Community Bank Earnings: SFBC, SBFG, PKBK

Owning community bank stocks is boring. Even on earnings day they often trade less than 1,000 shares. The shares move up and down on so little volume that you never really believe the moves are real. They seem like dead money, but then a year passes and you check out your account and you own a bunch of stocks up 20% and you can’t figure out how that happened.

So get ready for a boring but quite possibly profitable update.

I’ve had a number of the community banks I own report fourth quarter results. All of the results were good so far. I’m going to go through 3 of them here.

SB Financial (SBFG)

SB Financial was the first to report, a couple weeks ago. The company made 37 cents EPS in the fourth quarter and $1.37 for the year. The stock has traded up since the report, but even at $17.50 the PE multiple remains low at 12.5x 2016 earnings.

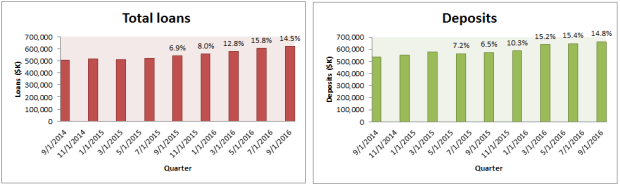

One of my criteria for buying a bank was loan growth and deposit growth. These are the two pillars that will lea to eventual earnings growth (as long as the bank is well run and can leverage their expenses). Loan growth at SB Financial continued in the fourth quarter, up another $15 million or 14% year over year. Deposit growth was up $20 million or 15% year over year.

My one complaint was that earnings were somewhat low “quality” compared to the past few quarters. Fee income was a little lower ($1.5 million versus $1.6 million in the second quarter), while the company got a big gain from the mark to market of its mortgage servicing right portfolio. I’ve talked about mortgage servicing rights in the past. The mark to market adjustments from servicing rights can be large as they are very sensitive to changes in interest rates. But this doesn’t really reflect health of the underlying banking business and if anything it portends to lower originations.

Nevertheless return on equity (ROE) was 10.72% and return on assets was 1.14% which are solid numbers. Non-performing assets remain a small percentage (0.65%) of total assets. I am happy with the results.

Sound Financial (SFBC)

Sound Financial put together a similarly good quarter. Loan growth was 8.4% year over year. Yield on loans reached 5.19%, which is a 10 basis point bump in the last year. Deposit growth was 6.3% year over year. Non-interest bearing deposits, which are the best because they are essentially free, rose to 13.6% of total deposits from 11.5% of deposits the previous year.

Deposits should continue to increase in the first quarter after the pending purchase of deposits from Sunwest bank in October:

Sunwest Bank of Irvine, California to acquire approximately $17.7 million of deposits for a core deposit premium of 3.35% and its University Place, Washington branch located at 4922 Bridgeport Way West. The cost of funds from this branch is an attractive 17 basis points and the cash received is expected to be used to pay down FHLB borrowings.

Earnings per share were 63 cents in the fourth quarter and $2.16 for the year. On a trailing basis the stock trades at 13.4x earnings.

Like SB Financial, Sound Financial suffered from lower fee income which declined from $647,000 to $586,000. I’m not sure the cause of these declines and whether there is general pressure on the industry. It is something to keep an eye on. Also like SB Financial, they took a gain on mortgage servicing rights, though the servicing portfolio is much smaller so it was to a much smaller degree.

Book value rose 80c in the quarter and is now $24. Return on assets crept up to almost 1%, at 0.97% up from 0.89% at the end of last year. Return on equity was at 9.4%.

Non-performing assets are up a little, to $4.5 million from $2.9 million a year ago, but this is still a tiny 0.77% of assets so nothing to worry about. Again, solid performance and it remains a cheap stock.

Parke Bancorp (PKBK)

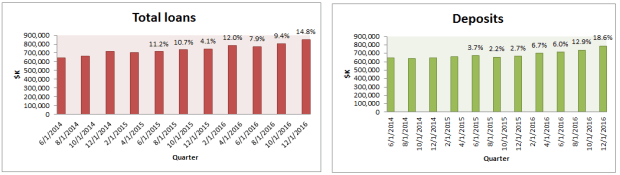

This is going to feel repetitive. Parke Bancorp had a good quarter as well. They saw year over year loan growth (15%) and deposit growth (18.6%).

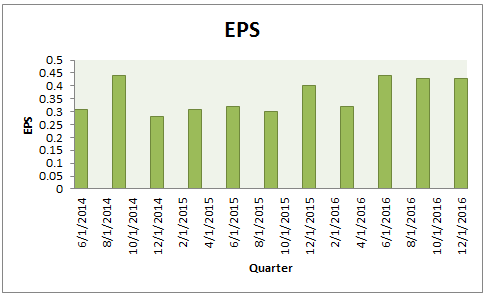

Diluted earnings per share for the quarter were 38c. For the year, earnings per share were inflated because in the second quarter the company sold its small business admin loan business for a $9 million gain. Excluding that sale I estimate diluted earnings for the year would have been about $1.50. That trades the stock at 13x earnings. Below is diluted earnings ignoring the sales of the SBA business.

Earnings likely would have continued to grow in the third and fourth quarter had the company not chosen to monetize their SBC business. I’m not sure why the bank sold it? In the second quarter press release they referred to it as a “unique opportunity”. It’s possible they just got a great offer, which the profit (over $1/share) suggests. They still plan to offer SBA loans through their bank, but it probably won’t be at the same scale. There were no SBA loans sold in the third quarter and no the fourth quarter press release there was no mention of SBA loans sold.

Parke Bancorp has somewhat higher non-performing assets than the other banks I own, at $21.7 million or 2.4% of total assets. Over half of that amount is real estate owned. In the fourth quarter press release the bank mentioned one property in New Jersey that has been written down from $12 million to a little over $3 million. The trend on non-performing assets is in the right direction though, they stood at $30 million a year ago.

The bank has opened two branches in the last year, which is helping deposit and loan growth. The first is in Collingswood New Jersey and the second is in Chinatown Pennsylvania. These banks are still ramping and should help fuel growth in 2017.