Week 372: Stealth Correction (also updates on Mission Ready, Blue Ridge and Empire Industries)

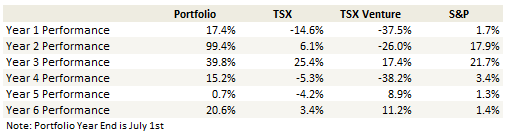

Portfolio Performance

Thoughts and Review

First off, the portfolio updates in this post are as of August 24th. I’m a little slow getting this out. So the numbers don’t include what has happened in this last week.

I really got it handed to me in August. The portfolio was cruising to new highs in July but those were short lived. Top to bottom I saw a 6% pullback in a little over a month before finally bouncing a couple weeks ago. Fortunately that bounce has continued this last week so things aren’t as dire any more.

What was funny about the move is that it didn’t feel like things were going that badly. Usually when I lose 5-6% in a month (this seems to be an annual occurrence for me) I’m tearing my hair out, contemplating throwing the towel in, and generally in a state of disrepair.

Not so this time. I have been surprisingly unconcerned by the move.

Why have I taken it in stride this time? Here are a few reasons I can think of.

1. I lost on stocks that I still have conviction in. Take for example Gran Colombia Gold (which is one of my larger positions). I’m just not that worried about the move, as painful as it has been. I’m still up on my position, and it remains cheap with no operating concerns. I don’t feel like it warrants my worry. RumbleOn was another (another large position), touching back into the $5’s at various points over that time. We know what transpired there this last week.

2. I was getting beat up almost entirely by my Canadian stock positions. Its probably irrational but I don’t worry as much when its my Canadian stocks that are going down.

3. Earnings for most of my positions were pretty good, even if those results weren’t reflected in the stock price. Vicor was great. Gran Colombia was stellar. RumbleOn was fine. R1 RCM was another stand-out, as was Air Canada. No complaints.

Anyways it is what it is. Things have gone better this week. In the rest of the post I want to talk about 3 stocks in particular and these have turned into rather long excursions. So I’ll leave any further portfolio comments for another time.

Mission Ready Solutions

Mission Ready has been halted since July 18th. Nine times out of ten if a stock is on a 6 week halt it wouldn’t be a good thing. Yet I’m pretty sanguine about the company’s prospects. The news so far has been pretty good.

The big news happened on July 31st, when Mission Ready signed an LOI to acquire Unifire Inc. They followed this up with an update on the foreign military agreement on August 2nd. Then there was another news release August 7th that gave more detail on the foreign military agreement and more detail about the acquisition. Finally they followed all of this up with a conference call to investors on August 15th.

Having spent some time reviewing Unifire and the deal, I am of the mind that it is a good one. I am also cautiously optimistic that it will close. On the conference call the CEO of Unifire was in attendance and spoke at it. While that doesn’t mean it’s a done deal, his attendance and all the detail provided by Mission Ready points to it being well along.

Here’s the deal. Mission Ready acquires Unifire for $9 million USD. The purchase price is comprised of $4 million in cash and 26 million shares (priced at 25c CAD. They are also taking on at least $6 million of debt (I say at least because Mission Ready didn’t specifically say what Unifire’s total debt was, only that they would be paying back $6 million USD of debt upon close). With 129 million shares outstanding at $0.25c, $15 million works out to about 50% of the Mission Ready enterprise value.

Unifire is bringing a lot to the table.

As per the first press release Unifire’s “trailing revenue for the 6-month period ending June 30, 2018 was approximately USD$18.3 million”. Their net income was $750,000 USD. That’s a lot more than what Mission Ready has (as per the second quarter financials, Mission Ready is running at about $1 million of revenue a quarter).

More importantly, in the second press release (the one where they expanded on the details) Mission Ready pointed out that Unifire was the following:

- A Department of Defense Prime Vendor.

- A contract holder for the Defense Logistics Agency (“DLA”) Special Operational Equipment (“SOE”) Tailored Logistic Support (“TLS”) and Fire & Emergency Services Equipment (“FESE”) programs.

- held “multiple General Services Administration (“GSA”) schedules, blanket purchase agreements and contracts with organizations such as the Department of Homeland Security, the U.S. Army Corps of Engineers, West Point United States Military Academy, Idaho National Laboratories, Hanford Nuclear Facilities, United States Air Force, United States Marines, United States National Guard, United States Navy, and many others”

I dug into this a little bit further. Turns out that Unifire is actually 1 of only 6 participating vendors from the DLA Troop Support program (from this original Customer Guidelines document issued by the TLS). Here’s a short list of the types of equipment offered by this program:

What does being a vendor of this program mean? It means that if, as a government organization, you want to order one of the 9,000 items covered by the Troop Support Program, you can (I don’t believe the program has mandatory participation but I’m not sure about that) do it through one of these 6 vendors via this program and get subsidized product.

So who would order through the program? According to ADS, “authorized Department of Defense, Federal Government and other approved Federally-funded agency customers”.

The overall amounts of product involved are significant. According to this article:

With both being small-business set-asides, and continuations of prior contracts, the first contract will be used to procure special operations equipment (SOE) worth $1 billion per year, and the second will allow for the purchase of a total $985 million in fire & emergency services equipment (F&ESE).

These are big numbers. So when Mission Ready stated the following in the August 7th news release with respect to Unifire’s justification for entering into the merger, they weren’t kidding:

Unifire has been limited in its ability to secure the initial capital required to facilitate many of the larger solicitations. Mission Ready has identified sources of capital that will enable Unifire to pursue TLS solicitation opportunities on a much larger scale than they have been able to at any point in their 30-year history, thereby creating immediate and significant growth potential.

Unifire has been getting maybe $30-$40 million a year in total revenue. But its sitting in the enviable position of being 1 of 6 companies participating in a $2 billion program. The lost opportunity is significant.

That said, Unifire is a significant vendor for the Department of Defense. Here is Unifire’s revenue from contracts over the past few years (from Govtribe.com). It seems to mesh up fairly well with Mission Ready’s stated revenue numbers for Unifire:

In fact Unifire appears to be the 15th biggest Construction and Equipment vendor with the DOD.

What Mission Ready is apparently bringing to the table is availability of capital. They are going to raise $15 million USD at 25c [note: it was just pointed out to me that the 25c number wasn’t communicated and there was no pricing specified for the PP. I could swear I read or heard that number somewhere but maybe I’m getting this mixed up with the Unifire shares. I’ll have to dig into this]. They are also going to enter into a credit facility of a minimum $20 million USD amount. The idea is that with the capital, Unifire will have a higher “solicitation readiness” and be able to bid on much more than the $2 million per month that they can right now.

Of course the other thing Mission Ready has is a suite of products that will fit nicely with what Unifire offers, and to which Unifire’s manufacturing capacity can be utilized. And they also have this massive $400 million LOI with a foreign military that we continue to wait on.

On that matter of the foreign military distribution agreement, it appears the wait will continue. In the August 2nd press release they explained what we already knew. They had expected to receive orders by now but that this hasn’t happened and while they expect to still receive orders this year, they really don’t know what to expect any more.

They had more comments on the August 7th news release, which was more upbeat, if not cryptic. With respect to the foreign military purchase order they said the following:

The Company is working diligently to finalize the Licensing Agreement in advance of the initial purchase order(s) (“Purchase Order” or “Purchase Orders”) and expect to complete the agreement for consideration by all parties no later than August 24, 2018.

You could read into it that they expect of some sort of purchase order soon that they need to get this new agreement in place for? Maybe? Bueller? But who really knows.

Here’s what I do know. I know that if the LOI for Unifire falls through and no PO comes from the foreign military then this thing is going to be a zero (or at least a “5 center, which is effectively the same thing).

But I also know that if the Unifire deal closes, if Mission Ready closes a $15 million financing and a credit facility of $20 million, if Unifire secures the $100 million of business in the next 18 months that is mentioned as a minimum requirement in the terms of the facility, and if the foreign military PO comes through, this stock is going to have a significantly higher capitalization then the current $25 million (CAD).

Honestly, when I review all the details above, I think the odds are on the latter scenario.

Blue Ridge Mountain

Oh Blue Ridge. This stock has turned out to be a bit of a disaster. I bought it at $9 and then at $7 thinking that it could be worth maybe $15 in a relatively short time as they sold the company at a premium. With the news this week that they are merging with Eclipse Resources that value is likely to be realized over a much longer time period.

I still like the stock and plan to hold my new shares of Eclipse. But I also recognize that this is a broken thesis.

I think what happened here is two-fold. First, part of the value in Blue Ridge was in their stake in Eureka midstream, which seemed like it could be valued at $200 million or more itself. In fact when the company announced the deal to divest their stake in Eureka (back last August), they said that the transaction was valued at between $238 million and $308 million (I’m not going to post the slide that breaks down that value because it has confidential written all over it for some reason).

Well presumably, given that the stock was trading at at $225 million enterprise value before the merger, the market didn’t agree. The problem was that much of the “value” in the Eureka sale was in the form of fee reductions and the removal of minimum volume commitments (which I don’t believe are going to bring any cash in, though I’m still not sure on this). So it was different than receiving tangible cash.

The second thing is something I missed originally. As I wrote about in my original article on Blue Ridge last year, they have a lot of acreage prospective for the Marcellus and Utica. What I didn’t understand well enough at the time was that much of the acreage in Southern Washington county and northern Pleasant county was outside of what is considered to be the “core” of these plays. While the step-outs Blue Ridge has had so far have actually been pretty good, there is a lot more work to be done before the acreage gets the sort of value that acres in Monroe, Wetzel or Marshall county get.

I kinda figured this out earlier this year, but by then the stock was in the $6’s, which seemed to more than reflect my new understanding, and honestly even if I wanted to sell it at that level I couldn’t have given the illiquidity.

Well now with the Eclipse merger there is liquidity. I think what you saw in the subsequent days was a lot of the bond funds that had picked up the stock in bankruptcy and who were now stuck with equity (which could very well be outside of their mandate) selling Eclipse in order to neutralize their Blue Ridge position and effectively get out of the stock.

That this seems to have waned on Friday, in particular given a pretty rough Stifel report on Eclipse, is likely a good sign.

My take is that the combined entity is not expensive. Here is a little table I put together of what the individual parts and the new Eclipse looks like (my $6.64 for Blue Ridge is based on the conversion of Eclipse at $1.50 per share):

If you look at the comps, the combined Eclipse doesn’t stack up too badly. 5x EBITDA for a company anticipated to grow 20% in 2019 is probably a little cheap compared to peers.

Peer comparisons are hard though because there aren’t a lot of smaller, all natural gas, players in the Marcellus/Utica. From what I can see its dominated by big companies like Range, Southwestern and EQT. These companies are 10x the size or more. They generally trade at higher multiples but that isn’t necessarily instructive. The smaller “peers” are more oil weighted and in other basins.

So what do I conclude? I’m going to stick with Blue Ridge/Eclipse because A. it’s not expensive, B. the Blue Ridge management team is leading the combined entity has done a good job operationally with Blue Ridge, C. There is a lot of undeveloped acres between the two companies and if they can prove up even a fraction of them the stock price should reflect that, and D. this is a nice way to play the upside option on natural gas.

But it didn’t turn out the way I expected.

Empire Industries

Empire announced second quarter results on August 27th. It was another “meh” quarter. But patiently I wait.

The reality is that Empire has been a perpetual “just wait till next quarter” story since last September when they announced the co-venture partnerships. They have an incredible backlog of business. Contract backlog as of June 30, 2018 was $280 million. The co-ventures have a tonne of promise. But neither the backlog or the co-ventures have translated into results yet.

They continue to struggle to turn the backlog into profits. In the second quarter gross margins reversed (again) to 16.7% from 19.6% in the first quarter. Remember that the magic number the company has said they should be able to achieve is 25%.

The problem has been the continued work through of three first generation rides that are being built at very little margin. In fact the company said on the conference call that these contracts contributed no margin in the second quarter. I had hoped that by the second quarter we would see the impact of these essentially unprofitable contracts abate. But that wasn’t the case.

I talked with investor relations about this and it appears that in the third quarter we should see less of an impact. But whether this means 22% margins or 18% margins is anyone’s guess.

Management also seem to recognize that their cost structure just isn’t low enough right now. Part of the problem appears to be that they operate much of their manufacturing out of Vancouver. They hinted that there are going to be changes in this regard in the next few months.

One of the key opportunities was how rapidly the growth — the market was growing, but with this growth came an increasingly apparent need to improve our cost competitiveness to capitalize on this growth. As a result, Empire has undertaken an aggressive action plan to reduce its cost structure, as described in detail on previous calls by Hao Wang, President and Chief Operating Officer of Dynamic Attractions, a wholly owned subsidiary and the primary business unit for Empire…The organization-wide cost-reduction initiative is well underway, reducing our headcount and fixed costs. Furthermore, we’ve identified and implemented design, procurement and production efficiencies that can improve our execution capabilities and our financial results.

They went on to say that “margin expansion is a top priority”. This is a good thing because it’s crazy to be letting this backlog pass without making any money from it.

The other piece is expansion. Again they touched on this (“we’re actively looking at innovative ways to increase our production capacity”) in the second quarter call. It’s clear that right now they are capacity constrained. For instance, the backlog has essentially doubled over the last year and a half and yet the quarterly revenue is pretty much the same. Its nice to have a backlog that extends out 3 years but it would be nicer if they could grow revenue a bit.

And then there is the co-ventures. Nothing to announce but still on-track to be announced this year.

Just to recap the co-ventures, last August Empire announced the creation of two co-venture attractions companies. The intent of these companies were to partner with “tourist-based locations” to co-own and operate Flying Theatre rides. One of the companies, called Dynamic Entertainment Group (DEGL), would partner with US locations, while the other, called Dynamic Technology Shanghai (DTHK), would partner in Asia (China most likely).

It was a complicated structure with a rights offering (at 50c) and a private placement to their Shanghai partner Excellence Raise Overseas (EROL) also at 50c.

In total Empire invested $12 million in the ventures. They own 62.5% of DEGL and (I think) 22% of DTHK. The ownership in DTHK is via DEGL, which is makes things complicated. The other 28% of DEGL and 78% of DTHK is owned by their partner EROL. EROL and Empire invested at the same valuation. Got that?

This somewhat ridiculously complicated ownership structure can be summed up with the following graphic (from the September 2017 presentation):

At the end of the day Empire gets to own 63% of a venture that will build and operate attractions in the United States and about 20% of a venture that will do the same in China. Empire also gets to build the attractions that these ventures market. Originally this was going to be at a low margin of 15% but given the recent results that margin is looking to be pretty much right in line <rolls eyes>.

Way back when the venture opportunity was finalized I was able to dig up more information on the economics of the attractions business. First, I found information on the economics of what appears to be a fairly similar existing ride called FlyOver Canada. The attraction is part of Canada place in Vancouver. Flyover Canada is a virtual flight ride experience. Its also owned by a public company named Viad, so unlike every other attraction I read about, there is actually publicly available information about its performance. Here is a quick summary from the 2016 Viad 10-K:

Flyover Canada showcases some of Canada’s most awe-inspiring scenery from coast to coast. The state-of-the-art, multi-sensory experience combines motion seating, spectacular media, and special effects including wind, scents, and mist, to provide a true flying experience for guests. FlyOver Canada is ideally located in downtown Vancouver, Canada. FlyOver Canada is rated by Trip Advisor as the #1 “Fun & Games in Vancouver” and has been awarded with the Trip Advisor Certificate of Excellence.

Flyover Canada is essentially a flying theater, which is the exact same attraction that Empire is looking to co-venture. Empire has built numerous flying theaters in the past and references a number of them on their website’s Flying Theatre description. It doesn’t appear that Empire built Flyover Canada (it was a competitor Brogent) but they did build Flyover Italy, Soaring over California, and Soaring, a Florida attraction.

Viad purchased Flyover Canada from Fort Capital at the end of 2016. According to the Fort Capital press release at the time of the sale, the purchase prices was $69 million Canadian (remember if all goes well Empire and its ~$50 million market capitalization is going to own 63% of one of these in the US and 20% of another in China). Flyover Canada had 600,000 guests and generated $11 million in 2016, so it’s a $20 a pop ride. In their 2016 10-K Viad gave the following 2017 forecast for FlyOver Canada:

FlyOver Canada is expected to contribute incremental revenue of $9 million to $10 million with Adjusted Segment EBITDA of $5 million to $5.5 million.

The numbers are in US dollars. Flyover Canada ended up doing $10 million of revenue in 2017, and though there was no EBITDA breakdown I have to assume it was close to expectations. So it’s margins of 50%+

At the time I talked to IR about the opportunity. The information I got was that depending on the size of the ride, revenue would be around $8-$14 million USD per year depending on the size. Margins on the ride would be around 50%. A smaller ride would cost $10 million to $12 million to build, while a larger attraction would cost $18 million. So these numbers are all pretty much inline with Flyover Canada.

The idea was (and is) that net to Empire’s 60% ownership, and assuming a split with a landowner, they should get somewhere between $3 million to $4 million of recurring EBITDA (CAD) out of the US deal. I didn’t get any information on the Chinese opportunity.

Empire (via Dynamic Entertainment Group) would partner on the attraction with a landowner in a tourist destination. The deal would be structured so that Empire got a preferential return until the cost of the ride is paid off. Empire would make 10-15% margins on the design and construction of the attraction as per their contract with DEGL. There is also a $3 million subsidy for developing creative content in Canada which would reduce the overall manufacturing cost to $7-$9 million.

The expectation was that the EBITDA should get a multiple of 10x. Viad bought FlyOver Canada for about that multiple. Again, if Empire got a 10x multiple on $3 million of EBITDA, that would eat up much of the current capitalization right there.

Overall, it’s always seemed like a decent venture for Empire once it gets off the ground. The company invested $12.1 million via $8 million in equity and $4 million in debt. In return they would eventually get the $2-$4 million of recurring EBITDA from the US venture, add two near-term attractions to their construction backlog (one for the US and one for China), and get some additional EBITDA (I don’t know how much) from the Chinese venture.

Of course like everything else with Empire this is a waiting game. On the call they said “Before the end of the year, we expect to announce our first co-venture location. We expect to have an opening sometime in 2019”. Hopefully we get an announcement soon.

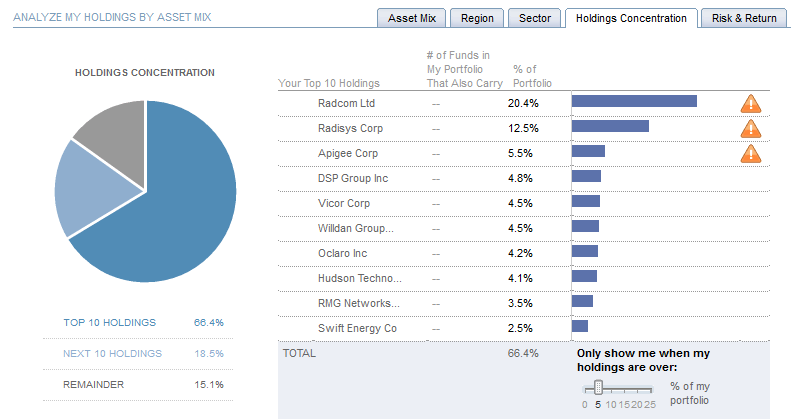

Portfolio Composition

Click here for the last six weeks of trades. Note that this is August 24th, so I’m a week behind here.

While the STACK/SCOOP lags the Permian in performance, the perception I get from listening to comments from Marathon, Cimerex and Newfield is that the area is earlier in the learning cycle, and we should expect further improvements (like we may have just seen with Continental in their Woodford SCOOP wells).

While the STACK/SCOOP lags the Permian in performance, the perception I get from listening to comments from Marathon, Cimerex and Newfield is that the area is earlier in the learning cycle, and we should expect further improvements (like we may have just seen with Continental in their Woodford SCOOP wells).