Star Bulk Carriers

I need to come up with a way to get my writing out on this blog more regularly. I haven’t posted in a while but that doesn’t mean I haven’t been researching and writing. I have. I have posts on Air Canada, Blue Bird, Crocs, UIPath, PagerDuty, Snowflake, HBT Financial, Innovative Solutions and a few others. I just keep getting this uncomfortable feeling about all the emails that get sent out when I put them on the blog.

To try to get past that, I deleted about 400 subscribers that I have again accumulated over the past 4-5 years, when I last did a purge. There is only about 40-50 left and I think I know pretty much all of those names in some way.

So hopefully that is going to help me get over this stage-fright and put up some of the stuff I’ve written. I’ll try to stagger it out.

This post is about Star Bulk Carriers, which I don’t own, but am thinking I will own some time soon.

What I wanted to do here is see whether this company is cheap at this level. I have begun to convince myself that it is.

First lets go through the numbers.

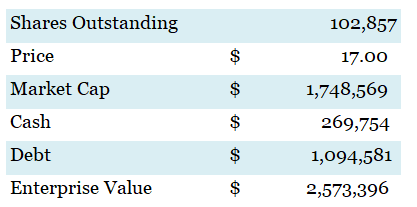

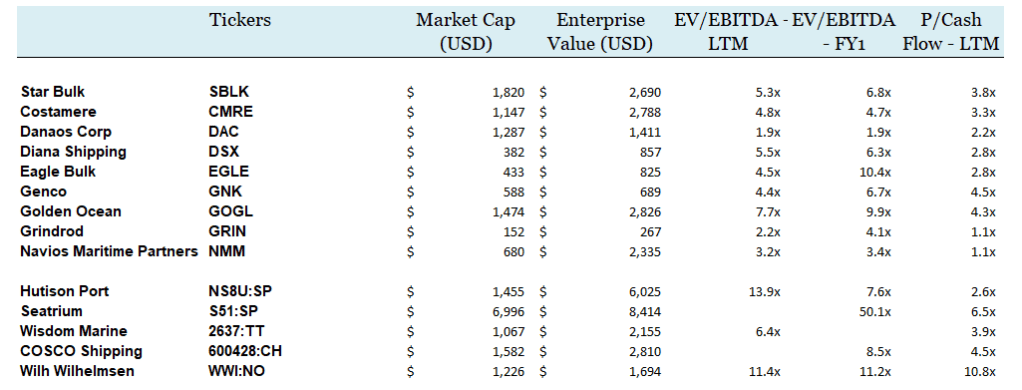

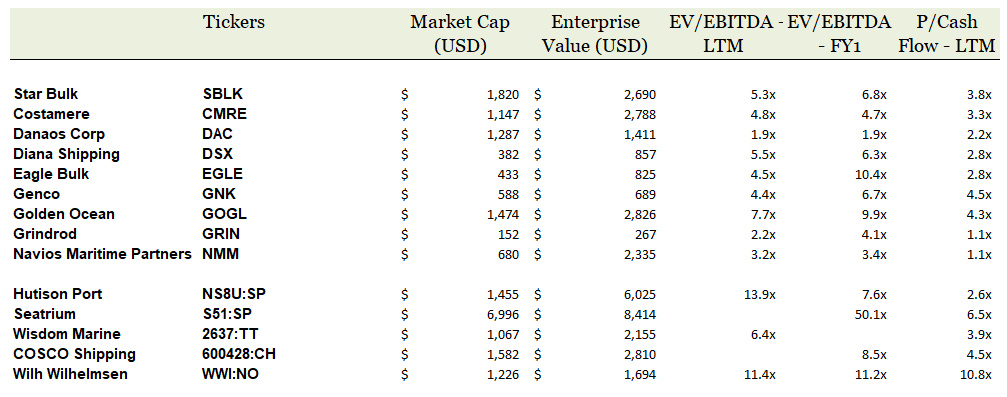

Right now SBLK trades at 9.7x P/E and 6.8x forward 2023 EV/EBITDA. All these dry bulk stocks trade quite cheaply on TTM cash flow:

WHAT ABOUT Q2 RESULTS

SBLK earned 47c EPS in Q223. They paid out a dividend of 40c for the quarter. They have a variable dividend that follows their earnings closely. This means that you can’t count on that dividend, it is more of a bonus.

SBLK also bought back 307k shares in Q2 – that’s a buyback rate of 1% of outstanding per year. If you go back through the last few years the share count has risen, not fallen, so while they are buying back stock, it isn’t offsetting dilution.

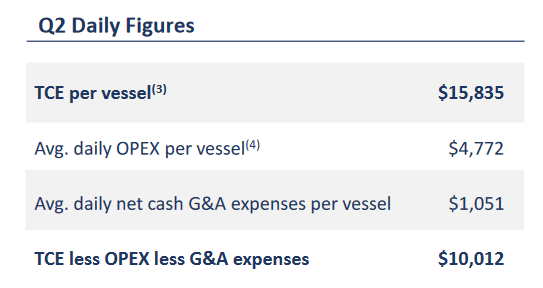

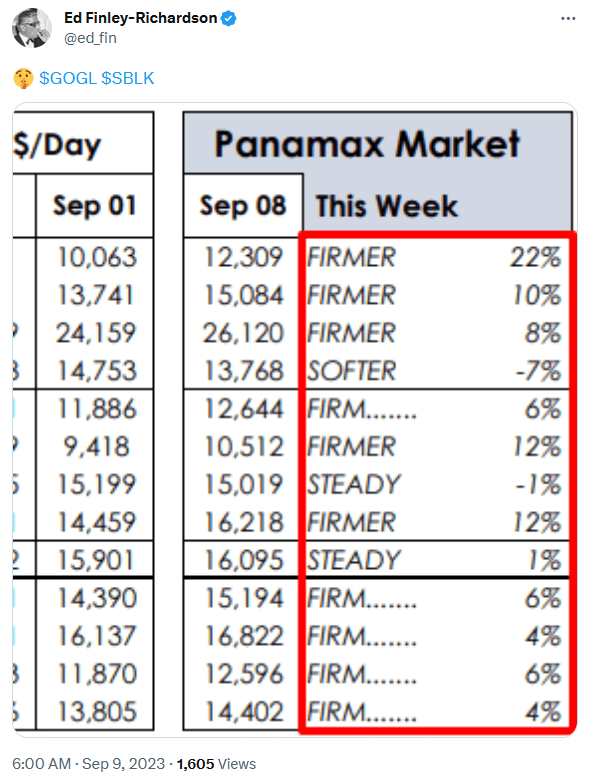

TCE for the quarter was $15,835 per vessel per day. This has come down A LOT from the highs of a few years ago. We are pretty close to historic levels now, which is one of the reasons I’m thinking about the stock:

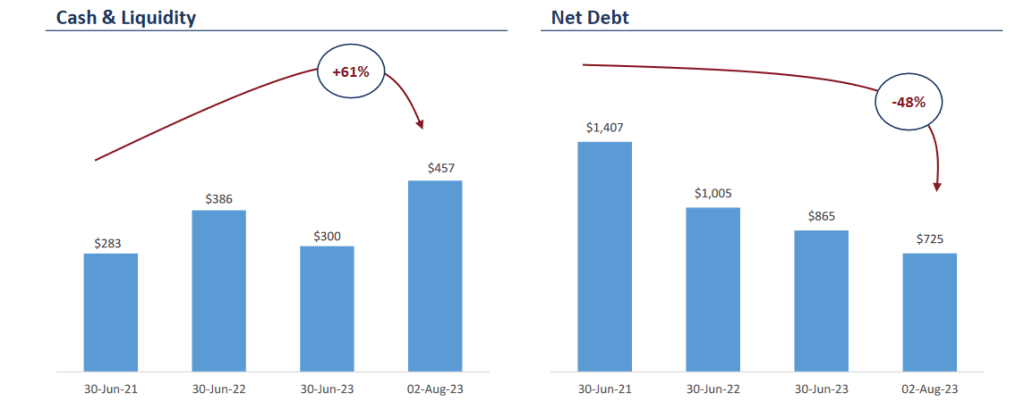

SBLK has definitely been paying down debt and raising cash the last couple of years. They aren’t really levered at all, which was always a knock against these shipping companies.

SBLK owns 120 ships with total tonnes of 13,347,973 DWT. This is the largest fleet among US and EU peers. They own a pretty even breakdown of the big, bigger and biggest dry bulks ships:

They have another 6 new builds coming in 2024. 4 are Kamsarmax and 2 are Ultramax.

From everything I have read, Star Bulk is one of the best operators. They have some of the lowest costs in the industry (I have a chart on that at the end). They haven’t done anything particularly stupid like some of these shipping companies are prone to do. They just are what they are – a shipping company that moves with the dry bulk market.

WHAT ABOUT DRY BULK SUPPLY/DEMAND

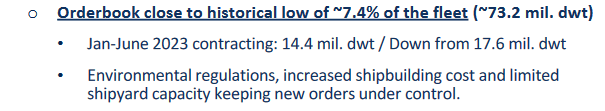

According to Star Bulk the order book is low:

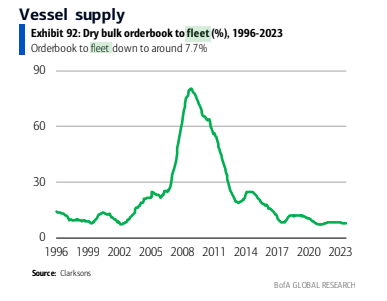

Looking back historically, that is about as low as it goes.

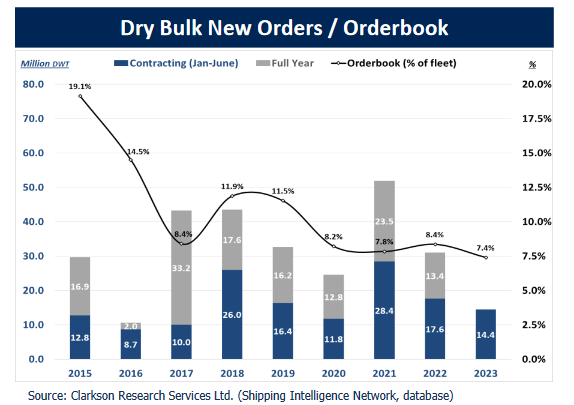

The order book also doesn’t look too bad to me. It is just about as low as it has been and it is down YoY for the first 6m

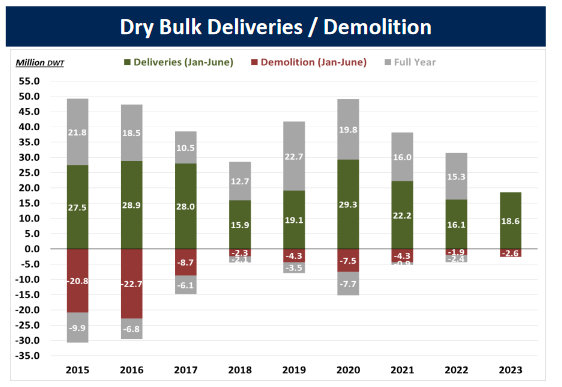

The delivery numbers don’t look too bad but the demolition numbers are low:

Fleet growth is expected to be pretty muted for the next couple of years. Only abought 1% for 2024 and 2025.

Here are some industry comments from Twitter:

First this. There is some evidence that dry bulk rates are bottoming and firming up.

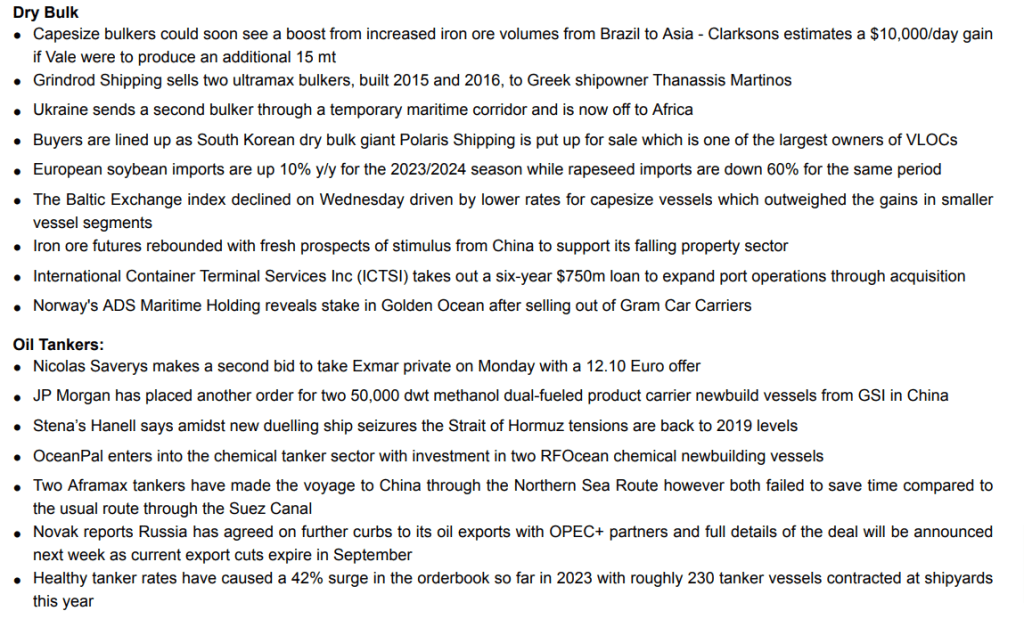

These are some thoughts on the market from Stifel. There isn’t really too much here other than that iron ore volumes could increase:

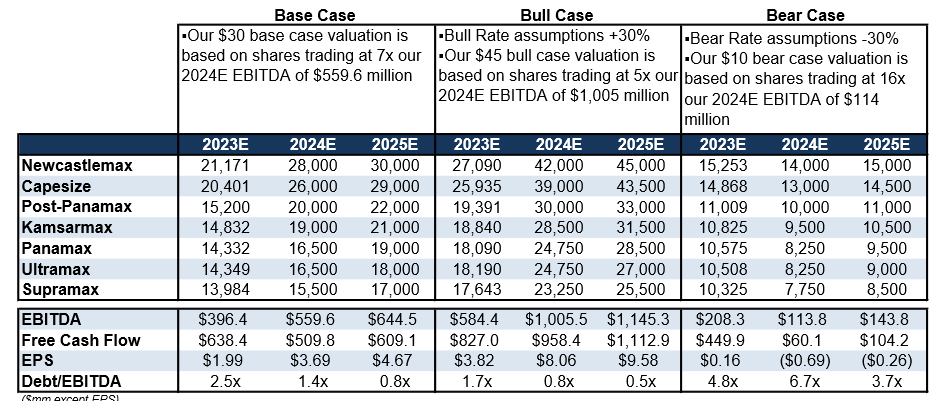

Stifel has a pretty strong rate outlook. if their base case plays out SBLK almost has to go higher.

VALUATION

Star Bulk has an NAV of $20 based on current vessel values. The stock has pretty consistently traded at between flat to a 30% discount to NAV. It is about a 14% discount right now. But also consider that this is off an NAV that is quite a bit lower than it has been even 6 months ago.

You could make the argument that on P/NAV SBLK is expensive compared to comps like GNK and EGLE. Both of these stocks are trading at more like a 30% discount. But SBLK is also out-earnings those companies. As I mentioned earlier, SBLK has some of the lowest OPEX in the industry. So they get more out of their ships than their peers.

Also playing to the “out-earning” idea, they aren’t comparatively expensive on operating metrics.

What are the risks? In the short-term, I think it is mainly global growth. A deep recession would hit them of course. China needs to pull out of its funk.

Over the longer term I have to think coal demand is a risk. But I don’t know if that is worth considering as a trade idea for the next 6-18 months. I’ve screwed myself enough ignoring oil because of my longer term worries.

But absent a big recession, I don’t think a big decline in rates is a risk any more. Rates have mostly done a round trip.

In Q2 SBLK had an average Time Charter Equivalent rate of $15.8k per vessel. In 2019 they did $13k and in 2018 $13.8k. Looking at the table below, rates were 2x to 4x current levels at the peak, depending on the ship (note that these are spot monthly rates, which are lower than the 1-year charter rates that are in the other charts/tables).

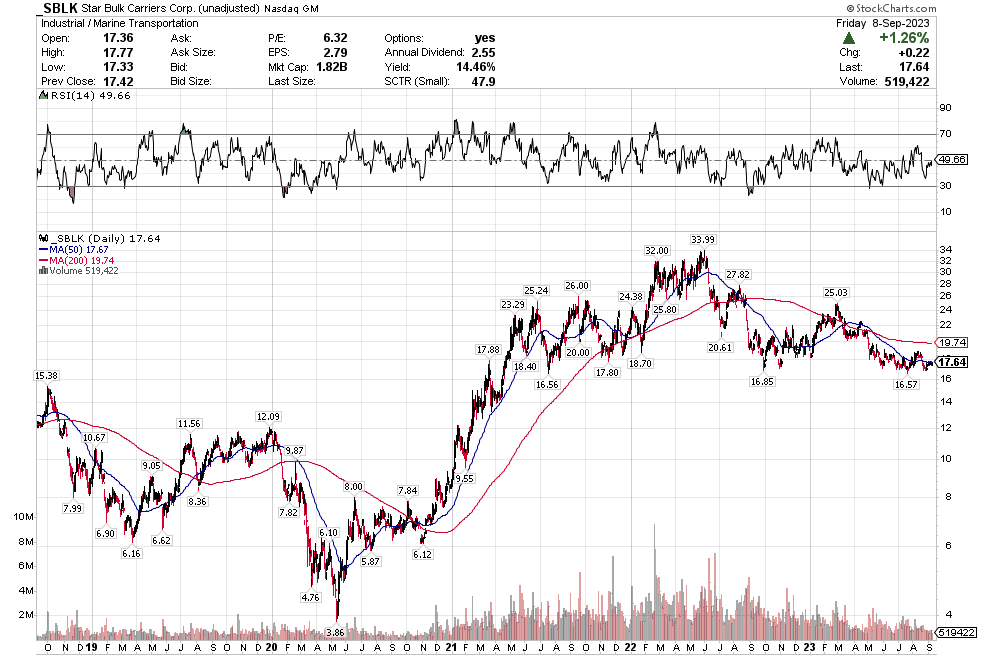

The stock itself is not all that different than it was before Covid. The price (unadjusted for dividends) today is $17.50 vs $12 at YE 2019:

Since that time, net debt has declined by $450 million. So really the difference in total enterprise value today is about $100mm, or a buck a share.

There are lots of ways to think about that comparison. A few are:

- SBLK had no FCF yield in 2019 vs. a 30-40% FCF yield today

- SBLK paid a 5c dividend in 2019 vs. a $1.90 dividend today

- Second hand vessel prices are about 50% higher today than they were then

CONCLUSION

This isn’t a blow your socks off kind of idea. It is also probably not an immediate buy. SBLK could easily go back into the $16s in the next few weeks or months if the market doesn’t leg higher.

And look, there is no getting around that the whole idea hinges on the economy not deteriorating significantly. You can’t deny that risk. The bulkers are screwed if we get a global recession.

But if we aren’t going to have a significant recession it just seems like this stock is likely bottoming at this level. And with the fleet growth muted and interest rates high to deter new entrants, there are some levers to make me think a cycle up could come quite quickly.