Week 294: It doesn’t matter how you get there

Portfolio Performance

Top 10 Holdings

See the end of the post for my full portfolio breakdown and the last four weeks of trades

Thoughts and Review

It’s a seminal moment for the blog! For the first time in what seems like forever my largest position is something other than Radcom. Thanks to more than doubling in price in the last four months (and even after pulling back from $6 to $5), Identiv now holds that honor.

At the beginning of November I wrote the following about Identiv:

I tweeted a couple of times this morning that I don’t think this stock makes sense at a $20 million market cap… The company has a $55 million trailing twelve month revenue run rate, they are showing growth, they are EBITDA positive now and it’s not an insignificant amount of EBITDA. That feels like it should warrant at least 1x sales.

We are already at a $55 million market capitalization but with momentum at the company’s back I haven’t sold a share.

A second position, RMG Networks, has also ran up the ladder, and now sits as my fourth largest position at a little less than 5%.

I wrote this about RMG Networks when I first took the position in late June:

With the focus on the new verticals and improve productivity of the sale force new opportunities in pipeline are up over 40%. And here is where we start to see an inkling that the strategic shift is bearing fruit. In the sales pipeline, Michelsen said that the number of deals $100,000 or greater has increased by 50% in the last year while the number of $1 million deals have tripled…My hope is that these early signs of sales improvements lead to an uptick in revenues in short order.

We are starting to see that pipeline bear fruit. The entire move has come in the last two weeks. The stock has moved from 70 cents to a dollar on news that they had secured contracts in the healthcare vertical and converted one of their previously announced trials into revenue in the supply chain vertical.

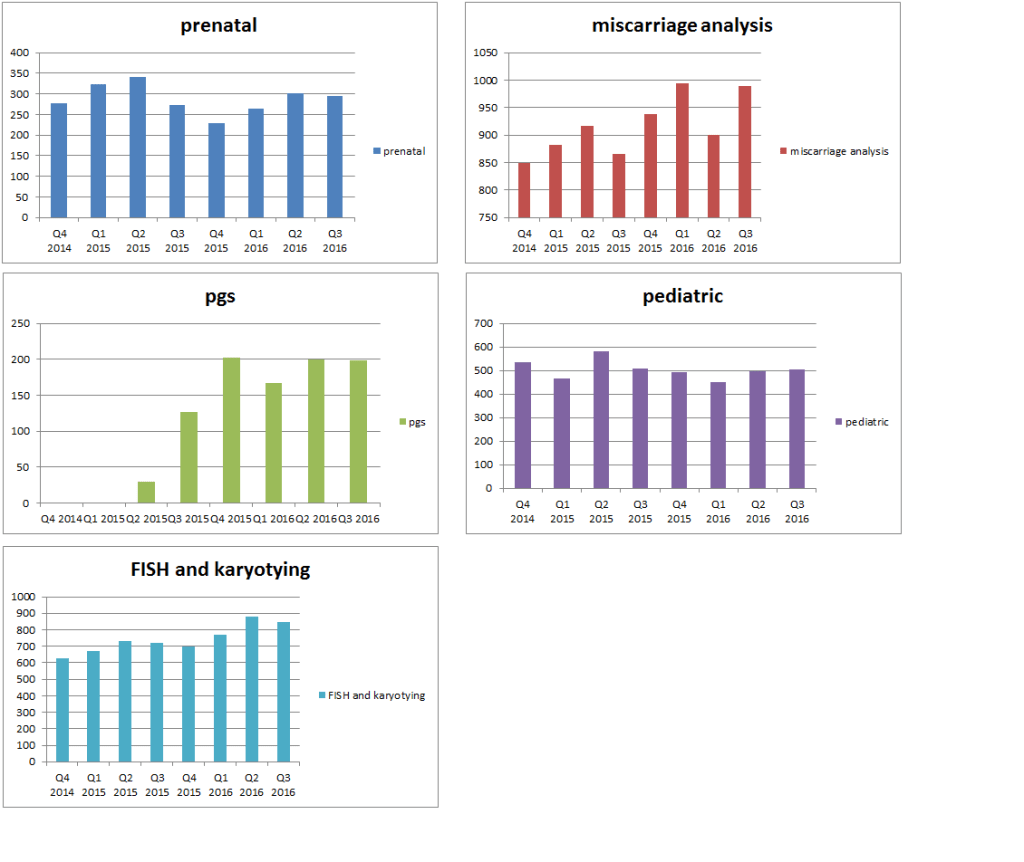

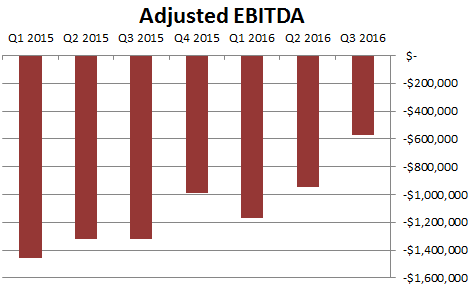

Finally, a third company, Combimatrix, which I wrote about earlier this week, is beginning to run and take a more significant position in my portfolio after releasing solid fourth quarter results.

So that’s all great, but the reason I mention these three examples is because they illustrate how bad I am at predicting how things will play out. In the second half of last year had you asked me what my portfolio would move on I would have replied it will rise and fall on the fortunes of Radcom and Radisys.

Flash forward a few months and my portfolio has moved significantly higher and Radcom and Radisys have done nothing. Radisys has actually went backwards to the tune of 20%. Whodathunkit.

This is why I carry so many positions. A. I’m a terrible timer. The events that I think are imminent take months or years to play out, while the events that I think are distant have a habit of manifesting much faster.

Second, my favorite ideas are often not my best one’s. I have no idea why this is. If I did I would change my favorite ideas. But it’s uncanny. I’ll sit on a thesis like Radisys, work it into the ground to understand it in depth, and then along will come a Health Insurance Innovations, which I will buy on a bare thesis (in this case that the Affordable Health Act will be repealed and this is going to be good for HIIQ) and when the dust settles I’ll have more gains from the latter than the former. Its kinda crazy.

I guess as long as you are moving in the right direction it doesn’t really matter how you get there.

Portfolio Changes – Adding Silicom

I added a couple of new positions this month. The Rubicon Project and Silicom.

Silicom got hit after releasing what I thought was a pretty good fourth quarter. The company traded down to $35 from $39 pre-earnings. I’ll try to get a more detailed write up out on Silicom at some point, but the basic points are:

- This is a $250 million market capitalization company with $36 million of cash and no debt

- It’s trading at a little over 2x revenue and just guided 15% growth in the first quarter and double digit growth for the year

- Their past seven year compounded annual growth rate is 26% and growth was 21% in 2016.

Silicom designs a wide range (over 300 SKUs) of networking, cybersecurity, telecom and storage products. These are generally board level and appliance level hardware solutions.

They expect their security vertical will grow double digits, their cloud vertical will “grow significantly” and that a contribution from SDWAN will kick-in in 2017 and is expected to become a “major growth area”. They said that over the intermediate term they see a larger opportunity in their pipeline than they have have in the past.

Already the stock has rebounded on news of a significant contract for encryption cards that will ramp in 2017 and reach $8 million in sales in 2018.

I’ll talk more about Rubicon Project in an upcoming post.

Apart from these new positions I did a bit of tweaking of my positions, adding a little to Nuvectra and Combimatrix, reducing my position in Bsquare and selling out of DSP Group. I also have added to my Vicor position in the last couple of days (subsequent to the update end so not reflected in this update).

Taking advantage of Bovie Medical Weakness

I also added significantly to my position in Bovie Medical. The stock sold off on news that their pilot project with Hologics for selling the J-Plasma device would not be extended. As I tweeted at the time, I didn’t think this was as big of news as the market did.

Added to $BVX, I think this selling is overdone based on $HOLX, diff selling model, guidance reaffirmed

— LSigurd (@LSigurd) February 2, 2017

To expand on my reasoning, Hologics has a particular business model they follow for their instrumentation and disposable business, of which J-Plasma would have been a part (from 10-Q):

we provide our instrumentation (for example, the ThinPrep Processor, ThinPrep Imaging System, Panther and Tigris) and certain other hardware to customers without requiring them to purchase the equipment or enter into a lease. Instead, we recover the cost of providing the instrumentation and equipment in the amount we charge for our diagnostic tests and assays and other disposables.

So they go “full razor blade”. Bovie on the other hand, generates significant sales from generators. The average selling price (ASP) for a generator is much higher than hand piece so Bovie generates a significant slice of their revenue from it. From the 2015 fourth quarter conference call :

I guess when you think about it, the generator ASP is north of $20,000, the hand piece ASP is $375

So the models aren’t aligned.

Second, Hologic’s Gyn Surgical business segment (consisting of the NovaSure Endometrial Ablation System and our MyoSure Hysteroscopic Tissue Removal System) is a $400 million business so J-Plasma is microscopic for them. They may not have been inclined to bend their model for Bovie.

Also worth noting is that Hologics wasn’t even mentioned in the Bovie 10-Q whereas the agreement with Arteriocyte that was mentioned favorably.

Finally the language used on the third quarter conference call around Hologics wasn’t exactly definitive:

Well, as you know, the sales channel partnership with Hologic,right now,is in a pilot phase. So we wouldn’t be in a position, if we were to disclose the economic relationship, until that’s a permanent agreement. So the pilot portion of our partnership will go until the end of February. So you could look at some period after that before we can announce a permanent relationship and we’ll decide at that point in time if we’re going to elaborate on the economics of the relationship.

The agreement with Hologics hadn’t generated material revenue so there is no hit to the bottom line. And in a separate press release (which oddly was released on the same day as the Hologics information but didn’t get on their website for a couple days after), Bovie reiterated guidance for 2017, including “accelerated growth for J-Plasma”.

I think the stock sold off in the following couple of days because its small, illiquid and under followed, not because this agreement was meaningful to the company. So I bought.

Portfolio Composition

Click here for the last four weeks of trades.