Hoping for a Turnaround at Mercury Systems

In the last few weeks I went through a whole bunch of sectors that are being blown out of the water. Many of these sectors are getting creamed because no one eats any more. But there are a few that are falling for other reasons. One of these is the defense sector, where I found no relationship between its demise and the introduction of weight loss drugs.

Because I don’t think that Ozempic will eliminate armed combat I went through the defense sector stocks and bought three of them. I bought some Lockheed Martin, RTX and Mercury Systems. Lockheed Martin and RTX are big and diversified so I don’t want to bother writing about them. Mercury Systems is more interesting.

Mercury is a sub-component supplier to the big defense contractors. They make chips (things like power amplifiers and limiters, switches, oscillators, filters, equalizers, digital and analog converters, chips, MMICs and memory and storage devices), boards and sub-assemblies (things like switched fabrics and boards for high-speed input/output, digital receivers, graphics and video, along with multi-chip modules, integrated radio frequency and microwave multi-function assemblies and radio frequency tuners and transceivers) and full systems (display and communication systems for aircraft, sensor and scanning systems for aircraft). These products are used as part of programs won by the direct defense contractors like Lockheed Martin, who use them and put into their end-products like aircraft, UAVs, radar systems and such. They sell to 25 different defense contractors.

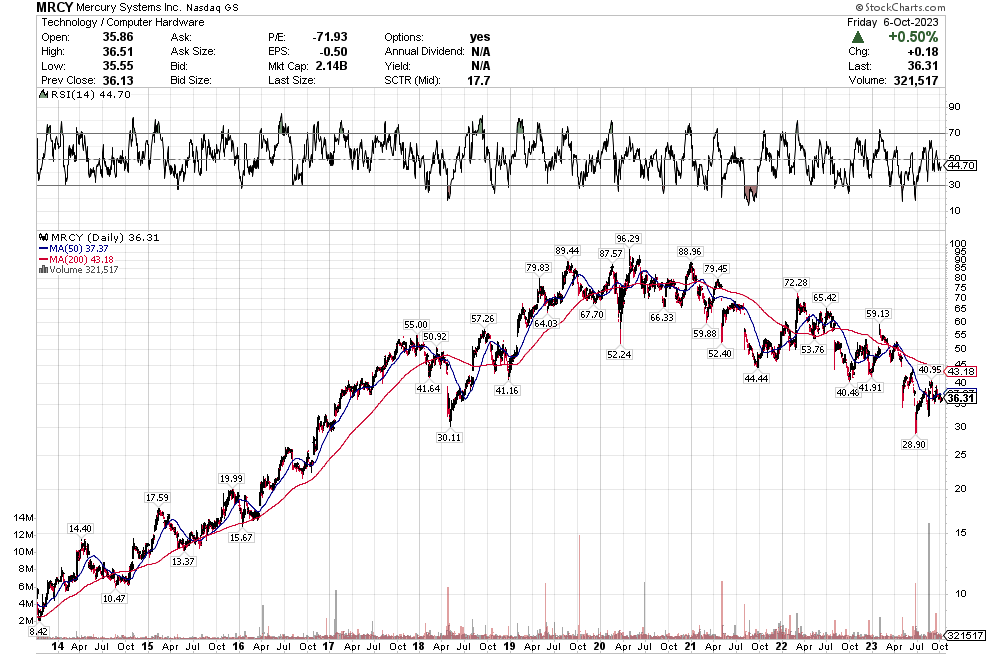

Mercury was a high flying stock for years and then in 2022 it fell out of bed.

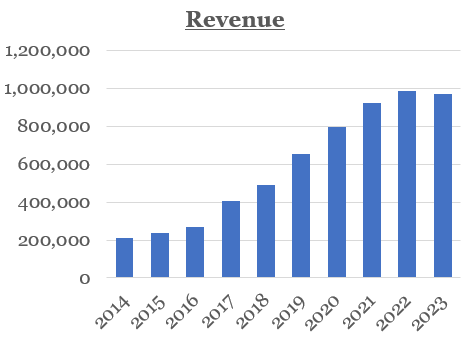

Mercury was a growth stock up until this year. The company grew revenue at an average rate of 22% per year from 2014 until 2023. Then it stopped.

HOW DID IT HAPPEN?

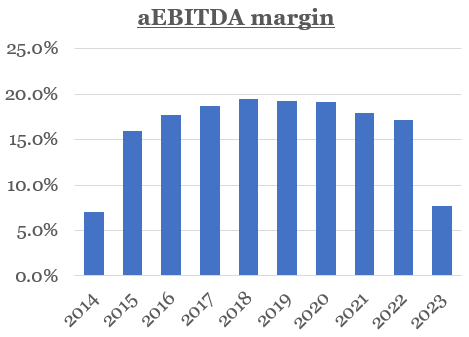

What happened? While there are lots of sordid details the essence of it is the same thing that happens to a lot of these growth stocks. The growth disappears, margins fall and then there is no basis for the rosy outlook that has buoyed the valuation.

This was followed by a couple activist investors, Starboard and Jana Partners (they still own 5% and 7% of the company), getting involved and trying to sell the company. That failed and the stock fell further.

The CEO and CFO were replaced, expectations have been reset with downward revisions to revenue and margins for this year and next, and the stock languishes in the $30s.

COST OVERRUNS ON DEVELOPMENT

That is the big picture. The more detailed picture of what is leading to reduced revenue and margins is this:

Mercury has 20 programs that are under-performing. These are all (or almost all) development programs – so programs where they care coming up with a new product that will eventually be manufactured, and because they are contracted to develop these projects from the larger defense contractors, they get paid for it.

These 20 programs are going over cost and are draining margins. Mercury noted on their last call that their portfolio is 90% firm fixed cost, so when a program goes over budget it falls 100% into margin. These 20 programs accounted for $56mm of margin decline in F2023 and $29mm in Q423 – which is to say the vast majority of the under-performance.

Having cost overruns on development programs also leads to lower revenue. “As total program cost increases on firm fixed price contracts the measure of progress on those programs decreases, resulting in a delay or reversal of revenue in the period the costs are recorded”.

That is the specific issue with 20 programs. More generally, all the development programs that Mercury is currently working through is impacting margins. Mercury’s usual mix between development and production is 20/80 but right now it is 40/60. Development programs, even when they are performing at expectation, have a much lower margin profile – in the low 30s versus in the low 40s for production.

A MARGIN MESS

As a result of all this Mercury’s gross margins are a disaster. They were down to 26.6% in FQ423 versus 41.3% in the previous year. About 11.5% of this is from the 20 challenged programs alone. The rest has to do with the mix of greater development programs and some unfavorable manufacturing variances.

That led to $21.9mm of aEBITDA in FQ423 vs $71.6mm in FQ422.

Some of this margin mess going to continue into their FQ124. They said expect negative EBITDA and lower YoY revenue. They don’t expect a real improvement in the business until the second half of their F24, which is after January.

Because the development programs have dragged on, it has impacted Mercury’s cash generation. Mercury was a consistent FCF generator or years but in F22 and F23 they were FCF negative. This is because their inventory and receivables grew, which in part was because of development programs that were buying inventory to go into production but then not going into production. COVID related supply chain issues didn’t help. This is expected to reverse here in 2024.

Mercury has said that working capital should be about 35% of sales. That would be about $350mm whereas right now its about $700mm.

WHAT’S BAD IS GOOD

The good news is that development programs eventually become production programs and having all these development programs bodes well for future growth.

Mercury’s model is to develop products that will be used across multiple DoD programs. So once they get through the development stage, multiple programs should benefit.

These are long-term headwinds. Mercury said on their FQ3 call (this was the former CEO) that the programs would complete in the next 2-3 quarters and reiterated something similar on the Q4 call (their new CEO said this). This excess of development programs that are coming in above budget should sort itself out by next summer.

Their bookings and backlog don’t seem too bad to me. Their backlog gives them 70% revenue visibility for 2024, which exceeds their historic coverage ratio.

Of course, they also had 80% coverage ratio going into Q4 and they still missed guidance.

REBUILDING TRUST

The story here is about getting margins back to normal and then seeing these development programs turn into production programs and generate revenue growth. Mercury expects that in 2024 they can get their EBITDA margin up to 16.8%-18.5%. The longer term goal is getting it to 20%+.

But these margins will be below YoY level in the first half of F24. So it will take time. And the market will be skeptical because they have disappointed in the past.

As recently as the Nov 2022 call (FQ123) Mercury said they thought they could get to 20% EBITDA margins in F23. And they said on the FQ2 call that EBITDA margins would be 30% in Q4. That was reduced to 18% guidance in FQ3 and then it came in at 8%. One analyst on the FQ4 call demonstrated the disbelief: “I still don’t understand how it got cut 45% in 90 days” which is about as close as analysts come to saying WTF are you doing?

There is a lot of trust that is going to have to be rebuilt after this level of miss this fast.

I think there is also a lot of skepticism simply because the previous CEO was misrepresenting what was happening in the business as Mercury tried to sell itself. He kept calling out “supply chain” as the issue.

We expect margins to naturally return to pre-pandemic levels as we overcome current execution challenges and as the supply chain conditions continue to normalize. Further margin expansion will follow is the late-stage development programs transition to production, and as we return to a more normal 80/20 business mix over time.

In retrospect, it seems like the former CEO was lumping in supply chain with the real issues, saying stuff like “we’re driving continuous improvements in new product development, supply chain, operations and program execution”, which made analysts think the problems were transient supply issues out of the companies control and not program issues that were.

The new CEO is straightening that out and now its clear there was more going on. Here is the broader explanation from the Q3 call:

In fiscal ’19 through fiscal ’21, we achieved a significant level of design wins, both organically and through acquisition, especially as related to the physical Optics Corporation acquisition. These design wins were predominantly within secure processing and mission avionics, 2 of our key strategic growth areas and translated into development contracts in our backlog. The onset of COVID in fiscal ’20 and the transition to remote work added latency to our development efforts.

Slightly thereafter, supply chain delays began to limit availability of critical components followed by the great resignation, which created labor constraints across a number of our program executing functions. We began to see some margin reduction in fiscal ’21 and fiscal ’22, partially offset by lower R&D expenses as more engineers charge labor directly to these development programs.

This resulted in increased levels of CRAD as discussed in many of our prior earnings calls and public filings. The higher engineering labor content, coupled with low unit volume on most development programs contributes to average gross margins in the low- to mid-30s on these programs.

I don’t think supply chain was what analysts were being told it was. It was really that they had ordered inventory that wasn’t getting used because their development projects were off-track. That is my suspicion anyway. One analyst called it out with the new CEO on the Q4 call, asking why all of a sudden there were no mentions of supply chain after hearing that the problems were nothing but supply chain before that.

There is also skepticism because the number of problem development programs increased pretty substantially from Q3 to Q4. In Q3 it was 12. In Q4 it was 20. So there is probably a bit of wondering what it is in Q124.

As a consequence of all these half-truths and the skepticism it has created, I feel like the new management team is really being conservative on guidance. When pushed they admitted they are erring on the side of caution here and the numbers bore that out.

WHAT IS IT WORTH?

During the years that Mercury was a growth company, they maintained pretty consistent EBITDA margins. The dip in margins in 2021 and 2022 could have just been COVID supply chain, more maybe it was the beginning of the bigger issues we see now. It’s hard to really say. But margins didn’t really collapse until this year.

At today’s price of $36 I estimate that the stock pricing in basically no growth (say 3% average for the next 10 years) and at least a four year grind to get back to historic EBITDA and FCF margins. Which is to say that there is very little of a potential turnaround priced in.

If Mercury turns it around, recovers to historic margins and shows that they are a 10%+ grower again, this is quickly an $70-80 stock.

There are a bunch of ways of getting to that valuation. A DCF model can give you $30-$35 fair value at 3% growth and $80+ at 13%. If you look at it from a multiple perspective, Mercury traded at an average of 21.5x EV/EBITDA over the period from F2014-F2022. If I use that multiple, assume that they recover to 19% EBITDA margins in F2025 and, after not growing at all in F2024 they get back to 13% growth in F2025, I get a 2025 stock price of $71.

Everything points to a current stock price that (not without reason) is discounting a lot of skepticism about the turnaround, about the numbers and about Mercury’s ability to pull out of this slump. And the upside is roughly a double. Which I think makes it a good risk/reward.

Not sure about MRCY. I worked in defense electronics for over 30 years. A more likely explanation for what happened is that the previous CEO signed very aggressive cost and schedule development contracts for the components. The company had growth targets to meet. They were zapped by Covid, then apparently had a lot of engineering talent and institutional knowledge walk out the door. The new CEO is in a rough spot. The primes need realistic schedules, and probably don’t like what they are hearing. What keeps project managers at prime contractors awake all night is a missing $100 part holding up their multi billion dollar weapon system. I would be concerned about primes willing to work with MRCY in the future.

Thanks for the great comment! I think the thing that would matter the most to me is if you have heard scuttle that the prime contractors are stepping away from MRCY as a result of underperformance. I didn’t really hear anything like that in the analyst reports or by trying to read between lines of the conference call question/answers, but I don’t think you necessarily would. That would for sure be bad.

My assumption has been that Mercury blew it with their bids on these 20 programs, they went over budget and they are eating the losses as a result. But I’ve also assumed that they have not performed in any way that would upset their prime customers. But that is just my assumption, i don’t have any evidence of that myself one way or another and for sure if the prime contractors are walking away then its going to be much harder.

Mercury inspired the a screen that I like to run every month:

5 sales CAGR above 10%

LTM EBITDA margins above 19%