Copper stars not quite aligned

Sometimes all the stars align for a trade. And sometimes there is one star that is way off in its own orbit, throwing off the whole picture.

That’s what I’m thinking about copper right now.

There is a lot I really like about this idea:

- The demand picture is premised on what seems like the inevitable adoption of electric vehicles and increasing electrical infrastructure

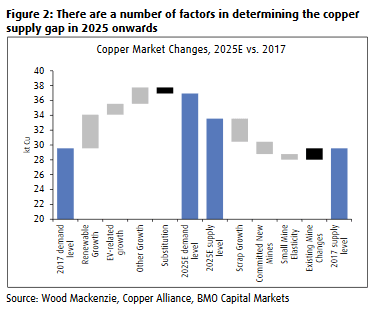

- The supply picture paints a scene of depleted reserves and an empty pipeline that will lead to significant deficits for years to come

- The prices of copper equities are reasonable, if not downright cheap, and certainly not pricing in the upside of a rising copper price

It all fits. Except for one thing. These damn tariffs.

In my opinion there are reasonable odds that what is to come is more brinkmanship, more anti-ups, and maybe even some sort of climatic event ala Nixon in 1971 that changes the way the world operates for good.

Of course maybe not. The market is certainly saying its all good. But the market also rose right after Nixon put a 10% surcharge on imports and pulled the rug out from under Bretton Woods.

The 70s didn’t really go all that well.

I don’t know what is going to happen. But it’s uncharted territory and it wouldn’t surprise me if the market is as clueless as I am.

Consider the following:

- We have a President that was elected, in part, by folks who lost their jobs or had their communities disrupted by the relocation of industries that were allowed to leave because of free trade (yes its complicated and there were other causes, but free trade was definitely part of it).

- The President has made it clear he will do whatever it takes to make good on his promise to fight for these people and communities and get those jobs back (whether or not what he is doing is actually going to be in their best interests is not clear but also not really relevant to the line of reasoning here)

- It’s not really clear if anything can be done to turn back the clock on these cities, counties and communities that have had the industries they were built on stripped from them, so perhaps regardless of what the President does, the outcome will disappoint

Those 3 points suggest that it is at least possible that we spiral into a vicious circle of escalating actions that don’t have the intended effect and therefore lead to even more escalation.

I’m just not sure I want to own a lot of copper in that environment.

With that all said, the picture for copper supply and demand assuming a “steady as she goes” economy is pretty enticing.

BMO put together a long and very interesting research piece describing the supply and demand dynamics of copper over the next number of years.

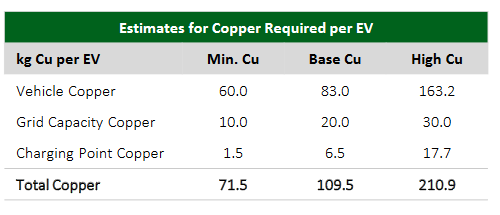

The demand side is being driven by electric vehicle demand and the grid infrastructure required to move to a higher amount of renewables.

The simplest explanation of why this will increase the demand for copper is this: An internal combustion engine contains 23kg of copper for wiring, whereas a battery electric vehicle and plug-in hybrid contain between 60-83kg of copper. On top of that another 20kg of copper is needed for grid capacity and 6.5kg for the charging point.

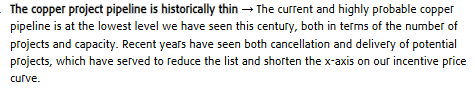

On the supply side, a combination of declining grade, rising capital costs and a number of years of depressed copper prices have left us with a depleted pipeline of projects.

The conclusion, which is hard to find fault with, is that there is a significant shortage of copper projects in the development pipeline and projects will only be added if the price of copper rises enough to incentivize them.

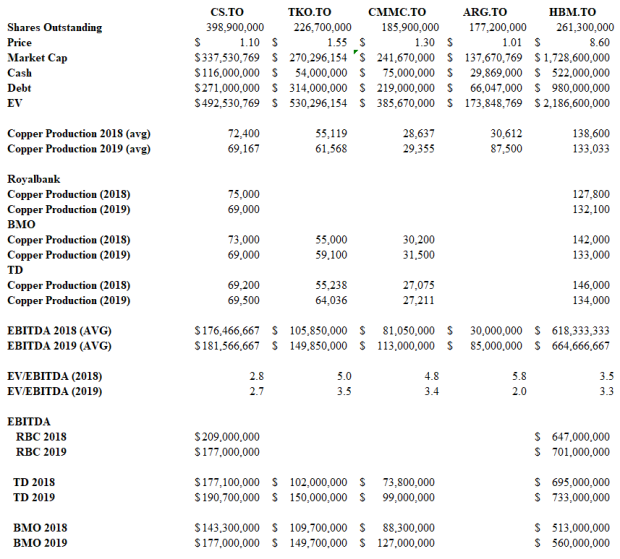

So how do you play this? Well maybe you don’t because there is just so much risk in the world. I’m still trying to figure that out. But if you do, I certianly think the copper stocks are reasonably priced for it. Below is a comparison of a few that I have dug into where I just took analyst EBITDA estimates and averaged them to get a rough idea of the EV/EBITDA multiple these companies trade at (note that because Amerigo isn’t followed by any brokerages I have reports for I used the companies own estimates that I found in their presentations).

At the moment I have taken positions in a couple: Copper Mountain and Capstone. But these positions are really, really small (<<1% each).

For now they are going to stay that way. I’m just too uneasy about where all this trade stuff is going.

Love this blog and commenting for the first time. But this analysis of copper is pretty thin — you’re missing the most important industry for copper: Chinese residential real estate. More than half of copper use is directly linked to building construction and infrastructure. Rest is almost irrelevant. Chinese RE market is a state of madness — hard to get long copper with that backdrop.

Thanks. As you might have gathered from the brevity my post (and that about half of it was talking about trade) the intent was not really to analyze the copper market. I would recommend you check out the report from BMO or another earlier this year from RBC, those are the two I’ve read through, as well as some work from the ICSG, if you want a thorough analysis. Both BMO and RBC addressed construction in China, as well as other factors like rising Indian demand that I also didn’t bother to mention here. The intent of this post, like all posts in this blog, is to succinctly explain my own personal investment decisions and so I only include elements that are key influencers of those decisions.

You got a link to that BMO report?

I dont know of one. But if you send me an email I can get you a copy.

I think it’s also important to keep in mind that the copper market is huge. So even with a supply deficit the price will never explode.

Uranium or cobalt are small markets so they can easily double and then still be reasonably priced for their respective usages.

You won’t see that with copper, also evident in the rather soft price escalation predicted by BMO.

Thats true. Though I suspect BMO is being quite conservative thinking that all we will see is $3.50 copper if the scenario they describe plays out. Commodities always surprise me by how far they overshoot. If we don’t see some disruption in the economy and this supply/demand scenario plays out I would bet we see way higher prices, maybe $5+

I agree. But bet on it? I think cheap names with prudent management and good economics will do well, very well. But I wouldn’t expect a huge headwind just from the commodity price. Just look at the gold stocks…gold is slightly up, stocks didn’t care.

Maybe I am wrong and once sentiment changes we will see some good development.

*tailwind

Another way to play it would be value added producers of copper products like wires. They often use cost plus method, so fixed gross margin %. On top of fixed expenses.

Yup good point. What are the companies that fit that?