Week 210: All about the 5-baggers

Portfolio Performance

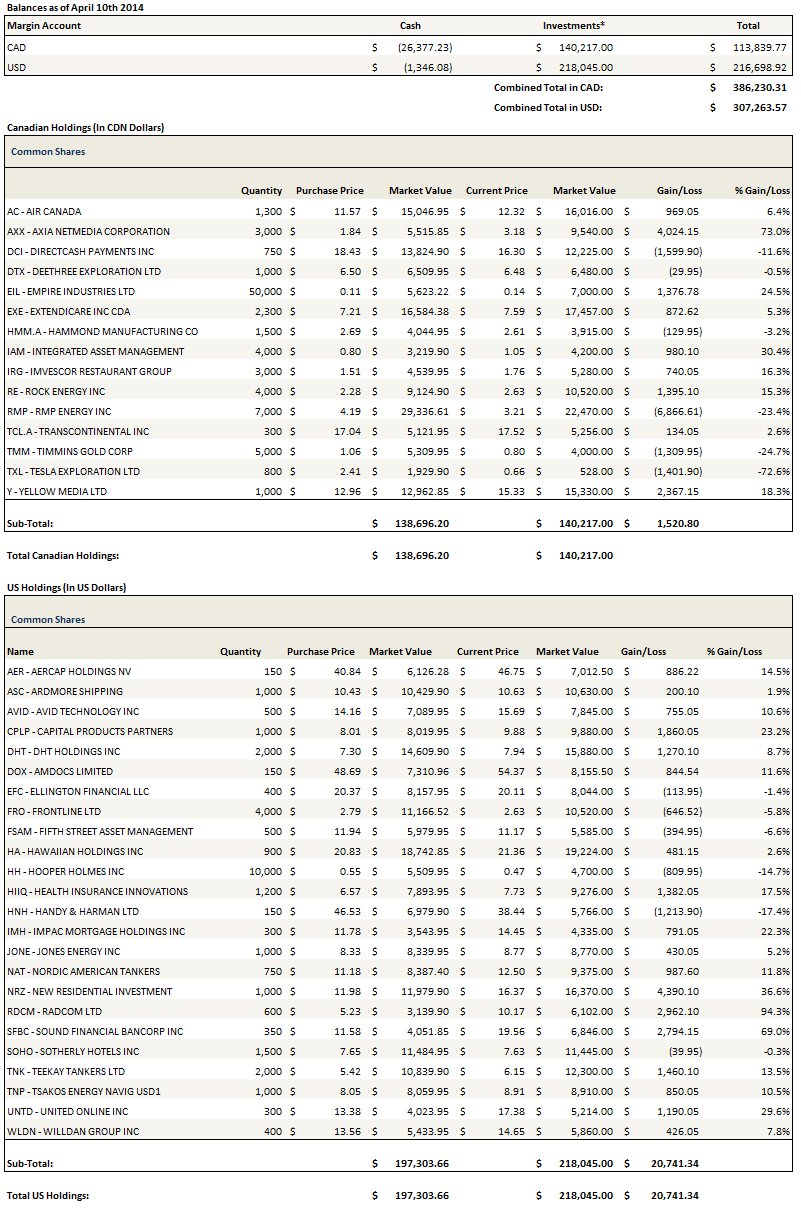

See the end of the post for the current make up of my portfolio and the last four weeks of trades

Monthly Review and Thoughts

A few weeks ago I was talking to someone who works at a large fund. He was telling me about a retail clothing chain that their fund was interested in. To help evaluate the opportunity, they commissioned a research firm to canvas and scout locations across the country.

That is amazing intel. It is also wholly impossible for me to replicate.

I generally have a pretty good idea about a business before I buy into it. I do a lot of work up front, far more than the highlights that go into these posts. But I’m always left with elements that are uncertain. For an individual investor with access to limited information and with limited time, certainty about one’s beliefs is more hubris than reality.

In the face of such disadvantages, my strategy is to take smallish positions and add to them if they begin to work out inline with my expectations. If they don’t, I cut them.

By keeping my positions small until they start working and cutting my losses before they get big I guard against the big hit to my portfolio. On the winning side of the ledger I generally end up with a similar number of winners that cancel out the losers. But I also end up with 2 or 3 big winners that lead to out-performance.

It’s the 5-baggers that make the engine go.

Another portfolio year has passed (I started writing this blog on July 1st 2011) and you can see from the results that the last year was not as good as the previous few. I still did better than the market, but I didn’t do that great.

In part the under-performance was caused by not sticking to my rules. I have already rehashed my failures with Bellatrix and other oil names in past posts so I won’t go into that again here.

But I also attribute it to my lack of “5-baggers”. I haven’t had a big winner in the last 52 weeks. I’ve had a lot of good picks (Air Canada, Axia NetMedia, PNI Digital, Extendicare, Radcom, Rex American, the second go around with Pacific Ethanol and so on) but only one true double and nothing that tripled or quadrupled.

Realizing how important multi-baggers are I’m sending myself back to the drawing board. I’m not sure why I’ve failed to discover the big movers over the last year. But I suspect that it is at least partially due to ignorance of the sectors that have had the momentum.

Up until recently I never owned a bio-tech. I’ve stayed away from technology in all but a few exceptions. I’ve only been in healthcare on a couple of occasions (one of those being Northstar Healthcare, subsequently Nobilis Health Corp, which I rather amazingly sold last October, at no gain or loss, literally days before it began a climb from $1.20 to over $10 in thee next six months). Yet these sectors are where the big winners have been.

My attitude towards these and other outperforming sectors is going to change. I have invested in a couple of bio-techs and in technology (shorts mind you, as I will explain later) and in the last couple of months. More new ideas will follow.

What I Sold

Usually I discuss my new positions next. While I have a couple of these, they are not significantly sized and my actions have been more weighted to the sell side of the ledger, so it seems appropriate to discuss what I sold first.

As I tweeted on a couple of occasions I have been skittish about the market over the past month and a half. I sold out of some positions and reduced others when Greece went on tilt and announced a referendum two weeks ago.

Since that time as my worries have subsided I have bought some of those positions back. It doesn’t look like an immediate contagion is upon us, which was my main concern. Still I’m keeping a healthy amount of cash (20%) and where I can I am short a number of stocks.

In what turned out to be an unexpected consequence of my recent research expansion, over the past month I spent a lot of research hours looking at short opportunities. Trying to take more of an interest in tech, I read through reports describing the state of business and dynamics at play in everything from telecom infrastructure to smartphone. As I did I felt most of the near term opportunity was on the short side, and so I took positions there.

My tech shorts have been based on three-fold expectations: PC sales are declining faster than consensus, smart phone sales will grow slower than consensus, and rumors that the big data build out by cloud providers has been overdone will prove to be true and future spending will be scaled back. Without going into the individual names, I’ve stuck mostly with the big players and mostly with semi-conductor providers, which seem to be the most susceptible to spending downturns.

I think however that this play has almost run its course. I have been taking off some positions heading into earnings (for example I was short Micron going into their June quarter but took it off the day after earnings were announced), and plan to exit my remaining positions as earnings are released. I don’t like to hold short positions too long.

While I have yet to take any short positions in healthcare, I get the feeling that the recent merger mania may be leading to valuations that prove difficult to justify once the feeding frenzy subsides. I note that a top pick of Jerome Haas, who I have followed and found to be a solid thinker, was a short on Valeant Pharmaceuticals.

In my online portfolio, in which I cannot short, I sold out of my gold mining shares, my oil stock shares, some of my tanker shares (Euronav and Frontline), a hotel play (Red Lion), reduced my airline exposure in both Air Canada and Hawaiian Holdings as well as my Yellow Pages and Enernoc positions.

I also sold out of DirectCash Payments, though I subsequently added the position back later (at about the same price). I really want to hold this one through earnings because its been beaten down so far and I still have doubts as to whether the first quarter is the secular harbinger that the market seems to think it is. In the turned out to be an unexpected consequence of my recent research expansion

Similarly, while I sold out of RMP Energy, I bought it back (at a lower price) because I want to see their quarter before giving up on the stock. Like DirectCash Payments, I question whether results will be as dire as the market suggests. In the same segment of his BNN appearance Haas also made DirectCash Payments another top pick.

I only added to a couple of positions in the last month. Patriot National continues to execute on their roll-up strategy, buying up smaller insurers at accretive multiples. The stock is up 40% from my original purchase (though in the online portfolio I forgot to add it when I originally mentioned it so its up somewhat less there) and I decide to add to the position since its working out.

Second, I added to my position in Capital Product Partners on what I believe is unwarranted selling on Greece. The company is incorporated in the Marshall Islands, does not pay Greek taxes but does have offices in Greece, which is at the heart of the sell-off. A scan of the company’s annual filings shows that their exposure to Greece is potentially some deposits in Greek banks and the risk that one or more of their subsidiaries could face higher taxes. I don’t think that correlates to the 20% plus sell-off in the share price.

I also added two new positions to my portfolio.

Intermap

I have followed Intermap for years. Its a company that my Dad owned. While it always held out the promise of a significant revenue ramp Intermap could never quite figure out how to monetize their world class geo-spatial data.

Then, a couple of weeks ago, the company signed a large contract with unnamed government for the implementation of a National Spatial Data infrastructure program.

For years Intermap was primarily a mapping services provider. They owned 3 Lear jets equipped with radar technology that scanned and mapped large swaths of terrain. They would land contracts to map out a country or region and be paid for providing that data.

The company always kept the rights to their mapping data and, over time, Intermap compiled a database of geospatial data for a large part of the earth. This spatial database became a product called NextMAP. The database can be accessed through commercially available GIS software like ArcGIS or web browser apps developed by the company. Customers can license either parts of or the entire NextMAP database for their use.

The latest version of the database, called NextMAP World 30, is “a commercial 3D terrain offering that provides seamless, void free coverage, with a 30meter ground sampling distance, across the entire 150 million km2 of the earth’s surface.”

Intermap has always had a leading technology. But they have struggled with coming up with profitable ways of marketing that technology. Over the last three years the company has been working on applications that can be layered over their basic mapping data. They have a program for analyzing the risk of fires and floods (InSite Pro), a program for managing hazardous liquid pipeline risk (InSite Pro for Pipelines) and a program for assessing outdoor advertising locations (AdPro).

None of these niche solutions have resulted in significant revenue to the company.

The carrot has always been that they land a large government contract for the full implementation of a geo-spatial solution for the country. Most investors have given up on this ever happening, but then it did.

The announced contract is for $125 million over two years, during which time Intermap will implement the infrastructure solution. This will be followed by an ongoing maintenance contract valued at $50 million over 18 years.

When I saw the number on the contract I knew immediately that the stock would jump significantly. Including warrants and options Intermap has 127 million shares outstanding. So at the closing price the night before the deal was announced the market capitalization was around $10 million. When it opened around 25 cents I figured the upside was only about half priced in, so I jumped aboard.

The implementaton of a full geo-spatial solution as per the contract will involve the implementation of the company’s Orion platform, which includes the company’s NextMAP data integrated with other relevant third party data and with applications for accessing and analyzing the data. The platform will be used to help with decision making with infrastructure planning, weather related risks, agriculture, excavation, and national security. Because this is basically a new business for the company, its difficult to peg margins or profitability. So I’m not going to try.

Nevertheless, just based on the rough assessment of what $125 million in revenue would mean, at this point, with the current stock price of 50 cents the contract is probably mostly priced into the stock. I maybe should have sold on the run-up to 60 cents, but I decided not to.

The company has suggested in the past that they have a number of RFPs in the works and some of those they have already won but cannot announce until funding is secured. The upside in the shares is of course a second contract. That could happen next week or next year. Its impossible to predict.

The other consideration, and something I have always wondered about, is why some large company doesn’t pick up Intermap for what would amount to peanuts, securing what is truly a world class data set and a platform that would seem to be more valuable in the hands of a large company with the resources to sell large projects to governments. Somebody like an IHS comes to mind.

Pacific Biosciences

This investment idea is a little out of my normal area of expertise and consistent with my desire to expand my investing horizons. Its an idea I came up with after reading this Seeking Alpha article which I think does a good job explaining the trend we are trying to jump on.

PACB has 74 million shares outstanding, so at $5.20 (where I bought it) the market capitalization is $385mm. The company has $79 million of cash and investments and $14 million in debt.

They are in the business of gene sequencing. Pacific Biosciences sells gene sequencing machines and related consumables for running tests to map an individuals gene in hopes of detecting a mutation that will diagnose the future susceptibility to disease. The machine of course is a one-time sale but the consumables are a recurring revenue stream so the business has a bit of a razor-blade type revenue model to it.

The big player in the gene sequencing arena is a company called Illumina. This is a $30 billion market cap company that did nearly $2 billion in revenue last year. They dwarf Pacific Biosciences, which did around $60 million of revenue last year.

In fact I read that Pacific Biosciences has only sold around 150 machines. One interesting thing from their presentation is that for each of the machines Pacific Biosciences sells, they generate about $120,000 of consumable sales a year. Thus the opportunity for significantly higher recurring revenues is there if they can sell a few more machines.

What seems to set Pacific Biosciences apart from Illumina is that their technology produces much longer gene sequencing strings which results in far lower error rates. Below is a comparison between the two.

One thing I am not sure of is where Pacific Biosciences sits compared to some of their non-public competition. I was reading through some of the comments on a site called Stock Gumshoe that suggested that some private competition may have as good or better sequencing technology.

One thing I am not sure of is where Pacific Biosciences sits compared to some of their non-public competition. I was reading through some of the comments on a site called Stock Gumshoe that suggested that some private competition may have as good or better sequencing technology.

Pacific Biosciences also has an agreement whereby Roche will market their product for the diagnostics market in 2013. In May Pacific Biosciences met the second milestone of that agreement. The only thing that is a little disconcerting about this agreement is that Pacific Biosciences did not announce how much revenue they would be giving up once (and if) the product is commercialized.

My bottom line is that there are enough interesting things going on for me to speculate in the stock. The key word being speculate. There is a chance of wider adoption, there is a chance of an expansion of their relationship with Roche, there is maybe even an outside chance of a takeover. And its an industry that is clearly growing, is in investor favor, and the stock was at a 52-week low when I bought it.

But I will flatly state that I would not take my comments about Pacific Biosciences too seriously. My knowledge of this industry remains weak (though its improving as I read more). They could be, or maybe even have been, surpassed by competition and I would not be the first to know. So we’ll see how this goes and chalk up any loss to the cost of education.

Portfolio Composition

Click here for the last four weeks of trades.