Sorry about the title. That was a terrible rhyme.

I didn’t set off with the intent of writing a long post on Aurizon Mines this morning. I have other research projects to spend my time on that hold more near term potential. In particular, I have regional banks to evaluate, mortgage lenders to learn about, and mortgage lending podcasts to listen to and transcribe.

Nevertheless I must have a masochistic side because I am always more fascinated by the times I am wrong and the things that I don’t understand than with what is working and making sense. And nothing has been wrong or made as little sense to me as the downward spiral of Aurizon Mines.

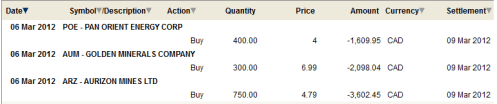

Over the past 6 months I have (somewhat unintentionally) been swing trading Aurizon Mines. I hold a core position but around that position I buy more at or just under $5 and I sell what I buy at around $5.75 or $6. It worked well a couple of times last year, however this year not so much. The stock stalled out a few weeks ago at $5.50, it didn’t stay there long, and I ended up jumping out of some of my non-core position in the $5.30 range. After that I sat as a bagholder with the rest, watching the stock tumble below $5.

In the last couple weeks I have been in and out some more, buying at $4.80, getting out at $4.9 before buying back on Thursday at $4.50. The frequency of my indecision is telling. I clearly don’t know what to think about the stock.

To be honest, I didn’t think Aurizon would get this low. The company holds $1.31 in cash and would be considered to be one of the lower cost gold producers. It has consistently met targets. Its not a management disaster like so many gold miners. These are solid operators.

The Alamos Gold Comparison

I did a comparison a few months ago between Alamos Gold and Aurizon Mines to demonstrate the disconnect. I think it is instructive to dig up and refresh that analysis now that the Q4 numbers are out:

Instead of focusing on the valuation discrepancy and how the market has it wrong, I want to focus instead on why the market is willing to value Alamos at 2x to 3x the value they are willing to assign to Aurizon.

I think its all about growth and costs.

In the Alamos Q4 report, the company forecast that they would increase production from 153,000 ounces to over 200,000 ounces in 2012. They also predicted that costs would come in about the same as they did in 2011.

In 2012, the Mulatos Mine is forecast to produce its one millionth ounce of gold. Ongoing exploration success has resulted in a track record of mined reserves being replaced. In 2012, the Company expects production to increase to between 200,000 and 220,000 ounces at a cash operating cost of $365 to $390 per ounce of gold sold ($450 to $475 per ounce of gold sold inclusive of the 5% royalty, assuming a $1,700 gold price). The Company expects that gold produced from the gravity mill, which will process high-grade ore from Escondida, will add a minimum of 67,000 ounces of production in 2012 at a grade of 13.4 g/t Au. Based on bulk sample testing conducted in 2007, the Company believes that there is the potential for higher production from the gravity mill as a result of realizing positive grade reconciliation to the reserve grade.

The high-grade gravity mill has been constructed and is currently undergoing commissioning and is expected to be operational with high-grade production by the end of the first quarter of 2012. The current life of the Escondida zone is approximately three years and exploration efforts in Mexico in 2012 will continue to focus on sourcing additional high-grade mill feed. Metallurgical testing completed in 2011 on higher grade ore from San Carlos demonstrated that it is amenable to gravity processing, potentially doubling the amount of available mill feed. Further optimization and metallurgical studies are underway in order to increase the amount of high grade ore that can be processed through the gravity plant.

On the other hand a look at Aurizon’s Q4 report shows the following outlook:

It is estimated that Casa Berardi will produce approximately 155,000 – 160,000 ounces of gold in 2012 at an average grade of 7.5 grams of gold per tonne. Average daily ore throughput is estimated at 2,000 tonnes per day, similar to 2011. Mine sequencing in 2012 will result in ore grades that are expected to be approximately 6% lower than those achieved in 2011. Approximately 42% of production will come from Zone 113, 41% from the Lower Inter Zone, and the residual 17% from smaller zones and development material.

Assuming a Canadian/U.S. dollar exchange rate at parity, total cash costs per ounce for the year are anticipated to approximate US$600 per ounce in 2012. Onsite mining, milling and administration costs are expected to average $134 per tonne, up approximately 6% from 2011 costs as a result of higher stope preparation costs and smaller stopes.

Flat production. Higher costs.

$600 costs are not high by most gold mining standards. With those sort of costs Aurizon would still sit in the top quartile of low cost producers. I think that in this case Aurizon is guilty by association. There have been SO MANY gold miners that have began to predict higher costs only to see those costs spiral much higher than was originally anticipated. The market is on guard.

The Sinking Growth Ship

As for the growth, the problem is that the company’s flagship growth project is not inspiring confidence. I stepped through the news timeline at Joanna in a previous post. Since Aurizon has made it a habit of updating the street with quarterly reminders of just how shitty the Joanna PEA is going to be, let’s do the same thing here. Below is the time line of events:

May 12th 2008

Aurizon first commissioned a pre-feasibility study on Joanna.

November 11, 2009

Aurizon finally received that pre-feasibility study and proceed to a full feasibility study.

September 14th 2010

Aurizon notifies shareholders that the original recovery process assumed (called the Albion process) would show lower recoveries and higher costs than first anticipated. Additional metallurgical test work would be done and the study delayed until mid 2011.

August 11, 2011

Aurizon delays the feasibility study for Joanna again, saying: “the projected capital and operating costs appear to be significantly higher than previously anticipated. The increased scope of the project, as a result of the expanded mineral resource base, has increased capital costs, including those associated with an autoclave process. The costs of ore and waste stockpiles, tailings and of materials and equipment have also all been trending higher, along with the gold price.”

January 11, 2012

Another update giving an ETA: Feasibility study work on the Hosco deposit will continue in 2012 with completion of the study anticipated by mid-year. The feasibility study will incorporate a reserve update based on the increased mineral resource estimate announced on June 13, 2011, together with results of metallurgical pilot tests, a geotechnical study, updated capital and operating cost estimates, and other relevant studies.

As I wrote at the time:

Its been almost 4 years since the original pre-feasibility study on Joanna was complete! At this rate they should be mining by 2100.

The time line can now be updated with the latest installment from the Q4 report and the following comment:

While some studies are still in progress, based on its review of information currently available the Company believes that the feasibility study is sufficiently advanced to conclude that the projected capital and unit operating costs will be significantly higher than estimated in the December 2009 Pre-Feasibility Study, due in part to the change in the scope of the project, the expanded mineral resource base, the selection of an autoclave process and a decision to process the ore on site.

I think this is about the 3rd time the company has warned investors not to get their hopes up about Joanna. Keep in mind that the original numbers for Joanna weren’t exactly thrifty (if I rememver right they were $200M + capital and $700 costs).

If I was going to translate this news-release-speak into plain english it would sound something like this:

It is surprising even us with how shitty this project is turning out to be

But that’s just my interpretation. I could be wrong.

Takeover talk!

I have found 3 articles (here, here, and here) discussing a post-earnings release interview (or maybe it was on the conference call, I haven’t had a chance to listen yet) done by George Paspalas, the company’s CEO, where he said that the company has been approached by potential suitors and that the company is also looking for companyies they could takeover.

With respect to the potential for an acquisition, Paspalas said the following:

To receive the company’s interest, a target would have to be producing around 120 000 oz/y, and at similar profit margins to Aurizon’s flagship Casa Berardi mine in Quebec. “We’ve looked hard, I can tell you that,” Paspalas said, speaking in a telephone interview from the firm’s Vancouver headquarters. “There are a lot of companies out there…that are at a point where they have a pretty good project, but they don’t have any cash – and the shareholders are saying ‘enough’s enough’ in terms of dilution,” commented Paspalas. “We have five or six opportunities in our grade one category,” he said, adding that one of these could close in the near-term if there weren’t any pitfalls in the technical due diligence or price negotiations process.

He went on to say that they are shifting their focus from looking at acquiring a producing mine to instead acquiring a near-term project.

The one report also said that Aurizon “has itself received informal approaches regarding potential mergers.”

Cautiously Optimistic

I think this is quite good news. The problem with Aurizon, as I have tried to lay out above, is that the market wants growth and the market isn’t buying Joanna as the vehicle for that growth. It’s too bad they will have to pay up a good chunk of their cash hoard to acquire a project but the argument could easily be made that the cash is being ignored by the market right now anyways. If you remember Argonaut Gold, their adventure to double digit share prices began when the company took over Pediment Gold and with that acquisition bought themselves a stable of near term production projects. A similar acquisition by Aurizon would be a positive. It would allow the brokerages to start prjecting realistic growth into the future, and from those higher production numbers they can begin to tag a higher multiple onto the stock. Then everyone gets excited about the prospects and we all jump on the bandwagon and a couple of fund managers get on BNN and hype the stock and pretty soon you have Argonaut Gold all over again, going from $3 to $10 in a little over a year.

Its a plausible scenario. If the takeover happens and it looks like its the right takeeover, I will no longer swing trade the stock and instead will begin to hold it for the longer term. But without the takeover I am just not willing to put too many of my eggs in the Joanna feasibility basket, which is sounding more and more to me like it has a big hole in it.