REEs: Another way to play the EV Ramp

There are a lot of ways to play the boom in electric vehicles. There is lithium. There is graphite. There is cobalt. And there is nickel.

I have invested in a number of companies levered to these EV minerals.

- Bearing Lithium, Albemarle and Orocobre for lithium

- Sherritt for nickel and cobalt

- Leading Edge Minerals which has a graphite operation they are trying to get qualified for battery grade graphite

- A bit of a takeoff on the battery idea with a Vanadium producer called Largo Resources

- A zinc play, Acendent Resources, where the electric vehicle ramp could have an impact but its not core to the investment thesis

In addition, there is one other play I have on the electric vehicle theme: Rare earth elements. I have taken a position in a company that produces them, Lynas Corp.

I’m breaking my discussion up into a couple blog posts. In this post I’m not going to talk too much about Lynas Corp. I’m going to focus on the rare earth market. I will talk about Lynas later.

But Lynas is core to the thesis. In fact the EV story for rare earths is probably not as strong as the story for lithium or cobalt. But Lynas is in a unique position and trades reasonably, and that makes up for it. So I’ll mention a few points about Lynas before I start talking about the rare earth market:

- With a single mine in Australia (Mt. Weld) Lynas is the only rare earth producer outside of China right now – seriously…the only one

- Lynas looks incredibly expensive on backward looking metrics that use average prices over the past few years

- Lynas will generate a lot of free cash if the price of Neodymium oxide and Praseodymium oxide stay at the level they are at right now. If prices rise further the numbers get very large

With that brief introduction to Lynas, lets talk about the rare earth market.

Rare Earth Elements

I’m not going to spend a bunch of time talking about what rare earths are, how they are classified and all that stuff. You can look it up on Wikipedia if you are interested.

What is important to know is this:

There are a few rare earth elements that can be used to make magnets. In particular neodymium, when combined with iron and boron, can be used to make a Neodymium-Iron-Boron (NdFeB) permanent magnet. In addition praseodymium (Pr) and to a lessor extent dysprosium are used in permanent magnets. Praseodymium can be substituted for neodymium up to about 25% of content in the NdFeB magnet. This is done if the neodymium price gets too far ahead of the praseodymium price. It also improves corrosion resistance. Combined neodymium and praseodymium supply is often described as NdPr, given their linked nature.

While there are other metals you can put together to create a permanent magnet, the NdFeB magnet is superior because A. it is stronger and B. it is primarily made from iron, which makes it relatively cheap.

Rare Earths and EVs

REEs are not the highest intensity way of playing the EV growth story. The demand numbers aren’t going to “wow” you like they do for lithium or cobalt. The introduction of electric vehicles is an important part of the rare earth bull case, but its not the only element of it.

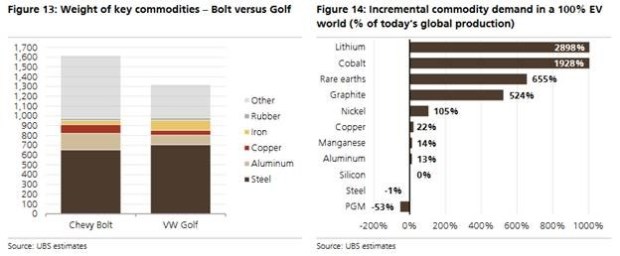

The chart on the right from UBS demonstrates the impact of a full EV world on rare earth demand:

While the rare earth content doesn’t show up on the chart on the left, that is because rare earths are used in relatively small amounts in all applications. A Chevy Bolt will have about 1kg of Neodymium in its engine due to the use of a permanent magnet in the electric traction motor.

The NdFeB magnet is used in the electric traction motor of almost electric vehicles. In 2016 89% of EV’s and hybrids sold used a permanent magnet motor. The motors are “unbeatable in delivering torque and overall power by weight, and suffer less electric and mechanical losses, and have a simpler rotor/stator configuration” (from this report).

In fact, every EV manufacturer is using a permanent magnet in the engine other than Tesla. Tesla has been using an AC induction motor. However, recently Tesla announced they would be switching to a permanent magnet on their Tesla 3 long range model and I have read anecdotes that the change could be made globally to all Model 3’s.

In addition to the larger electric traction motor, there are about 20 other motors in an EV that use an NdFeB permanent magnet. In total an EV will use about 1.5kg-2kg of NdPr, with about 1kg of that being in the engine. This is an incremental of 1kg-1.5kg over an internal combustion engine (internal combustion engines still uses about 0.5kg of NdPr throughout the vehicle for various smaller motors).

Wind Turbine Demand

Electric Vehicles are one piece of the demand story. The other piece is wind turbines.

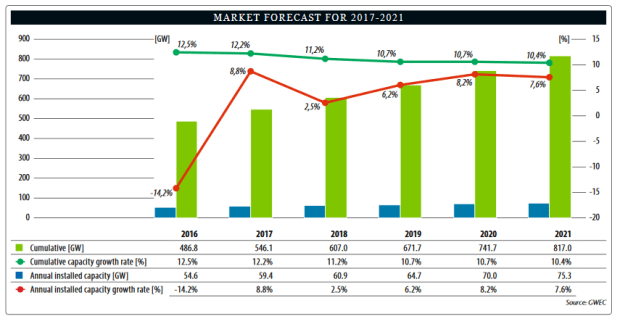

Global installed wind capacity has been growing significantly over the past decade.

Given that wind is now cheaper than gas turbines in many locations wind installation is forecast to continue to grow, at 11.5% CAGR, over the next 30 years. The following is a near term capacity growth estimate from the Global Wind Energy Council:

Hybrid drive (HD) and direct drive (DD) wind turbines use permanent magnets to convert the wind energy into electrical power. They are an improvement over traditional gear box systems because they are lighter, quieter, more efficient and require less maintenance.

A hybrid drive requires about 70 kg of Neodymium. A direct drive requires about 210 kg. I get these estimates from this report, which provides an extremely good dive into the entire sector.

Adding up demand

To come up with a rough idea of where NdPr demand is going, I used the consensus uptake of electric vehicles, growth in wind turbine capacity and an underlying growth in demand from other applications of NdPr of 2.5%. With these assumptions I see demand going from about 37,500 tonnes in 2016 to 54,000 tonnes in 2021.

Global consumption of NdPr is 2015 was 37,300 tonnes. 2016 was likely in the area of 39,000 tonnes. But note that the number seems to vary depending on the source. I saw one set of numbers for 2016 that were a little above 40,000 tonnes and another that was below 30,000 tonnes (thought I suspect this one was really referring to Neodymium demand only, even though the referenced it as NdPr). Its an opaque market.

UBS recently estimated that they expect 3.1 million EVs by 2021 and 14.3 million EV’s by 2025. Assuming 75% of those cars use permanent magnet motors that translates into about 3,000 tonnes of NdPr. 14.2 million EV’s, the estimate for 2025, would translate to 12,500 tonnes of NdPr (assuming the mass/unit declines from an incremental 1kg down to 0.88kg by the time this happens).

At 35% market share for HD/DD turbines of cumulative capacity growth, rising to 50% by 2020, an additional 2,344 rising to 5,591 tonnes of NdPr will be required to support incremental turbine demand. If HD/DD market share rises further (some expect these turbines to eventually reach 75% market share) that number will grow. At a 75% market share in 2020, over 8,500 tonnes of NdPr would be required.

While a move from 37,000 tonnes to 54,000 tonnes is significant, the demand growth pales in comparison to some of the other EV materials. Lithium demand, for example, is expected to go from 189 Kt LCE (lithium carbonate equivalent) in 2016 to 329 Kt LCE in 2021. Almost twice as much growth.

What differentiates the rare earth bull case from the lithium bull is that its not all that certain where additional supply is going to come from.

Looking at Supply

What I like about the REE story is that its more two sided then lithium and cobalt. Lithium and cobalt are seeing a supply response that is most definitely occurring. You can argue whether that supply response is going to be sufficient (I am of the mind it won’t as I think the demand numbers will end up too low and the supply will be delayed) but there is no question lithium and cobalt supplies are going to increase substantially in the coming years.

With REEs, that is not so clear. First, there is a complete lack of mine development outside of China. There is Lynas, which operates the Mt. Weld mine in Australia. And there is one small development in Burundi, run by a company called Rainbow Rare Earths, that is trying to get into production by the end of this year. But I think that’s it.

Rare earth mining is very difficult. Processing the rare earths and separating the constituent elements can take many cycles and can be toxic to the environment if not done carefully. Lynas took almost 5 years of fits and starts before they have finally been able to produce at a consistent level and with decent costs.

Second, rare earth have, for some time, relied on a single source of supply, China. China supplies about 95% of rare earths. There are 6 state owned enterprises (SOEs) that legally produce REEs in the country. These companies are given a quota by the country that they can produce 105,000 tonnes of REEs (note that this includes all rare earths, not just NdPr).

But China has been producing far above that amount for years. They produced around 150,000 tonnes in 2016. The difference between the official tonnage and actual production is due to illegal miners.

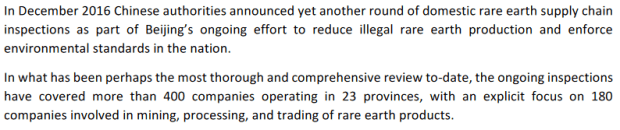

Illegal mining of rare earths is profitable because it is polluting and harmful to the environment. As part of the governments efforts to stem pollution, China is cracking down on illegal mines. The following is from this Adamis Intel note:

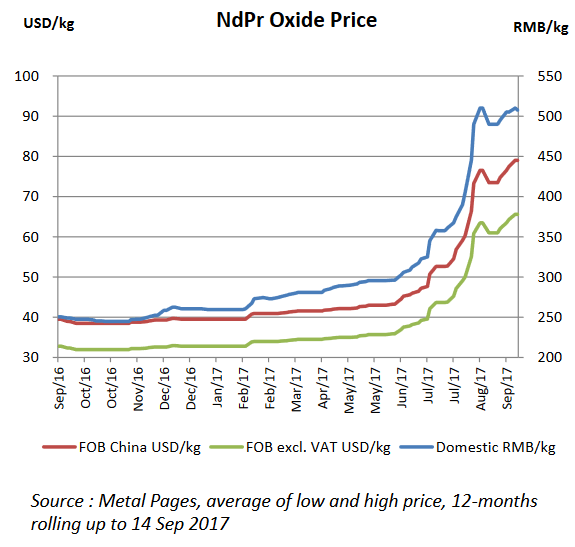

Adamis concludes that tightening the reins on illegal mining has lead to stockpile draw downs in 2017. Its also led to a huge jump in the price of both Neodymium and Praseodymium (from slide 8).

With the moves taken by China, particularly given that they are part of a larger effort to reign in pollution, there seems to be more chance that REE supply from China falls then rises in the medium term.

Interestingly, Chinese companies have been buying up or taking stakes in a number of rare earth deposits outside of the country. Here is a list of projects that have recently become affiliated with or owned by Chinese interests:

- Shenghe Resources takes a 12.5% stake in ASX listed Greenland Minerals and Energy which owns the Kvanefjeld rare-earth-uranium project

- Shenghe Resources and JHL Capital place winning bid for Mt. Pass rare earth mine in the United States (was the last mine to operate in the US and used to be part of Molycorp)

- Huatai Mining invests Northern Minerals and its Browns Range dysprosium project

- Northern Minerals sales agreement with Guangdong Raising Asset Management

- Mkango Resources on the TSX has done two financings with Noble Resources

Its possible these are just opportunistic Chinese speculations. But it could also be an understanding within China that soon their rare earth dominance must be tapered. Adamis Intelligence was quoted as saying that they expected China to be a net importer of NdPr by 2025, and that demand from magets within China will significantly exceed their internal supply by that time.

Conclusion

I missed out on the first spike in REEs. To be honest I never really bought into the thesis. That didn’t turn out to be wrong. The boom in rare earths in 2011-2012 was driven entirely by Chinese trade dispute with Japan, which led them to pull back on exports, which led to price spikes in a number of the minerals. When that ended so did the spike.

It wasn’t really based on demand in any significant way.

Now, however, is different. There is both a demand story and a supply story. Both are coming to a head at the same time. Both have legs in my opinion.

But this is not without its risks. The biggest risk is China. We can’t be sure what the government is thinking and how they will direct the SOE’s to act. We can’t be sure they will continue the hard line against illegal mining.

Maybe most importantly, we can’t be sure what impact price rises will have. Will they cause China to back-off? China has strategic stockpiles. These are being worked down but so far its been orderly. Also, further price rises will, at some point, encourage substitution. NdFeB is not the only permanent magnet and eventually if it gets too expensive, alternatives will be considered.

I’m of the mind that the spike we saw in NdPr over the summer was off of an unsustainable low. Prices needed to rise to encourage some investment in new mines outside of China. But I’m not sure a further spike would be constructive. The best case scenario would be a slow rise over time. As I will talk about in a later post, that would be more than enough for Lynas.

I’ll end with this comment from an article quoting Adamis Intelligence:

The outlook for rare earth demand from 2020 through 2025, and beyond, is exceptionally promising. This period reveals that for many of today’s most highly publicized rare earth end-uses, such as electric vehicles, wind turbines, and many others, the rate of annual demand growth is poised to accelerate between 2020 and 2025, steering global rare earth demand to unfathomable new heights in the years thereafter.

From the China 2016-2020 Five year plan, which is as clear as it can get:

Mineral Resource Conservation and Management:

We will tighten planning and management of mineral resources; put in place

strict systems which ensure their regional management, control total exploitation, and

require mining authorization; and we will better coordinate multiple mining activities.

We will support technological and process upgrading in mining enterprises, guide the

merging and reorganization of small mines, and shut down mining activities that use

outdated techniques or are environmentally undesirable. We will promote the

development of demonstration zones for green mining and the green mining industry,

launch demonstration projects for the economical and multipurpose utilization of

mineral resources as well as projects to preserve and build reserves of mineral resources,

and work to increase the rates of exploitation of mineral resources, ore dressing recovery

rates, and multipurpose utilization rates of mineral resources. We will improve

mechanisms to keep the prices of superior minerals stable through limiting production.

We will establish a national royalty system for mineral resources and improve mineral

resource tax and fee systems. We will carry out the mineral exploration initiative.

…

Reform of Fundamental Fundamental Environmental Governance Systems:

We will ensure that local governments fulfill their environmental responsibilities,

make environmental protection inspection visits, and establish a responsibility system

and performance assessment mechanisms for meeting environmental protection targets.

We will put into effect a system that places the monitoring, supervision, and law

enforcement activities of environmental bodies below the provincial level under the

supervision of environmental protection bodies at the next level up, explore the

establishment of trans-regional environmental protection bodies, and encourage

coordinated pollution prevention and control efforts in entire river basins and between

regions as well as coordinated urban- rural environmental governance. We will institute

integrated control and unified monitoring of multiple pollutants, establish a business

emissions permit system that covers all fixed pollution sources, and put the regulation of

the discharge of all pollutants under an emissions permit. We will establish sound

systems for the compensated use and trading of emissions rights. We will ensure the

strict and trans-regional joint enforcement of environmental protection legislation, and

strengthen oversight over law enforcement and investigations into accountability. We

will compile a record of the environmental credibility of enterprises and a blacklist of

those that illegally emit pollutants, require greater self-monitoring by enterprises over

their emissions of pollutants and strengthen the public disclosure of environmental

information, improve the channels for public participation in pollution control efforts,

and improve the environmental public-interest litigation system. We will conduct

auditing over the performance of outgoing officials in fulfilling their environmental

protection responsibilities.

Thanks – I’ve been reading up more on the Chinese environmental shift. I agree, it looks like the real deal. Good for REEs, also good for Vanadium, Tungsten. Others?

One way I am starting to think about this is that there are a bunch of metals that have been artificially DEPRESSED because they were being produced at below the cost of production of legitimate operations by illegal or messy Chinese operations that ignored environment.

So maybe the move up in these metals is not so much a spike but just a revaluation to a true cost of production that includes environmental considerations. Is this a crazy way of looking at it? Thoughts?

The idea is certainly great. Here is by the way the link:

Click to access P020161207645765233498.pdf

I will think about it. The problem is of course to identify candidates, where the price is depressed and there are no other developments that would lower prices as well.

And another caveat: Keep recycling in mind! If you think of REEs, they WILL be recycled. Your thesis obviously remains intact, but this should definetly be considered.

What do you think of Uranium? I see potential, because there seems to be not enough production to support the growing demand from the growing number of nuclear plants from China but also other countries.

I think the idea that a bunch of metals were artificially depressed by Chinese production below cost is probably right. I think the problem stemmed from the steel industry. However I think there is also a risk that metals prices have over corrected in the other reduction on steel capacity reductions.

Take a look at two recent Economist articles about this:

https://www.economist.com/news/leaders/21728640-investors-have-been-cheered-sweeping-cutbacks-they-should-look-more-closely-making-sense

https://www.economist.com/news/finance-and-economics/21728623-one-biggest-and-more-controversial-trends-global-economy-capacity

I know not all metals correlate with steel all the time, but I think the steel overcapacity was a big reason metals crashed in 2011, and I think the broad correlation is still a big reason the metals bottomed in 2016. If steel prices are at risk because of, say, the overheated Chinese property market or unsustainable Chinese infrastructure development, it might be bearish for metals as a group. I’m bullish on metal prices too, but I’m curious for your thoughts on a bearish argument.

I have done a lot of digging on Uranium recently. Rick Rule is unabashedly bullish, and estimated cost of production at about $40/lb, while prices are about $20/lb. Japan restarted 5 reactors and will supposedly restart 14 more next year, China is supposed to build a lot, and the U.S. still derives 19% of electricity reform nuclear. Kazakhstan, the largest producer, cut 4% of world production, and Cameco, the second largest, is also cutting capacity.

BUT, all the reactor operators, like AREVA and Exelon, appear to be running nuclear division at an operating loss, even with rock bottom uranium prices. Most of the new reactors scheduled for the developed world are running into delays, and the largest builder, Westinghouse, is bankrupt, which will probably mean even more delays. Japanese are still protesting the restart of their reactors, and there are probably going to be delays in the restart there as well. And old nuclear reactors in the U.S are being decommissioned steadily. Finally, the Olympic Dam, in Australia, is the largest Uranium resource in the world, and it’s also very rich in Copper, which is soaring in price right now. If BHP expands production at Olympic Dam, it could sell off Uranium at less than production costs.

Ultimately, I couldn’t bite on Uranium yet. I think some of the smaller N.A. uranium plays look interesting though, like UEC, especially if the US administration gets paranoid about buying uranium from Kazakhstan and other ex USSR states.

Sorry I didn’t mean to hijack the conversation, I’ve been thinking a lot about this and curious for you guys’ thoughts.

Your thoughts are very insightful. You have certainly more knowledge about the uranium details.

However I can assure you that our German nuclear plants are CASH MASCHINES and that despite being the safest in the world. (Of course our government in panic mode after Fukushima decided to shut them down) I think the real costs are however in the (final) storage, I would imagine increasing uranium prices would not hurt the operators.

What do you think by the way of Nexgen Energy, developing the larges uranium mine in the world?

Concerning steel: I would never rely on correlation, it can change over time. Except maybe you are a quant, build a model and utilize a huge basket of assets. I think nobody can reliably say, what steel will do. I think simple steel will go nowhere, it is too cheap to produce and production can easily be ramped up. The straategy of basically every steel maker not in China is to specialise in highly sophisticated steels. There’s the money.

With regards to uranium I suggest waiting until the Japanese election on 22. October is over. The opposition wants to phase out nuclear power until 2030 which would be a major blow for a recovery.

Interesting video from Sven Carlin:

HOW TO INVEST IN THE ELECTRIC VEHICLE TREND – COBALT, LITHIUM, TESLA $ MORE

curious what you think largo resources will earn 2 years out at current prices? Looking forward to next post on this.

We will just have to see how REE prices go. I’m hoping it can double but we will see.

Srry I meant Lynas corporation.

Also have you looked at Alkane resources?