Research: Cardlytics

I was going to put this out on Friday and then I got bogged down with some other names and didn’t. It is too bad because I have a good take on it that it would seem much more clever if I had said it on Friday (before the vaccine news).

Nevertheless, what I was going to say then, and will still say, is that Cardlytics seems like a very good post-COVID/growth story to me.

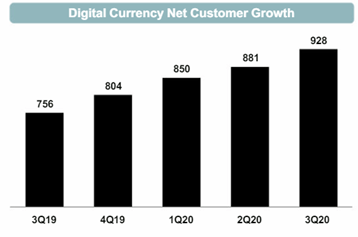

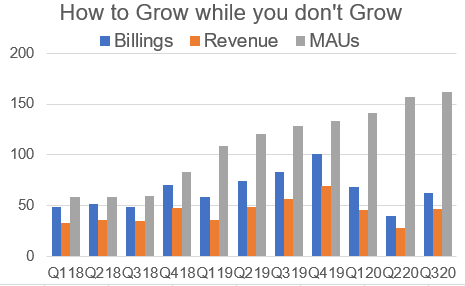

The take is this. I think you can sum up the entire CDLX post-COVID bull thesis in this chart:

Cardlytics is continuing to grow its customer base as they expand their coupon/advertising platform with more bank customers. But their revenue is a mess because of COVID.

(for some reason Cardlytics almost never refers to what they do as offering coupons but it seems like that is basically what this is. Cardlytics offers coupons to bank clients that their customers can access through their mobile and online banking sites and when they do, Cardlytics takes a small fee).

I’m just thinking that when this all ends that revenue number is going to catch up to the MAUs. Probably pretty quickly I would think.

- $2.5 billion market cap

- net cash of about $100mm

What they do

- operate advertising platform within financial institutions digital channels

- they partner with the banks and get info about purchases and digital banking customers

- they have access to 1 in 2 credit card and debit card transactions in the US

- then they use this data to better target advertising to a whole bunch of merchants:

national and regional restaurant and retail chains, large providers of cable satellite television and wireless services, and increasingly, travel and hospitality, grocery, e-commerce and luxury brands

- their financial partners include:

Bank of America, National Association (“Bank of America”), JPMorgan Chase Bank, National Association (“Chase”) and Wells Fargo Bank, National Association (“Wells Fargo”) in the U.S. and Lloyds Bank plc (“Lloyds”) and Santander UK plc (“Santander”) in the U.K

- they have MAUs of 122.6mm – who are the users though?

- they make a very small amount per user – $1.72 in 2019 – and this is down quite a bit from $2.30 in 2018

Competitors

- they are the only company that enables marketing through FT

- from ML conference in June:

The challenge you have is, first of all, we’re new. No one’s ever seen anything like us. There is no real competitive set. So you can’t say, oh, we’re just like X. And when advertisers want to spend with us, the money has to come from somewhere else. And so it is a slow process to get advertisers to understand the power of our platform and to use it and then to adopt it in a really big material way. But what’s really accelerated that process is scale. The thing is, before we launched Chase and Wells, we only had about 50 million monthly active users, and that made us a very small digital platform compared to the others that are out there.

The competition there is, like the Amex example below, is not targeted:

ML: obviously, there’s no direct competition for your inventory because you’re the only one who allowed that inventory. But there are analogs. You do have Amex offers out there. And if I look on my Amex offers right now, I happen to be a BofA customer and an Amex customer, on my Amex offers right now, I have a 100 ad units available.

CDLX: remember, all of our offers are targeted. So if you’re not using your card in the category, you’re not going to get the offer. Amex offers and I believe my knowledge should be accurate, but I don’t want to represent Amex in any way, but Amex offers are not targeted. Everybody gets the same set of offers. And so as a result of not being targeted, they also don’t generally have material revenue, if any revenue, associated with those offers. So the Amex model is very different from the Cardlytics model.

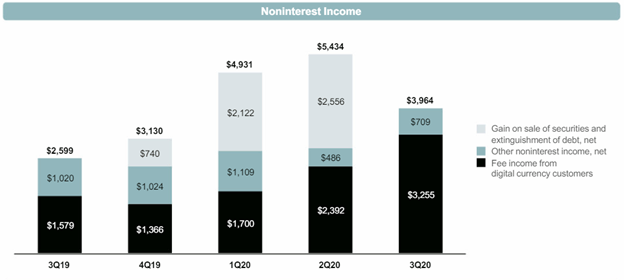

Revenue

- comes from the marketers

- they collect a small fee each time a transaction is made using one of their coupons

- their revenue is gross the share that the FI takes – so that is why gross margins are low-ish – in 45% range

Q320 Results

- billings down 25% yoy, revenue down 18% yoy

- prior to Q3 they had every Hotel exit the channel, signed up for a “recovery campaign” in Q3

- also in recovery campaign with one airline partner

- Wells Fargo continues onboarding – contributing to MAU growth of 26% yoy – also saw growth from existing partners

- planning to launch with US Bank soon – first half of 2021

- for Q420 expecting billing of $79mm to $89mm and revenue of $55mm to $62mm – this would be down 10-20% yoy

- they have developed a self-service tool for agencies – have two test agencies on it, are expanding customers from those agencies in Q420

- they did a $230mm convertible at 1%