Taking advantage of the disappointment with Bellatrix

This is a company I should have owned 12 months ago when I was looking around the Canadian oil and gas universe but instead pissed around trying to buy the cheapest thing. When investing in an oil and gas company buying the cheapest thing is simply not the way to make money. I’ve been investing in the sector for 10 years now; every time I walk away and return I have to learn that lesson again. Hopefully that will end now.

Bellatrix Exploration (BXE) is simply a company with lots of land in very prospective areas and a history of being able to grow production on a consistent basis. The stock is on sale because of a bungled private placement and I think that presents an opportunity.

Background about the company

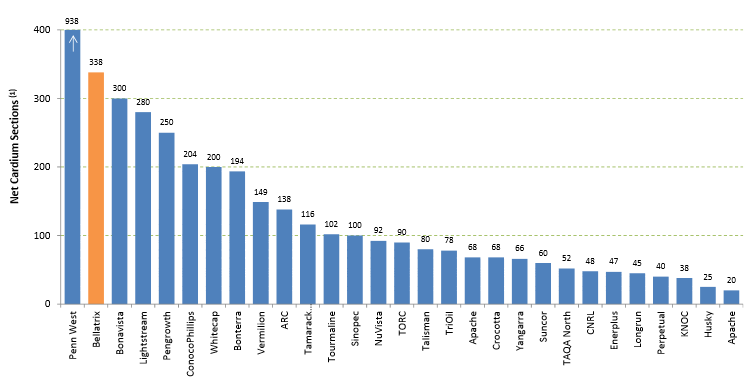

Bellatrix owns one of the largest positions in the Cardium (in Alberta) in the industry.

They’ve proven they can develop that land in an efficient manner. The company has grown its production the last 4 years and expects another strong year of growth in 2014 (note though that the 2014 production number is being buoyed by the acquisition of Angle Energy, which closed late last year). Read more