25 billion of statutory capital as of Q2, but its awfully close.

MGIC said the following in their disclosure about the lawsuit against Freddie:

“We account for losses under our interpretation although it is reasonably possible that, were the matter to be decided by a third party, our interpretation would not prevail,”

It’s not exactly a reassuring statement of certitude.

The real problem is that Freddie is in the drivers seat here. As one Reuters article put it:

“Freddie Mac has all the leverage, so my sense is that MGIC is going to have to put in at least the $200 million (in new capital) that Freddie wants and it could go beyond that,” said a hedge fund manager, who no longer trades in MGIC shares but has been a long-time investor in other mortgage insurers.

The other risk is that through the negotiations and/or litigation, MGIC and Freddie taint their working relationship.

“While it is likely that MGIC and Freddie come to an agreement, it is not a given that these two firms continue a productive business relationship,” said Jason Stewart, and analyst at brokerage Compass Point Research and Trading LLC.

As for the issue at question, whether or not MGIC or Freddie’s interpretation is right, this article provided the best explanation I have found as to the legal claim at issue, as well as some direct excerpts from the submitted documents from MGIC. Quoting directly from court documents:

“During 1998 and 1999, Freddie submitted an ever-larger number of loans for insurance under the eleven policies,” the complaint states. “As of June 30, 1998, the eleven loan pools included loans totaling approximately $35 billion in initial principal balances. By September 30, 1999, the combined IPBs of the loans insured under all eleven pool policies totaled $76 billion, with a weighted average loss limit of approximately 0.85 percent. After payment of modest losses in the initial years of the policies, the remaining combined aggregate loss limits of the policies – MGIC’s amount at risk – totaled approximately $647 million.”

The large risk exposure constrained MGIC ability to write more insurance policies for Freddie Mac and others, so the two parties restructured the deals to get “new pool insurance capacity,” according to the complaint.

The complaint states: “As agreed by the parties, each of the policies was amended by a substantively identical endorsement that (a) kept each policy separate, but replaced the eleven individual aggregate loss limits with a single, combined aggregate loss limit calculated by combining loans insured under each policy into one ‘mega pool’ for aggregate loss limit purposes; and (b) establishing the combined aggregate loss limit at the greater of (i) the ‘existing aggregate loss limit,’ calculated based upon the respective total initial principal balances and existing aggregate loss percentages for each of the policies, or (ii) 0.69 percent of the combined total initial principal balance of both loans ‘insured’ under the eleven pool policies and loans which ‘become insured’ under those policies.”

The thing that doesn’t make sense about Freddie’s claim, and what MGIC alluded to in the court filing, was that if you go with Freddie’s version then MGIC would be taking on more risk than it was before the pools were aggregated. Indeed MGIC said in the court filing that:

“[Freddie’s interpretation] leads to the entirely illogical result that the mega pool has a constant combined aggregate loss limit of over $1.3 billion for a period of more than ten years – from 2007 until 2018 – lasting many years after coverage has actually ceased for the vast number of individual loan pools at one time insured under the Policy.”

The original coverage before the pools were aggregated was only $647 million and Freddie is suggesting that the amendment made upped the coverage to $1.3 billion? I don’t really understand how they could argue that MGIC would have agreed to such an amendment.

MGIC also pointed out that Freddie has subsequently acted in a way that was consistent with MGIC’s interpretation of the contract. After the amendment, Freddie added new, separate pool policies with MGIC. If Freddie had believed that the coverage on the existing policies was up to $1.3 billion, they would have concluded there was ample room to add under the existing policies.

It should also be pointed out that MGIC isn’t immediately on the hook for the entire $535 million if the dispute goes against them. As of Q2 2012 the company said that past losses would be about $175 million higher. Future losses look like they would be coming in at a rate of $40-$50 million per quarter.

I have to say though, based on the information available, it’s muddy. The language MGIC uses to describe the contract does not specifically say whether pools are to be removed as they cease to be insured. So I whether this is implied is really a matter of interpretation. I do think that the muddiness of the whole thing does make it unlikely that MGIC would have to take the full $535 million hit but it probably also makes it unlikely that they will walk away without any hit. It’s probably going to end up somewhere in the middle, which still will not be great for the company’s statutory capital.

4. MGIC is double leveraging

This is another strictly MGIC issue and I am a little fuzzy on it but I’m going to put it out there and maybe someone might comment who understands it better.

I garnered this issue from the following conference call question and answer (taken from Seeking Alpha)

Questioner: All right. And then second, on MIC, if the third stipulation in the Freddie later were granted and MIC was on the hook for losses on MGIC, what would the incentive be for states that aren’t letting you write business above 25:1 now? Why would they allow MIC to write business even if it’s liable for MGIC losses?

J. Michael Lauer: I mean, you’re talking now about the insurance commissioners, regulatory power. The subsidiary is owned by MGIC. And effectively, he’d be control of both of those entities in some kind of situation. The point is that he believes, as we do, that there’s more than enough resources at MGIC to pay claims, okay? So the issue that Freddie Mac has, obviously, is a theoretical issue that if it weren’t, what are the capabilities of getting money out of MIC. And the only way that you would get money out of MIC in that type of situation was if there was excess capital in MIC. And in the near term, I would say that we’re not using much of the capital, obviously, and it’s got a significant amount of capital in it to write business for the next 5 years. So it really doesn’t have a capital issue going forward no matter how much business we write in it in the next 4 years.

Reply of Questioner: But I guess, my question is, I mean, if MIC is ultimately on the hook for MGIC’s losses, could the California or North Carolina, say, regulators like not allow MIC to write new business even though on a stand-alone basis, MIC would have a really good risk-to-capital ratio?

The basic point that this question addresses is that the $440 million of capital in MIC is also being recognized as capital for the MGIC subsidiary. It is effectively being double counted as capital for the MGIC sub and for the MIC sub.

Presumably as MGIC uses that capital to write business in MIC, the capital available for the MGIC sub becomes less. Either that or any risk in force added at MIC is added at MGIC. Regardless, the way the two subs are laid out makes it appear there is more capital then is actually there.

I was listening to an Old Republic call yesterday and they brought up how they didn’t want to get into the business of double leveraging. Now they didn’t explain what that term meant, but I garner that it means exactly what MGIC is doing. They are double leveraging the $440 million to count against MGIC and MIC.

Of course the insurance regulator of Wisconsin has agreed to this. So its viability as a strategy is in immediate question. I bring it up simply as a concern since it seems to me to be a strange structure for the subsidiaries.

So like I said, I don’t understand this issue well enough to draw any sweeping conclusions, but it seems like a funny business to me.

5. Cure Rates on existing loans

I’m going to distinguish here between the issue I already addressed, which is what appears to be the abnormally low cure rates on loans that have been delinquent for 12+ months, and the more general issue here, which is whether cure rates in general can hold up and improve.

This more general issue is relevant to all delinquent loans. And the answer to the question of whether cure rates are going to improve or get worse, is probably more of a function of the economy than anything else.

I thought that Old Republic did a good job in explaining the factors at play in determining the cure rates. They said that the bucket was highly dependent on the following factors:

- Modification opportunities

- Re-employment opportunities

- View of property values going forward

When asked to elaborate on the trend, Old Republic said the following:

So far we’ve kind of been on trend. I can’t say that I have seen any serious change the cure rate that would portend to a change in the trend long term.

The risk, and potentially the reward, with the cure rate are the risks to the economy and to housing market in general. The modification opportunities, with HARP II, are there. Property values appear to be improving. Employment is up and down but every month we go without an all out collapse portends to an eventual firming up. My basic reason to get involved in the insurers is that while housing may not be about to go into a robust up market, it has stopped going down and can be expected to modestly rise. Moreover, it is my experience that often when things turn, they turn much faster than anyone anticipates. Its human nature to extrapolate the current trend and expect only small deviations from that trend. When the cycle hit the inflection point the result is often much more violent. While I’m not about to predict a robust turn in housing, I wouldn’t be surprised….

Regardless, things are looking better on all fronts, but as we all know, the risk remains…

And with risk comes…

So there you have it. Lots of risk. No question about it. There are multiple pitfalls and trapdoors that these company’s need to negotiate to get to the point where they can see blue sky. But my point, and why I own both stocks, is that these pitfalls and trapdoors are mostly priced in. The stocks, particularly MGIC but also Radian to a degree, are priced for bankruptcy. If they manage to navigate this treacherous terrain successfully, they will not always be so. And as I have written about on a few occasions already, if that comes to pass, the revaluation will be rewarding. For now, I just have to watch the news and the data carefully and see how it plays out.

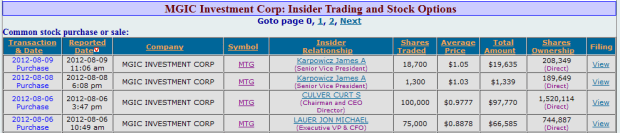

On one last note, I was encouraged to see that both Radian and MGIC management bought shares over the past few weeks (with MGIC being the more important of the two in this respect). These purchases, which are not insignificant and show that management has not thrown in the towel yet.

in case you missed it, baupost took a stake in genworth. looks like they’ve been in and out a bit over the last year.

thanks for that. I’ll take a look

I have continued to look at the concerns I brought up in this post. With respect to the question of long term delinquencies, Radians first quarter conference call was a very good source of information. Radian brought up a number of points to support their claim rate assumption on the 12+ month delinquency bucket:

1. Historically actual claims on that bucket has actually been lower than what they are currently assuming

2. There has been a big modification effort by servicer, government programs, etc. A lot of these loans are 12+ month delinquent because the borrower has chosen not to pay the claim because they hope to get a modification on their loan. 20% plus of the delinquent loans on Radian’s book are in some sort of modification program.

3. They know from doing the outreach efforts that they’ve done that the borrowers have the ability to pay and are waiting to get a deal

4. Some borrowers are expected to go back to being current if their economic situation improves, when they get a job, etc.The majority do not want to leave their home, they want to stay there.

5. There is an existing cure rate on the bucket of 3-4% per quarter

6. A lot of the older loans are aging not just 12+ but 2,3,4 years and we think there is a reason they are not becoming claims, either documentation or title or servicing, and a lot of the external models we are looking at on how to estimate MI reserves actually start taking down the roll rates as the loans become significantly aged.