Combimatrix: Just too cheap

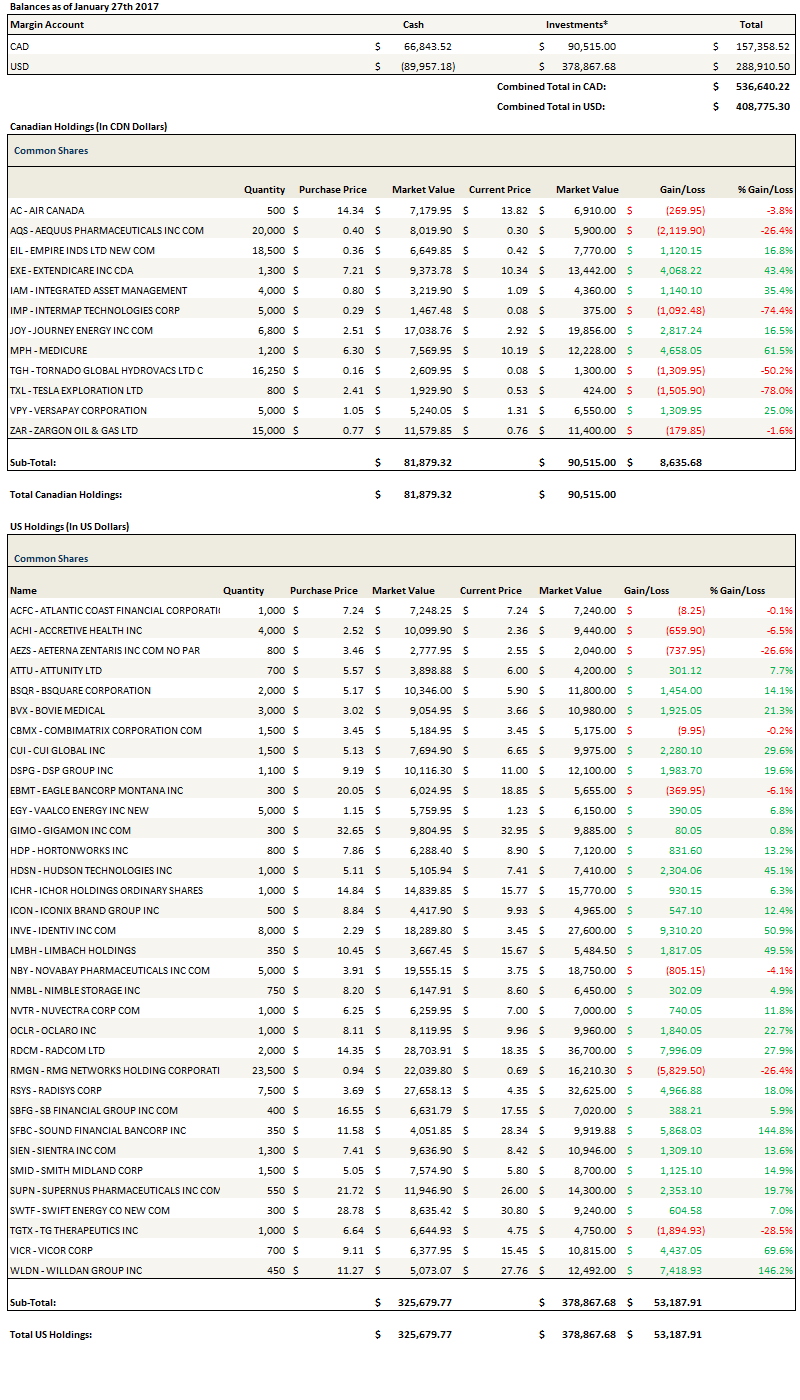

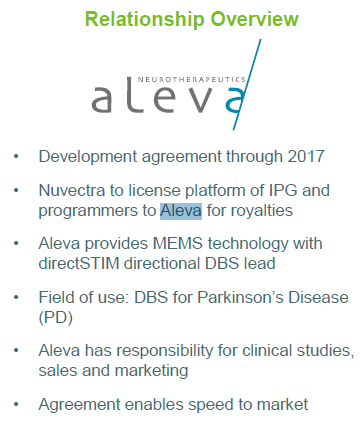

I stumbled on Combimatrix shortly after taking a position in Nuvectra. The companies have similarities. Both are very small biotechs trying to gain momentum on sales. Both have showed recent growth. And both have a large part of their market capitalization tied up in cash.

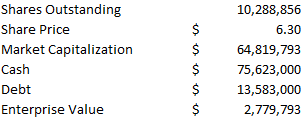

But Combimatrix is cheaper. To be honest, I don’t quite understand why Combimatrix is as cheap as it is. It’s possible that there is an element to the story I a missing. When I bought the stock, in the low $3’s, the market capitalization was a little over $8 million. It’s closer to $10 million now. The company has over $4 million in cash and very little debt.

While there are many biotechs around that boast high cash percentages (Verastem, for example, remains with a cash level well over 2x their market capitalization) these companies aren’t generating any revenue. Combimatrix has a revenue generating business, and the business is growing.

Combimatrix provides reproductive diagnostics testing. They offer three types of tests: microarray, karyotyping and fluorescent in situ hybridisation (FISH). I believe these are the only three commonly used testing methods for such diagnostics.

Of the three, Combimatrix’s primary focus is on microarray testing. It makes up about 70% of their testing volumes. Microarray is (I think) the newest test method (based on what I’ve read, though there is some indications that FISH being applied to some reproductive diagnostics is new). It seems that microarray tests have the advantage over karyotyping and FISH in that they provide more information about potential problems (from this article):

chromosomal microarray, detected more irregularities that could result in genetic diseases — such as missing or repeated sections of genetic code — than did karyotyping, which is the current standard method of prenatal testing.

But it is also a more expensive test. Which has led to problems getting insurance coverage:

The tests can cost $1,500 to $3,000 in addition to the cost for the amniocentesis or C.V.S. procedure. Karyotyping can cost $250 to $1,500. Insurance does not always pay for microarray testing since it is not considered the standard of care for prenatal testing.

Looking back I believe that this is where some of Combimatrix’s problems have come from. Insurers have been slow to adopt microarray tests into their coverage. The company hasn’t ramped revenue they way they had anticipated. There have been cash issues, and capital raises. But this seems to be changing. In August Combimatrix put out a press release with the following comment:

“There are now at least 20 health insurance providers this year that have revised their medical policies to include coverage for recurrent pregnancy loss testing,” said Mark McDonough, President and Chief Executive Officer of CombiMatrix.

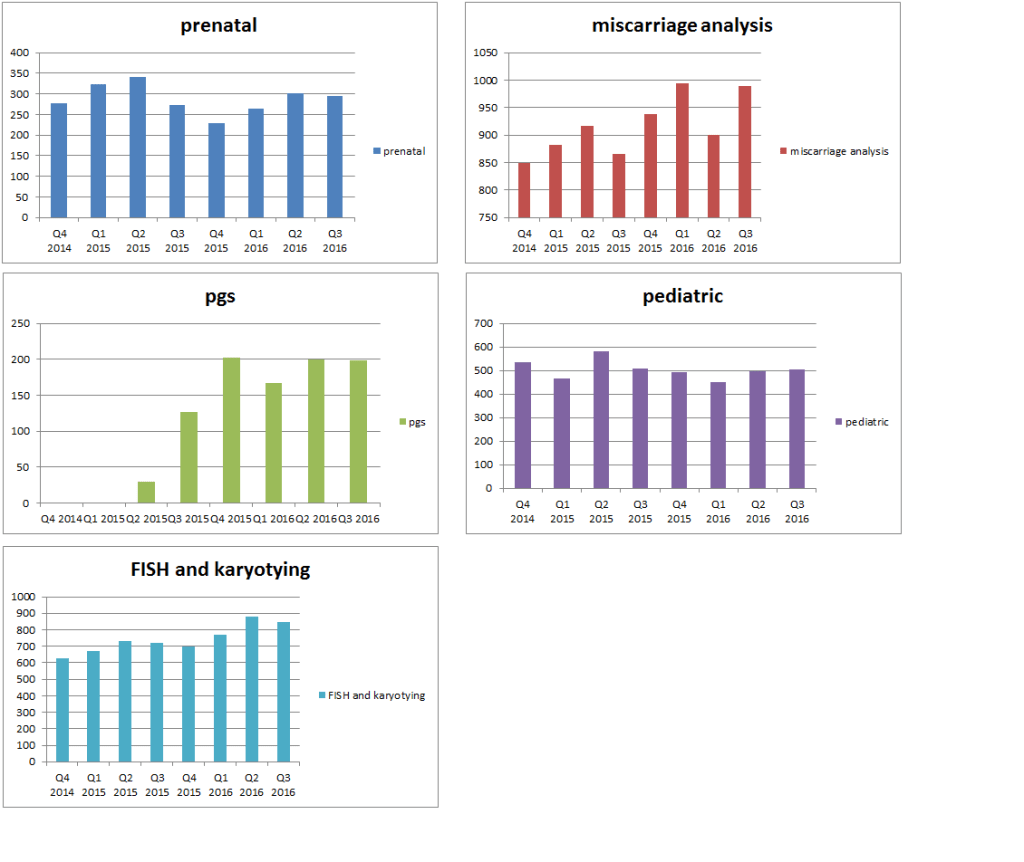

Below are charts showing volume growth for the 5 segments that Combimatrix reports. Growth is lumpy, but overall there has been a trend towards increasing tests. They also seem to have pricing leverage, as similar charts showing revenue by product line (not shown) trend more clearly left to right.

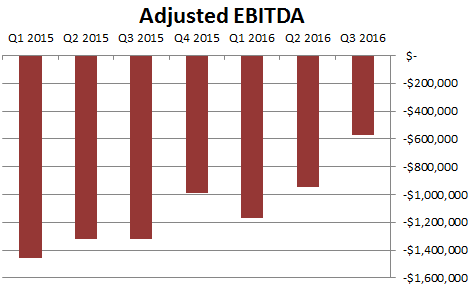

Management has reiterated on a few occasions (most recently in the third quarter conference call) that they will be cash flow breakeven by the end of next year. This seems reasonable as adjusted EBITDA has been trending towards that level for 2 years now.

So it’s a cheap stock with a business that is pointed in the right direction. The only reason I can think of for the stock being so cheap is the risk of further dilution. As they approach the breakeven mark this concern diminishes and hopefully the stock price responds. At least that is my expectation. We will see.