How I know this is a bubble

Last night our family was about to sit down to dinner and just as we did I was struck by fear.

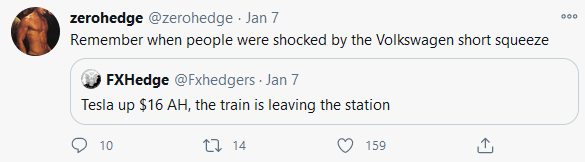

An hour before I had read this zerohedge tweet about Tesla:

After I read the tweet I looked at the after hours price of Tesla. It was up about 2%. After being up about 8% during regular trading hours.

I began to panic. Complete, pure, irrational panic.

Here’s the thing. I was short Tesla.

I’m not a TSLAQ guy. I think I shorted it briefly once in the past. But I had put on a short at the beginning of the week.

This was not a large position. It would not even qualify as a small position. It added up to 0.27% of my portfolio. And that’s after losing on it for 3 straight days.

Yet before I sat down for dinner last night, I was panicked enough about this tiny, little Tesla short that I had to run and close it out in after hours before I could sit down to eat.

Its not just Tesla.

I have had hedges on in my portfolio, in one form or another, since about 2016. During that time I’ve never really worried about them. If the market goes up, then my stocks go up. The hedges go down but that is part of the deal.

But right now, I have become actively worried about my hedges. So much so that before the market closed Thursday I went through all my inverse index positions and calculated how much my portfolio would lose from them if the market was up 2%, 3% or 4% on Friday. And then I adjusted their size to make sure each was at a level I could live with.

This is not normal.

It is not normal for me to be so uncertain. It is not normal for me to be thinking that the market could be up multiple-percent for no particular reason.

To be so unsure of what the market might do that a 0.3% short in Tesla feels dangerous? That it makes me start calculating the damage if this is the next Volkswagen and the stock flies up 2x, 4x or 10x in a few hours on some bizarre index inclusion short squeeze (which I have to say doesn’t really make any sense to me, not that such reason mattered at the time).

And this isn’t some fear bred from a string of bad trades. I know that fear. I’ve been wrong about a bunch, I’ve had bad luck streaks, and I know the feeling when you get to a point where you don’t trust your own judgement.

That isn’t what this is.

I’ve done quite well the last couple of months. Yet I can’t shake the feeling…

I have not been as skittish as I felt this week since… well I don’t know when.

I certainly have never felt this skittish at a time that my portfolio was going up.

I was not even this skittish in March. After all, that made some sense. This does not make sense. So anything seems possible.

It could be passive or options or $2,000 checks. Or some combination of all of the above. I look at Twitter and I see all these guys calling out their big returns on portfolios that look like they are all identical with the same SaaS and EV and momentum names (or they are just 100% Tesla or something crazy like that). And these guys don’t look like the guys that usually get rich on stocks.

Meanwhile many of the guys that I know from years on Twitter that are good at stocks are either silent or incredulous.

Apart from taking off my Tesla short (which I replaced with an even tinier option position where at least I know my downside if something bizarre happens), today I did the only thing I could do given my unease. I sold. Both longs, shorts and hedges. I am now very small.

That will mean I don’t fully participate in what could very well be the blow-off top. But I am just not comfortable with what is happening right now.

What the market is doing doesn’t make sense. I doesn’t feel right. So I had to get small enough that it doesn’t matter.

I’m in pretty strong agreement with you and have been selling slowly. The question which keeps going through my head is whether we see everything come down like in 2008 or more of a rotation where the overvalued come down and undervalued come up. My best years of market outperformance were in the 2000 – 2002 period, not my best years ever, but very good years and much better than the market. I’m leaning towards a 2000 type scenario as many of the stocks I own are very cheap still and the market is very overvalued and there does not seem to be systemic risks in the economy, but they could be there and just be being hidden by the low interest rates.

What do you own right now? I kinda think the same about 2000 and I did keep my bank stocks, though I reduced a few somewhat.

I’m underweight in the US and have moved more into Canada and Europe.I have a lot of financials and consumer stocks.

My largest holdings are:

European Insurer NN Group – good write up at https://www.thetimeisnowfornngroup.com/

Flooring distributor HDI in Canada

Bathroom Company Norcros NXR in the UK

Auto Parts Martinrea – MRE

Very cheap, well run Texas Life Insurer – NWLI

Wood Distributor Goodfellow – GDL

Canadian Life Insurer/Investment company – ELF

Dutch Bank ING

Electrical Component Maker Hammond – HMM.A

Mexican Airport PAC, but I will probably sell as has moved a lot

I’ve got very little high tech stuff left and they are closer to sell than buys. I’ve still got half of the INOD we talked about before, but I’m watching it closely to likely sell the rest.

I’m thinking the driving market factors this year are pent up consumer demand and rising inflation/interest rates. I’d like to move more into hospitality type stocks, but the valuations are not great any more. For example, I also own A&W shares but they have moved up and are OK here, but not great like they were a few months ago. Mexican airport PAC is higher now than its been anytime in its history other than a few months at the start of 2020.

The only stock I’ve bought recently is Cominar REIT CUF.UN. I think residential real estate is risky in the current environment, but this is Retail, Industrial and Office. It is still down a ton (and not for no reason), but they are looking at options to increase value and George Armoyan has taken a 10%+ position and will be looking to find value in here,

What do you think about energy stocks at this time? Oil seems to be able to stay up and most of the rest of the commodity complex is doing very well. I think if oil can stay up, there should be a lot more activity and the energy services companies are very cheap.

I don’t have a lot of faith in oil. All these commodities are up but I’m not going to bet on them. How can oil do that well when there are 2mmbbl/d+ of spare capacity just waiting to come online. And then on top of that its all a melting ice cube over the next 10-15 years. Too many headwinds for me.

Very interesting. A friend whose portfolio is very concentrated in Peter Lynchy (AAPL, AMZN, SQ, V, JPM, and a few others) stocks with which she has personal experience and which she buys with no regard to valuation–and whom I like to discuss stuff with because her approach is so different from mine–was up ~48% last year. She told me today that she thinks this will be a pretty good year in the market, up another 10-15%, but is still thinking of selling everything for reasons she was a little vague on.

What do you think?

A few months ago I penciled in a big break in 1st quarter 2022 because I thought that would be the “sell the news” moment: whoever was in charge here in the US would have had a full year of policy under his belt, which is around when optimism really starts to face reality. Also, COVID will (I hope!) be mostly in the rear view then, along with the mulligan it offers. I still favor this scenario but it is based on gut and nothing more, and I don’t trust my gut at this point.

If you told me the S&P 500 was going up 10% next week, and 50% this year, I’d believe it. If you told me down 10 and 50: same. I am buying silly option hedges which will probably expire worthless and absorb some of the gains I realized in the first week. I want to reduce exposure but working against that is the fact that there are still many interesting ideas out there and there seem to be a lot of people convinced the wheels are about to come off. I keep on thinking I see bear capitulation, but when I look harder it’s so partial.

I’m trying to eliminate all positions I feel anything other than the strongest conviction on and add to those I’m more price-agnostic or catalyst-clear on, which I feel can generate good returns in the mid-term from here (in addition to the usual side bets on binary-type things and cash boxes which might share some, as Jemtec recently did and PFHO may). I have no framework for precisely valuing IDT, but given their history I’d be happy holding/adding through a 50% drawdown. I think SNFCA will continue offering shareholders a moderately larger share of the company through its share dividends and buybacks, and will build its Center 53 office park into a development worth about as much as the company is worth now. I think RDNT will continue blocking and tackling, and dominating in its market. I think EPM will increase its dividend, at year-end DEN, once permitted by its credit facility, will start a capital return program that will support its warrant price. I think either fertilizer/refinery cycles or Carl Icahn will figure out a way to get paid on CVI. I think 12% of book and a trailing P/E of around 1 is a fine price to pay for QCCO while waiting to see whether its getting its house in order is transitory or longer-lasting. I think AAIC will resume a dividend in the relatively near future and then will be worth selling. I think probably–though I haven’t made up my mind yet–Firan and Quickstep are probably close to inflections up. I think the people who decided Darling International is worth over twice what it was last year will reevaluate. I am trying to figure out which ideas I think prospectively are market-agnostic are actually market-agnostic, which is to say, at least halfways, mentality-agnostic.

If you concluded from the above that I am confused about what I think, you would be correct.

Yeah me too. I’m just going to keep holding the stocks I’ve held but in smaller quantities until I can figure out what is driving all this.

I know this is a bubble because the people who occasionally ask me for stock recommendations are now bombarding me with speculative weed and biotech tips

hah!

Me too Joe. And the FOMO of the bitcoin returns seen to becoming too large to resist.

We all have similar stories. Here’s mine.

We needed a massive dead tree removed, so I called around for bids. The guy we ended up choosing, in the course of talking, mentioned his “portfolio” over the last 6 months or so. Of course he was like 5x. Restraining myself, I asked him about his plans. “What next,” I said. Literally his response was, “I’m gonna do 3x by May”. I thought wtf? That’s a plan!?

In any case, sure, this all plays into the retail trade & FOMO narrative out there (amongst many other driving effects, too), but my mind was blown when he started telling me about this.

Oh, I forgot the most important point — we did get the tree knocked down with minimal yard damage at a reasonable price. So tree removal costs aren’t in a bubble in the SE US.

Crazy! Well I’m glad you got your tree knocked down.

The market is ridiculous. Latest Stat – Door Dash now valued more than Fedex. People are just trading and not paying attention.

Been selling down some things. Sold the rest of my INOD for $6.70 today. Probably it goes much higher as it is kind of trendy with their AI solution, but I’m starting to wonder if this whole thing ends up coming down with a crash.

You held onto INOD longer than I could. I keep selling out of names only to find them up another 20% the next week.

The poster child of this mania is, for me, OEG. Because I have followed the company for years I can say with some certainty that this run up is unjustified. I mean this is the same company as CUI always was except they now own Reach Construction, a solar EPC firm. From what I saw Reach doesn’t even factor in on the top-300 solar EPCs in the US. All these EPCs have tiny margins, like 10% gross margins, lots of competition. Yes there is this new CEO at OEG and maybe he can create something of value but if you look at the financials the last few quarters it doesn’t look like it to me. Its a total – “this is a solar stock = buy” thesis and its up like 4x since November and doubled in the last week or so. I mean really?

Why not buy value stocks? And special situations. Looking around the globe, plenty of cheap stocks still. Isn’t that bubble stuff mostly isolated in a couple of tech stocks?

Didn’t value stocks outperform after the dotcom bubble burst? Then for after a while growth outperformed, and probably in the next couple years, the more boring value stocks will get more attention and outperform again. It has sort of already happened in December and early January, but we might just be getting started. While probably stocks like TSLA and SaaS stocks will under perform in the next few years as results will likely not live up to the insane expectations.

If you give me 5 stocks you think don’t go down if the market corrects 5-10% I’d love to take a look at each.

Difficult situation (aren’t they all?).

There are plenty of possible good ideas but market dynamics right now don’t fully suggest to me a sharp bifurcation/direction/pivot. Liquidity is the driver of everything, and the recent strength in value might have as much to do with the liquidity sloshing into that bucket as with a sea change in sentiment/market focus (though I’d say there is some of that too, given the timing of the small cap “liftoff.”) So if there’s a selloff, I’m of low confidence that value will be spared.

Interesting that you can still buy a few companies with real businesses trading around or below cash. PFHO, mentioned above, and NHTC are profitable(ish), and NHTC has a rather large current dividend; a glance at these would suggest why implied expectations are low….RBCN isn’t making money but I think it has interesting prospects; PBSV after its big runup is at more like 2x cash but is a fine business, with tailwinds, IMHO.

Would these go down in a correction? Maybe not…because they hardly trade!

thanks, I don’t think I’ve heard of any of those names. Will look. The thing about names that haven’t moved all that much that I worry about is what happens when this bubble that we have in some names pops? I keep meaning to look back at what happened in March 2000 when the internet names crashed. I think about this with EAST, I keep waffling between wanting to keep it because I think it is cheap and turning around and wanting to get out because if it can’t go up in this market what is going to happen in the next sell-off?

I don’t really think like that. But check out MTR, USDP, VHI, kind of obscure but pretty badly mispriced IMO with likely catalysts this year.

Fair enough. Thanks for the ideas, I’ll check them out. I kinda asked my question rhetorically in response to your comment – meaning that if a value name hasn’t gone up in this run, it probably will go down in the next decline and you will see better prices to buy at then.

My (less than) 2 cents on the above names: USDP interesting, but contract expirations next year make this too binary for me, since it’s such a small name. VHI/NL/CIX/KRO an eternally-complicated source of potential value and disappointment (I own VHI and NL) which could be cleaned up any day or never.

As for what happens in a collapse: yeah, exactly. Net-cash names (add AHC to the list–forgot to mention, though they are still maybe burning a little bit of cash) offer a theoretical floor, but not really since the market doesn’t think much of their businesses already, so why would they remain unmangled in a downdraft? Would be interested to hear what 2000 looked like; I was there, but don’t remember!

One thing I have started to do a little of is sell puts on names I wouldn’t mind getting at the strike, and selling calls on a few things I think are fairly valued like my MREITs. It’s insane what you can get for OEG out of the money calls, not that I would.

2000 was an interesting time where the high fliers (think Nortel, Cisco, pets.com, etc.) came crashing down, but value stocks, which had had a poor couple of years in 1998/1999, did well. Take a look at Cundill Value Fund for example, it was a hardcore value Fund in the traditional style like Benjamin Graham, but with the twist of looking for a catalyst to go with the cheap stocks.

https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P00007085&FundServCode=CND836@3,MFC3180@8,MFC7043@8,MFC736@3,MFC836@4&lang=en-CA

Clink on “Show Interactive Chart” to see the long term performance and you can see how it did well in the 2000/2001 period (compare it to the Nasdaq 100 for example), and the the end of the bear market pulled everything down at the end before rebounding into the next bull market. But value stocks like this would have held returned almost 40% from 2000 t May, 2002.

Thanks, Brent!

Id dig a bit deeper on USDP, and you find that they will likely sign a pretty significant number of 10 year take or pay contracts at better rates this year.