A Game Changing Disposition for Altura

I mentioned Altura last week in a comparison table I made to Zargon and Gear Energy. As I noted in the comments, I had a position in the stock in another portfolio (my RRSP and my wife’s account) but not in the portfolio I track online so I haven’t talked about the stock outside of that reference.

Well that changed today. I added to the stock in all my portfolios even though I was getting it up 20% on the day.

I want to give a big hat tip to @BrownMarubozu for bringing my attention to Altura a month or so ago.

Altura announced first quarter results after the market closed last night. The results were fine, maybe a little weaker then expected actually, but the real news was the announcement of the sales of their Eye Hill, Macklin, Wildmere, Killam and Provost Minor assets.

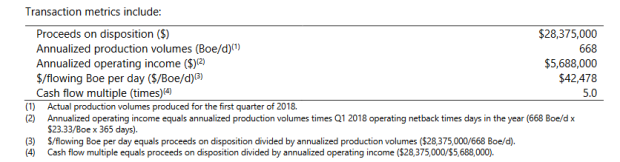

Altura sold the assets to Surge Energy (here’s their press release on the transaction. The transaction metrics the company provided are below:

The sale of these assets leaves Altura with about $20 million of cash and no debt. With the rest of their properties sold off, they are a pure play on their remaining asset: Leduc-Woodbend.

Leduc-Woodbend

They are going after the Upper Mannville formation at Leduc-Woodbend, which is about 1,300 meters deep. They have amassed 65 sections (41,000 acres) in the area, with 40,000 of those acres considered undeveloped. The formation produces 17° API heavy oil.

The Leduc oilfield has been around forever and is a well drilled out area using conventional vertical wells. Given that its not a new area (Altura themselves says there are over 700 vertical wells in the area) I’m not sure if Altura discovered something new here or whether this was a previously uneconomic pool for vertical wells that is now being unlocked by better technology. At any rate Altura described the pool as “one of the largest conventional oil pools identified in the Western Canadian Sedimentary Basin within the last 20 years” in their initial press release on the prospect.

This is early in the game in Leduc-Woodbend. They have only drilled 5 wells in the property so far. But these wells look quite good.

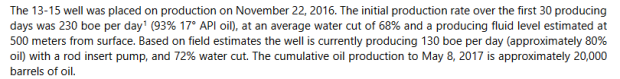

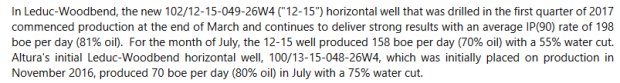

They started drilling into the Mannville formation in early 2016. The first well, the 13-15 (see the map below), produced 230 boe/d over the first 30 days and was producing 160 boe/d after 5 and a half months. It was producing 70 boe/d in July, after 8 months of production (from this news release).

The 13-15 was a one-mile horizontal and cost $1.7 million to drill and complete.

Their second well, the 12-15, was another one mile lateral drilled at the beginning of 2017 and place on production in April 2017. This well was a full 6 sections north of the initial discovery well but production was inline with the 13-15 (this press release).

You can get an idea of how far apart these wells are in the map below (the 13-15 is the well furthest to the south while the 12-15 is the northern most well).

In their November presentation Altura detailed a reasonably steady decline profile from both wells (they are both one mile laterals):

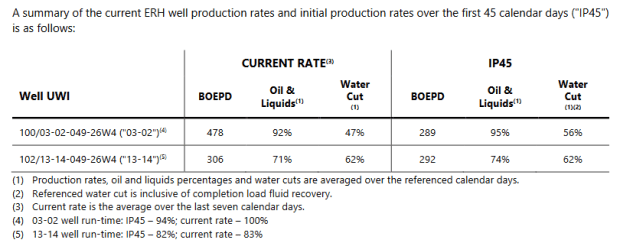

Since the beginning of the third quarter Altura has followed up with 3 more longer wells, 1.5 mile extended reach horizontals (ERH). The first two (03-02 and 13-14) were placed on production in October (from this press release).

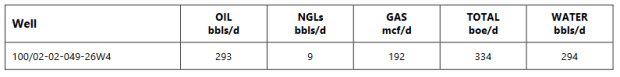

The third ERH well (02-02) was drilled in January and placed on production in February. This well averaged 334 boe/d in the first 26 days of production (from this press release).

In the May 15th release the company said the well had produced 10,626 bbl of oil in the first 45 days, which equates to a 236 bbl/d average before being shut in for a month to replace a broken rod.

The company went on to say that they expected 150-175 boe/d over the first 12 months for all 3 of the ERH wells.

My takeaway from all this well data is that the results are consistent. We only have 5 data points but so far the repeatability looks excellent. Its particularly exciting that the original discovery well is so far away from the others and yet has yielded comparable results.

I was cautiously optimistic about Leduc before the quarterly release but the numbers presented have added to my confidence.

Guidance

The company obviously has confidence. In addition to focusing entirely on Leduc they raised guidance significantly even after divesting over half their production.

Right now Altura is producing around 550 boe/d from Leduc, 80% oil. They expect to exit the year at 1,900 boe/d.

To do this they are increasing their capital budget from $15 million to $33 million and expanding to an 8 well program. So the cash they are getting on this transaction will be put to use drilling out Leduc.

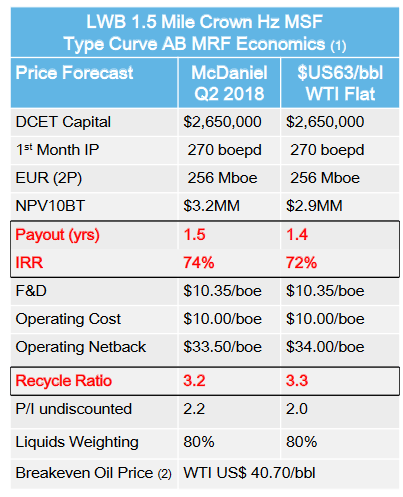

Based on their presentation it looks like the wells cost $2.65 to drill, complete and tie-in. They also spent $7.3 million already in the first quarter. That means the company is spending roughly $7 million on infrastructure at Leduc.

The infrastructure money is going towards a larger oil battery. They are increasing the size of their oil battery to 3,000 – 3,500 bbl/d. So that gives you an idea of where they are expecting to take the property to.

They seem undervalued to me

When I forecast ahead at what Altura looks like at year end using the company’s guidance, it looks cheap to me on most metrics.

Here are my estimates of cash flow and EV/CF using their guidance. I am assuming they use all the cash to complete the drill program which should be conservative. I looked at two scenarios: A WCS price consistent with the first quarter (so a low price) and the current WCS price (a high price).

Apart from the valuation, what’s interesting is that at roughly $70/bbl WCS, Altura can cash flow $30 million based on their exit volumes. So they should be able to fund a similar sized capital program in 2019 (actually a bit higher because they wouldn’t be building an oil battery) without adding at all to debt. If they get similar production growth from that budget (based on exit guidance growth in 2018 is 1,250 boe/d), they’d grow over 60% and be producing over 3,000 boe/d by the end of 2019.

Considering that sort of growth runway, the company seems extremely cheap to me. The risk of course is whether the oil price holds up and whether they can meet their target.

It’s still early days so we’ll have to see. The economics that they present for these wells is impressive.

The wells have IRRs of close to 75%, which is pretty good. But it looks even better when you notice the price forecast these are based on:

They are essentially using $55 WCS prices for 2018, followed by $61 for 2019 forward. At last look WCS stood at $74/bbl.

Conclusion

One question that might be asked is why the stock didn’t move even more? One answer is that I’m totally missing something. Maybe, but I don’t think so. Another is that the market isn’t going to de-risk Leduc until they drill more wells. That definitely accounts for some of it.

A third reason has to do with liquidity. I know that one of the reasons I didn’t buy more Altura before today was because it was so hard to buy. The share volumes were anemic and it seemed like my bids would sit for days some times before getting bought up. The Level 2 liquidity was usually equally sparse and it seemed like I would quickly move the price up to 44c or higher if I bought too much.

With that in mind I wonder how many sellers today are just liquidity sellers. This is a liquidity event, lots of volume, so it’s a chance to unload shares. If you have a very big position, you probably want to take some off.

Whatever the reason I took advantage of the volume and bought a decent position. I’m looking forward to the next operations update.

Wouldn’t they grow production more in 2019? 33m gets them +1300 boe in this location. Production rises 675 boe but that is vs pre sale.

Or are you just being conservative?

Sorry yeah you are right, I made a mistake there. I’ll correct it.

No problem! Consise summary of the points that matter. Good job!

Thanks for bringing my attention to latest developments, added some as well.

From what I can see the oil bulls have pretty good arguments why oil will likely go higher, and a lot of the oil bears have kind of hand wavy arguments why oil prices will crash back again. I guess time will tell who is right.

Have you looked at other commodities? The prospects for Fortress paper and CVR partners end products look pretty good as well a year or two out. The Iran deal failing might take a significant chunk of fertilizer supply out of the market. With little recovery priced in as well. And dry bulk shipping has pretty decent prospects as well in the medium term based on the latest stats:

https://www.hellenicshippingnews.com/orderbook-offering-an-echo-of-the-distant-past/

Sure. Now you know why I sounded annoyed when you asked why don’t I like Altura! 🙂 I thought it was a good idea, though I have to say before this transaction I was thinking of Leduc as just one of a bunch of properties and hadn’t really considered it the game changer.

Also thanks for the heads-up on Fortress, I’ll take a look. I did take positions in a few copper stocks as well as added to ASND and of course I own some gold, vanadium and neodymium. And I have been adding to oils. So I have a lot of commodities.

Just curious, what copper stocks you own? Looking to add more myself there as well.

There is a good report that BMO put out on copper if you want me to send it you. Just shoot me your email address.

just out of curiosity, do you still think ASND is still worth adding to given that zinc is at 1.40 and their 2018 earnings are based off a 1.50 zinc price assumption? could be totally wrong there myself.

i think if you adjust down their ebitda and fcf to reflect this fact, it may not look so cheap anymore…

Can you tell me the numbers you are seeing? Thanks!

just out of curiosity, do you still think ASND is still worth adding to given that zinc is at 1.40 and their 2018 earnings are based off a 1.50 zinc price assumption? could be totally wrong there myself.

i think if you adjust down their ebitda and fcf to reflect this fact, it may not look so cheap anymore…

Sorry, I double posted under bf. But in their latest investor presentation (slide 5) they assume a 1.50$ zinc price per lb for their 2018 guidance numbers. It probably got around 1.55 per pound for Q1 which made Q1 results look pretty good, but reasonably they are getting 1.4 per pound during Q2. This might bring down their forward ev/ebitda multiple a bit but still pretty cheap. Would love to get your thoughts on this if any.

Click to access Ascendant-Corporate-Presentation-May-2018.pdf

You still like cathedral? Seems like the market is selling it off over some small short term issues.

Do you mean the margins and equipment issues? Or is there something else I don’t know about? I’ve added here today. I think its about half of book value here. You’d think someone would be interested in the equipment if nothing else.