Week 254: Just a Bunch of Company Updates

Portfolio Performance

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

First some house keeping. RBC’s has added new tools to make it easier to show performance for practice accounts. I’ve maintained my portfolio manually through an excel spreadsheet for the last couple of years because RBC screws up the purchase values on their portfolio holding page and the gain/loss on individual stocks are, at times, ridiculous (my average cost is sometimes negative).

Recreating the results, even after building a visual basic routine to update the month of trades, was quite cumbersome, so I welcome these new tools. At the beginning of the post I showed a list of my top ten holdings and below are all my positions, both are from the new tools.

The only information that is lost in this new format are the position by position gains and losses. While this is unfortunate, its so much less work compared to the process I had to go through before that this is how its going to be.

With that said…

I didn’t purchase any new stock in the last month so this is going to be a bit of a boring update. I’ve be dedicated the space below to a discussion of a few of my larger and/or more interesting positions.

With April/May being an earnings period, there is a lot of information to consume. I had mostly good news from the companies in my portfolio. I’ve tried to stick to names with solid operating momentum, staying away from those that might be turning it around but where good news has yet to trickle out. And that has served me well.

As I have remarked before, my portfolio has been sitting in a holding pattern for the better part of a year. While I am still waiting on a break out from the range, I feel better about the stocks I own than I have for a while. Not all of them will pan out of course, but a few will, and hopefully 1 or 2 will be the multi-baggers that I depend on for out-performance.

Radcom

There is a lot to write about Radcom.

Radcom’s first quarter results were fine. The company had revenue of $6.5 million and generated non-GAAP income of 15 cents per share. Perhaps the only negative about the quarter came out in a subsequent filing, that over $5 million came from their Tier 1 client, AT&T.

For the first time the company provided revenue guidance for the full year, a range of $28-$29.5 million. They said that they were very confident in their ability to achieve this guidance as 80% of it was already secured with contracts. In a later filing they said that 50% of their revenue in 2016 would come from North America.

Putting that together, Radcom is saying that they will generate about $14-$15 million from AT&T, and another $14 million from their existing non-NFV deployment.

Overall this is all as expected to slightly positive. But the quarterly results and guidance don’t begin to tell the whole story here. In fact what is most telling about guidance is what is left out; it does not include any contribution from additional Tier 1 service providers.

The company is actively pursuing additional Tier 1 customers for their virtual probe solution (MaveriQ). They said they are in discussions with carriers from North America, Western Europe and APAC. I’ve heard that the number of Tier 1’s is in the range of a handful.

It was reiterated on the conference call that MaveriQ is well ahead of its peers. Competitors either haven’t rolled out an NFV product, or if they have they don’t have real world implementation on it, and it is still tied to hardware.

We have competitors in the market but to our best understanding and everything that I am hearing from the CSPs and say they enrolled out an NFV product, some are saying that they have – they don’t have real world implementation on it. Some seem to be still in the hardware area and you cannot monitor an NFV network with the equipment, that’s why we believe they were the first mover and we were widening the gap with our competition.

This is inline of what I have gathered from one of the leaders in physical probes, Netscout, who recently said that their first virtual device would not be released until May. I listened to Netscout’s webinar dedicated to NFV where they talked about their virtual probe technology and I was not impressed. It felt like the event was put together to prove that they were in the game.

I note that Mark Gomes wrote the following on Friday, which corroborates with scuttle I had picked up from a different source:

In fact, word is spreading that RDCM’s product (MaveriQ) scored a perfect 100/100 in its lab trials, while the nearest competitor could only manage a 70/100. In other words, RDCM’s technology lead is wide, making them the de facto leader for NFV Service Assurance.

Amdocs provided some color around the cost advantage of virtual probes in this interview. Justin Paul, head of OSS marketing at Amdocs, said the following:

The fixed video network model uses virtual probes instead of physical probes. This is because traditional, physical probes can’t probe a virtual network and the cost of a virtual probe is significantly lower than a physical one. We’re working with Radcom to implement a vProbe solution with a North American CSP and we’re seeing from the work we’ve done there that physical probe is 20-25% less costly than a physical probe. In addition, you can throw up a ring of probes around a specific area to address a specific peak in demand and redeploy those licences elsewhere when the peak has passed. They’re cheaper to buy and they offer greater flexibility and agility to operators because of that redeployment capability.

Since the results of the first quarter Radcom announced a share offering. What has followed is an ensuing sell-off in the shares ha culminated Friday when the pricing of the shares came in at a disappointing $11.

Maybe I am too sanguine but I am not worried about the sell-off and while the dilution is unfortunate it is not overly material compared to the eventual upside.

Whether Radcom did a poor job selling their story, were poor negotiators, or just deemed the institutional backing and analyst coverage as being worth the cost of dilution at a somewhat low-ball price is unclear to me.

In the same article I quote above Gomes commented about over-subscription. I have heard similar comments from another source. The price action on Friday where the stock traded enormous volume and did not dip below the offer price suggests significant demand even as some shareholders throw in their cards in frustration after what could be perceived as a poor deal.

So the evidence is that the offer price is not a function of lack of interest and not a reflection on investor enthusiasm for their business prospects or for the strength of their MaveriQ solution. And that was the real negative here; does $11 reflect poorly on Radcom’s business? If it does not, and is a function of their willingness to concede in order to improve their balance sheet and get institutional support then really its not very negative at all.

I added to my position in the days leading up to the pricing. That’s unfortunate. I could have gotten those shares lower on Friday. But I do not see any reason to back track on those purchases.

I sat on a 1-2% position with Radcom for a couple years, all along thinking that this was an interesting little company with a promising technology that was worth keeping close tabs on in case they were able to step into the big time. That is exactly what they’ve done with AT&T and are on the cusp of doing with other Tier 1’s. I would be want not to do exactly what I anticipated doing in the event of such a progression. And in the long-run I don’t think I will care too much that I bought the stock a day or two too soon.

Radisys

The first quarter results marked another step along the trajectory towards transforming Radisys’s business. The company continues to add to its suite products and services designed to facilitate the migration of service providers towards virtualizing their networks.

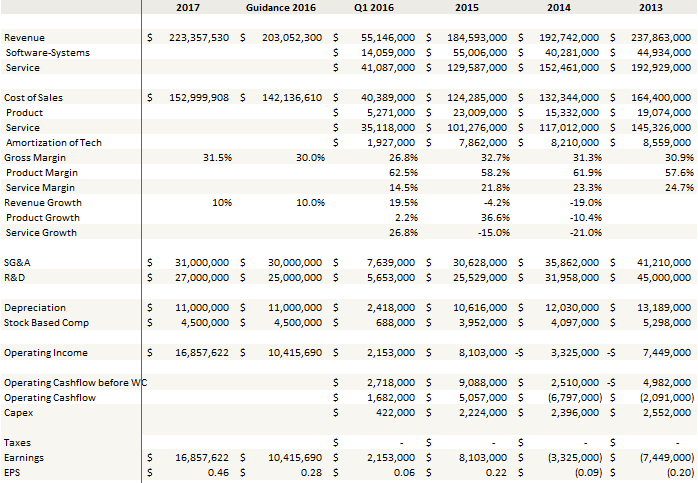

The company hit the high end of their guidance and then raised their guidance for the rest of the year. They raised revenue to the range of $195-$215 million from $180-$200 million previously. They left earnings per share guidance with the range of 22-28 cents on the expectation that additional costs would be incurred to support the expected revenue ramp.

he guidance raise was in large part due to the new DCEngine product.

DCEngine is a rack frame pre-installed with open-architecture software and white box hardware. Its designed to be an alternative to the “locked in architecture” sold by the incumbent providers, and is consistent with the move to virtualize network functions (as opposed to tying them to hardware) so that upgrades, additional capacity and new functionality can be installed via software installs rather than hardware swaps.

DCEngine had its first order from Verizon, a $19 million order, at the end of the fourth quarter and this order was fulfilled in Q1. On the first quarter call the company said the order from this service provider was expanded to $50 million, with the rest of the order expected to occur in the second quarter.

While this a large order for a company Radisys size, what is most interesting is that Brian Bronson, the CEO, referred to it as a “rounding error” in comparison to what Verizon needs to build out.

DCEngine is a low margin product, somewhere south of 20% gross margins. But volumes could be significant, and management said that once the product gains traction that DCEngine orders “should be in the hundreds of millions.”

In addition, there is ancillary revenue to be gained from DCEngine sales. Right now Radisys populates each rack with two white box switches. In the second half of 2016 the company’s FlowEngine product will be upgraded and allow Radisys to replace those switches with it. FlowEngine is a 60%+ gross margin product.

Second, the move from central office to data center is complicated and often requires support services from Radisys. Providing the rack positions Radisys as the natural support resource, which on the call the company said can add another 10 points of operating income.

The company painted a positive picture of growth going forward.

They said that in addition to the Verizon order they were in discussions with a dozen service providers for DCEngine and expect to have 4 to 6 in trials by the end of the year.

With MediaEngine Radisys continues to ship product to their Asian servicer provider customer and said they are “increasingly confident in our ability to secure further orders.”

They also see strong orders for FlowEngine in the first half from their Tier 1 carrier and while that might taper off somewhat in the second half they are still expecting revenues for FlowEngine to double year over year and there is the opportunity that more orders will materialize in the second half.

There are a lot of evolving parts with Radisys which make it difficult to pinpoint a forecast. If I assume that revenue can grow 10% in 2017 on top of midpoint of guidance growth in 2016, that gross margins stay constant and SG&A and R&D costs increase modestly, I easily get to an EPS above 40c in 2017. This seems like pretty conservative projections and yet it should easily support a stock price that is 50% higher.

What is interesting is how sensitive the numbers are to incremental revenue growth. 15% revenue growth produces and EPS above 50c while 20% revenue growth in about 60c.

What is interesting is how sensitive the numbers are to incremental revenue growth. 15% revenue growth produces and EPS above 50c while 20% revenue growth in about 60c.

What this makes clear is that there is real upside if the product suite begins to gain traction and realizes some of the expectations management alluded to one the conference call. The speed of the move up above $4 makes it difficult to pinpoint exactly where one should add to their position, but I feel like somewhere in the low $4’s, high $3’s will look like a good price in the long run.

Medicure

I was pleased with the first quarter results announced by Medicure. Sales were down to $6 million from $9.5 million in the fourth quarter. Earnings per share were 5c again down from the fourth quarter. None of this was unexpected after the run-up in earnings in Q4 due to Integrillin shortages.

Earnings as reported by the company are also being depressed by higher intangible amortization due to Medicure reversing some of the write-down of intangibles related to Aggrastat in the fourth quarter of last year. These intangibles show up in the cost of goods sold (which is why margins were down to 86% in the quarter) and most drug companies exclude them from their adjusted earnings. Without the intangible earnings would have been 8c per share.

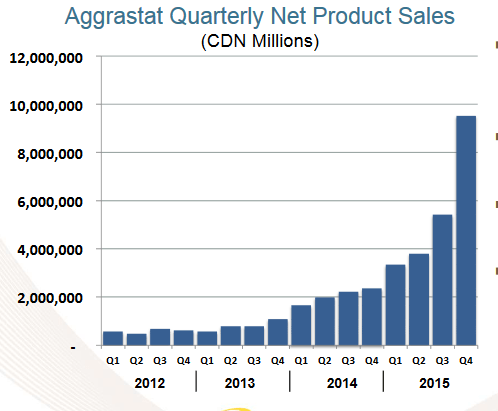

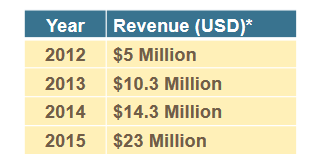

As the slide below, from their first quarter presentation, demonstrates, first quarter sales of Aggrastat were down sequentially as wholesalers that had stocked in the fourth quarter due to shortages of Integrillin purchased less but still up from the third quarter.

The company also provided data for hospital bag demand, which was down again from the fourth quarter but to a lessor extent than sales, and up significantly from Q3.

The company also provided data for hospital bag demand, which was down again from the fourth quarter but to a lessor extent than sales, and up significantly from Q3.

Interestingly, the company gave a couple data points to help investors normalize their sales data. They said that first quarter sales understated demand by “a couple million dollars” because of the destocking. They also said that they are currently shipping 1,700 bags per week, which works out to 20,000 per quarter and means that bag demand has continued to ramp subsequent to the first quarter.

Interestingly, the company gave a couple data points to help investors normalize their sales data. They said that first quarter sales understated demand by “a couple million dollars” because of the destocking. They also said that they are currently shipping 1,700 bags per week, which works out to 20,000 per quarter and means that bag demand has continued to ramp subsequent to the first quarter.

The day before earnings Medicure announced that they are in the process of filing for bolus vial format approval – this will make it easier for hospitals to use Aggrastat. Some hospitals struggle with delivering high dose bolus via intravenous pump instead of syringe. The company provided the following clarification on the conference call:

Although the current bag format can be used to deliver the HDB as well as the maintenance infusion, some physicians and hospital catheterization labs prefer to administer the initial bolus dose with a smaller volume of drug product. Moreover, the availability of a ready-to-use bolus vial will provide greater operational similarities and efficiencies for hospitals transitioning to AGGRASTAT.

Finally, although there is nothing concrete yet, the company reiterated its interest in purchasing Apicore, the generic supplier that they own 5% of, have a purchase option on the remaining interest, and are in partnership with for the production of a as of yet unnamed generic later this year.

There were a couple of questions in my last post about Medicure. In particular what generic Integrillin meant to Aggrastat and second, whether Aggrastat itself would have a generic equivalent soon.

The second question came up because when you look at the patents that Aggrastat has, some of them run out as soon as 2016. While its still not totally clear to me everything I have read suggests that when a drug is approved for a new indication it extends the exclusivity of the drug. Medicure was granted patent until 2023 on the high dose bolus.

I still haven’t found the smoking gun that addresses this type of situation specifically but I did find a number of resources that indicate that generics will not be allowed until the high-bolus patent expires. This link to the FDA describes the periods of exclusivity for various NDAs. This slide show describes how a new drug is patented and how the exclusivity period is determined. This q&a describes how a patent is extended with a label change for a new indication and how that will keep a generic off the market. In the book “Cracking the Code” authors Jim Mellon and Al Chalabi write:

Quite often, drug companies therefore try and extend patent life by tweaking the molecular structure of their drugs, changing the dosages or combining their drugs with other therapies to try and create a novel but similar product that allows the patent life to be extended.

Also worth noting is that Medicure does not refer to generic tirofiban (the drugs name) competition as a risk factor in their AIF.

As for the generic competition from Integrillin, it is real and occurring but Medicure allyed concerns by updating their price competition slide to include the cost of the generic.

Aggrastat remains the cheapest of the bunch.

I have added to my position around the $5 range and even caught a couple purchases in the $4’s. Unless I am wrong about the direct generic competition being years away I think the stock is too cheap and should trade up to a high single digit number on the current level of Aggrastat sales alone. If there is a positive event with Apicore, the new generic introduction, or additional sales from new indications for Aggrastat, then all the better.

Air Canada

I continue to believe that Air Canada is misunderstood. Maybe some day I will be proven right.

The stock trades at a significant discount to all of its peers. The justification behind the discount amounts to:

- Air Canada has a lower operating margin

- Air Canada has a comparatively higher debt load

- Air Canada’s strategy of capacity additions is bound to end in tears

I get that (1) and (2) validate a somewhat lower multiple than a debt free, high margin peer. But the current discount is too much. As for the third justification, I think it fails to recognize what Air Canada is trying to accomplish.

Air Canada is adding capacity, but it is not to serve a slow Canadian economy. Capacity is being added to international flights in what they see as under-utilized Canadian/international hubs in Toronto, Montreal and Vancouver. The strategy is to pin-point international demand where the location of the hub and cost structure puts them at an advantage against the competition.

Air Canada is also taking advantage of what is actually a lower cost structure on some routes (due to Canadian dollar based expenses and new airplanes with better efficiency) to claw back trans-border traffic that they lost to US carriers during the dark period of their bankruptcy and near-bankruptcy.

Finally Air Canada has added new planes and routes that increase their flexibility to redistribute the fleet during slowdowns like the one that we have seen in Alberta. It didn’t seem to get a lot of focus in the first quarter follow-up but the Alberta slowdown barely blemished their results.

I think its instructive that with few exceptions when Air Canada comes up on BNN’s Market Call, the pat responses is:

- The Airline industry is always terrible

- Air Canada has gone through bankruptcy before

- It can’t be different this time

What is unfortunate is that there is no quick fix to this perception. The past couple of years of mostly excellent results are proof that it is going to take time, maybe a full cycle, before portfolio managers become comfortable with the idea that Air Canada has positioned themselves to withstand economic weakness and grow the business in good times. Perhaps when oil prices recover and we see the Canadian economy turn up investors will start to conclude that hey, that was the downturn, and look, Air Canada is still standing. I’m willing to wait that out as long as the company continues to perform.

Health Insurance Innovations

Health Insurance Innovations turned in a very good first quarter but they haven’t gotten a lot of credit for it. Revenue was up 88% to $42.5 million. EBITDA grew from a negligible amount in the first quarter of 2015 to $4.2 million in 2016. Policies in force grew from 195,100 to 258,000 sequentially while submitted applications grew from 153,300 to 192,200. They saw growth from all their sales channels but in particular Agilehealthinsurance.com, their online sales channel, doubled from 11,000 policies submitted in the fourth quarter to 23,000 policies submitted in the first quarter. Both revenue and EPS guidance were increased for the year.

I’m not sure why the stock hasn’t responded better. There is a large short interest, which I don’t really understand, so maybe those players have been doubling down on their bet. The mid point of EPS guidance is 40c, so the stock trades at 15x this years earnings which does not seem expensive given the growth they are beginning to experience. I suspect that comments on the conference call are partially responsible for the muted response. They said their baseline assumption is that growth will level out at Agile until the next open enrollment:

we’re taking a view that says a lot of people bought it during open enrollment that’s why we’re still strong and things are going to level off until the fourth quarter when open enrollment comes in.

Hopefully, we’re wrong and we have dramatic sales in between these open enrollment periods, but frankly given the dynamism of this market, we’re not sure and so we’ve done our best to forecast sales at Agile and the rest of the company over the next six months and that take place in our guidance.

I think this might be conservative. The story seems to be getting better. At the current price the growth trajectory that has began to emerge over the last couple of quarters is not priced in. While something has held the stock down since the release of the first quarter results, I doubt that can continue with the release of another strong quarter.

Shorter thoughts on a few other names

Granite Oil

Granite Oil had their credit line reduced from $80 million to $60 million. While I expected some reduction, this was a bit larger than I had anticipated given that the company has such modest debt levels compared to its peers. Fortunately the company only has $40 million drawn so the reduction is not really an impediment.

Intermap

Intermap still hasn’t received initial payment to allow it to start its SDI contract in the Congo. I never expected this to be easy and I acknowledge that the stock is a flyer so I have it sized accordingly. The bottom line is that the risk reward remains attractive if you treat the position like an option that could expire worthless (or close to it anyways) but also could be a ten bagger. I note that Mark Gomes, who I quoted above, is involved in Intermap as well and has written a number of good posts on the name.

Rentech

Rentech had a not unexpectedly terrible quarter. In the fourth quarter the company was pretty clear that the ramp at Atikokan and Wawa wasn’t going smoothly, needed more equipment, that they were still tweaking operation plan, and that they were not even sure Wawa would reach original capacity. In the first quarter they appeared to get Atikokan on-track which leaves Wawa. Here is what they said about Wawa on the conference call:

Our production shortcomings appear to be the product of limited experience operating the plant at higher levels of throughput and sustained operations as a result of our past conveyor problems. We are now experiencing the operational and production issues that we should have witnessed last year, but for the conveyor problems.

Even with these recent challenges, we’re still learning how to respond to or prevent these causes of production disruption that are typical of ramp-up of new pellet mills, such as sparks, jams, plugging, dust, moisture content, silica content, truck dump outages, hammer mill clogging, et cetera.

On top of that they experienced weather related weakness at NEWP. The warm winter in the North East reduced demand for wood pellets.

I have only taken a small position in the stock and I don’t plan to add more until we see positive momentum from the Canadian operations. But I look at these plants like a mine, which I have quite a bit of experience investing in, and the two things I have learned about starting a new mine is that A. it never goes smoothly and B. the initial start-up problems are typically figured out after some time. So I think Rentech will get their hands around this, and I want to be ready when they do.

Mitel

I sold out of Mitel, at least for now. The acquisition/merger with Polycom takes the company further down the path of being a hardware provider for enterprise telecom solutions, which is not really why I found the stock interesting. The justification around the deal is mostly about cost reductions and synergies, not growth, which again is not inline with my original thesis. And the combined entity still has to compete against Cisco which is significantly larger and has been taking market share from Polycom. Until I get a better understanding of where Mitel is going from here, I thought it best to exit my position.

TG Therapeutics

I bought back into TG Therapeutics at $7 last week. There hasn’t been any negative data to justify the fall in the stock of late. My original investment thesis still stands, just at a price now that is about 2/3 of what it was at the time. Really, if anything we are getting closer to the conclusion of their Phase II and Phase II studies.

By the way, if anyone can recommend any good books for understanding biotechnology please send me an email liverless@hotmail.ca. Thanks!

Portfolio Composition

Click here for the last four weeks of trades. Note that the 224 share AdjIncr transaction is because when Swift pink sheet equity converted to new equity I lost my shares in the practice account and so I had to restore those manually.