Week 127: A couple of new stocks and getting rid of a few others (JONE, MHR, PXL.CA, DGIT, TROX)

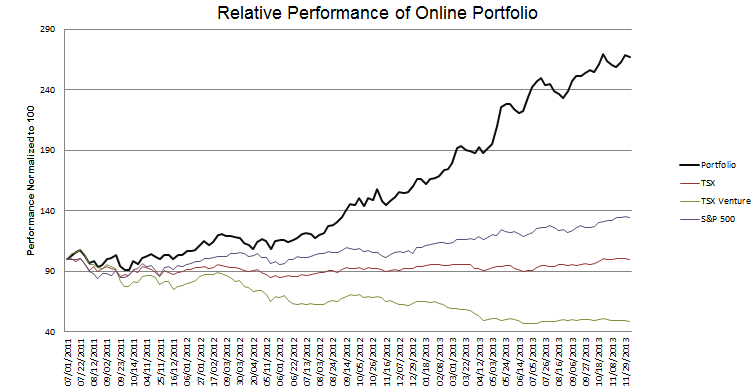

Portfolio Performance

See the end of the post for the current make up of my portfolio and the last four weeks of trades.

Recent Developments

I don’t have a lot to say about the macro picture or generalized musings about my portfolio this month. The macro continues to be a party-on atmosphere so I guess we’ll keep dancing. My portfolio is still not performing as well as I would like but I don’t have any insights into why that is or what I should do different. I had a very good first seven months of the year, and now I am having a lull. These things ebb and flow. Onto the stocks.

Adding Jones Energy (JONE)

I really like this stock. It’s a recent IPO (it went public at the beginning of August), I don’t think it’s well covered or known by many, but it looks to me like they have been drilling extremely profitable gas-condensate wells in the mid-continent, and they have plenty of undeveloped acreage to drill more. I took a big position in it right off the bat at 6%. Read more