Research: 3 Biotechs

I mentioned a few posts ago that there were a few biotech microcap stocks that I had been looking at. Below I have reproduced my notes on 3 of them (NTEC, ABIO and ETTX).

These are all interesting ideas I think, though with the market where it is I cringe a little to post about them. The XBI has had quite a move. But as I’ve said before, I’m inclined to believe that the XBI is just beginning a new bull market, finally breaking out of a long consolidation. So maybe we have further to go.

More generally though, this has to be a speculative mania right? One that is, in many ways, the opposite of what the Mike Green et al passive is king proponents have professed would happen.

Many of the stocks that are going truly bonkers have very little ETF exposure. The best way to profit lately has been by chasing small individual names in the right sector and actually looking for illiquidity (ie. a low float). Another tactic has been to chase an active ETF manager – ARK. This doesn’t seem like a passive tidal wave to me. It seems like a return to active, albeit active speculation.

But it is crazy. I wrote in the comments of the last post about OEG. The only thing that stock has going for it is that it gets lumped in as “solar”. That is enough for a 4-bagger in 2 months.

I am trying to keep my exposure fairly low (though its hard when you see trains leaving the station and you are compelled to jump on – I did this with FSRV yesterday) but I am purposely leaving some speculative positions in my portfolio because, like it or not, that is what is working.

With that said, the three biotechs below have not participated much in the market run, but I think that each could pop under the right circumstances.

I mentioned in my prior post that I liked NTEC and I still do. But it is far from a perfect stock.

In fact it is mostly a failed stock – they have a drug-delivery platform (called the Accordian Platform) that has failed at pretty much every turn. This was a pick from Marc Cohodes a couple of years ago (as a long). It performed miserably after they failed their Ph3 trial for Parkinsons (though if you read the details it is more complicated than just that – they did not fail completely).

Since then NTEC and their Accordian Platform have had a go with a Novartis compound, a go with a cannabinoid compound and a go with a Merck compound. None of these have stuck.

But what is curious is that the partners keep coming – Merck signed up for another compound in the fall and GW Pharma signed up in December.

So you wonder, what exactly is so promising here? It rings a bit with a story I read about another biotech, the name of which I can’t remember, that toiled in these sort of failures but was eventually bought out at a significant premium – for its platform. So even though every indication it targeted failed, someone realized that the platform was sound, that it would eventually succeed, and that it was worth owning it before that happened.

NTEC trades at just under cash.

ABIO is another biotech laggard. This one is even more straight forward.

They have a COVID drug, which drove a crazy spike in the summer when they announced a trial. But the COVID drug angle is not really important going forward IMO.

More interesting is that before COVID, ABIO had another drug, called Gencaro, that was about to go into a Ph3 trial against chronic heart failure (HF).

HF is a huge market ($10 billion+) and ABIO is trading at less than cash.

Now this is not a perfect story. Because of COVID the Gencaro Ph3 trial, called Precision-AF, has been postponed. And you could argue, quite rightly, that Gencaro didn’t actually work that well in the Ph2 trial.

So what was the point of doing a Ph3 study on a drug that didn’t work in Ph2? Well ABIO is adept at genetically targeting their therapies, and the Ph2 study did not do that kind of targeting. But those patients who did have a specific genetic biomarker, which are a subset of high-risk patients, performed very well in Ph2. So those patients will be targeted in Ph3.

Those patients are as much as ~1/10th the market. While not as large as the whole HF market, that is still very large for a company trading at less than cash. What’s more, there is no approved alternative right now.

So those are their stories. In both cases, and to a lessor extent with CLBS and ETTX (the other two names I’ve added over the last few weeks), these are names that could have a speculative pop. Take a look at the charts. They seem quite bullish and we’ve had a couple false starts already (including yesterday). Each has a fairly low float. For NTEC in particular there is only about 4 million shares outstanding and there seems to be a couple of institutions that hold a fair number of those.

I don’t like to think that way. About spikes and floats and silly moves. But that is what this market is. You have to take what you can get.

Entasis Therapeutics

- this was a $5 stock back in March

- $61mm of cash

- 35.5mm shares so $75mm market cap at $2.10

- was a 2015 spinoff of AZN

- focus is on precision antibiotics

- they go after infections caused by multidrug resistance Gram-negative bacteria

- it’s a platform! Has produced a pipeline of product candidates

- has 2 ph3 trials against high-priority pathogens

- SUL-DUR – sulbactum-durlobactum

- will have Ph3 readout on SUL-DUR in 20201 – targets Acinetobacter – also called CRAB

- resistant CRAB rates in US are 40-50% and 90% in parts of Europe/Asia

- really high mortality of 50%

- SUL-DUR is a beta-lactamase inhibitor

- has broad Class D beta-lactamase coverage, essential for CRAB

- well tolerated in Ph2 and in three Ph1 trials

- Ph3 trial ongoing – called ATTACK

- can market SUL-DUR with 15-20 rep salesforce because CRAB is found in targeted settings:

- 300 large ICUs, 200 transplant/burn/cancer centers, outpatient LTACSs and Infusion centers

- would replace colistin and polypharmacy in CRAB

- can point to better efficacy, lower cost, safety

- CRAB TAM is $1b

- also have royalty and milestones that offset cost – so they don’t own 100%?

- Ph3 data on zoliflodacin in 2022 – targets N. gonorrhoeae

- oral application

- is resistance to existing drug called Intramuscular ceftriaxone

- 87mm cases a year, grows at 10%

- Ph2 showed efficacy in 47/47 patients

- they started Ph3 in Sept 2019

- two other early stage programs – ETX0282CPDP against MDR UTIs and ETX0462 against pseudomonas aeruginosa

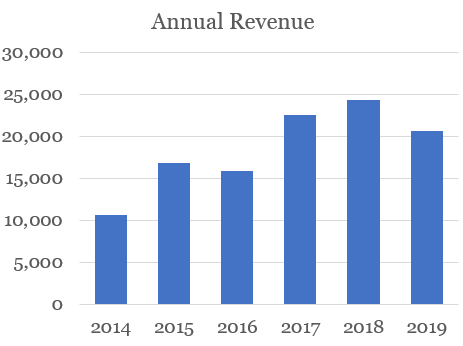

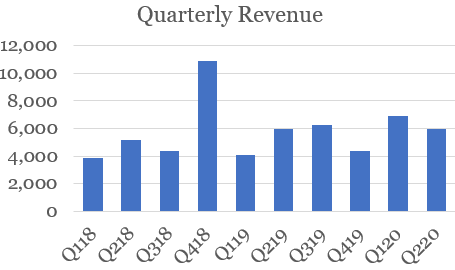

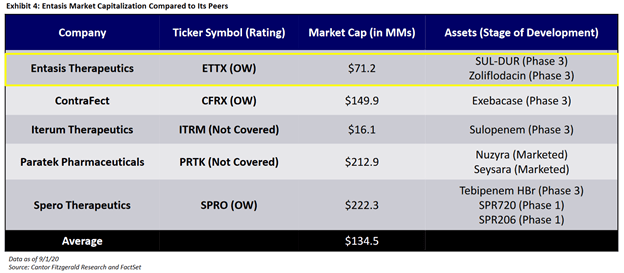

- cheap compared to competition:

- iterum has actually come up a lot since this – it trades at $1.23 for $60mm market cap, $90mm EV

Intec Pharma

- $17mm of cash

- 4mm shares at $4 for $16mm market cap

- seems to be burning $3-4mm of cash a quarter

- its a platform!

- they develop drugs based on their accordian pill platform

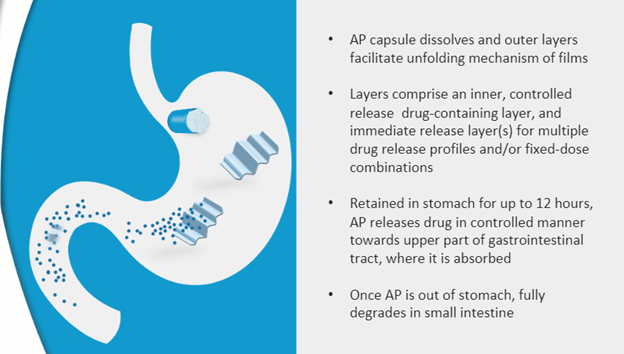

- this is an oral drug delivery system

- they expect it to A. improve efficacy, B. improve safety of existing drugs via “efficient gastric retention” – so it is digested better, gets in the system better

- it uses a sort of folding structure that lets the drug be released as the accordian structure unfolds:

- then the accordian goes into small intestine and degrades

- AP-CD/LD:

- most advanced drug is Carbidopa/Levodopa – developed for Parkinsons

- so this is where the shit hit the fan

- announced Ph3 results in July 2019 – Accordance Study

- did not meet endpoints

- they call it numerically superior but not statistically superior – “not a statistically significant reduction of OFF time)

- they also say this, which I’m not sure what to make of:

- In preliminary review, AP-CD/LD provided meaningful reduction in OFF time for those patients who were dosed at 1.6 to 2.0X IR-CD/LD dose

- I believe though that they are attributing it to sub-optimal dosing, but sounds like they are saying dosing comp has to be close to 2:1

- did provide treatment, did not demonstrate statistical significance over the existing CD/LD formulation – an immediate release pill

- also wasn’t any better tolerated

- so it basically didn’t work any better

- it did meet endpoint in Ph2 trial back in Feb 2019

- they are looking for a partner here to redo (??) the ph3

- Cannabinoids

- initiated 2 clinical development programs

- formulating and testing THC and CBD for various pain indications

- their AP-cannabinoids should A. extend absoroption phase, give more consistent level of cannabinoid

- will address problems with cannabinoid delivery such as: A. short duration, delayed onset, variable dose

- did Ph1 trial in March 2017 – showed that it was safe and did show better exposure

- but follow-up in Dec 2018 did not meet their expectations

- Novartis

- developed AP version of proprietary Novartis compound

- they went thru invitro with this, then a human PK study

- In Dec 2019 Novartis dropped them

- Merck

- in May they announced collaboration with Merck – this one went thru in vitro, met endpoint but is not going further

- in Oct entered second research agreement with Merck for new compound

- GW Pharma

- entered into agreement in Dec

- explore AP with undisclosed partner

- basically no details disclosed here

Arca Biopharma

- $51mm of cash

- no debt

- 9.3mm shares outstanding at $4.50 for market cap of $42mm

- they aren’t burning much cash, $1.5mm a quarter

- develops genetically targeted therapies for cardiovascular disease

- its a platform!

- they have a COVID treatment called AB201

- initiating Ph2 trial in Q420

- is an inhibitor of something called tissue factor

- tissue factor is a receptor, it is a coagulation pathway

- in COVID you get overactivation of coagulation and immune response

- the idea is that this is related to the TF pathways, so if you can restrict those you can stop the response

- not just COVID – it has shown to prevent coagulation disorder from Ebola and Marburg virus

- could be used with other antivirals

- they think it would have a broader spectrum for other coronoaviruses and RNA viruses beyond just COVID

- the Ph2 will be on 100 patients, then do a Ph3 with 450 patients (if there are that many by that time?)

- was originally developed as a anticoagulant

- they did a Ph1 and Ph2 study using it in thrombosis and it was safe and had efficacy

- also have a molecule called Gencaro, used for chronic heart failure

- have a trial on hold because of COVID – called Precision-AF

- they had Gencaro in a Ph3 with HF patients – say that it improved mortality, hospitalization

- published the Ph2b trial, called Genetic-AF in Journal of American Cardiology in May 2019

- the result of the Ph2b was for them to target a subset of patients with high “left ventricular ejection fraction” and specific genotype in the Ph3, would enroll 400 patients

- it seems like what happened is the drug didn’t really work any better over the broad population, but it did over a subset with genetically-defined HF and a severe case of it

- so they can move forward with Ph3 targeting those patients

- HF is a huge market – $12.5b in total, while for the subset for Gencaro would be $500mm to $800mm

- third drug is AB171, genetically targeted treatment of chronic heart failure and peripheral arterial disease