What to do with Air Canada

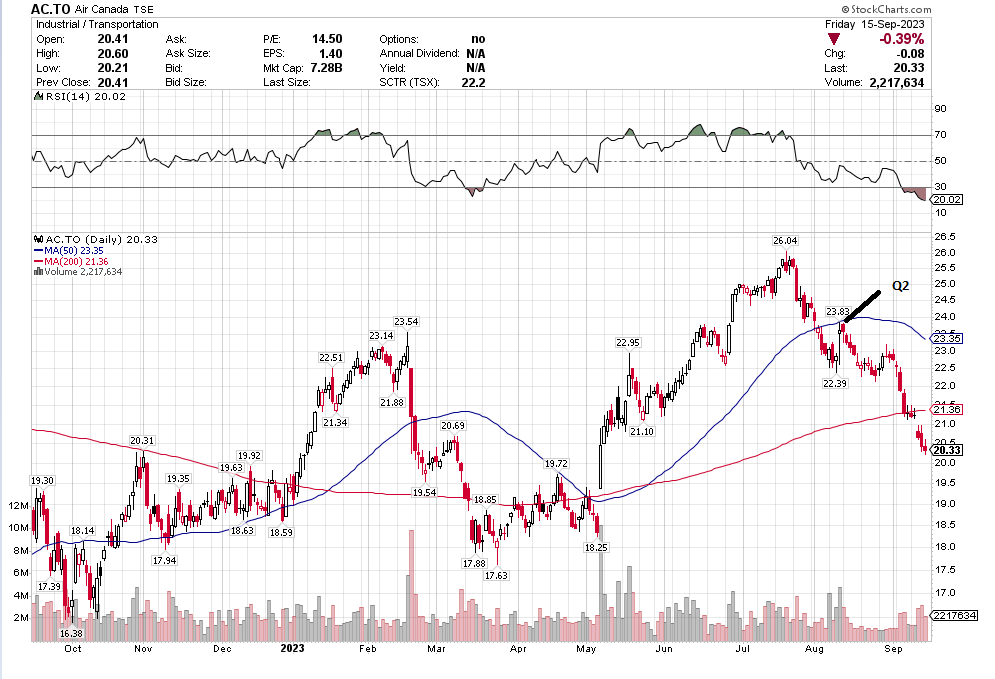

Air Canada has gotten whacked since it released its Q2 results. The stock popped on the day of the results and has fallen since.

I took a small position in the stock at $22.50, when it dipped after a good earnings report. I thought: it was a good quarter, they guided well for Q3, the economy continues to do okay, they are hedged for fuel, and the stock is pretty oversold.

That reasoning has not turned out very well. The stock has continued down, all the way back to $20 and now we are really, really oversold. My loss is at that 10% level where I usually revaluate and often admit defeat.

Q2 WAS GOOD

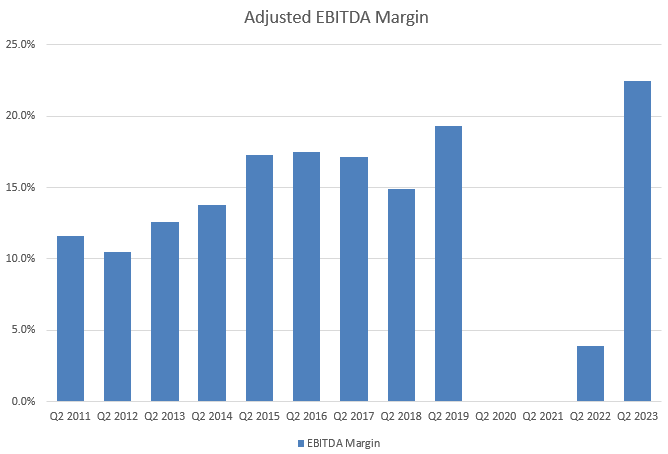

Air Canada had a very good second quarter. Revenue was up 36% YoY and they had $1.2b of aEBITDA, which is an aEBITDA margin of 22.5%. FCF for the quarter was $965mm which is up $537mm from 2022. They raised the low end of their FY EBITDA guidance.

Air Canada said that their international segment was really strong, up 70% YoY. US transborder was up 26%. Domestic Canada revenue was up 15%. The only real down business was cargo.

They said that “based on current passenger booking patterns, we see prevailing strength in travel demand over the second half of 2023, giving us confidence to increase the lower end of our adjusted EBITDA guidance range”.

PILOT SHORTAGES

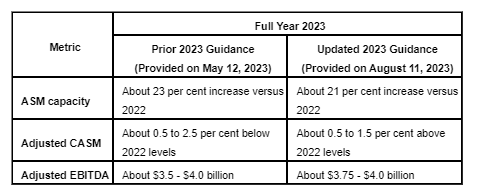

They slightly reduced their average seat miles capacity and decreased their average cost per available seat mile guidance for the full year.

It sounds like the reduction in ASM is due to pilot shortages and planes that are taking longer to put back into service. In fact, at the end of August they removed routes out of Calgary to Ottawa, Halifax, Los Angeles, Honolulu, Cancun, Frankfurt because of the shortage.

Pilots are also an issue for Air Canada because their contract agreement is up next year. WestJet pilots and some of the american airline pilots got large raises this year.

FUEL COSTS

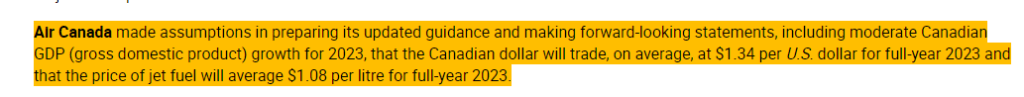

All the airlines are getting hit because of fuel costs. Spirit and American both warned this week with Spirit raising their fuel cost estimate from $2.80/g to $3.06/g and AAL raising their from $2.60/g to $2.95/g. US$3/g works out to about C$1.08/litre.

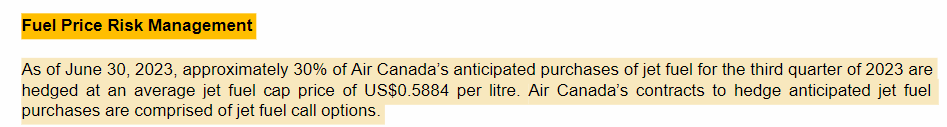

Air Canada was pretty smart about fuel prices. They are one of the few to hedge out some fuel costs for Q3.

That works out to about 79c per litre in Canadian dollars. Which is well below current jet fuel costs. Their guidance for the FY calls for C$1.08 per litre assuming a $1.34 US dollar.

In Q2 Air Canada’s fuel cost was $1.01 per litre vs $1.47 per litre in Q2 2022. Just looking at roughly the impact, Air Canada used 1,162b liters of jet fuel in Q2. A 10c move in jet fuel would be about $110mm more costs per quarter. EBITDA was $1,220mm in Q2. So big moves in jet fuel can certainly impact results.

I think its fair to say that Air Canada’s Q3 results aren’t going to be impacted by fuel costs like the other airlines because of the hedge. But post-Q3 their costs will be hit if prices stay this high.

PROFITABILITY

Air Canada margins have improved a lot since before the pandemic. Gross margins in Q2 were 14.8% vs 8.8% in Q2 2019 and 7.1% in Q2 2018.

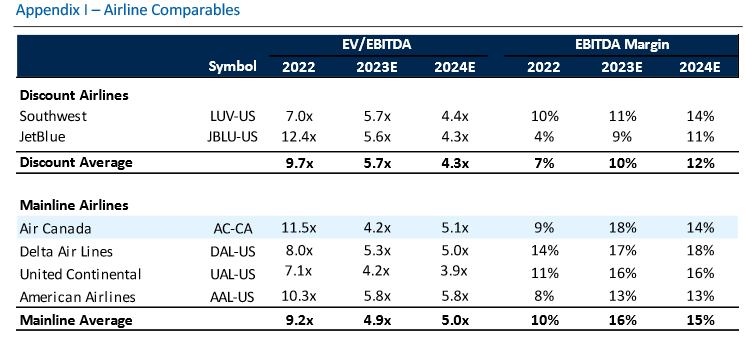

In what is kind of an amazing flip from when I liked the stock in the 2015-2018 period, Air Canada actually has better margins than its peers:

That has led to this higher profitability. Air Canada’s available seat miles (ASM) was 24,606 in Q2 2023. This was about 3,000 seat miles less than 2018/19. But the company still generated significantly more EBITDA and cash flow than both those years.

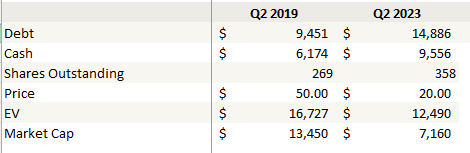

Air Canada has a lower market cap today but more debt (which is a carryover from COVID). Net debt is $5.3b vs 2019 net debt of $3.3b. The overall enterprise is still about $4b lower than it was in 2019.

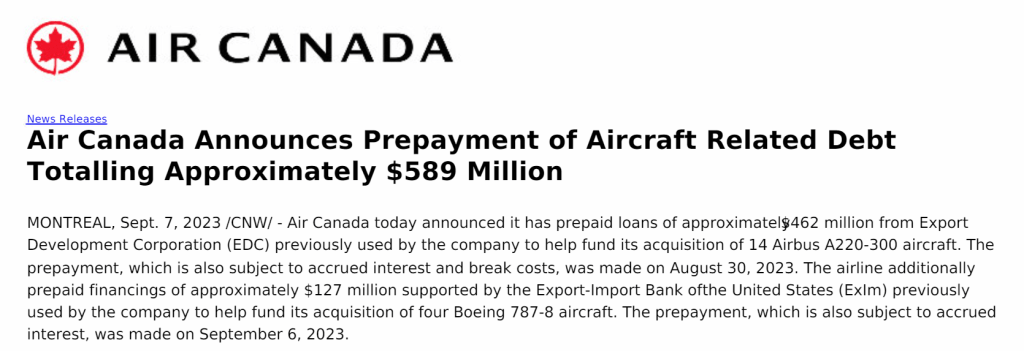

They are actively reducing debt – they announced $589mm of repayments just last week.

Here is the big question – should it be cheaper today than 2019? Yes, there are headwinds on fuel and pilots. But margins are better. Growth into 2024 looks better. Competition in Canada looks more favorable.

If Air Canada can maintain margins and continue to add capacity (they are calling for a normalization of their capacity to 2019 levels by 2024), I think you can make the argument that the discount is not warranted.

To get the same enterprise value as the end of 2019, Air Canada would need a $32 share price. That is $12 more than the price today and a 60% return.

Of course the case to be made against Air Canada is that margins aren’t going to stay at this level and Air Canada is fairly valued versus where comps are today. The table I made above showing them and other airline multiples is from RBC. The stock trades at average multiples on 2024 estimates – 5.1x EV/EBITDA.

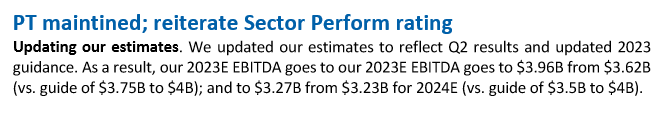

But RBC is pretty bearish on 2024. They are estimating $3.27b EBITDA in 2024 vs. Air Canada’s guide of $3.5b to $4b.

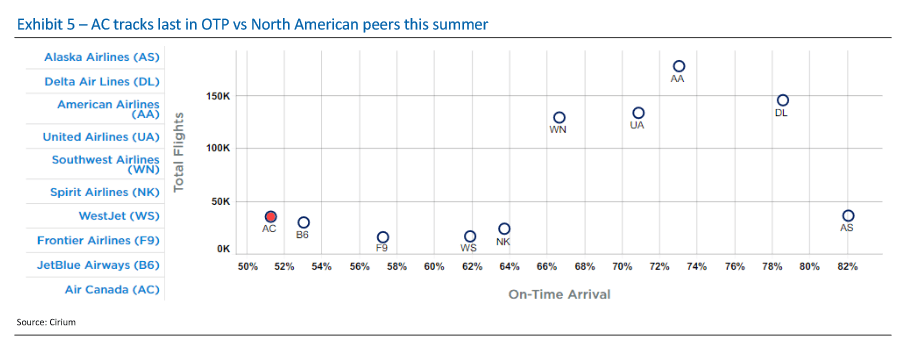

Another strike against Air Canada is that is has been pretty crappy to fly on. It does not have the best consumer metrics, in fact on some measurements it has some of the worst consumer metrics, which is a strike or two against it.

On the other hand, I really kind of wonder how much it matters. Air Canada and WestJet basically have a duopoly in Canada. I see that first hand, and I suspect that they have used COVID to come to a mutually beneficial (unspoken) arrangement in that duopoly, with WestJet dropping eastern routes and Air Canada dropping western routes.

That could be why their margins are now as strong as Delta and American, and better than United, Southwest and Jet Blue. In Q2 margins were higher than they have ever been for that quarter.

They are in a weird spot. Air Canada has record high demand, loads and fare giving them record margins and loads of cash flow. The argument that RBC is making is that this is as good as it gets – but to what stock price? The stock needs to get well into the $30s to get to 2019 levels and that is a time with lower margins.

They were at the Morgan Stanley conference last week, which would have been the opportunity to warn on fuel if they were going to do so. They didn’t.

Also factor in that because of the extremely strong cash flow Air Canada should be able to reduce debt by another $2 billion by year-end 2024 – which if you add that to the stock price is another $5.50 per share. Air Canada produced $965 million of FCF in Q2 and $1.95b of FCF in the first half of the year (though much of this was changes in working capital).

Honestly, I don’t know what to do about this one. Hold or give up. I can see reasons both sides. Sometimes decisions aren’t cut and dry.