Pacific Ethanol – Cyclical Turn?

Over the years I have had pretty good luck catching cyclical businesses at the turn of a cycle. One of my first really successful investment ideas centered around the turn in copper prices in 2003-2004. I ended up with multi-baggers in Aur Resources and Hudbay Minerals. I caught the move in metallurgical coal in 2007-2008 and saw similar results from Western Canadian Coal and Grand Cache Coal. In 2010 I latched on to a turn in the pulp cycle and saw 3-baggers from Tembec and Mercer International. More recently I took advantage of the turn in trucking with a double from Frozen Food Express and of course YRC Worldwide, where I was able to make 6x my money in about 4 months.

So cyclical businesses can pay off big, but you have to time them right and never forget that they are cyclical businesses; what can seem like very easy come can also be just as easily gone. Nevertheless, the upside can be quite large, because most of these businesses are low-margin commodities where relatively modest changes in prices can have a large impact on company margins.

A Turn in the Ethanol Business?

I’m still in the middle of looking at Pacific Ethanol so take what I’m writing here with a grain of salt. There may be elements of the thesis that I am missing. Nevertheless the idea seems promising and it appears, at least so far, to fit with the theme of a cyclical business on the cusp of a turn. I’m throwing this post out now because the stock is moving quite quickly and I am looking for feedback to fill the holes and solidify the idea for me.

I got the idea from an Investorhub poster who goes by the moniker Bobwins. I’ve had a few ideas come by way of this fellow in the past and so I make a point of following his posts on a fairly regular basis. I am also told that a couple of newsletter writers, Keith Schaeffer and Chen Lin, have latched onto the idea.

The Business

Pacific Ethanol produces ethanol from 4 facilities in the Western United States.

Through a holding company (New PE Holdco) they own 85% of these plants. They have increased their ownership from 20% over the last couple of years, taking advantage of depressed prices given the state of the ethanol market.

In addition to ethanol, each of these plants produces an array of corn based co-products. The company recently began to produce corn oil at two of its plants, which is expected to be a high margin addition to the mix.

The company has 14.7 million shares outstanding which, after another big jump on Friday to $5.30, would put the market capitalization at $78 million. They have about $115 million of long-term debt, making their enterprise value $193 million.

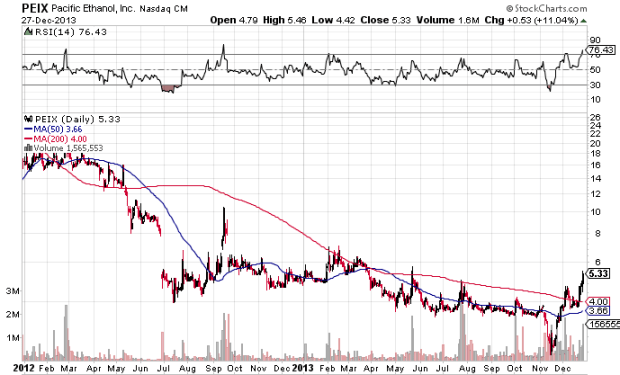

The ethanol market has been depressed over the last couple of years, and this has caused the share price of ethanol companies like Pacific Ethanol to crater. Pacific Ethanol used to be a $20 stock as recently as Q1 2012.

The stock price fell because ethanol margin became non-existent in 2012. This was the result of historically high corn prices and to some extent depressed volumes for ethanol brought on by a still slow economic recovery.

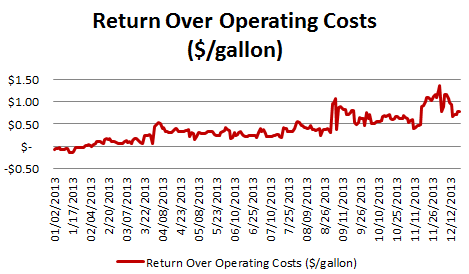

I’ve created the table below from an excellent resource I found via the Iowa State University. The Center for Agricultural and Rural Development (CARD) there compiles historical data on the constituent parts of ethanol operating margins, including corn prices, natural gas prices, and ethanol prices. I have made use of this resource on a few occasions in this post. You can see the trends in margin and input corn cost.

The dynamic around ethanol margins has changed this year. They have been slowly creeping up, and in November and December they jumped well above $1/gallon. The graph below is again taken from CARD and is basically showing the corn crush spread with the added detail of including natural gas costs to come up with what is essentially a gross margin per gallon.

What does it mean to Pacific Ethanol?

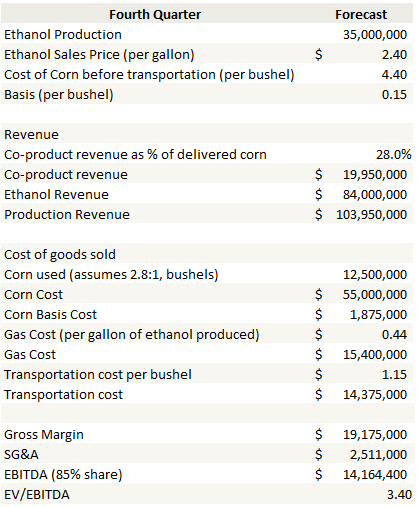

While its clear that Pacific Ethanol has significant leverage to ethanol margins, what has taken some time for me to figure out is exactly how much the company will benefit from them. I’ve had a heck of a time trying to come up with a forecast for the fourth quarter. While its a pretty simple business model; corn and natural gas inputs and ethanol as the product, there are a few wrinkles that have made it difficult.

First, the corn price that Pacific Ethanol pays isn’t exactly the CBOT exchange price. Pacific Ethanol pays that amount plus a basis plus shipping. Complicating matters, up until the third quarter the company did not break out the corn basis, and they still don’t break out the corn shipping cost. In each case I have been able to back them out using a few assumptions.

The corn basis cost typically run a few cents either way in most quarters, but it rose to $1.60 per bushel in the third quarter because of old crop/new crop dynamics. In the third quarter conference call management said it was averaging between flat to 15 cents in the fourth quarter, so I have used 15 cents. The corn shipping cost seems to run about $1.15/bushel on a fairly consistent basis and management verified a range of $1.00 to $1.30 per bushel on the last conference call.

The second complication comes from third party volumes. Pacific Ethanol produces its own ethanol product, but it also markets third-party product. Its not clear to me how revenues and cost of goods are accounted for with these merchant sales or what the overall margins are. On one hand, in the 10-K it clearly says that merchant sales are considered on a gross basis (page 36). However in the discussion of revenue this is contradicted and that third-party sales are primarily net sales (page 26). I’ve decided to ignore the whole third-party marketing segment entirely and focus only on the internal production of the company. Presumably this segment won’t lose money in a positive operating environment like what is currently upon us.

Third, the company derives some of its production revenue (not to be confused with total revenue, which includes merchant sales) from co-products, wet distillers grains (WDG) dried distillers grains with solubles (DDGS), and recently corn oil. None of these co-products are broken out in revenues, though they are tabulated in each 10-Q as a percentage of delivered corn costs, so one can back them out once some estimate of the total cost of corn is made. I estimate that about 20% of revenue comes from these co-products. Note that there could be some conservatism in my numbers because I am making no extra allowance for the ramp in corn oil production that has been occurring at two of the plants over the last few months.

Finally, the company lumps corn cost, basis cost, corn transportation cost, and natural gas cost together into a single cost of sales item, which provides little transparency on the costs of the constituent parts. As I noted already, I had to use the work of CARD to help me break-out natural gas costs. Consistent with CARD I assumed that natural gas costs would be around 0.1mcf/gallon of ethanol produced.

Below is my own estimate of the company’s quarterly EBITDA from its owned production. This is technically for the fourth quarter, but given the number of assumptions I’ve had to use, I would think of it more as a ballpark-like estimate of how the company’s fortunes change due to the recent increase in margins. In addition to all the above mentioned assumptions I also assumed that SG&A would be consistent with that of the third quarter. The company has over $80 million in net loss carryforwards so I don’t expect taxes to be paid for some time.

Conclusion

If my calculations are in the right ballpark, the company stands to make a significant amount more money from their ethanol production with current conditions. They paid net interest costs of around $3 million per quarter. Depreciation and amortization has typically run at about $3 million per quarter, though this number jumped to $9 million per quarter (gross) in Q3 because of new corn oil processing facilities at two of the plants. Presumably once fully operational the corn oil production units should be able to cover the extra D&A costs. If I assume this is the case in the fourth quarter (and this might be a big assumption since the Stockton plant only became operational in October), then the company’s net earnings from its own production would be around $7 million for the quarter, or a little more than 40c per share.

While, given all the aforementioned assumptions I had to make to get there, I am not super-confident in this number, it remains big enough to warrant a position in the stock. If the company can indeed earn $1+ in 2014, we are probably looking at twice the current sticker price on the stock.

I still have a lot of work to do to understand how the ethanol market works, whether current trends are sustainable and whether there are any details in the company’s filings that I have overlooked. But this story has the smell of something good to me. If I am right, I will continue to add to my position as I gain confidence. I welcome any comments to help my understanding.

One thing I would be careful of is the political risk, as even the EPA is ok with scaling back on ethanol requirements: http://stateimpact.npr.org/pennsylvania/2013/11/15/epa-scales-back-on-ethanol-requirements/

Patent Infringing PEIX is being sued for infringing GERS’ family of patents. Legally licensed producers like ANDE, MPC, GPRE, and SXL extract up to 50% more oil than Patent Infringing PEIX. Patent Infringing PEIX fought being transferred to the MDL their process provider, ICM is losing badly in.

Can you explain the lawsuit in more detail please. When I read through the details in the disclosures it didn’t seem like that big of a deal. isn’t the lawsuit with respect to the new corn oil that the company just began to produce in June at Magic Valley and Stockton in October?

Your corn oil # is way off. PEIX is repaying ICM out of corn oil revenues so it’s not possible for your presumptions to be correct. Plus you didn’t mention how many millions$$ to pay for the lawsuit they got. That’s a serious cost.

Thanks for the comment. What are your referring to when you say corn oil number? Because I didnt explicitly account for corn oil in the spreadsheet. Do you mean the corn oil won’t cover the D&A? If so maybe you understand this better than I do, in particular how the increase in D&A is broken down. I’m really basing it off of the comment on the CC that the $5.9mm increase in D&A is attributable to corn oil facilities. Generally a company isn’t going to implement new facilities that don’t cover the D&A and so that was my assumption – that corn oil would be a wash. I’d appreciate a description of why this isn’t the case.

you have a nice write up here… this is the way most of my ideas start… I est. a marker position and then when I have skin in the game I make it my business to learn more. And the comments are valuable too to illuminate the other side of the trade.

Thanks and yes, this is what works for me. I’m sure that some don’t like it; they want to read a fully worked out thesis from start to finish but by the time I have that I have no interest in writing any more. Why I can’t write for Seekingalpha though I’ve tried. This is the process that works for me and if its useful to some then great.

Dice el refranero español: “Más vale una imagen que mil palabras”

Thanks for your work.

Trend weekly candle. Heikin-Ashi

The year chart. Volume is coming and the trend stop going down.

Do you subscribe to any publications as a way to generate new ideas – Value Line, Morningstar, etc?

DDG’s price has crashed. Most of the production goes to China, and they have stopped imports due GM found in some shipments. Not sure how this affects bottom line but I suspect significantly. Although there is also a huge local market in California, the price is the price. Normally by-products make up a good chunk of profits for these type of enterprises. Love your analysis by the way.

Is this a recent occurrence? Do you have an article link or something I could refer to?

It is quite recent, yes. http://www.huffingtonpost.com/2013/12/26/china-rejects-gmo-corn_n_4502719.html

great thanks. I’ll take a look.

Step by step.

I don’t have a way to post a chart here but since bottoming a couple months ago ethanol prices have been vertical. I played it small just with futures (ticker AC_F), got out too early for the larger part of the move. But your suggestion for PEIX stock might be the way to go. Nice article, thanks.

The pacificethanol.net website links to ir.stockpr.com. The stockpr.com domain is controlled by Equisolve, a company that provides “investor awareness” services for publicly-traded companies. Many of Equisolve’s customers seem to be pump and dumps.

I’m not surprised that the borrow on PEIX is so expensive.

hah – well I guess you can cross that one off the list of useful indicators of stock performance.