Well we made it through another week without the world washing away. In fact the market was even up a few percent. I don’t understand how, but it was. We have a horror show all around us, with this perhaps being encapsulated most eloquently by the WSJ, of which I posted about on Tuesday.

The WSJ printed a truly frightening account of the borrowing situation in Europe. The quote is so jarring that it is worth repeating I think. As per the WSJ, from the lips of one French bank executive:

“We can no longer borrow dollars. U.S. money-market funds are not lending to us anymore,” a bank executive for BNP Paribas, who declines to be named, told me last week. “Since we don’t have access to dollars anymore, we’re creating a market in euros. This is a first. . . . we hope it will work, otherwise the downward spiral will be hell. We will no longer be trusted at all and no one will lend to us anymore.”

The S&P promptly went up 12 points.

I mean, seriously?

Of course BNP denies the rumor vehemently. So it must be just fear mongering, right? The WSJ, meanwhile, stands by their source. I don’t think its any secret that the French banks are going to be the first to have short term funding problems. This has been pointed out many times by FT, with the most recent being here. FT provided the following two graphs to bring the point home.

Both BNP Paribas and Soc Gen are high on wholesale funding (ie. they need access to markets to get the dollars to meet liabilities) and low on liquid assets (ie. they don’t have a lot of readily exchangable assets on hand to trade for dollars).

FT summed this situation up by commenting that it was “not good.”

Indeed.

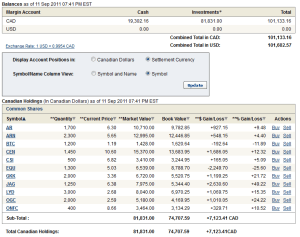

Anyways, I made money this week, and it felt a bit like it might when you collect you’re last severence check and you’re not sure where the next one is going to come from. I also sold more stock to raise more cash. Every week my portolfio comes closer to approximating an underleveraged turnaround gold stock ETF. Gold stocks are the only asset class I have an ounce of comfortable holding. I keep hoping for a buyout of Arcan or for some truly unignorable news from Coastal that will send these positions to the stratosphere, but candidly I admit that the more likely scenario is that they shall go down with the good ship Europe.

What will next week bring? God only knows. Europe implosion? Europe salvation? Or more muddling misery where every rumor of an Asian knight is met with cries of relief and cheers of joy, even if its just the 5th update on the same retread story from Bloomberg. Anyways, some day something is going to give. Lets just hope that when it does, gold goes up.