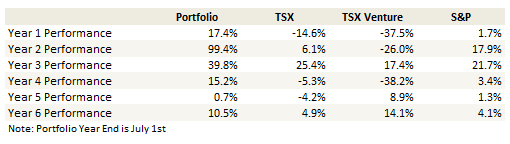

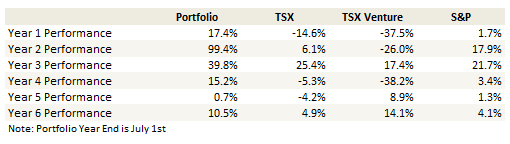

Portfolio Performance

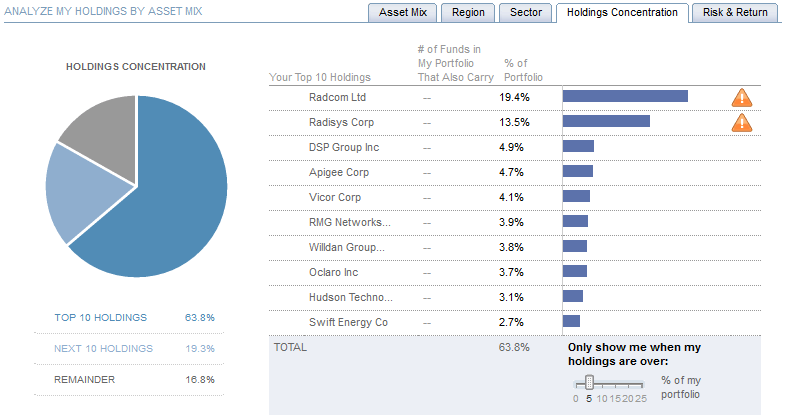

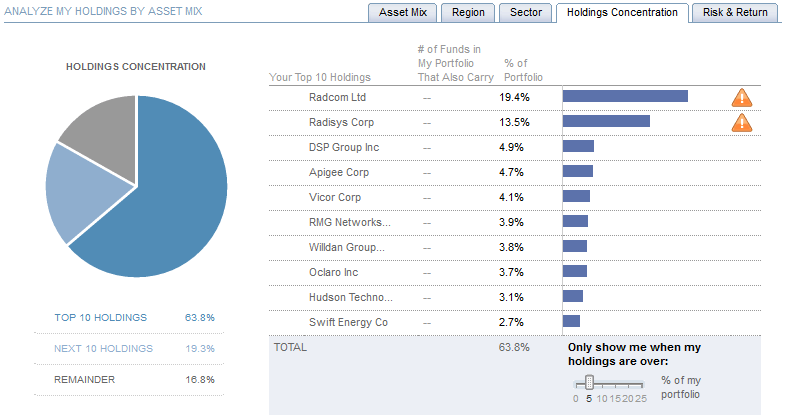

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

Its been a good market for my approach to investing. Volatility is low and the market isn’t really making any big moves. Individual companies are being judged on the merits of their business and the macro picture is taking a back seat.

I believe I have also benefited from being more selective. As I have written previously, I’m taking fewer flyers, being more suspicious of value, staying away from dividend payers and focusing on growing businesses and emerging trends.

As a result these have been the best couple months that I have had in a while.

I made a number of changes around the edges of my portfolio, adding starter positions in a number of names, reducing position size in others, but I remained relatively constant in spirit: I have two large positions: Radcom and Radisys, and a number of small 2-4% positions where I am waiting for a reason to make them bigger.

With respect to my two biggest positions, nothing was said or reported over the last month, including their second quarter results, that deters me in my allocation. I will give a quick synopsis of Radcom’s quarter below. With Radisys I spent a lot of time on them a couple of months ago so I will wait until the next update to say more. In short though, the results were fine, they are engaged with a lot of carriers, they seem extremely confident that those engagements will lead to more deals and we will wait and see what new business the second half brings.

I did add five new positions to my portfolio in the last month. I’m not sure what it was about this month that made it such a boon for ideas. It wasn’t because I worked unusually hard to find them. I just went about my usual process and for some reason kept coming up with interesting stocks.

I’ll talk about 3 of those positions (Bovie Medical, Hudson Technologies and Sientra) in this post. In the interest of space I will leave the other two, Mattersight and CUI Global, for next month. This being an August update I have a lot of earnings news I want to talk about and I don’t want things to go overly long (though I suppose it always goes overly long, so relatively anyways).

With that I will cut-off my general comments and get straight to it, starting with some company updates followed by my new positions.

Radcom – waiting on the next deal

Radcom announced results on August 8th but more importantly was a separate news release giving an official endorsement of Radcom’s technology from AT&T along with the recognition of the role Radcom will be playing in AT&T’s open source NFV backbone ECOMP.

The press release from AT&T validates the work that Radcom has done, and should make the company the go-to player for other service providers following in AT&T footsteps with ECOMP. I have always felt the big risk with Radcom was the execution of such their large and cutting-edge deployment with AT&T and that something went off the rails. That seems off the table now.

As an aside, I found this webinar, which includes a description by AT&T of what they are trying to accomplish with ECOMP, to be quite useful in trying to understand the platform.

While the second quarter results were inline, on the conference call Radcom’s CEO Yaron Ravkaie made a number of bullish comments. He said that Radcom was now in discussions with 9 carriers, up from 5 in the first quarter, and that the earlier discussions had progressed positively, with feedback coming back from carriers that “this is exactly what we need and we want to progress with it”.

Interesting new opportunities are also opening up. Radcom has soft launched a new adjacent product to MaveriQ that Ravkaie called a “very important component of NFV implementation”. I am assuming this was a joint effort with AT&T to some degree since the product is already being used by AT&T even though they have only started marketing it to other carriers.

A final interesting comment was made at the end of the call when Ravkaie referred to a Tier 1 carrier that was recently in their office in Tel Aviv, their “head of their NFV program spend hours with them”, he went “deep into their NFV strategy” and was interested in “partnering” and “co-creation of cutting edge stuff”.

The negative with the story is timing; we don’t know when the next deal signs and telecom providers are notoriously slow footed. I felt like Ravkaie was cautious about timing, making the following comment on the second quarter call:

the next coming quarters is going to change some of these into deals, and again I can’t really comment on when it’s going to happen, and on exactly when is the next order is going to come in, because everything is so new, so it’s hard to predict. And because as of the end of the day, big solutions in the telecom’s environment, so it does take time

Nevertheless it remains a great story. The stock has moved up strongly since earnings. I’m not sure where it goes in the short run, it all depends on the “when” with the next deal, but I see no reason to believe they won’t get that next deal done at some point.

Willdan looks good

The single sentence story on Willdan is that the company had very strong second quarter results, beat estimates significantly, guided higher for the year, said on the conference call that they have signed contracts that will be deployed in 2017 that they just can’t announce yet, said that revenue in 2017 will show further sequential growth, and said that their micro-grid strategy is taking hold with “increasing evidence to suggest that overall spending on microgrids will increase significantly in the coming years and we are well positioned to capitalize on this emerging market opportunity.”

Willdan reminds me of Argan, which was a little engineering, procurement and construction company that I found on the Greenblatt Magic Formula list back in 2011 (I just checked and its still there!) when the stock was $8. I bought the stock but sold it a few months later at $14. Argan continued to run from single digits to almost $50 now on the back of successful growth of their engineering services.

Argan demonstrates how engineering services can be very profitable if you have a team of the right professionals and you are delivering a service along the right trend. I have said before that I think that we are on the cusp of changes to the power grid that will mirror what we saw first in computing and storage (ala the advent of the datacenter) and currently in telecom service providers (which is why Radcom and Radisys are my biggest positions). If I am right about that Willdan is positioning itself to be in the middle of the build-out.

Oclaro was fine but Infinera made it a bit of a debacle

Oclaro had an excellent quarter, beating estimates and putting out strong growth guidance which was good news. Unfortunately I only held about half the position that I had only a few days before.

I got turned around by a report out of Needham entitled “Optical Super Cycle”. I don’t get Needham research, but I caught wind of a report they had in mid-July that described an optical upgrade super-cycle and managed to get my hands on it. Its compelling; the explosion of data is causing metro, long-haul and data-center interconnect to require upgrades simultaneously.

Its exactly the reason I am in Oclaro. But after being convinced by Needham, I felt like I needed more. So I went with one of their recommendations, a company called Infinera that seemed to be well positioned in long-haul, had the ability to take market share in metro, and wasn’t expensive compared to its peers. No problem right?

Well Infinera announced results three days later and gave probably the worst guidance I have EVER seen. Ever. The company guided third quarter revenues of $180-$190 million versus Capital IQ consensus of $271 million.

This caused a couple of things to happen. First I lost a large chunk of my investment in Infinera. Second, it really shook my confidence in Oclaro, which is a much larger investment for me. After some back and forth I decided to cut the position in Oclaro in half.

My reasoning hear was admittedly a bit suspect. Infinera didn’t appear to be a big Oclaro customer. Oclaro has significant business in China, a market where I don’t think Infinera plays at all. The evidence from the call was that much of Infinera’s problems were internal, in particular that they weren’t gaining share in the metro market like they had anticipated and that a recent acquisition wasn’t bearing expected fruits. Nevertheless what Infinera’s disaster highlighted to me is something that I have always worried about with Oclaro; that I will be the last to know when the optical cycle turns, and that these cycles turn quickly.

Well Oclaro announced their results and they were stellar. Both their results and those of some others suggest that the cycle hasn’t turned yet. Oclaro said they expect at least 30% growth in 2017. Gross margins are expected to expand into the mid-30s from the high 20’s they were only a quarter ago. Their 100G transceiver business has doubled in the last year. The company is well positioned with the two vendors in China (Huawei and ZTE) where their growth depends. The stock has continued to go up since, nearly hitting $7 on Friday.

But I can’t add. I’ll stick with my half position but that’s it. The cyclicality scares me, in particular the fact that they don’t really get to pass through price increases even when the cycle is in their favor, so the benefit is all volume and when the cycle ends or when inventory builds they will be smacked. Needham could very well be right and maybe that doesn’t happen for 3+ years. But I haven’t been able to put together enough knowledge to feel really confident about that. So I think I’ll just leave that one as is.

What is going on with BSquare and DataV is interesting

Here is why I added to BSquare. They had a crappy quarter. The stock tanked. The company has a market capitalization of $54 million but subtracting cash the enterprise value is only $27 million. The market has left them for dead but I’m seeing data pointing to how their new DataV product might on the cusp of taking-off.

Right now DataV has one announced customer, a $4.3 million 3 year contract with an industrial company. Because this company is so small, and because DataV has 70% margins, it won’t take many contracts to be meaningful.

In my last blog post I highlighted a career opportunity I read about on the BSquare site. In particular I noted the following language in one of the sales job postings:

Bsquare is investing significantly in marketing demand generation tied to its industry leading DataV IoT platform. Market response has overwhelmed our current sales capacity, and we are looking for proven inside sales dynamos to join our team

I thought that was pretty positive. Last week I went and looked at the job postings again. There were a bunch of new one’s for android developers but also I found they updated the posting I referenced before, (its here) with the following additional language about responsibilities:

Responsible for making 30-70+ outbound calls (including follow up) per day to inbound leads

I don’t know if this is saying what it reads, but an inbound lead should be a company that has first contacted BSquare, so 30-70+ calls to those leads is an awful lot. Are they exaggerating? Or is there that much interest in the product?

They also quietly published this interview on their website, describing the integration of DataV with a heavy-duty truck environment. Whats confusing about this is that there was a question on the first quarter call that suggested to me that the one DataV customer they had was VF Corp, which is not a trucking or industrial company.

The company has like zero following. There were no questions at all on the last conference call. The only intelligent questions I’ve heard in the last few calls is some private investor named Chris Cox who I am presently trying to hunt down (feel free to drop me a line if you read this Chris!). I don’t think anyone cares about this name. Maybe there is good reason for that. But maybe not.

RMG Networks – will have to wait another quarter for the inflection

RMGN results were somewhat lackluster, the CEO had said that they would be growing revenues sequentially from here on out on the first quarter call and that didn’t happen. Revenues were flat, the issue was that the international business lagged and some timing of sales issues. In particular it sounded like the Middle East was down a lot sequentially.

So it wasn’t a great press release but the color on the call was very positive. In a separate news release they said they had a sales agreement with Manhattan Associates and gave further color on that relationship on the call. RMG Networks had previously been something called a bronze partner with Manhattan which meant they would be recommended by sales if it came up but there was no compensation to the sales staff for any sales they created. The new agreement integrates them into the selling package, most importantly now is that sales gets commission on the RMG products that they sell. Because the products are complimentary this is expected to drive sales. Manhattan Associates is a supply chain solution company so the partnership is right in line with what RMGN is trying to expand into and is also a $4B company so much bigger than RMGN.

They also said they have similar relationships that have been agreed to in principle but are not press releaseable quite yet with two other partners.

The second positive is that the 3 supply chain trials that they have referred to in the previous quarter has progressed into the purchase phase. We should start to see revenues from those in the coming quarters. The CEO gave a lot more color around the sales pipeline and how many leads they are generating and also with respect to the team that they have put together. He really tells a good story, though that can be taken both ways I guess. He is bringing people aboard that the market likes, signing agreements and getting their foot in the door where needed so I am inclined to believe this is just a waiting game to see how it translates into revenues in coming quarters.

Medicure has lots of catalysts, have to wait for them to materialize

As for Medicure, results again were probably a bit weak, I would have liked to see revenue at $8 million but $7.7 million is still pretty strong. The bottom line was hurt by a large stock option expense, and they price their options as awarded so it all hits in a single quarter, you don’t get the spreading out of the option effect that most companies see.

Overall the idea is still there, they are continuing to gain market share with Aggrastat, hospital bags purchased increased 16% sequentially, the company said that June was their highest sales quarter since December and in a response to one of the questions on the Q&A they implied that the disconnect between sales and scripts should resolve itself into high sales, likely in the third quarter.

They are on-track to hear back from the FDA with respect to the bolus vial in the second half of the year, and the Complete Response they got from the FDA back in June for the STEMI indication sounds rectifiable. They said there were 7 concerns that FDA had identified, 6 have been addressed and agreed to by the FDA and the seventh they have sent in their modification and are awaiting the response.

They also provided some color on Apicore. It sounds like they expect to plan to purchase the other 95% of the company, said that Apicore continues to grow over and above the $25 million of revenue they generated last year, and they have a new cardiovascular generic that they are developing along with Apicore that they expect to submit. They were asked again about the price for their purchase option on Apicore and they again said they wouldn’t disclose, which is unfortunate. They commented that they have built out their sales and administrative staff in response to the higher Aggrastat demand and it now has the ability to support multiple products. In particular they can add this new generic with no additional staff increase. They are also on the hunt for acquisitions of other drugs that are complimentary and low risk.

Vicor was Disappointing

I was disappointed in the second quarter results from Vicor given the expectation they had set the last quarter. Much of Vicor’s backlog depends on a server standard called VR13. The new server standard is in turn dependent on a new Skylake chipset being delivered by Intel and the chipset has been delayed (again), this time until the second half of 2017.

The consequence is that rather than orders beginning to ramp beginning in the second half, they likely won’t start receiving order for another 6 months.

I reduced my position on the news. The company still is a technology leader and they still have the best power conversion solution for the next generation of datacenters, but six months is a long time and I’m betting I can build back the position at lower prices.

As I do continue to hold Vicor, I’ll be sure to follow Intel more closely to see where they are at with the chipset. In the mean time the best Vicor can hope for is to tread water.

New Position: Bovie Medical

I came across Bovie Medical doing a scan of 52-week highs on barchart.com. This is a scan I like to do as much as possible during earnings season; you can catch stocks that are starting their next leg up because of recently released results.

Unfortunately I was on vacation at the time and so I caught Bovie a little later than I might have otherwise. I bought the stock at $2.60, which was a couple of days after they had announced earnings. That was up from $2.05, which is what it had opened at the day of their earnings announcement.

Bovie Medical operates in 3 segments:

The “core business” is made up of electrosurgical medical devices (desiccators, generators, electrodes, electrosurgical pencils and lights) and cauteries. This segment makes up largest percentage of revenues and has flat to low single digit growth historically. Bovie has said they want to grow the business at mid-single digits which they were able to accomplish in the first half of this year.

The OEM business segment manufactures electro-surgical generators for other medical device companies. It generated $1.6 million of revenue in the second quarter, up from $941,00 in Q1 and $648,000 in Q2 2015.

The growth from the OEM segment this year was somewhat unexpected. It was partially due to contract restructuring that staggered contracts – they said that contracts are typically front-end development, back end production so they staggered the contracts to even out the revenue. The company did say after the second quarter that the expected the growth rate to slow in the second half of the year but still show growth. From the Q2 conference call comments:

…second quarter performance benefited from purchase orders signed last year and several new contracts were signed in the second quarter that should contribute to revenue growth over the next several quarters.

So the OEM business is posting some interesting numbers but the real reason I bought the stock is a new product called J-Plasma that Bovie recently developed. J-Plasma is a tool that improves the outcomes of surgeries through an ionized helium stream of plasma. The result is better precision and coagulation without significant heating of the tissue.

The J-Plasma system consists of a helium plasma generator and tool disposable. Here’s a screen cap of the disposable tool just to get an idea of what it looks like.

The generator (called the ICON GS plasma system) ionizes helium and produces a thin beam of the ionized gas. You use the beam for cutting, coagulating or ablating the soft tissue. The disposable is the hand piece for delivering the ionized gas stream. It sounds like you replace the disposable with nearly every surgery. There are different disposable hand pieces offered depending on the surgery being performed. The procedure can be used on delicate tissues like fallopian tubes, ureters, the esophagus, ovaries, bowels and lymph nodes.

The initial generator purchase is in the $20,000 range, and the hand tools average $375. Bovie said on its second quarter call that they are shifting to a pay per use option with a leasing program to bypass the upfront capital expense of the generator.

The success of J-Plasma didn’t happen immediately. The company has had the product on the market since January 2015. For the first year growth was in fits and starts. In particular, the capital required from the up-front generator was a stumbling block. The company said the following about the slow progress as recently as the fourth quarter conference call:

The operating metrics and leading indicators for J-Plasma product adoption were strong in the fourth quarter, but sales were below our expectations. We continue to face an exceedingly slow pace of J-Plasma generator sales. While we know that the long sales cycle for capital equipment is an industry wide issue, we also know that our VAC approval track record has been outstanding at over 92%, which makes this situation even more frustrating.

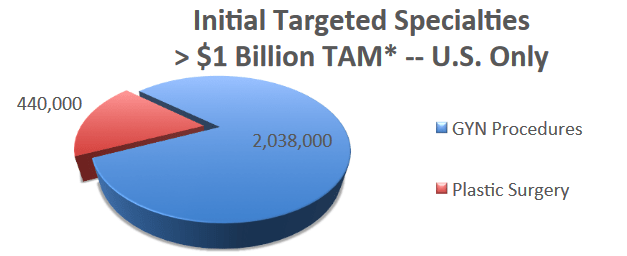

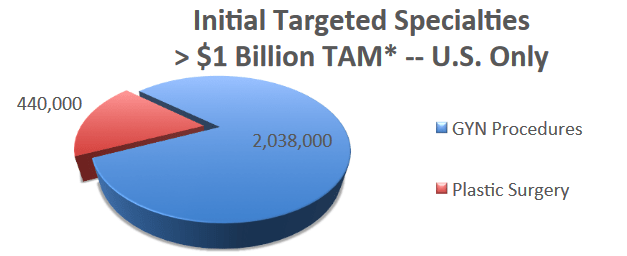

The company is targeting two verticals. They are currently selling J-Plasma into gynecology (estimated total addressable market, or TAM, of $2 billion) and are moving into the plastic surgery business (estimated TAM of $440 million).

There are a number of other markets they can expand into including cardiology, urology, oncology and ENT.

There are a number of other markets they can expand into including cardiology, urology, oncology and ENT.

There is also the opportunity for the J-Plasma system to be used in robotic surgeries. Bovie has an expert in robotic surgeries on their medical advisory board that has begun to use J-Plasma in trials. Results are expected in the first half of next year, Bovie is also developing an extension to the product, due to be out in 2017, that will integrate into existing robotic surgical systems. They said on the second quarter call that they are exploring relationships with “existing and emerging surgical robotic systems”.

Sales of J-Plasma increased substantially in the second quarter. J-Plasma sales were $766,000. This was up from sales of J-Plasma of $356,000 in the first quarter, which was up from $284,000 in the first quarter of 2015.

The company made a couple of moves in the second quarter that should increase exposure of the product further. On the second quarter call they announced sales partnerships with two large distributors: Hologix (developer, manufacturer and supplier of premium diagnostic and surgical products) which will add them to their GYN and GYN Surgical line of products ($300mm line), and Arteriocyte, which will start selling J-Plasma to their network of plastic surgeons.

Given that Bovie’s sales force currently consists of a mere 16 employees and 30 independent sales reps, this should increase the reach significantly. The company said that the two agreements are going to expand their salesforce “by multiples”.

One thing I like about Bovie is that they have a small revenue base to grow from. In the second quarter revenue was $9.2 million. This is up from revenue of $7.2 million in the first quarter.

Even though J-Plasma revenue remains in its infancy, incremental growth is still quite accretive to the top line because of the simple math that comes along with the company not being very big.

So we will see how things go in the upcoming quarters. The one negative of note is when I model the growth out to next year, the company is still only borderline profitable after assuming a similar sales pace to the last couple of quarters. So we may be a ways away from a real earnings inflection. Nevertheless, I’m not sure that will matter much if J-Plasma sales can continue at the pace they are at. If they do, profitability is an eventual inevitability and that is what the market will focus on.

New Position: Hudson Technologies

In an unfortunate turn of events I was listening to the Hudson Technologies presentation at the ROTH conference (the presentation is no longer available but I could send a copy I made if someone wants it) on my bike ride home a few weeks ago. I was thinking wow, this sounds like a really interesting idea. So I get home, take a look at the chart and boom! The stock had jumped from like $3.50 to $5 that very day.

Sigh.

Nevertheless I continued to dig and found that in some ways the stock is actually a better idea now than it was pre-spike.

Hudson is the biggest refrigerant reclaimer in the United States. The stock jumped on July 18th (the day of my bike ride) because of the announcement of a contract with the department of Defence:

[Hudson] has been awarded, as prime contractor, a five-year contract including a five-year renewal option, by the United States Defense Logistics Agency (“DLA”) with an estimated maximum value over the term of the agreement of $400 million in sales to the Department of Defense. The fixed price contract is for the management and supply of refrigerants, compressed gases, cylinders and related items to US Military Commands and Installations, Federal civilian agencies and Foreign Militaries. Primary users include the US Army, Navy, Air Force, Marine Corps and Coast Guard.

So this is a big deal for a little company. But it wasn’t the primary reason I was looking at the stock. The story that intrigued me centered around their reclamation of R-22 refrigerant volumes.

R-22 refrigerant, also known as HCFC, is an ozone depleting substance, much like the CFC refrigerant that we all remember from the 1990s. In fact, R-22 took the place of CFC’s in many applications. But because R-22 also has an negative environmental impact it was decided by a number of governments t phase the refrigerant out. In the United States, between now and 2019, production of virgin R-22 will go to zero, as ruled on by the Environmental Protection Agency.

This article did a good job outlining the phase-out cycle by the EPA:

In October 2014, the EPA announced its final phasedown schedule regarding the production and importation of HCFC-22. The order called for an immediate drop from 51 million pounds allowed in 2014 to 22 million pounds in 2015, 18 million pounds in 2016, 13 million pounds in 2017, 9 million pounds in 2018, and 4 million pounds in 2019. No new or imported R-22 will be allowed in the U.S. on or after Jan. 1, 2020.

With R-22 production being phased out, the remaining source of R-22 will be from reclaimed refrigerant. This is where Hudson comes in as the largest reclaimer in the U.S. Hudson should benefit from the production restrictions as they gain market share as well as benefit from price.

Its price where things get really interesting. Over the time period where CFC’s were phased out the price spiked from $1 per lbs to $30 per lbs.

Already we are seeing the price rise. R-22 ended last year at $10/lbs (up from$7.50), it rose to $12/lbs in the second quarter and prices are currently at $15/lbs. The company said on their second quarter call saying they are “showing signs of further price improvement.”

Hudson benefits directly from the price rise. The company has said that they expect that for every $1/lbs rise in the price, 50c should fall as margin.

The opportunity won’t continue forever, but it appears to me that the runway will be measured in years. While new air conditioning units do not use R-22, the economics of repairs for existing units work in favor of R-22. At the Roth conference the company said the following:

…lets say you want to repair unit outside of your house, has 10lbs of refrigerant, repairs are $2,500, even if refrigerant is $100/lb its $1,000… [in comparison] new unit is going to cost you $8,000

Hudson has a market capitalization of around $165 million and there is about $30 million of debt. The company announced 15c EPS in the second quarter. Keep in mind that this number includes no impact from the department of Defense contract and that R-22 prices have risen another $3 in the third quarter.

I honestly thought the stock was going to take off after the second quarter. While it flew in after hours (and sucked me in for a few more shares) it gave up those gains the next day and actually traded down 10% in the in suing days.

It turns out that company executives sold a bunch of stock over that time. The company released a press release on the 10th saying that various executives had sold 1.1 million shares. That’s a lot of shares for a little company to absorb.

You could of course look at this negatively, but keep in mind that these say executives still hold 20%+ of the company, and so they sold down their positions by about 10%. They’ve waited a long time for some sort of pay day, its hard for me to put too much stock in them cashing in a bit once it comes.

I really like this idea.

It seems to me that R-22 prices have no where to go but up, that upwards trend has already affirmed itself, and the stock really isn’t reflecting this. Nor is it reflecting the full impact of the DoD contract, which should be worth around $40 million in annual revenue at similar to higher margins than the existing business right now. While the stock hasn’t really moved up from my original purchase price so I haven’t been adding much, the size on the high side of what I usually allocate to a new position.

New Position: Sientra

I honestly can’t remember how I came across Sientra. It was probably some sort of screen, but I have no recollection of what I was screening with. I’m not getting enough sleep.

At any rate, I came upon the stock the day before it released earnings, which forced me to do some quick work and decide whether I knew enough to take a position or not.

I took a position on that day only an hour before the close. I tweeted my thought in this tweet (as an aside I’ve decided to try to return to Twitter to comment on my portfolio adds. I feel like I am missing out on a level of feedback that was often useful).

I always wince when I make a decision like this; I’ve been bitten by acting too fast before. Yet what drove me to act quickly was because Sientra seemed like a time sensitive situation.

Here’s the scoop with Sientra. The company sells a breast implant. Their product was approved by the FDA in March 2012. By most accounts it is a better product than those that already on the market from Allergan and Johnson & Johnson. The company was taking market share and sales were increasing. In the first six months of 2015 sales were $26 million, up from $21 million in the comparable period the year before. In the third quarter sales were $13 million, up from $10 million in 2014. Unfortunately the results were overshadowed by manufacturing problems that led to the company taking a $3 million allowance for product returns and suspending further production of the impants.

A few weeks before they announced their 3rd quarterr results the company announced that on October 2nd they had “learned that Brazilian regulatory agencies announced that, as they continue to review the technical compliance related to Good Manufacturing Practices (GMP) of Silimed’s manufacturing facility.”

On October 9th Sientra released a letter that they had sent plastic surgeons regarding the issues with the facility. Sientra relied on a single source manufacturer. The compliance issue caused the company to put a voluntary hold on sales. The stock dropped from over $20 to $10.

Sientra did its best to come clean. They worked with the FDA and hired a third party firm to verify the safety of the product. The company was silent for two months and the stock continued to fall, eventually settling at $3 in December.

On January 8th, in a published letter to doctors, the company announced that they had “submitted all of the third testing data of its products to the FDA. He says that, in the company’s opinion, the results show that all are safe and present no significant risk to patients. If the FDA agrees, then their implants will be back on the market.”

The company said that while their investigation found that there were microscopic levels of particulate matter on the products, that data also revealed that even with well controlled manufacturing processes the presence of microscopic particles is unavoidable, and the level of particles from the shedding of a typical laboratory pad would have more particles than their products.

They started selling their implants again in March. The second quarter was their first full quarter of results. Along with the results the company provided an update on their search for a new manufacturing partner. As I had hoped, they announced a new partner.

Sientra has entered into a services agreement with Vesta, a Lubrizol LifeSciences company and a leading medical device contract manufacturer of silicone products and other medical devices…Under terms of the agreement, Vesta is establishing manufacturing capacity for Sientra and is working with the Company to finalize a long-term supply arrangement for its PMA-approved breast implants. Sientra anticipates that all project milestones will be achieved for the Company to submit a PMA Supplement to the FDA during the first quarter of 2017.

Sales in the second quarter were $6.2 million, which is only about half of the $14.2 million in sales they had the previous year, but still a very successful initial level considering their limited launch. In fact the company has to be very careful about how much product they sell before they get manufacturing back up and running. They do not want to risk another supply disruption.

The response to their return to the market has been positive. The reason I was so interested in getting into the stock sooner rather than later is because management gave a very positive review of how quickly customers were coming back. On the first quarter call by CEO Jeffrey Nugent:

We were removed from the market voluntarily and our primary competitors naturally came in and took over those customers that we were no longer able to serve. So what encourages us, and me particularly, is the relative speed and ease of converting those previous customers to come back from those products that they used as a replacement.

So, I could give you a number of other statistics. We have a very high level of analytics inside the Company. We know exactly who is ordering what. We’re following that on a very detailed basis. But as far as pushback, we’re not seeing much. There are virtually no concerns about the safety issues that were raised and we’ve been able to convince those customers that we have the confidence and are giving them the assurance that we are not going to allow them to go back on backorder.

So customers want the product and the market for growth is there. The breast implant market is large compared to the size of Sientra. I had to do some searching, and most of the numbers are behind expensively priced reports, but I was able to gather that the US implant market is at least $1 billion. Sientra had a revenue run rate of around $50 million before it ran into troubles. It seems that there is plenty of market share left to capture.

The one negative consideration is that this story isn’t going to play itself out in the next couple of months. The company remains supply constrained and are relying on inventory for sales. While the details about the manufacturing partner are great, its going to be a while before they are producing new product. The company said the fourth quarter of 2017, which I believe is probably conservative, but regardless new product is still some time off.

Nevertheless, with a positive response from customers and the path to new product clearing, I suspect we will see the stock move higher as we inch towards that date. My hope is that we eventually get the stock back to the $20 level, where it was before the roof caved in.

What I sold

I reduced my positions in Air Canada, Granite Oil and Intermap. Air Canada and Granite continue to be slow to develop. I did like what I read from Granite’s second quarter earnings release on Friday, and I may add to the position again in the coming days.

Air Canada just continues to lag regardless of what results they post. I’m keeping what amounts to a start position here, but after seeing the stock struggle for the better part of two years even as the business continues to improve, I just don’t know what it will take for a re-valuation to occur.

Intermap just keeps dragging along with no financing in place. I sold a little Intermap in the high 30’s but mostly decided to reduce after lackluster news along with the quarterly results released Friday.

In all three cases there is also the consideration that I have come across a number of new ideas as I discussed above and prefer to make room for them.

I also sold Iconix in mid-July but bought back my position before earnings. However, as I am want to do, I neglected to add back the position in my tracking portfolio and didn’t realize that I had not done so until I reviewed the positions this weekend. So I will add it back Monday morning.

Portfolio Composition

Click here for the last four weeks of trades.