Week 2015: Maybe its just a bear market

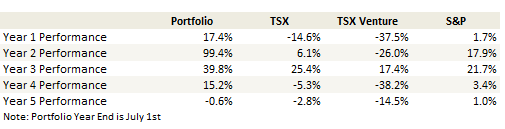

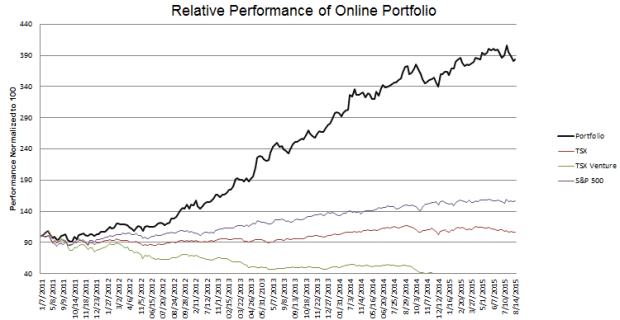

Portfolio Performance

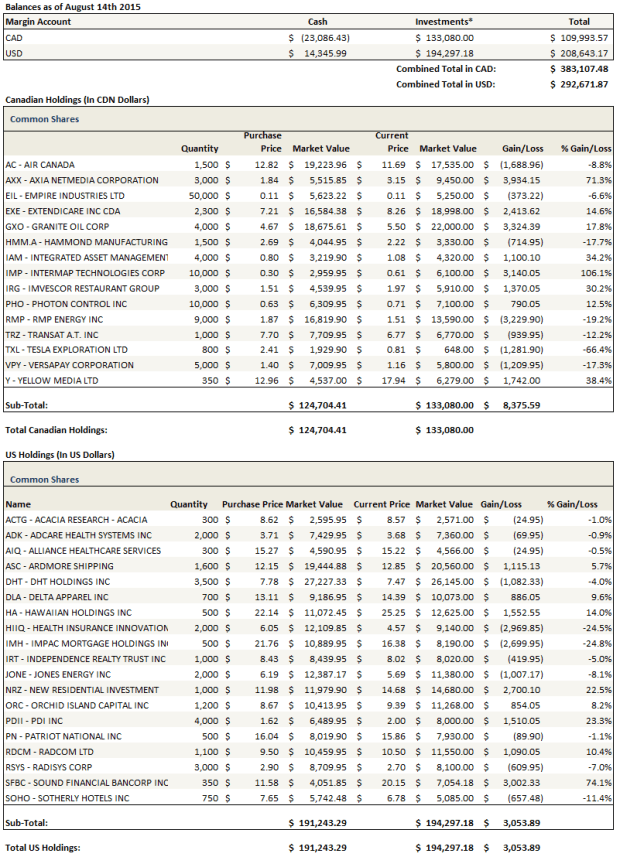

See the end of the post for the current make up of my portfolio and the last four weeks of trades

Monthly Review and Thoughts

I don’t flash sensational headlines about bear markets for the sake of getting attention. I get about 100-150 page views a day and given the frequency and technicality of my writing I don’t expect that to increase materially regardless of the headline I post.

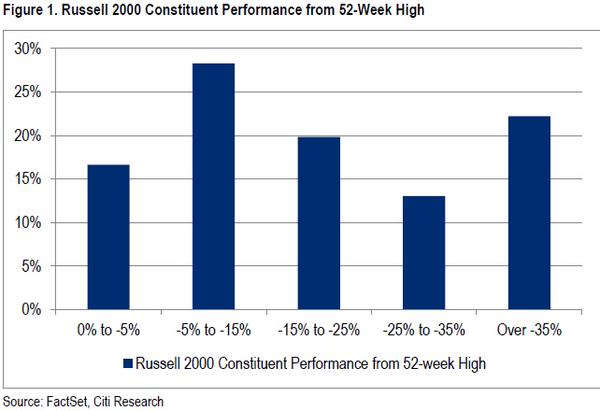

When I raise the question of whether we are in a bear market, its simply because even though the US averages hover a couple of percent below recent highs, the movement of individual stocks seems to more closely resemble what I remember from the early stages of 2008 and the summer of 2011.

A breakdown of the performance of the Russell 2000, which is where a lot of the stocks I invest in reside, was tweeted out this week by 17thStrCap and I think illustrates the pain quite well:

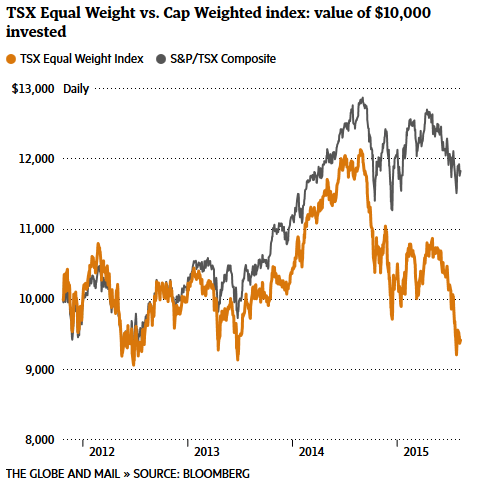

The Canadian stock averages have been made respectable by Valeant and not much else. In a Globe & Mail article appropriately capsulizing my comment here called “The market is in much worse shape than the TSX index suggests” the following comparison was made between the TSX Composite and an equal weighted version of it that dampens out the Valeant effect.

When the Federal Reserve ended its quantitative easing program last year I was concerned that the market might revert back to the nature it had demonstrated after first two QE endeavors. But for a number of months that didn’t happen. Stocks kept moving; maybe not upwards at the speed they had previously but they also did not wilt into the night.

I am starting to think that was nothing more than the unwinding of the momentum created by such a long QE program. Slowly momentum is being drained from the market as the bear takes hold.

A week late

I am a week late getting to this update. We were on vacation last week, which made it tough to write. As well I was in no mood to ruin my vacation and write with my portfolio going through significant perturbations to the downside.

It is frustrating to see my portfolio doing poorly. My investment account is being saved by two things:

- Shorts

- US stocks in Canadian dollars

As I mentioned last month I have had a number of technology shorts, some shorts on Canadian banks and mortgage providers, and hedges on energy and small caps via the XOP and IWM. I actually took a bunch of the tech shorts off in the last few days for the simple reason that they are up so much. I had some decent gains from INTC, SNDK, MU, ANET AVGO, RAX, HIMX and TSM. I also ended my multi-year short on YELP.

I am covering my shorts because with earnings season over I think there could be a counter rally resulting from the news vacuum. The China collapse angle has been beaten up and priced in; I could see the perception shifting towards the positive outcomes of the stimulus. And I’ve read that Apple is increasing orders for the iPhone 6s and 6s+ which may or may not be warranted (I suspect not) but could lift tech results in the short term.

I would put these shorts back on if the stocks recovered. But I don’t feel like I know enough about tech to be pressing my luck on the names. And as I reduce my long portfolio and raise cash, I feel less need to have what feel like stretched shorts to hedge those positions.

Without the benefit of short hedging this blog’s online tracking portfolio has done worse. I’m down about 5.6% from a brief peak I hit in mid-July (when the tankers were at their highs) and I am essentially running flat for the last 4 months.

At the center of my frustration are tankers, airlines, small caps and the REITs. So pretty much everything. Let’s talk about each.

The Tankers

With oil oversupplied and refiners working at record capacity producing gasoline, jet fuel and heating oil, one would expect that the market would turn to crude and product tankers as a natural beneficiary.

No such luck.

The recent moves by my favorite tanker plays: DHT Holdings, Ardmore Shipping and Capital Product Partners, have been to the downside. There was a brief move up towards the end of July that coincided with earnings (which were outstanding) but it was quickly unwound and now we are back to levels seen a few months ago. While I sold some along the way up, it wasn’t (and isn’t) ever enough.

Ardmore Shipping

Particularly with the product tankers (specifically Ardmore Shipping), I just don’t get why the behavior is so poor. I found it difficult to come away from their second quarter conference call with anything but an extremely bullish take on the company’s prospects.

The product market is benefiting from extremely strong refinery utilization and strong demand for products. It is also benefiting from the move by Middle East nations to add refining capacity with the view of exporting finished products.

Ardmore had earnings per share of 30c. They achieved those earnings with 18.4 ships. By the end of the year, once all of their newbuild fleet is delivered, the company expects to have 24 ships. If newbuilds had been operating in the second quarter, earnings would have been 43c for the quarter.

In the second quarter Ardmore saw spot rates of $22,400 TCE. So far in the third quarter spot rates are up again to $23,500. At current $23,500 spot rates and with 12 MR’s in the spot market, EPS would be $1.85. The stock has been trading at around $13.

Yet the stock sells off.

DHT Holdings

Likewise, I couldn’t believe it when DHT Holdings traded down to below $7 on Wednesday. At least the crude tanker market makes some sense in terms of rates. Voyage rates have come off to $40,000 TCE for VLCC ships. This is seasonal and if anything rates have held up extraordinarily well during the slow third quarter.

DHT stated on its conference call that they had more than 50% of their third quarter booked at $80,000 per day. The company has a net asset value of around $8.50 per share.

While I already had a pretty full position heading into the last move down I held my nose and added more at $7.15 (i never catch the lows it seems). I’m not holding these extra shares for long though. In this market having an over-sized position in anything seems akin to holding an unpinned grenade.

The Airlines

While Hawaiian Airlines has been an outperforming outlier, responding well to strong earnings, Air Canada has languished. The stock got clobbered after the company announced record earnings and great guidance.

Air Canada reported 85c EPS and $591 million EBITDAR. In comparison, BMO had been expecting 90c EPS and $618mm EBITDAR and RBC had been expecting 77c EPS and $558mm EBITDAR.

The story here really boils down to the Canadian economy.

Both WestJet and Air Canada are increasing capacity. The market is worried that they are going to flood a weak market and pressure yields. On the conference call Air Canada addressed the concern by pointing out that A. the capacity they are adding is going into international routes and B. they have yet to see anything but robust demand for traffic.

What’s crazy is that while investors have responded negatively, analysts have been bullish to the results. I read positive reports from RBC, TD and BMO. Only Scotia, which I don’t have access to, downgraded the stock on concerns about no further upside catalysts.

Its rare to see multiple upgrades accompanied by a 7% down move in a stock. I would love to see one of the darling sectors, tech or biotech, respond in such a manner.

So the analysts are bullish and the company is bullish but right now the market doesn’t care. As is the case in general, the market cares about what might happen if some negative confluence of events comes to fruition. And it continues to price in those worries.

Its just a really tough market.

Trying to find something that works

Another contributor to my poor performance has been that what has worked over the last five years is working less well now.

In particular, over the last give years I have followed a strategy of buying starter positions in companies where I see some probability of significant upside. In some cases I will buy into companies that do not have the best track record or are not operating in the most attractive sectors. But because the upside potential is there I will take a small position and then wait to see what happens. If the thesis begins to play out and the stock rises, I add. If it doesn’t I either exit my position or, in the worst case, get stopped out.

This has worked well, with my usual result being something like this. I have a number of non-performers that I end up exiting for very little gain or loss, a few big winners, and a couple of losers where I sell after hitting my stops.

I’ve had a lot of winners this way over the last few years: Mercer International, Tembec, MGIC, Radian, Nationstar, Impac Mortgage (the first time around in 2012), YRC Worldwide, Pacific Ethanol, Phillips 66, Nextstar Broadcasting, Alliance Healthcare Yellow Media and IDT Corp are some I can think of off-hand. In each case, I wasn’t sold on the company or the thesis, but I could see the potential, and scaling into the risk was a successful strategy of realizing it.

Right now the strategy isn’t working that well. The problem is that the muddling middle of non-performers is being skewed to the downside. Instead of having stocks that don’t pan out and get sold out at par, I’m seeing those stocks decline from the get-go. I am left sitting on either a 5-10% loss or getting stopped out at 20% before anything of note happens. Recent examples are Espial Group, Hammond Manufaturing, Versapay, Higher One Education, Willdan Group, Acacia Research, Health Insurance Innovations and my recent third go round with Impac Mortgage.

All of these stocks have hair. But none has had anything materially crippling happen since I bought them. In the old days of 2012-2014, these positions would have done very little, while others, like Patriot National, Intermap, Photon Control, Red Lion Hotels and most recently Orchid Island would run up for big gains and overall I’d be up by 20% or so. Instead this year the winners still win, albeit with less gusto, but its the losers that are losing with far more frequency and depth.

So the question is, if what has worked is no longer working, what do you do?

You stop doing it.

I cleaned out my portfolio of many of the above names and reduced a couple of others by half.

So let’s talk about some of what I have kept, and why.

Health Insurance Innovations

HIIQ announced results that weren’t great but the guidance was pretty good. Revenue came in at $23 million which is similar to Q1. In the first quarter the company had been squeezed by the ACA enrollment period, but in the second quarter this should have only impacted April. So I had been hoping revenue would be a touch better.

The guidance was encouraging though. The company guided to $97-$103 million revenue for the year which suggests a big uptick in the second half to around $28 million per quarter. In my model, I estimate at the midpoint they would earn 40c EPS from this level of revenue if annualized.

Also noted was that ACA open enrollment would be 90 days shorter next year, which should mitigate the revenue drag in the first half of the year. And they appear to be doing a major overhaul of management – bringing on people from Express Scripts (new president), someone new to evaluate the web channel and a number of new sales people.

Its been a crappy position for me but I don’t feel like there is a reason to turf it at these levels, so I will hold.

Impac Mortgage

As usual Impac’s GAAP numbers are a confluence of confusion. The headline number was better than the actual results because of changes to accretion of contingent expense that they incurred with the acquisition of CashCall.

The CashCall acquisition had contingent revenue payout and that payout expectation has decreased leading to lower accretion via GAAP. Ignoring accretion the operating income was around $8 million which was less than the first quarter.

The decline was mostly due to lower gain on sale margins, which had declined to 186 bps from 230 bps.

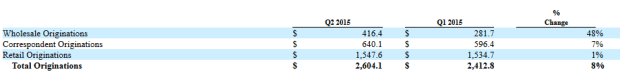

While origination volumes were up 8% sequentially (see below) I had been expecting better. The expansion of CashCall into more states was slower than I expected. In the second quarter CashCall was registered in 19 states. I actually had thought that number was 29.

By the third quarter CashCall is expected to be compliant in 40 states. And really that is the story here. Volume growth through expansion.

By the third quarter CashCall is expected to be compliant in 40 states. And really that is the story here. Volume growth through expansion.

CashCall is a retail broker dealing primarily with money-purchase mortgages (mortgages to new home owners). Therefore Impac is not as dependent on refinancing volumes as some other originators.

While it was not a great quarter the company still earned 70c EPS. Its lower than my expectations but in absolute terms not a bad number. On the conference call they said that Q3 margins looked better than Q2, and while July production was only about $700mm, they expected better in August-September as the pipeline was large.

I made a mistake buying the stock at $20 on the expectation of a strong second quarter. But I think at $16 its reasonable given earnings power that should exceed $3+ EPS once CashCall is operating nationwide.

PDI Inc

The response to the PDI quarter is indicative of the market. The company released above consensus earnings on Thursday along with news that their molecular diagnostic products were being picked up by more insurers. In pre-market the stock was up 20% and it looked like we were off to the races.

It closed down.

Recall that PDI operates two businesses. They have a commercial services business where they provide outsourced sales services to pharmaceutical companies looking to market their product. And they have the interpace diagnostics business, which consists of three diagnostic tests: one for pancreatic cysts and two for thyroid cancer.

I suspect that the market decided to focus on the one negative in the report: reduced guidance for interpace revenues from $13-$14 million to $11-$12 million. The guidance reduction was caused by a delay in receivables from some customers. The metric by which to judge the growth of the actual operations, molecular diagnostic tests, increased from 1,650 in the first quarter to 2,000 in the second quarter.

But in this market you gotta focus on the negative. At least on Friday.

Patriot National

When I bought Patriot they were a new IPO whose business was a platform that allowed them to procure and aggregate workers compensation policies for insurance carriers. They sign a contract with a carrier for a bucket of policies with particular characteristics and then distributed that to their pool of agents, collecting a fee in return.

But over the last couple of months Patriot seems to be expanding that role to something more holistic. Among their nine acquisitions in the past six months is an insurance risk management firm, an auditing and underwriting survey agency, an insurance billing solution platform and a beneits administration company for self-funded health and welfare plans nationwide.

Patriot describes themselves in their latest presentation as follows:

Patriot has shown solid growth since their IPO, both through their roll-up strategy of small insurance businesses and organically. They have increased their carrier relationships from 17 to 82. They are expanding their relationship with a few big carriers like AIG and Zurich. They have grown their agent pool from 1,000 to 1,750.

Patriot has shown solid growth since their IPO, both through their roll-up strategy of small insurance businesses and organically. They have increased their carrier relationships from 17 to 82. They are expanding their relationship with a few big carriers like AIG and Zurich. They have grown their agent pool from 1,000 to 1,750.

I’m not really sure what it was about the second quarter that caused the stock to sell-off like it has. It was down 16% at one point on Wednesday, which is about the same time I tweeted that this is crazy and pulled the trigger. I suspect its simply another case of a bad market, a run-up pre-earnings and a release that didn’t have anything clearly “blow-outish” about it.

Nevertheless the company provided guidance along with its results and for 2016 predicts 37% revenue growth and 55% earnings growth. These numbers make no allowances for further accretive acquisitions, which undoubtedly will occur.

The stock trades at 6.5x its 2016 EBITDA multiple. From what I can tell its closest peers trade at around 10x, and they aren’t growing at a pace anywhere near Patriot. As I said I added under $16 and would do so again.

Orchid Island

I have followed Orchid Island for a long time having been an investor in its asset manager, Bimini Capital, in 2013. I never bought into Orchid though; it seemed small, it always trade around or above book value and being an mREIT it seemed that you had to have more of an opinion on the direction of rates than I have had for a while.

But when the stock got below $8, or a 30%+ discount to book value, it just seemed to me like the opportunity was too ripe to pass up.

There have been a number of good SeekingAlpha articles by ColoradoWelathManagementFund on Orchid where he describes the MBS investments and also the Eurodollar hedges. These hedges, which require a different GAAP accounting then other more commonly used hedges, seem to be at least partially responsible for confusing the market and leading to the massive discount to book.

However I don’t plan to wait this out until book value is realized. When the stock hits double digits again I expect to be pulling the trigger.

Higher One Education

I bought back into Higher One after it got clubbed down to $2.20, where it seemed to be basing. Upon buying the stock was promptly clubbed down again to below $2.

Like many other names I am not sure if the clubbing is warranted. The company’s second quarter results were better than my expectations.

Adjusted EBITDA in the second quarter came in at $8 million versus $7.2 million in Q2 2014. While the disbursement business EBITDA was down, both payments and analytics were up (46% and 38% respectively). EPS was 8c which again was better than last year.

They lost 6 clients representing 86,000 signed school enrollment (SSEs), signed 4 new clients with 16,000 SSEs and renewed 59 clients with 675,000 SSE’s. Their total SSEs were 5mm at the end of Q2. Given the headwinds in the industry, Higher One is holding their own.

The overhang in the stock is because the DOE proposed new rules that ONE and others are pushing back on, with the biggest issue being that you can’t charge fees for 30 days after deposits. From their conference call:

The way the rule is proposed every time there is a disbursement made into the students accounts, we’d have to freeze all fees for 30 days.

This of course would severely impair Higher One’s ability to be profitable with these accounts.

On Friday after writing this summary I decided to sell Higher One. I’m waffling here. I like the value but don’t like the uncertainty and if the market can knock it down to $1.90 then why not $1.50? Uncertainty reigns king. I might buy it back but its difficult to know just how low a stock like this can go.

My Oil Stocks

I’ve done a so-so job of avoiding the oil stock carnage of the last few months. After the first run down in the stocks I added a number of positions in March and ran them back up as oil recovered to the $60’s. Then oil started dropping again and in May I began to sell those stocks.

By mid-June I was out of all my positions other than RMP Energy. By July I had reduced RMP Energy down to about a percentage weighting in my portfolio.

By mid-June I was out of all my positions other than RMP Energy. By July I had reduced RMP Energy down to about a percentage weighting in my portfolio.

So far so good.

Unfortunately I started buying back into the oil names in mid-July, which was too early. I bought Jones Energy in the mid to high-$7s but sold as it collapsed into the $6’s. I tried to buy RMP again at $2.20 but got pushed out as it fell to $2. I bought Baytex and Bellatrix which was just stupid (I sold both at a loss). I’ve probably given back half of the profits I made on the first oil ramp.

In this last week I made another attempt but I am already questioning its efficacy. I took small positions in RMP Energy and Jones Energy and a larger position in Granite Oil. The former two have done poorly, while the latter had an excellent day on Friday that provides some vindication to my recent endeavors.

One thing I will not do with any of these names is dig in if the trend does not turn. I’ve learned that commodity markets can act wildly when they are not balanced, and the oil market is not balanced yet. So its really hard to say where the dust settles.

Even as I write this I wonder if I should not have just waited for a clear turn to buy.

These positions are partially hedged in two ways. First, I shorted XOP against about a quarter of the total value of the positions. And second by having so much US dollar exposure (still around half my account) as a Canadian investor they act as a bit of a counter-weight to the wild moves I can see from currency changes.

Jones Energy

One of the interesting things happening right now is that natural gas production is flattening, in many basins it’s declining, and yet no one cares. When natural gas first went to new lows in 2012 many pointed to the declining natural gas rig count, believing prices would quickly bounce back. They didn’t, in part because of the associated gas coming from all the liquids rich plays.

With the oil collapse much of the drilling in those liquids rich plays is no longer as attractive. You have to remember that even as oil has fallen, natural gas liquids like propane and butane have fallen even further (ethane, which is the lightest of the liquids, is now worth no more than natural gas). Many producers that were labeled as oil producers, because they produced liquids, really produced these lighter liquids that are now trading at extremely depressed levels. Drilling in light-liquids rich basins (the Marcellus but also the Permian and parts of the Eagleford) has declined precipitously, and with it all of the associated gas being produced.

Meanwhile much needed propane export capacity is on the horizon and expected to arrive en-masse in 2016.

Jones Energy has too much debt (around $770 million net) but they also have oil and natural gas that take them out into 2018. I think they are a survivor. They have reduced their drilling and completion costs in the Cleveland from $3.8 million to $2.6 million. They actually increased their rigs in the Cleveland in June, though I have to admit that might be dialed back again with the prices declining. I bought back into the stock for the third time this year when it was clobbered on what seemed to be pretty good earning results (a beat and guidance raise). Its a play on oil, but also on falling natural gas production, as natural gas makes up 43% of production and much of the associated liquids are light.

RMP Energy

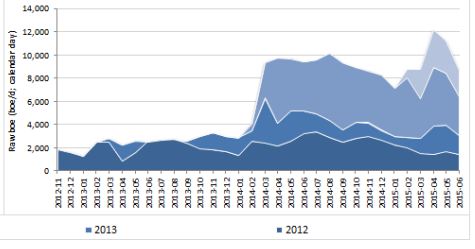

I think that the miserable performance of this stock is overdone, but I have thought that for some time and down it continues to go. RMP gets punished over and over again for essentially the same concern – Ante Creek declines. This latest pummeling seems to have been precipitated by the disclosure that August volumes at Ante Creek were around 8,500 boe/d. This is a decline from April volumes of 12,200boe/d but similar to end of June volumes. Below is a chart from Scotia that details Ante Creek production:

The April increase coincided with the new gas plant. The subsequent fall was because the company drilled no new wells in the second quarter. That production has stabilized from June to August without any new wells being drilled is encouraging.

But the market sees it differently.

Lost in the shuffle (with nary a mention in any of the reports I read) is that RMP has reduced its drilling and completion costs by 30% and that operating expenses were down from $5.26/boe to $3.89/boe. Also forgotten is that the company is experiencing positive results at Waskahigan with it new frac design.

RMP trades at about 2x Price/cashflow and has debt of about 1.35x expected 2015 cash flows. Its not levered like many peers and its not expensive. These constant concerns about Ante Creek need to be priced in at some point.

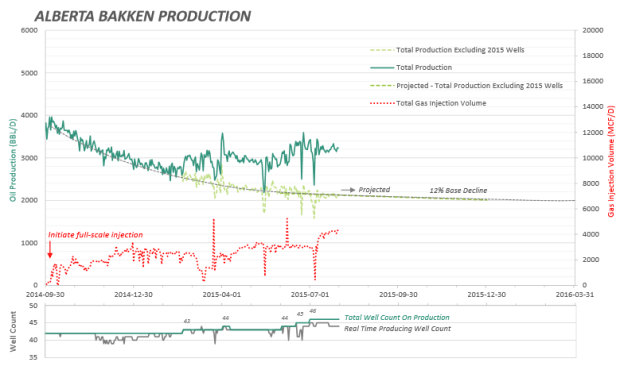

Granite Oil

Of the three names I own, this is the one I am going to stick with the longest. Granite has a $150 million market capitalization and $50 million of debt. Their asset is a large position in the Alberta Bakken (350,000 net acres). They can drill 240MBBL wells that are 98% oil for $2.8 million per well.

And they are beginning a gas injection EOR scheme that is showing promising results. Below is company production as gas injection has increased.

The results are well above expectation and show minimal decline even as the number of wells drilled has only increased marginally.

The results are well above expectation and show minimal decline even as the number of wells drilled has only increased marginally.

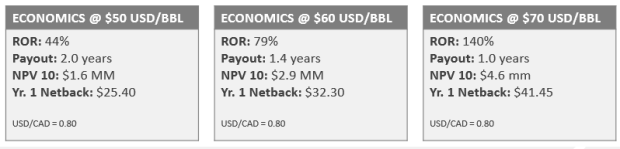

The result is some pretty strong economics even at lower oil prices.

Granite management had been loading up on shares in the $4’s. I did too. The company announced earnings on Friday and is probably the only oil company to announce a dividend increase. Like I said, this will be the last oil position to go for me.

Portfolio Composition

As I’ve said a number of times in the past, I sometimes forget to mimic my actual trades with the online RBC portfolio I track here. After a while these differences get too out of whack and I have to re-balance. I did some of that on Friday, and so the transactions on that day are simply me trying to square up position sizes. I don’t have things quite right though; the cash level of my online portfolio is negative while my actual investment account is about 15% cash. I looked at why this is and its the contribution of a number of positions that are all slightly larger in the online portfolio than they should be. I didn’t have time to adjust everything exactly so I’ll just try to reduce this discrepancy naturally over time.

Click here for the last five weeks of trades.

Intermap is flying, where do you see it going? http://poisedtotriple.com/shares-intermap-poised-triple/

Its a tough one to target. Either they get another contract signed and the stock probably does triple or they don’t and it probably sits as this kind of level indefinitely. I don’t think the current price reflects any optimism about further contracts and that is why I continue to hold the stock.

Always enjoy these updates, and your thinking.

re:contemporary energy markets in general, the informed discussion that follows this short piece on SUNE covers a great deal of ground on volatility trades, derivatives, next generation asset backed paper markets: http://seekingalpha.com/article/3480136-sunedison-can-go-lower

thanks for the link

Dear Sir,

I look forward to your insightful posts each month. Last week I purchased Granite Oil. I want to add to my position, seeing that it is on a steady, upward trajection, albeit with low volumes. Today it hit the middle $5 mark here in the US market. What is your top buy price on it, if I may ask?

Thanks for your input!

Robert

Greenwood, S.C.

Sent from Yahoo Mail on Android

From:”Reminiscences of a Stockblogger” Date:Sun, Aug 16, 2015 at 10:00 PM Subject:[New post] Week 2015: Maybe its just a bear market

Lsigurd posted: “Portfolio Performance See the end of the post for the current make up of my portfolio and the last four weeks of trades Monthly Review and Thoughts I don’t flash sensational headlines about bear markets for the sake of getting attention. I get”

I’d be careful adding to it above $7 CAD simply because of the oil price. Its just really difficult to say with certainty what the oil price is going to do over the next 3-4 months. Its surprisingly easy for me to make the case for lower oil prices and higher prices depending on how you tweak the supply/demand numbers and whether you believe the IEA numbers or think they are underestimating demand/overestimating supply. But I like GXO better than any of the other oil stocks I have and it will be the last that I reduce. Its one of the very few that actually can produce a decent return, enough that they can actually grow marginally, at these prices.

What are your thoughts on BXE at the current price? It looks like they are going to focus more on Spirit River and may get rid of Cardium. That makes them a gas pure play which they are hedged at 50%in 2016 and 35% in ’17. But the market is still valuing them as leveraged oil play.

The debt makes me nervous but the covenants just got revised and they should be able to weather out this downturn.

I keep watching BXE and maybe i should have bought it when it got to $2. I added a couple more oily stocks instead – CPG and BTE (since have sold BTE). The latest thing that has me a bit nervous with BXE is this El Nino that seems to be forming. We had some really warm winter weather in 97-98 when there was a comparable El Nino. I know BXE is hedged but even so we know that these stocks won’t always react appropriately when prices start falling. That said, the Spirit River wells are very good. I might be overdoing my worrying about possible negatives, I think with the bear market we’ve been having its hard to not focus on any negatives out there.

Never thought about El Nino. Looks like every variable count in a commodity play. My biggest concern is the management. Either they are untrustworthy or a really poor capital allocator. If they have the leadership like Granite Oil(By the way great call ) I would be in the trade in the blink of an eye but so would everybody. I like the Nat gas secular trend and this one seems to be a great play considering Orange and Klarman are in it.

probably a reason to be more bullish on gas vs oil is because demand is going to go up a lot in the next few years. 25GW of coal plants are retired/replaced by gas directly in 2015 and 2016, and another 6GW in 2017.

if ran at 100% capacity you would need 7.5bcf / day to replace that (vs 2014 gas consumption in total north america including mexico of 90bcf/day). Then there are exports coming online of about 2-3bcf/day from Cheniere starting in late 2015 throughout 2017. And im sure a bunch of industrial plants as well that use gas (with all the tax incentives).

So demand is extremely likely to grow at a healthy clip in the next few years (vs likely much lower growth in oil production).

And looking here:

Click to access dpr-full.pdf

A lot of the major fields stopped growing, or started shrinking in 2015. Seems there is a lot of production that needs 4$ gas to not shrink.

You could say that takeaway will increase in the two most interesting fields (marcellus and utica), but in that case why not bet on a company like Southwestern? Since current discount to henry hub price is more then a dollar. You would probably win either way then.

Hi Lsigurd,

I’m glad to hear you’ve customized your strategy to take into account the possibility of a bear market. I’ve poked around your website several times and been surprised by how well your investing has worked. But I also wondered with the combination of stop losses, scaling when stocks rise, and micro-caps if you might have higher than usual exposure to bad things happening if everything blows up. In a market crash for example, the micro-caps might gap past the stop losses and market volatility coupled with negative momentum could lead to repeatedly getting stopped out. I agree that having a nice cash buffer is a good idea.

Maybe but I also go to cash quite quickly. For example I am over 50% cash right now. The market has declined about 3x more than my portfolio since May. I will continue to sell stocks/hedge with shorts if the market declines further.

any thots on hiiq i put mine over on cobf there may be big seller

(huber?) weighing on shares, big fan of ceo pm sidoti presentation is v good

The quarter looked really good, they showed another big increase in apps and Policies in Force, I added the day of earnings which turned out to be a mistake as it trended down, not sure why the share price hasn’t reacted, your theory is as good as any, maybe too that while they raised guidance they kind of threw in some question that they didnt know how sales especially at Agile would perform this year outside of open enrollment period.